How are current support services for pensions under-delivering on what consumers really want and expect – and where may targeted support make a difference?

Context

As part of the Advice Guidance Boundary Review (AGBR), the UK government and the Financial Conduct Authority (FCA) are considering a new form of regulated support that bridges the gap between personalised financial advice and generic information-only services, designed to help customers make better decisions about their pensions. Current support from providers often does not meet consumer expectations, leaving a noticeable gap between what is offered and what is needed. Based on our recent research for the FCA, we explore this ‘expectation gap’ and how targeted support could make a difference.

Information beyond the basics

On turning fifty, Defined Contribution pension savers in the UK are targeted with information about pensions and retirement. Retirement Options Packs from providers explain the choices available, presenting products neutrally and give due attention to features and risks. If more support is needed, signposts to government pension information services, and to professional financial advice, are part of the standard retirement journey.

At a glance, it seems comprehensive – yet NMG’s recent research for the FCA points to a wide gap between the information consumers receive and the support they expect.

The challenge of retirement decision-making

This becomes most pressing when consumers reach retirement and shift from saving to spending their pension. Today’s post-Pension Freedoms world requires savers to make many decisions, most of them complex and new. To consolidate or not? Annuity’s security or drawdown’s flexibility? Change investments or stay in the default? How much to withdraw? What about taxes? After accumulation journey founded on inertia, this sudden requirement to make decisions comes as a shock to many.

Pensions content of providers aims to inform consumers, but it cannot advise them. Yet when you ask consumers what they want, they say they want advice. Not always ‘advice’ in the way the industry defines it, ie paid-for, personalised recommendations. But ‘advice’ in the way consumers expect help from professionals in areas where they are unfamiliar, and which lie within the provider’s domain of expertise. This call for help centres around key questions: What does this mean for me? What should I do?

This disparity between what consumers want and what providers can currently offer is what we call the expectation gap.

Pensions support as a duty of care

Consumers see pension providers as go-to experts in their domain. During accumulation, inertia-based journeys mean most consumers leave the difficult decisions to their pension provider, in conjunction with their employer. Consumers are largely comfortable with this as they do not want to make these decisions. There is an expectation that providers will know what the best strategy is for someone saving into a pension.

“There is an expectation that providers will know what the best strategy is for someone saving into a pension“

Nearing retirement – or at least the time of first access to a pension – is a key moment where consumers also expect that expert support. It is when consumers face a complex decision far outside of their comfort zone, and as many are already customers of the companies that will manage their pensions in retirement, they assume that this type of ‘advice’ is part of the customer care a provider owes them, often after many years of loyalty.

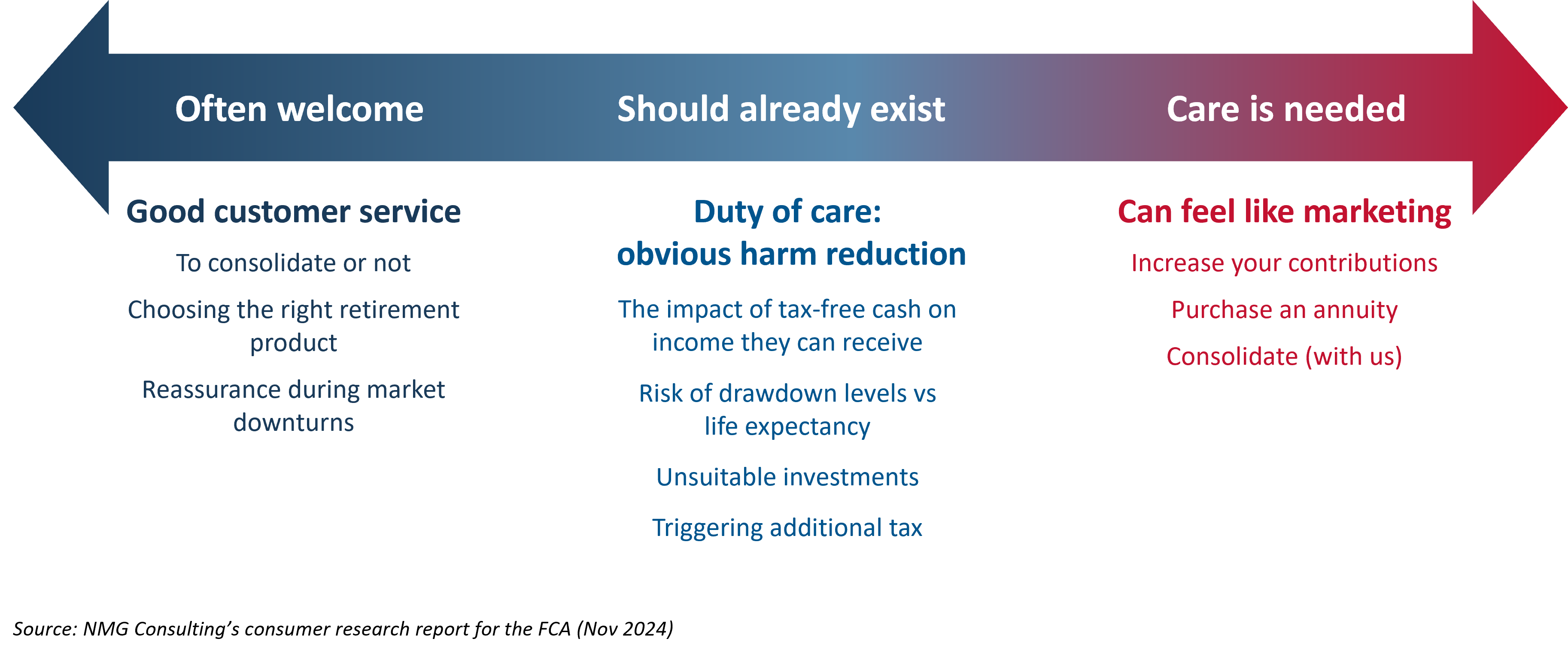

Exhibit 1: Consumer support expectations from providers

Consumers understand that accessing a pension carries risks, such as the possibility of running out of money with Income Drawdown. But they struggle with weighing up the different risks for their own circumstances and needs. Generic risk warnings create worry, but rarely reassurance – disappointing at the crucial moments of reliance when a duty of care feels lacking.

This is especially the case when it comes to preventing foreseeable harm outside of consumers’ comfort areas: unsuitable investment choices, unsustainable withdrawal rates, or tax consequences. If they are making decisions that may lead to an adverse outcome, consumers expect providers to tell them why this might not be right for them – not in the abstract but based on a few specific points.

Targeted support could fill the gap

Current regulations around the scope of advice and guidance make it difficult for providers to go that step further and help consumers weigh up the different factors as they relate to them.

The FCA’s concept of targeted support – suggestions developed for a segment of consumers with similar circumstances – landed well with our research participants, particularly those near retirement, filling the perceived gap between information and advice. While unlikely to be perfectly tailored to individual circumstances, it offers valued perspectives to support self-directed decisions.

Pension providers are seen as the obvious source for targeted support given their domain expertise, existing relationships and access to customer data. While targeted support is not likely to deliver on all of a customer’s pension support needs, it would help reduce the expectation gap, particularly around retirement.

To find out more about targeted support for pensions, including key use cases, limitations, and considerations, you can read the full report here.

If you are interested in discussing the topics within this article, please contact:

Jane Craig, Partner: [email protected]

Miba Stierman, Senior Consultant: [email protected]