The underlying competitive advantages enjoyed by banks, coupled with changing regulatory settings could combine to enable the previously unthinkable, the (sensible) return of Australian banks to retail advice.

Mass exodus despite growing need

At the time, the almost choreographed departures of the major Australian banks from the Advice segment made sense. The implementation of FoFA had increased the cost and complexity of advice enormously and the Royal Commission had damaged (if not destroyed) the reputation of much of the advice industry.

The stampede contributed to a fundamental re-shaping of the advice landscape. Absent the balance sheets and distribution channels offered by major banks, and with the ever-increasing costs of providing FoFA-compliant advice, advisers – those that remained in the industry – steadily reweighted their books toward wealthier clients (and ditched the rest).

This reweighting, combined with falling adviser numbers and the all-or-nothing FoFA regime has led to a market with a significant advice gap, comprising:

- Demand for comprehensive advice exceeding supply capacity of 1.2 million households (by 2025)

- 3 million households, who need or would benefit from limited-scope advice, unable to receive any advice at all

Given that retirement balances of mass-market Australians continue to rise through the momentum of mandated contributions, any steady-state estimate of the advice gap would necessarily be a lower bound, in this instance four million households.

A new advice spectrum

The Quality of Advice Review (QAR) has raised the prospect of a diminishment of the largest obstacle to advice access, namely how advice is regulated.

The QAR recommends what effectively amounts to a personal advice spectrum, absent best-interest-duties (for some) and where the depth of fact-find and the required expertise of the adviser are entirely dependent on the scope of the advice being provided.

Implementation of QAR, or something similar, would allow providers to specify the scope of the advice they are willing to provide, opening the door to the provision of simplified, limited scope, transactional advice, tailored to the needs of a client.

Compared to where the industry finds itself today, straight-jacketed with an all-in ‘one size fits only 10% of Australians’ regulatory framework, this has the potential to be transformative – and positively so.

Banks remain well placed

Banks are uniquely positioned to meet the demand for simple, mass-market advice, possessing the scale, balance sheet and required digital ecosystems to support an embedded advice environment, not to mention brand recognition and distribution channels (physical and digital).

Furthermore (and perhaps most importantly) banks have better data and customer access than other financial institutions, giving them an advantage in identifying and acting upon customer advice needs at scale.

If the shoe fits

Each of our major banks have mission statements to the effect of ‘improving the financial wellbeing of our communities’.

Given the societal need for sound, accessible and affordable advice is clear – and assuming that these mission statements are intended as fundamental drivers of corporate strategy – then re-engaging in Advice would seem to be strategically appropriate, when the regulation allows.

Beyond fit, banks would of course have to be satisfied as to the commercial attractiveness of Advice going forward. A priori it seems reasonably compelling that a well-executed, simple advice offering should deliver commercial benefits across customer acquisition and retention and share-of-wallet. This is also a significant opportunity to differentiate customer value proposition.

And what would bank participation in advice look like this time around?

First things first, a return to comprehensive advice, in competition with licensed financial advisers, is not (should not be) on the table. A comprehensive advice offering remains far too divergent from their core business model and does not sufficiently leverage core structural advantages. Banks should instead cast their attention to event-triggered episodic advice models, centred on specific client needs that arise through different life stages.

Life is event ‘full’

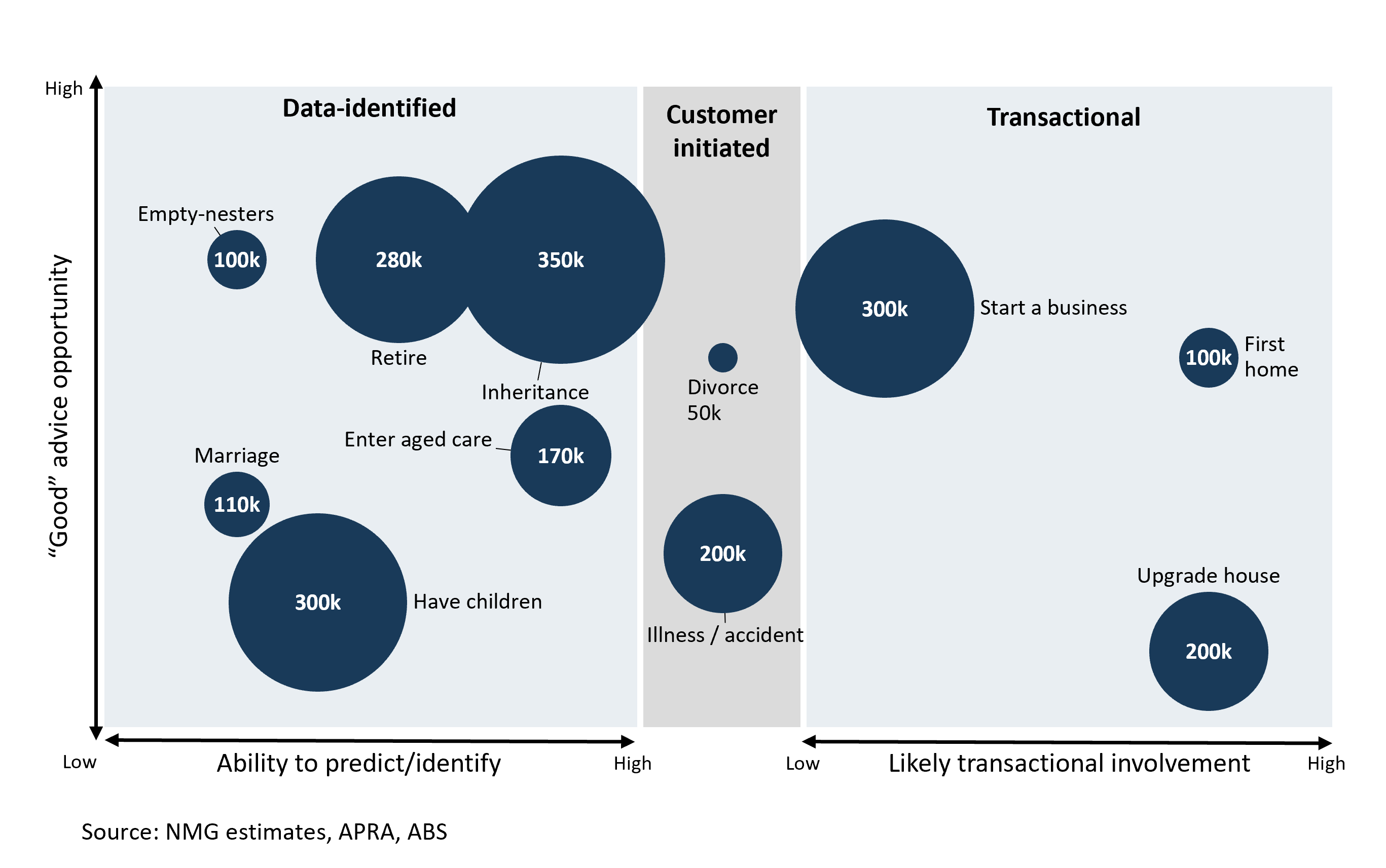

Analysis conducted by NMG Consulting (2022) points to nearly two million event-based opportunities arising annually (in Australia).

Exhibit 1: Advice opportunities abound

After accounting for overlap in these events, and the fact that some will already be captured under comprehensive advice processes, there are ~1.25 million event-based advice opportunities each year that are contestable for banks. It is around these events that banks should anchor their advice strategies.

For many of these events, banks already play an active transactional role. Others can be predicted based on the customer and transactional data that banks hold. And some are addressable only where a client initiates the conversation. In each instance, the provision of responsible, simple, ‘good’ advice has the potential to meaningfully improve the financial wellbeing of the individual (and their relationship with their bank).

Clarity required

The final report from QAR is due in late December which will give a clearer view on some of the finer points, and the extent to which industry and consumer group feedback has swayed the recommendations.

As ever, the optimal model for participation will not be one-size-fits all, nor will the path to re-entry. Each requires careful consideration of internal capabilities and existing partnerships, and a sensible debate about risk/reward.