October 21, 2019

A new pricing model for wealth – video

In this video, Nickola Cable examines one of the innovations we expect to see – a new...

It’s not that long ago that the main issue facing institutional investors considering an ESG investment was how much return they were willing to give up in return for investing in a responsible manner.

The easiest argument was always for G, ‘governance’, because a simple case for enhanced returns over most timeframes can be made if robust governance is evident. Environmental and social factors were barely mentioned in mainstream investment processes.

Fast forward to today and the landscape has changed dramatically. The ESG arms race is on, with institutional asset managers jostling to establish their long-held – but only freshly publicized – ESG credentials. Their clients, the asset owners, are demanding more, looking for evidence of how ESG factors form part of the manager’s investment process not just a handful of dedicated ESG strategies.

Critically, clients aren’t expecting this decision to impact negatively on returns. Quite the opposite, in fact: 74% of ESG adopters believe it will enhance returns and reduce risk, making ESG a potential investment unicorn.

Naturally, asset managers are responding to their clients’ growing expectations. All of the world’s top 30 asset managers by FUM mention their commitment to ESG on their website. In fact, so keen are they to position as experts in ESG investing that many of the top 30 have tens of thousands of mentions of ESG on their website, seen below:

The real question is: ‘How can ESG be monetized?’

The ability to extract margin, or FUM, from the ESG trend is clear for those niche firms that exist wholly for this purpose (think Green Century, for example, whose institutional share classes have fees of around 100bps). However, for large firms with hundreds of billions under management the commercial case is less clear, especially given they have historically been many things to many people (if not all things to all people). The question for these large firms is whether the drive to ESG is being led by left-leaning millennials without a care for the bottom line, or whether there is a sensible business case for them to invest in their ESG proposition?

The answer is clearly the latter, but the debate is about the ‘how’, and we advise proceeding with caution to avoid being pulled into an expensive and fruitless arms race.

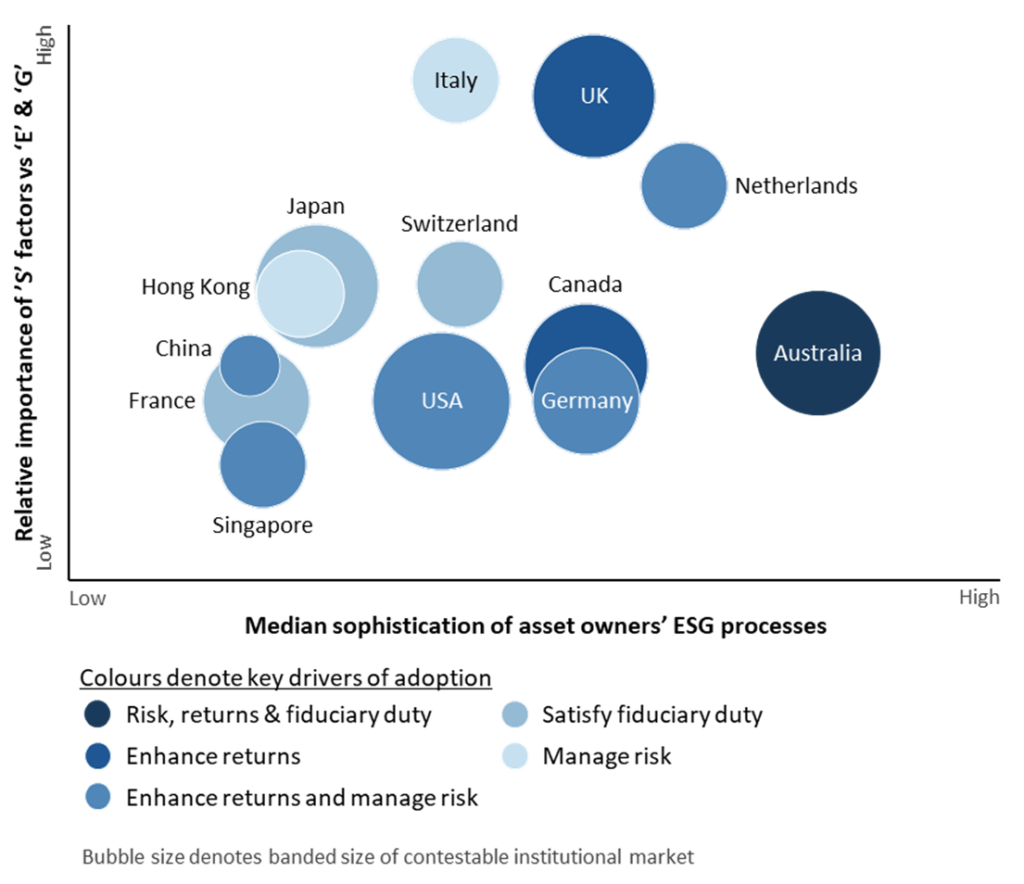

This doesn’t necessarily mean an ‘ESG-lite’ strategy is right for you or your clients, however. There is an enormous difference in what asset owners are looking for by country, by investor type and depending on how sophisticated their approach is. One size does not fit all unicorns, as far as ESG is concerned. Instead, a granular, segmented and focused approach is required from asset managers.

The chart below shows how different the needs of asset owners in different countries are (note, for instance, how important a focus on ‘S’ social factors are in some countries):

So, whilst there may be a philosophical case for ESG, the commercial case for ESG adoption – and critically the level or type of adoption – is more nuanced. Certainly, there is little ESG ‘white space’ left to fight for considering the number of asset managers diving headfirst into the ESG fray. Having said that, given the prominence of ESG at the ‘universe screening’ stage of selection, asset managers can’t afford to ignore it either. What is clear is that asset managers need to put their stake in the ground now by working out how to position in each country they operate in, and even each segment. Successful managers will need to either be confident of winning the arms race (few will) or consider how to build their ESG arsenal and where.

If you would like to talk about your strategy for monetizing ESG (or where best to invest) please get in touch. We have recently completed a global study of asset owners analyzing the size, shape, momentum and trajectory of ESG integration and their views of the ESG capabilities of asset managers by region and market.

The Global ESG Study delivers insights to the size, shape, momentum and trajectory of ESG integration among asset owners and their views of the ESG capabilities of asset managers by region and market. The study can be used as an evidence base for ESG marketing strategy, including understanding the opportunity, identifying target segments, and positioning choices; as well as to support internal advocacy and product design / development.

Fieldwork was conducted between April and June 2019 and comprised a large sample of investors actually undertaking ESG implementation – from long-standing experts to those early on the journey. Respondents were key ESG decision-makers able to discuss how the investor considered and made ESG-related decisions.