October 21, 2019

A new pricing model for wealth – video

In this video, Nickola Cable examines one of the innovations we expect to see – a new...

The wealth management industry in Australia has reached an inflection point where the haze of the past 12 months has started to clear and structural changes are emerging. The revelations of the Royal Commission have called into question long established ways of doing business, regulators are emboldened and there is an increased desire from all industry participants (and their clients) to change the way business is done. In the past, we tried to preserve existing arrangements (in spite of pressure to change) to protect the way we shared revenue across the value chain. However, it’s our view that the mood has shifted and it’s time for a new, more transparent pricing model.

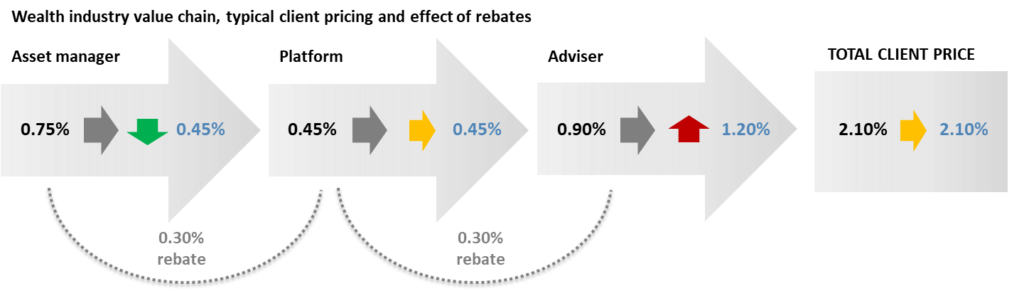

Historically, the way the industry has priced across the value chain has been complex and beset by layers of cross-subsidisation and rebates, hiding who receives what and making it difficult to assess value for money.

For example:

The diagram below shows how these rebates impact the value chain for a typical client with around $250K invested in a balanced portfolio. We show the headline price (in black) and the transparent price (in blue), net of rebates.

The extent of this distortion of the value chain makes it impossible to understand who is providing good value for the revenue they are actually receiving and to assess performance.

This status quo can’t continue. We believe that the increasing regulatory focus (particularly the best interest duty, and the approaching end of grandfathered commissions and shelf space fees) and shifting community expectations towards improved transparency and has created the opportunity for a new pricing model – clear and unambiguous (or transparent) pricing.

To date, there have been significant hurdles to overcome:

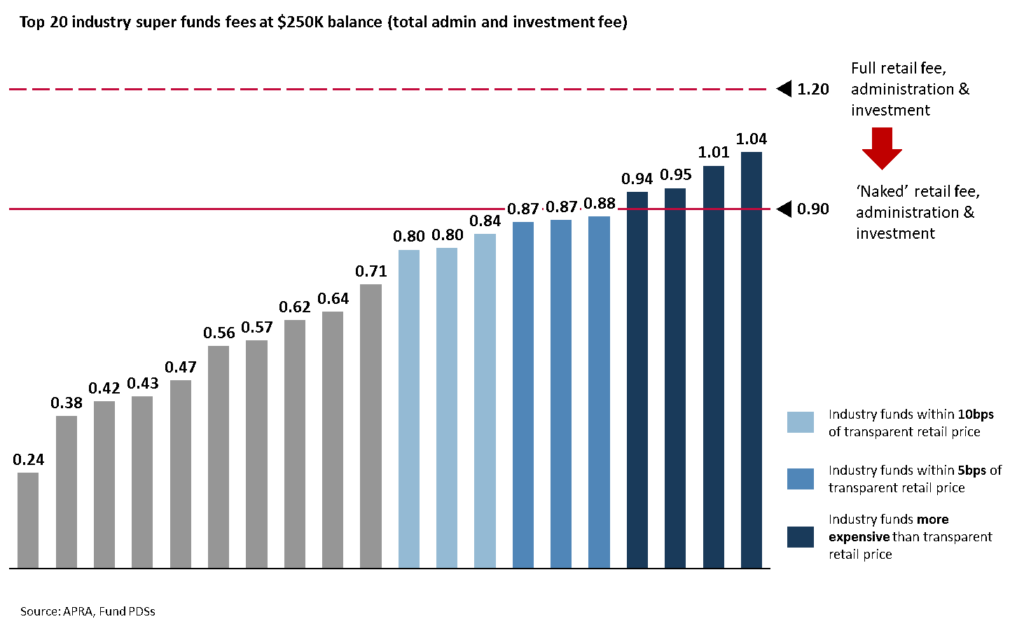

However, it can be done. In fact, there is a group who already use a transparent pricing structure – industry funds and there’s no doubt they’ve enjoyed a significant competitive advantage as a result of their low prices. In fact, if you compare the cost of investing in an industry fund to the fully loaded administration and asset management price that we saw in the value chain at the beginning of this post, you’ll see that not one retail fund comes close to the price set by industry funds. That’s, in large part, because of the rebating and cross-subsidisation that retail funds are forced to load into their pricing.

But if retail funds adopted the transparent price and excluded their rebates and cross-subsidies, then we’d start to see a big change – four of the top 20 industry funds would be more expensive than the new, transparent retail price and 10 of the top 20 industry funds will fall within 10 basis points of the naked retail price.

For those looking to adopt this approach there are some important implications. There’s no doubt industry funds have enjoyed a significant competitive advantage as a result of their low-price structures. As long as platform rebates remain, there is an opportunity for industry funds to capture a significant portion of the mass market who need simple products at a lower cost. However, if platforms were to change their pricing structure to a transparent pricing model and remove the rebates, then retail funds become competitive with industry funds, and provide an opportunity to attract and retain that advised mass-market.

Of course, breaking the status quo is not easy. But there is an opportunity to enjoy some early advantages from a change in pricing structure. An asset manager with a ‘category killer’ product could shift to a transparent pricing structure first. A manager with a product strong enough that it simply must be on platform menus can lead the way by removing rebates altogether. Platforms and advisers would still need to have the product, despite the absence of rebates and that will create a catalyst for other managers to follow suit. Of course, this will take time, all the while our first mover is gaining FUM.

Likewise, a vertically integrated participant might find that a transparent pricing structure makes their (already strong) asset management and platform proposition even more compelling. Aligned and salaried advisers have a good case to recommend house product and the firm can enjoy some favourable positioning in the market. Moving to a new pricing model is not going to be easy, and a lot of the heavy lifting will fall to the advice part of the value chain where price has to increase to maintain revenue. It’s difficult, but it’s not impossible. The question is, will anyone who can see the commercial upside have the long-term vision to make the move?