March 8, 2023

Global Trends & Performance

Our global perspectives on the P&C reinsurance industry are drawn from the feedback of more than 2,000...

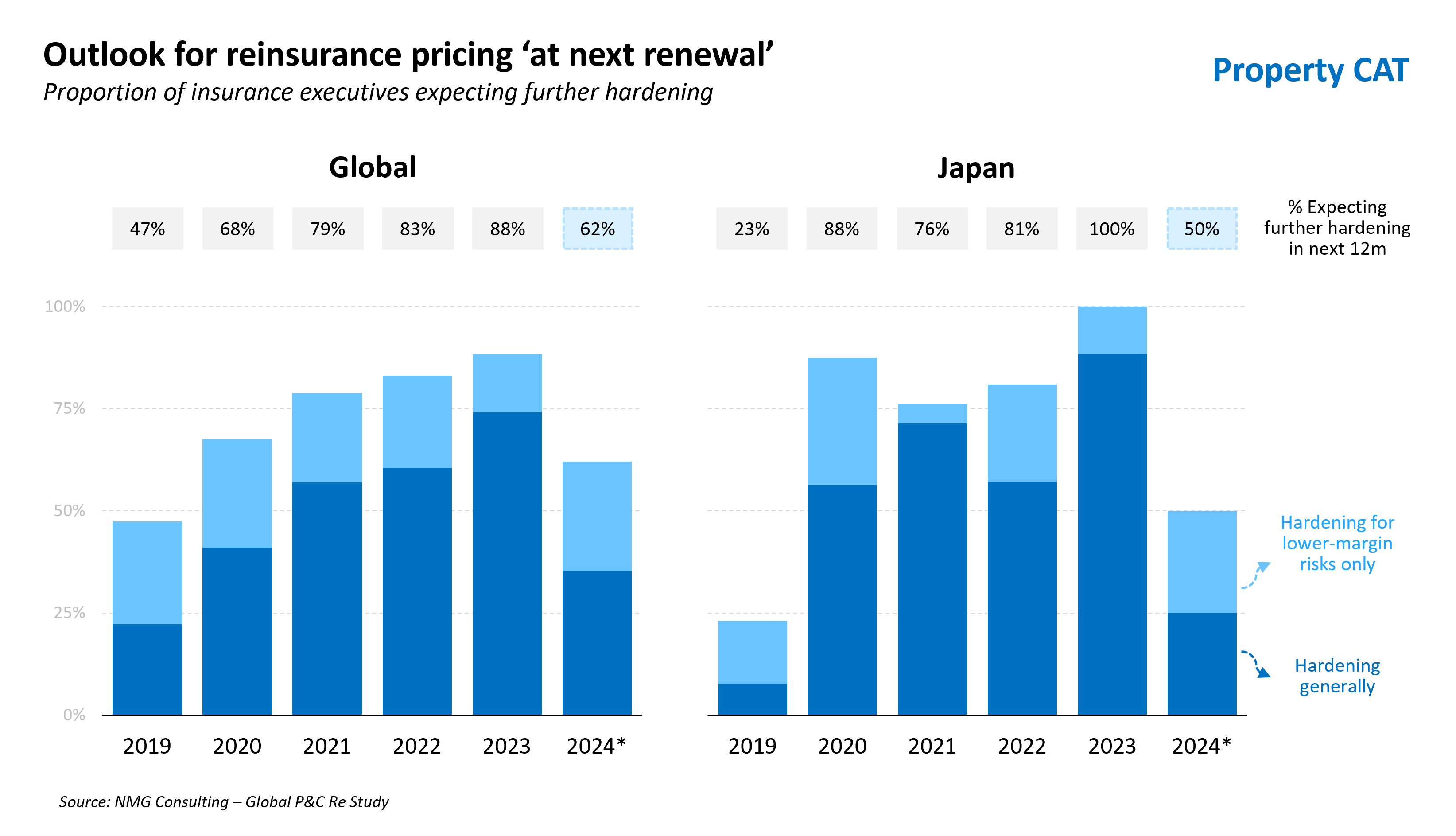

Having lifted by >50% since 2017, the increases in reinsurance rates at Property CAT during 2024 renewals have slowed. Reinsurance buyers are divided as to what comes next, although <10% expect rates to decline at their next renewal.

After many years of poor returns, reinsurers have successfully revised Property CAT rates upwards over the past 5 years, although it will be 1 January 2023 that will be remembered as the moment of ‘reset’.

Reinsurers have also insisted on higher points of attachment, passing frequency risk back to insurers recognising that the profile of secondary perils had begun to incorporate some ‘attritional’ features.

Preliminary feedback from our 2024 P&C Re Study indicates that just one-third of CAT buyers anticipate further rate increases of a systemic nature (ie ‘hardening generally’), compared with nearly three-quarters a year ago. A more than two-fold reduction.

“Sentiment on future pricing emerges from a synthesis of emerging portfolio experience, a forward view of risk and messaging from reinsurers and brokers”

Accordingly, about one-third of buyers expect rate increases to be limited to low margin/loss-making accounts, with a similar proportion of the view that CAT prices have peaked.

This however is not to suggest that there are broad-based expectations for price reductions. Quite the contrary, as fewer than 1-in-10 buyers expect prices of Property CAT to soften. Indeed, this could well be an acknowledgement of the need for CAT prices to be higher more permanently (ie here to stay).

Exhibit 1: Taking a breather

Globally, 62% of respondents expected rate hardening at their next Property CAT renewal, down from 88% a year before. Heading into 1 April 2024, expectations of rate hardening on Japanese portfolios fell to their lowest level in 5 years

A year ago, following a bruising 1st January, expectations unanimously favoured a systemic hardening in CAT prices for Japanese exposures.

Fast forward to today, shortly before renewal finalisation at 1 April 2024, views from buyers of Japanese CAT still point to increases, but of a much more moderate profile, with a greater focus on low/negative margin accounts.

Most recently accounts of the 1 April 2024 renewal were of a more orderly process, with a healthy balance between demand and supply, and rates levels mostly unchanged.

Sentiment has done well to anticipate rate movements for Japanese CAT exposures.

For reinsurers. There are many reasons that would support the case for a more robust pricing environment for Property CAT in the years ahead: higher attachment points, better data, improved CAT models and levels of climate uncertainty that should raise the bar in terms of underwriting discipline and rationality. And yet history would suggest that a single year of benign experience could be enough to trigger a return to the ‘bad habits of old’. Experts are divided.

For insurers. There is a clear risk of not passing on higher reinsurance costs and higher expected costs due to higher retentions. This may come down to insurers being unable or unwilling to, or perhaps even unaware of the full severity of expected claims on retained risks. There are indications that there could be some pain ahead, with just 1 in 3 insurers of the belief they could pass on increased costs in full.

Our global perspectives on the P&C reinsurance industry are drawn from the feedback of insurance executives and reinsurance brokers (P&C Re Study 2024; Preliminary feedback February-March 2024) which includes views on recent movements in reinsurance premiums and coverage, as well as the outlook for reinsurance pricing following on from renewals in the first quarter of 2024.