February 17, 2021

Walk this Way

In this thought-piece written in association with Legal and General Investment Management, we look at the consumer...

The FCA’s Investment Pathways have launched with the aim of improving retirement income outcomes for consumers, particularly those without access to advice. In this Citylogue, we follow up our last blog looking at non-advised drawdown, to discuss consumer reactions to Pathways and the increasing onus on providers to support consumers in making good investment decisions.

Investment Pathways is an FCA initiative that aims to support non-advised consumers entering pension drawdown to achieve better outcomes on the investment of their drawdown fund. Launched 1st February this year, platforms and pension providers now have to offer Investments Pathways to their customers, typically around the time of first withdrawal from the pension.

But will Pathways be adopted? What routes are consumers likely to take? What are the roadblocks that need breaking down? This Citylogue explores insights arising from our recent research collaboration with Legal and General Investment Management.

Consumers are approaching access to their pensions with patchy knowledge, insufficient planning and low levels of confidence. With 1 in 3 accessing their pensions without advice (and evidence that this is increasing), there is a great risk of poor decisions being made. For example, FCA data shows that 1/3rd of non-advised consumers in drawdown are invested entirely in cash, leading to issues around income sustainability over the longer term.

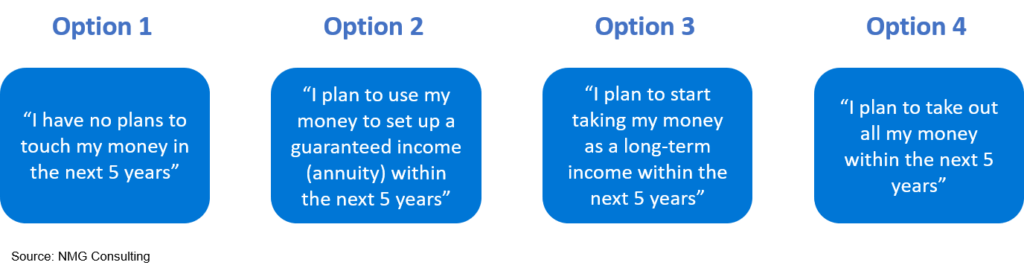

Investment Pathways are designed to provide at least some level of support for consumers that don’t want to make investment decisions themselves. Four paths (options) are offered, each with a single fund solution, that align with the objective of each Pathway:

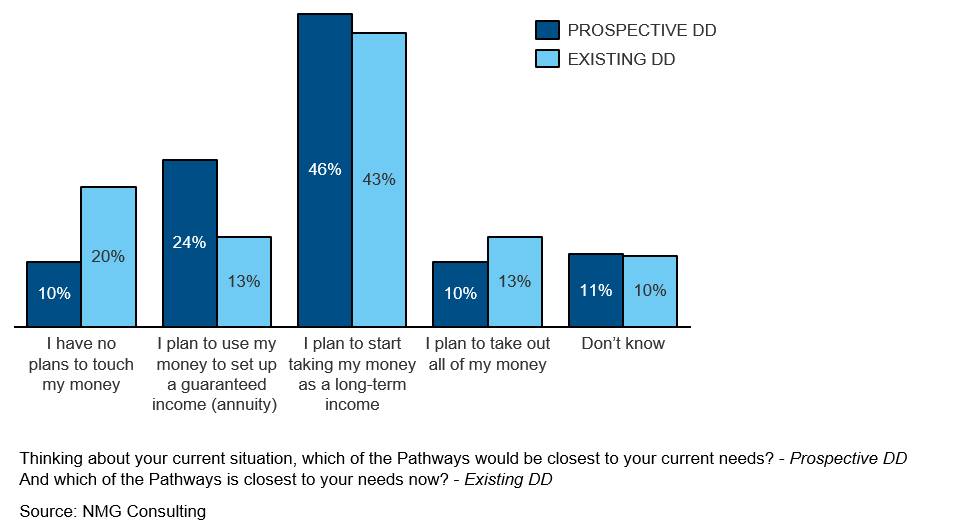

Overall reaction to the Pathways concept from consumers is encouraging: 60% are positive about the idea, and this tends to rise once further information is provided. In fact, 9 in 10 believe they could find a Pathway from the above choices that would meet their needs. The simplification of the options available, and the plain English used is liked, indeed for many, this is the clearest explanation of retirement income choices that they have seen so far, and particularly helpful to newcomers.

Investment Pathways are considered most useful by future drawdown users early in their journey – interest peaks in the early 50s group – and for those with mid-size pots (£30k-£100k). Lowest levels of interest are seen amongst the most confident and knowledgeable group of ‘savvy’ pension savers, likely more engaged and informed already on their options for retirement and for whom Pathways are perceived to be too simplistic.

Drawdown Rules

Option 1 lands as the simplest option for those who are unsure about what to do with their pension. The challenge here is in providing a strong rationale on why this option is likely to be better than simply staying in your current fund. Option 2 is selected by those for whom income security is a strong driver in the absence of other sources of income. Negative perceptions around annuities is the main barrier to interest in this Pathway. Option 4 is considered inappropriate for the majority, however with around 1 in 10 likely to do this, it is a reminder of the need for providers to clearly highlight the risks and consequences of this option. Of most interest is Option 3, however uncertainty is expressed on how this would work in practice, demonstrating greater clarity is needed around, for example, the flexibility of this option and how much is prudent to draw down (consumers love a rule of thumb to play by).

Removing Roadblocks

Take up of Pathways is not going to be without issue. The single fund solution is problematic in two ways. Firstly, some pension savers want a choice of funds – 1 in 5 say they want to choose from a wide range of funds, another 1 in 3 from a short list. While in practice these fund preferences are likely overstated, it suggests some level of resistance to the idea of a single fund solution. Secondly, a single fund presents a single level of investment risk within the Pathway, and this may not align with the consumer’s risk tolerance or needs. Providers will need to explain the risk and return relationship and its impact on income sustainability.

Inertia is likely to be a significant issue. Given low knowledge levels around pensions, introduction of the Pathways concept is going to prompt many questions and may mean in practice fewer people opt into the Pathways framework, preferring instead to avoid making a choice. 1 in 3 respondents told us they’d prefer to simply stay in their fund used in accumulation than move into the Pathways. There need to be very clear benefits and support provided to encourage consumers to move into the appropriate Pathway otherwise inertia will prevail and Pathways will fail to meet their purpose.

Successful Engagement

So how can pension providers help make Investment Pathways a success? Engaging consumers much earlier on in their savings journey is needed and Pathways should become part of the dialogue of pensions from the outset, explained with annual statements and other touchpoints.

Objectively positioned pros and cons of each option is required. Consumers appreciate case studies and examples of ‘people like me’ to help simplify decision-making.

Informing consumers that no Pathway is for life will be important. While an annuity option may not seem appealing at age 55, at age 75 this may well be the best route given changing circumstances. Equally important will be highlighting that funds can be split across Pathways – a blended solution is possible.

Pathways aren’t perfect but pension savers need help, now. In the absence of advice, Pathways meet a consumer need by providing a simple, outcomes-based framework and investment solution for those least confident about what to do with their retirement fund.

Please see the full report with LGIM here: https://www.nmg-consulting.com/partner-insights-reports/walk-this-way/

For more information, contact:

Jane Craig, Partner (London; [email protected])