March 24, 2020

Customers can’t buy toilet paper. Time for a new messaging framework.

The exponential spread of COVID-19 and its impact on financial markets has resulted in substantial losses for...

Since Pension Freedoms in 2015, would-be retirees have faced complex decisions on how best to access their pension savings. The risks faced by those doing this without professional advice can be great. In this Citylogue, we explore consumer capabilities for non-advised drawdown ahead of the launch of Investment Pathways*.

There is a sizeable and growing cohort of pension savers who start their decumulation journey without professional advice – around 1 in 3 consumers who entered pension drawdown in 2019/2020 did so without advice. Due to a belief in their own decision-making abilities, mistrust of advisers, an unwillingness or inability to pay advice fees, or simply inertia, swathes of self-directed future retirees are making pension access decisions that will impact their long-term financial wellbeing. While a minority are well-equipped to make their own decisions, we recognise that many are not. NMG decided to explore the environment for non-advised pension savers wanting to access their DC pensions, to better understand their behaviours and highlight the risks they may face, five years on from Pension Freedoms. Many thanks to Legal and General Investment Management, our sponsor for this research2.

*Investment Pathways is an FCA initiative that aims to support non-advised consumers entering pension drawdown to achieve better outcomes on the investment of their drawdown fund. Consumers will be offered four Pathways, each with a single fund solution, and designed to meet different retirement income needs. Platforms and pension providers must offer Investments Pathways to customers from 1st February 2021.

The lack of consumer engagement in pensions is well documented and most pensions research is united in highlighting a dearth of consumer interest in pensions. In fact, low engagement is almost inevitable when considering the broad structural and functional complexity of pensions. It is now evident that the normalisation of default behaviours during accumulation, particularly for members of DC workplace schemes, is leading to severe challenges at decumulation. Consumers are approaching access to their pensions with insufficient knowledge levels, a lack of formal planning and often, a ‘head in the sand’ mentality. After a lifetime of low engagement, the confidence and capability levels required to make active pension decisions with respect to funds and retirement income choices are low. Perhaps of even greater concern is the degree to which some retirees may be over-stating their capabilities and underestimating the gaps in their knowledge.

So what are the knowledge gaps? Amongst prospective drawdown users, close to accessing their DC pensions for the first time, just 8% state they feel ‘very knowledgeable’ about their retirement income options, with 22% admitting to feeling not very or not at all knowledgeable. Those that fall in the middle are probably being generous in their assumed knowledge levels, as consumers “don’t know what they don’t know”. Understanding of underlying investment funds is a common knowledge gap, with 35% admitting they know nothing about the funds they are invested in, and another third unsure. Such low knowledge around investment funds makes it very hard for consumers to make good decisions about how to best invest their pension during decumulation – the easiest solution is to do nothing. In fact, just over half of existing drawdown users told us they stayed in the same fund used for accumulation when it came to start drawing down.

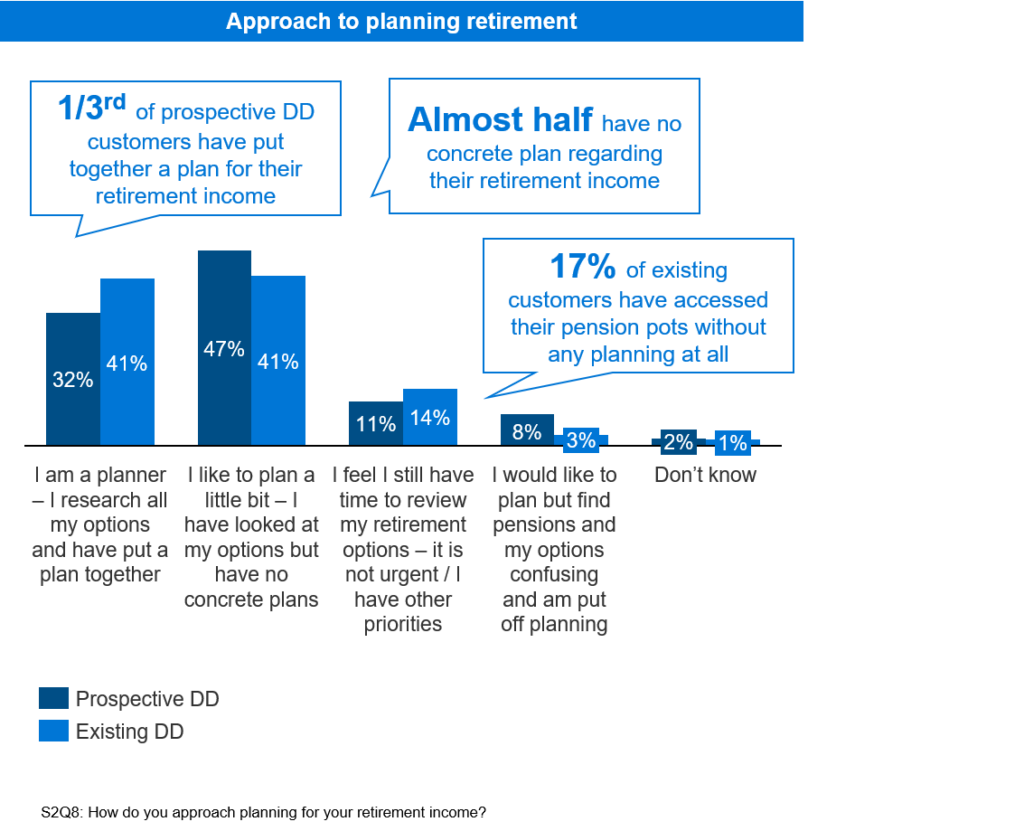

Consumers are unclear on the risks involved and very few can articulate risk beyond the ups and downs of investing. Consumers tend to think too short term where pension income is concerned, and many are prone to ‘present bias’ – enjoying themselves today rather than protecting the future. This is evidenced by a lack of formal planning for retirement income, which in turn is likely to affect the quality of retirement income outcomes.

Upon probing, those who have undertaken some planning admit it is largely informal. Most are unable to answer the big questions including ‘will my income meet my needs, will my income last’… For the majority, retirement planning consists of ‘thumb in air’ estimates and assumptions, leading some to hold unrealistic expectations that their pot will be able to sustain the lifestyle they aspire to.

Given this backdrop, it is concerning to see that readiness for retirement is an increasing challenge for older Gen X’ers, in their 50s, compared to the more established 60+ Boomer generation. Gen X’ers have less generous DB pensions, have longer to wait for State Pensions to kick in, and show heightened concern around the impact of Covid on their finances. Unsurprisingly, they are more concerned about their pensions dropping in value or not meeting their needs in retirement than retired Boomers. They will not have had sufficient time in market to take full benefit of auto enrolment DC pensions, Just one in four of the non-retired group in our research felt they will be able to meet their every need in retirement, versus nearly half (44%) of the already retired. The ‘silver squeeze’ is discussed in detail in our report with LGIM, which can be read in full here: https://www.nmg-consulting.com/partner-insights-reports/the-silver-squeeze/

Given the lack of desire to self-educate and/or take advice, many non-advised consumers are highly reliant on their pension provider for information and support on their retirement income options and ongoing arrangements. Investment Pathways are one solution to help non-advised savers navigate their retirement income choices. It is clear that providers still need to do much more in helping consumers engage much earlier in their pensions journey to reduce the risks and fears associated with pensions drawdown. Our next report with LGIM and subsequent Citylogue will discuss the likely take-up of Pathways and consumer reaction to the concept.

For more information, contact:

Jane Craig, Partner (London; [email protected])

1https://www.fca.org.uk/data/retirement-income-market-data

2Insights based on primary research (qual-into-quant) with almost 1200 non-advised existing and prospective pension drawdown users