Australia’s life insurance has faced significant struggles recently and is in the process of restructuring: Profits have trended down from their 2015 peak of AUD3.2bn, to a AUD100m loss last year; similarly, advised new sales have trended downwards consistently since 2013, on the back of regulatory imposts and reduced shareholder appetite. When will the industry bottom out?

(Another) challenging year

2020 presented both new and familiar challenges for Australia’s life insurance sector:

- Further reported losses for the life sector in aggregate (c. AUD100m; APRA)

- Continued exits from the Financial Adviser Register totalling just over 3,800 individuals, adding to the ~5,000 that left in 2019

- The introduction of regulatory restrictions on agreed value income protection products

- Ownership uncertainties and operational integrations

- Regulatory uncertainty, with some insurers not wishing to be over extended and waiting for clarity

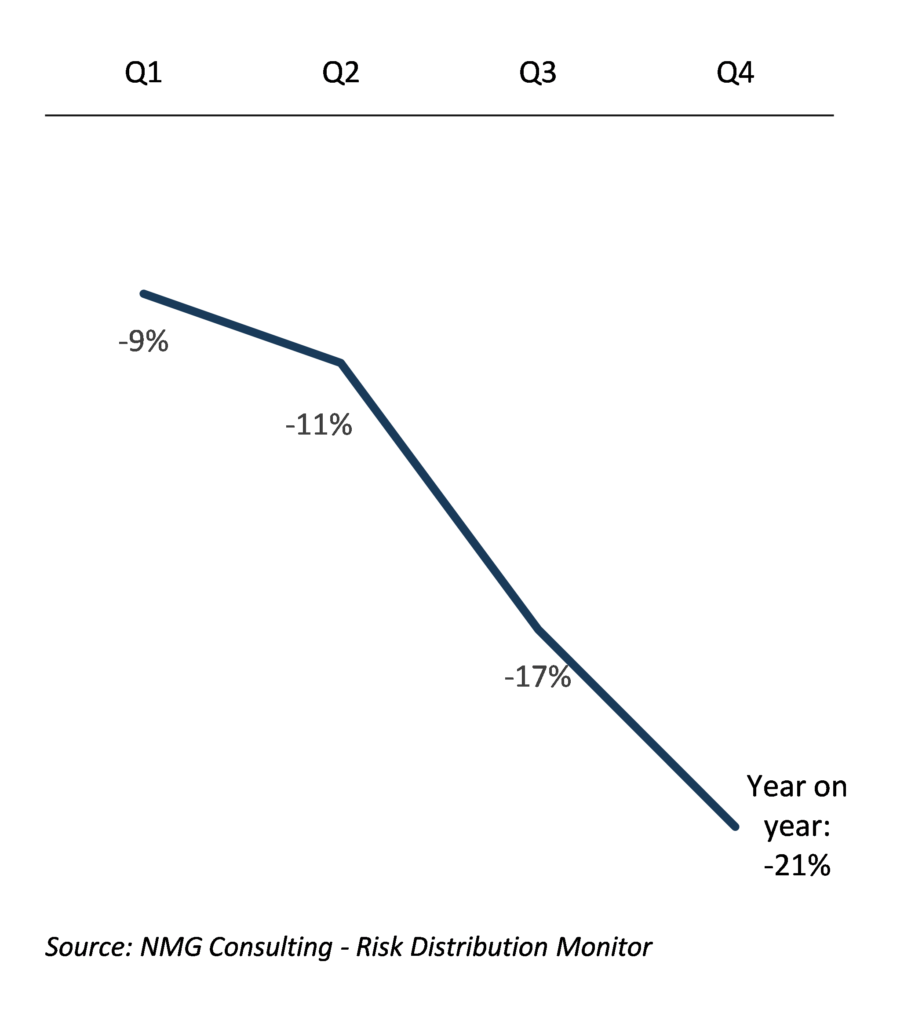

Mostly these exerted downward pressure on advised new sales, which fell by 21% over 2020, contributing to a massive 57% decline from their peak in 2013. In-force premiums have remained broadly stable, supported by automated increases and improved persistency.

Exhibit 1: Advised Life risk new sales (CYTD vs 2019)

The decline in new sales accelerated through 2020 (when compared to the same quarter in 2019)

Departing from the norm

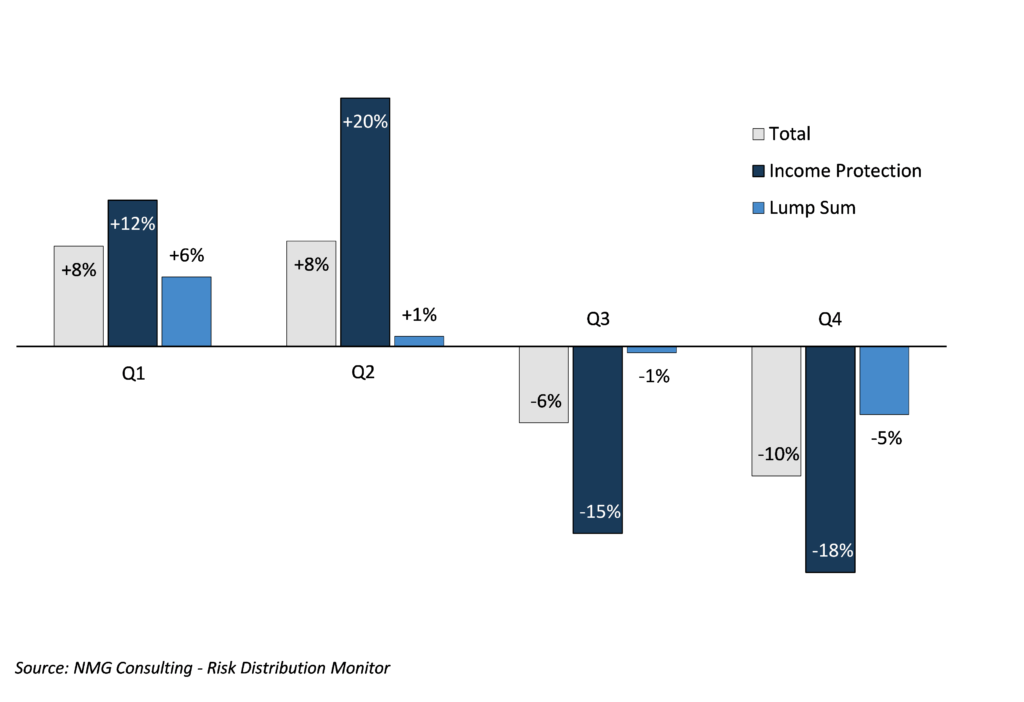

The distribution of sales across 2020 was atypical, with the share of new sales attributable to the first 6 months more than 8% higher than the 5-year average, leaving the second half comparatively lower by 8%.

Exhibit 2: Quarterly Distribution of Sales – 2020 v 5 year average

The distribution of lump sum new sales distribution was largely consistent with prior years, the deviations mostly being attributable to income protection sales

While there were some panic-driven sales at the onset of the pandemic, a deeper examination reveals that the biggest drivers of this deviation were of a regulatory nature:

- The distribution of income protection new sales varied significantly from the five-year average. Insurers could not place agreed value business for applications received after April 1 2020, creating a significant backlog that was only processed through Q2 (and thus evident as a large uplift in Q2 new sales). This rush to the door, combined with the inability to place agreed value income protection in later quarters left new sales in the second half of 2020 significantly below the five-year average

- The distribution of lump sum new sales were broadly on par with the five-year average. The small decline in the second half of the year being in line with the number of advisers exiting the industry that actively sold risk

- Despite high headline numbers of advisers leaving the industry, those that left in 2020 contributed to only 5% of new business in 2019

Bottoming

To recap: New sales via advised channels fell by 21% year on year, 6% higher than the 15% decline seen in 2019 – concentrated in a 30% decline in the last 6 months of 2020.

Ordinarily, this would indicate there was still some distance to the bottom, as deceleration and possibly stabilisation would be expected before a bounce-back could occur. The circumstances driving this accelerated decline may however point to 2020 being the year new advised life insurance sales hit bottom:

- Adviser numbers are starting to stabilise as the effects of the royal commission are absorbed – though end of year FASEA exam requirements do raise some uncertainty

- Insurers are set to launch new, simplified and perhaps most importantly APRA-compliant agreed value products through 2021, positioning to recover a slice of last year’s losses

- Rising optimism based on Australia’s re-emergence from the pandemic-driven recession may provide a lift (along with raised risk awareness)

- The prospect of supply-driven growth of new entrants in the advised life risk space, presenting a more efficient and effective service offering to advisers