- Reinsurance rates have increased by a cumulative ~4% over the past two renewals

- A majority of insurers and reinsurance brokers expect a rise in reinsurance prices come January 1, 2020, concentrated around specific lines: Auto, Professional Liability, Marine/Aviation/Transport, Property CAT and Engineering

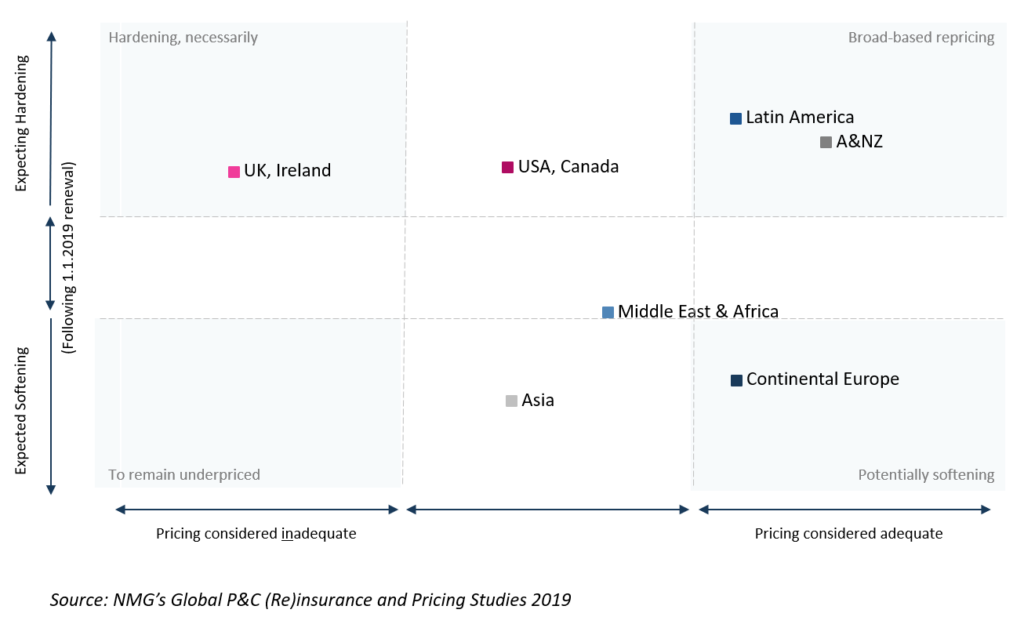

- Concerns about rate adequacy are most pronounced in the UK, the USA & Canada, and Asia. These concerns underpin an anticipated further hardening in the USA & Canada and the UK. Yet in Asia, insurers and reinsurance brokers mostly don’t expect rate increases despite their views on adequacy

- Swept up in a broader re-rating, the markets of Latin America and Australia & New Zealand anticipate rate increases despite prevailing views that current rates levels are adequate

- Rates for Property CAT are expected to lift in all major markets with the exception of Continental Europe and Asia

Rising reinsurance rates

Two cycles of hardening have seen global reinsurance prices edge higher by nearly four percent [1] (more than five percent for Property CAT), and a number of recent reinsurer quarterly briefings indicate a significant rebound in underwriting profits. ILS offerings are also being remodelled following disappointing returns and unconstrained exposures, and ILS growth has slowed. What were once-leading ILS propositions are being replaced with more moderated alternatives.

[1] Global Study of P&C Reinsurance Pricing – 2019; NMG Consulting

These are positive signals of a turnaround, but reinsurers are far from being out of the woods just yet

These are positive signals of a turnaround, but reinsurers are far from being out of the woods just yet. Price uplifts have to a degree been offset by expansions in coverage. Returns also remain mostly below long-term requirements, and low (and lowering) interest rates diminish income levels from fixed-income-dominated asset portfolios on which reinsurers depend. Total returns for P&C reinsurers are therefore more dependent on underwriting outcomes than at any prior point.

As part of NMG’s 2019 Study of the Global re/insurance segments, insurance executives and reinsurance brokers were asked to share their views on the adequacy of current rates as well as their expectations for the outlook for the pricing cycle (post the 1 January 2019 renewal). Interviews were conducted between January and May 2019.

Further hardening expected

On a global scope, a majority of insurers expect reinsurance rates to lift further across most lines.

Four lines of business (Property CAT; Marine, Aviation & Transport; Professional Liability; Engineering) dominate concerns for current rate adequacy, underpinning expectations for increases in reinsurance rates for each.

Expectations for rate increases in Auto portfolios have been evident over two cycles but vary between markets and years. In 2019, expectations for increased prices in Auto are centred around an expected hardening in the US (and to a lesser extent Canada).

Exhibit 1 – Reinsurance Pricing Outlook – Insurer & Broker Perspectives

The views of reinsurance brokers mostly align with those of insurers, sharing similar opinions on pricing adequacy for most lines of business. The views of reinsurance brokers are distinct in that they carry higher levels of conviction about the likelihood of a further hardening in prices.

Reinsurance brokers carry higher levels of conviction about the likelihood of a further price hardening

There were a few notable exceptions. The views of insurers and reinsurance brokers differ markedly as to the adequacy of current reinsurance rates for Cyber and Property (non-CAT). A significant majority of reinsurance brokers consider Property (non-CAT) rates unsustainable, while insurers associate higher levels of uncertainty with the actual future loss experience for stand-alone Cyber.

Many pictures paint a story

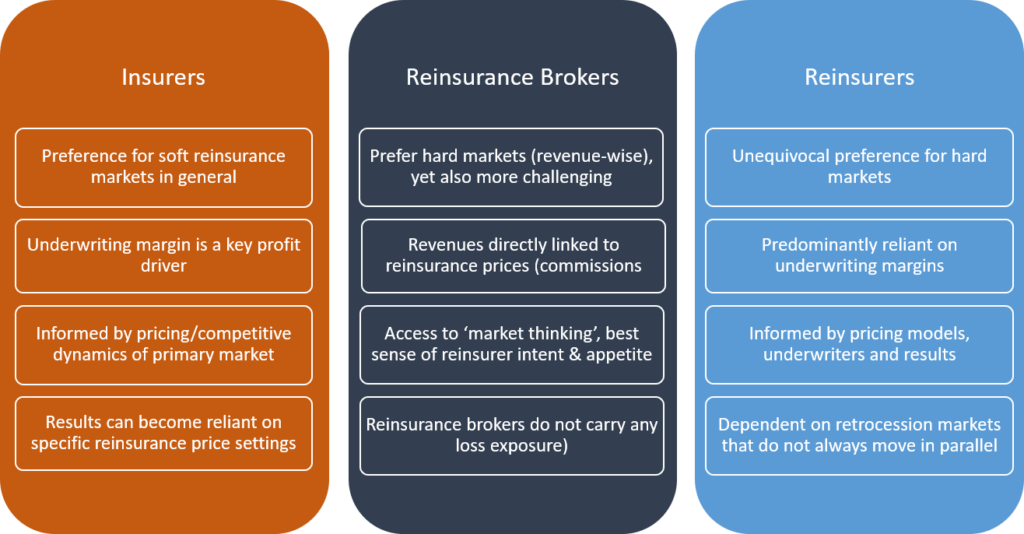

Viewpoints on the adequacy and the outlook for reinsurance pricing are logically influenced by an observer’s comparative sources of information and positioning along the value chain. Viewing feedback from different vantage points provides valuable additional insight via a sort of ‘triangulation’.

Exhibit 2 – Different Lenses and Requirements

Significant variations within regional markets

For the largest economic regions, the outlook for reinsurance pricing appears to stem from views on price adequacy in that region. In contrast, it appears that smaller regions expect to inherit the general pricing changes from the largest markets. The adage that “A sneeze in America translates to a cold in Australia” seems to hold true here.

Come the 1.1.20 renewal, insurers and brokers in the USA & Canada anticipate further pricing increases across a majority of business lines.

Insurers and brokers in the US & Canada anticipate further hardening across a majority of business lines

Insurers and brokers in Asia indicate clear concerns about the current adequacy of reinsurance rates, yet in contrast few expect reinsurers to take action in the form of rate increases. Such is the perceived importance of Asia to reinsurers’ growth narratives.

Reinsurance rates are expected to harden further ‘Down Under’ despite insurers and brokers being overwhelmingly of the view that current rates are adequate.

Exhibit 3 – Reinsurance Pricing Outlook – Insurer & Broker Perspectives

Views in Continental Europe were that current pricing is adequate for the major Property & Casualty lines, and expectations are that prices will soften. Views on Marine, Aviation & Transport, Auto, A&H and Professional Liability favoured increases and thus provided offsetting effects.

Rate increases are expected in Latin America and Australia & New Zealand, despite views that current price levels are generally

Views on rate adequacy in Latin America were only slightly less favourable than those in Europe but were nonetheless coupled with expectations for significant levels of further hardening, particularly for Property lines.

CAT due for further re-rating in key markets

Property CAT is the largest reinsurance category in many countries/regions and has seen large upward adjustments for loss-affected areas. Broker and especially insurer expectations firmly favour further hardening across the Americas.

Expectations are for increases in Property CAT prices in the United Kingdom & Ireland as well as in Australia & New Zealand. Interestingly, however, the views of insurers and brokers as to price adequacy in each market occupy different ends of the spectrum.

A majority of insurer and broker views in Continental Europe lean towards of a softening at 1.1.2020

In stark contrast, views across Continental Europe strongly favour the adequacy of current CAT rates, with a majority leaning towards a softening at 1.1.2020.

This said, insurer and broker expectations for further rate rises could be tempered by 2019 delivering a benign NatCat season. Only time will tell.

Exhibit 4 – Reinsurance Pricing Outlook – Property CAT – Insurers & Brokers