April 7, 2020

Crisis offers recordkeepers opportunity to stand out from the crowd

The rapid spread of corona virus has resulted in the U.S. economy coming to a screeching halt….

It feels like very old news to even mention the Royal Commission now, but if I can ask you to cast your mind back just 6 months, you might recall that many (including us) were watching the precipitous decline of the aligned advice model and predicting it would decline significantly as a segment in Australia.

Aligned licensees were struggling to demonstrate their value to advisers while increasing licensee fees to recover the revenue they previously would have taken from grandfathered commissions. Their brands were severely damaged by the revelations of the Royal Commission and detracting from advisers’ client acquisition and retention activities.

It might have taken a global pandemic to do it, but could the pendulum swing back?

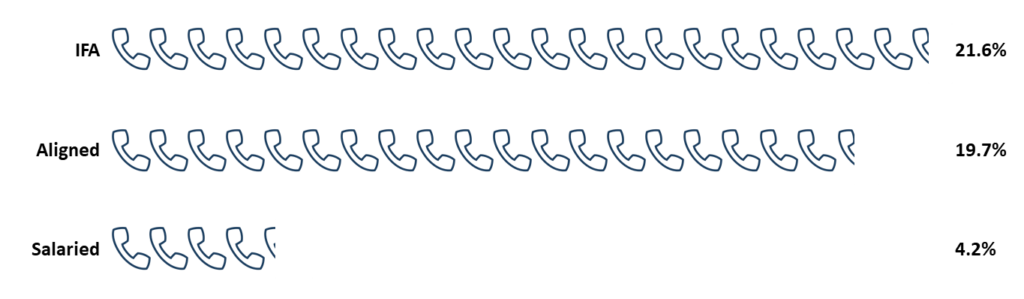

Across the board, advisers have seen massive increases in inbound client contacts – about 35% on average. However, when we asked advisers what proportion of these contacts were from clients new to advice, both IFAs and Aligned advisers reported similarly (large) proportions.

Proportion of inbound contacts from clients new to advice (%)

There are some important lessons to be drawn from this, not least of which is that in times of crisis, people seek comfort in large, well-known institutions. Despite all the brand damage of the past 18 months, when thinking about who to call, customers who had never seen an adviser before sought out both IFA and aligned advisers.

If this is an opening for a come-back, what can aligned firms do to help those advisers acquire and retain clients? How can they make sure they’re delivering at a time when they can really prove their value to their licensees?

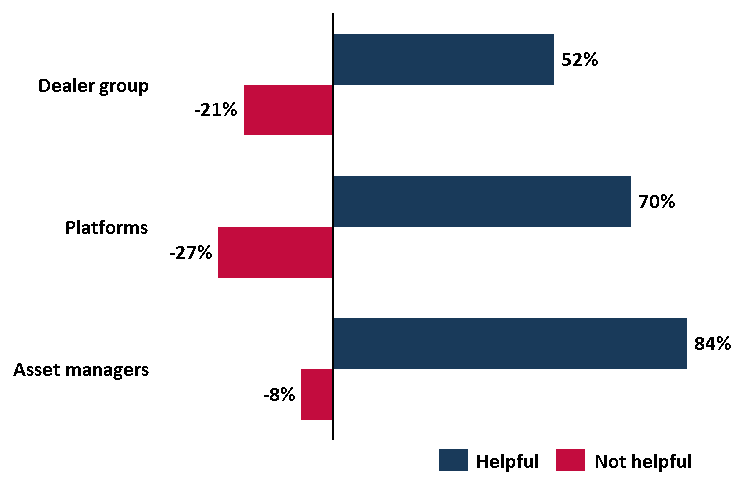

So far, dealer groups are underperforming other service providers when it comes to helping advisers deal with the events related to the coronavirus

Percentage of surveyed advisers rating service providers as helpful / not helpful in dealing with the events of the coronavirus

We’ve identified 3 ways all service providers, including dealer groups, can help advisers:

1) Look to the asset managers for inspiration

When we asked advisers who was communicating well, 4 of the top 5 most mentioned firms were asset managers and the thing they were most commonly cited as doing well was providing regular, objective, succinct thought leadership and commentary.

Tapping into the expertise among your leadership and presenting insightful commentary that helps advisers make decisions and understand the changes happening around them will be highly valued, provided it is timely and relevant.

2) Produce client-ready material

Moving on from what advisers appreciated, the most common request was for client-ready material. At the beginning of the crisis, adviser focus was reactive, particularly among aligned advisers who were most concerned about client consultation and education and managing their clients’ portfolios, with little time to think about proactive initiatives, despite most having in place or considering the capabilities to deliver thought leadership and client education materials proactively.

Enabling advisers to proactively reach their clients and supporting them with content that helps them to address their clients’ questions and concerns will position advisers to attract new clients and retain their existing clients.

3) Deal with the things that matter

Matching the requests for client-ready content and support were almost as many pleas for less noise and poorly targeted communications. Our industry, like many others, has moved on from assurances about sanitiser and safety.

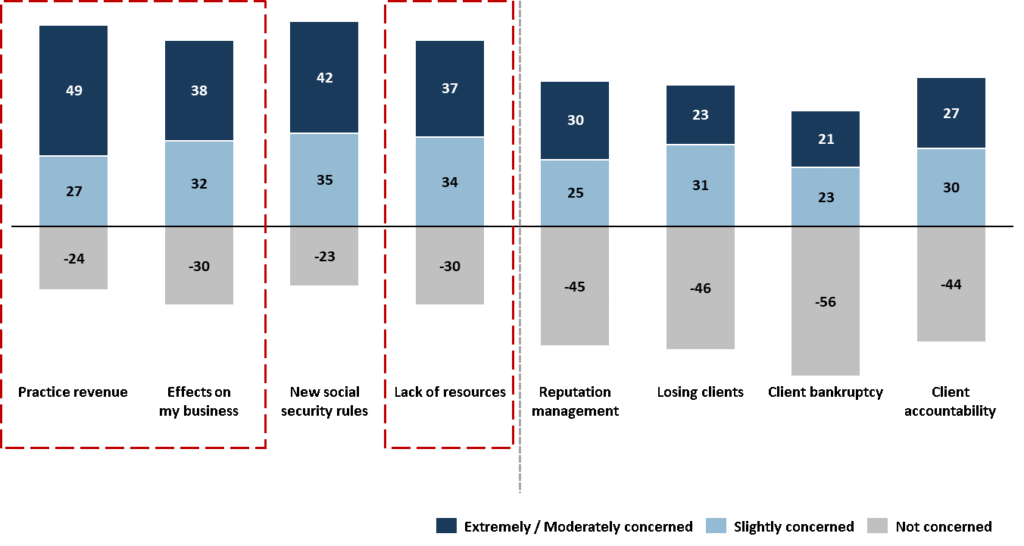

It’s clear that advisers are concerned about managing their businesses over and above other issues. Practice efficiency and tools to run a better business are firmly within the bailiwick of platforms and dealer groups and there is clearly an opportunity to fill the gap in support in that area.

Percentage of surveyed advisers who are concerned / not concerned

All these options to support advisers can apply to whichever licensee type you’re targeting, but there’s a real opening for dealer groups to step up and demonstrate their value add at a time when advisers will appreciate the support. Asset managers have provided a blueprint for how to go about it.