October 22, 2019

Financial advice reimagined

It’s our view that the industry in Australia has reached an inflection point where the haze of...

Doom and gloom predictions about the future of the financial advice industry are widespread, and while there’s no doubt that significant change is occurring, we see a rapid lift in advice quality that presents somewhat of a ‘coming of age’ for advice.

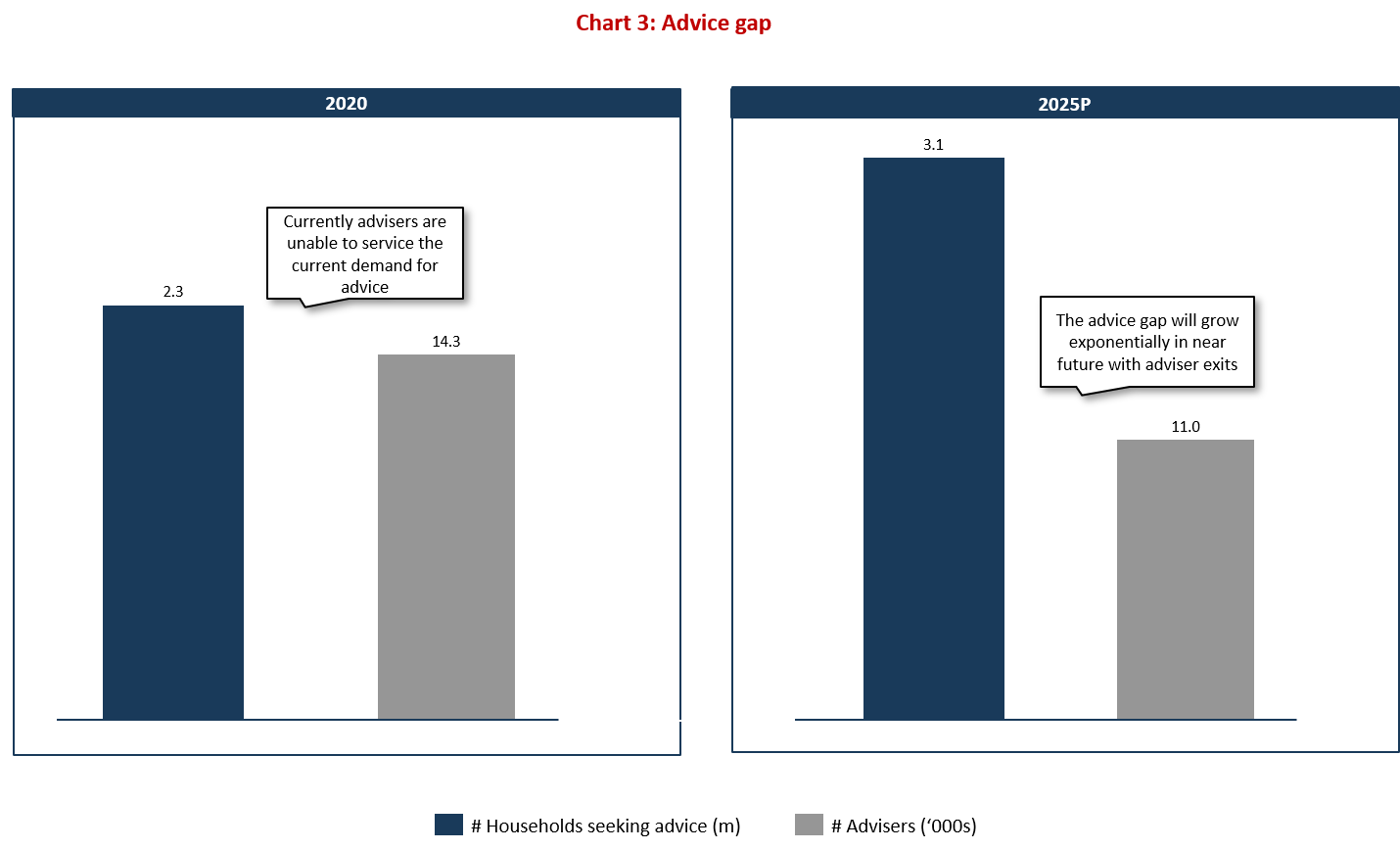

The ‘advice gap’ is regularly cited as an implication of all the change. With the propensity for advice firms to be cross-subsidised by product revenues decreasing, and the cost of providing financial advice rising, those who can get advice are likely to be wealthier households who can afford to pay for the pleasure…creating a growing number of unadvised people who could really do with some advice.

How big is the advice gap, though? To answer that, let’s look at some of the outputs of the NMG Australian Advice Model which considers the demand and supply of financial advice.

Demand

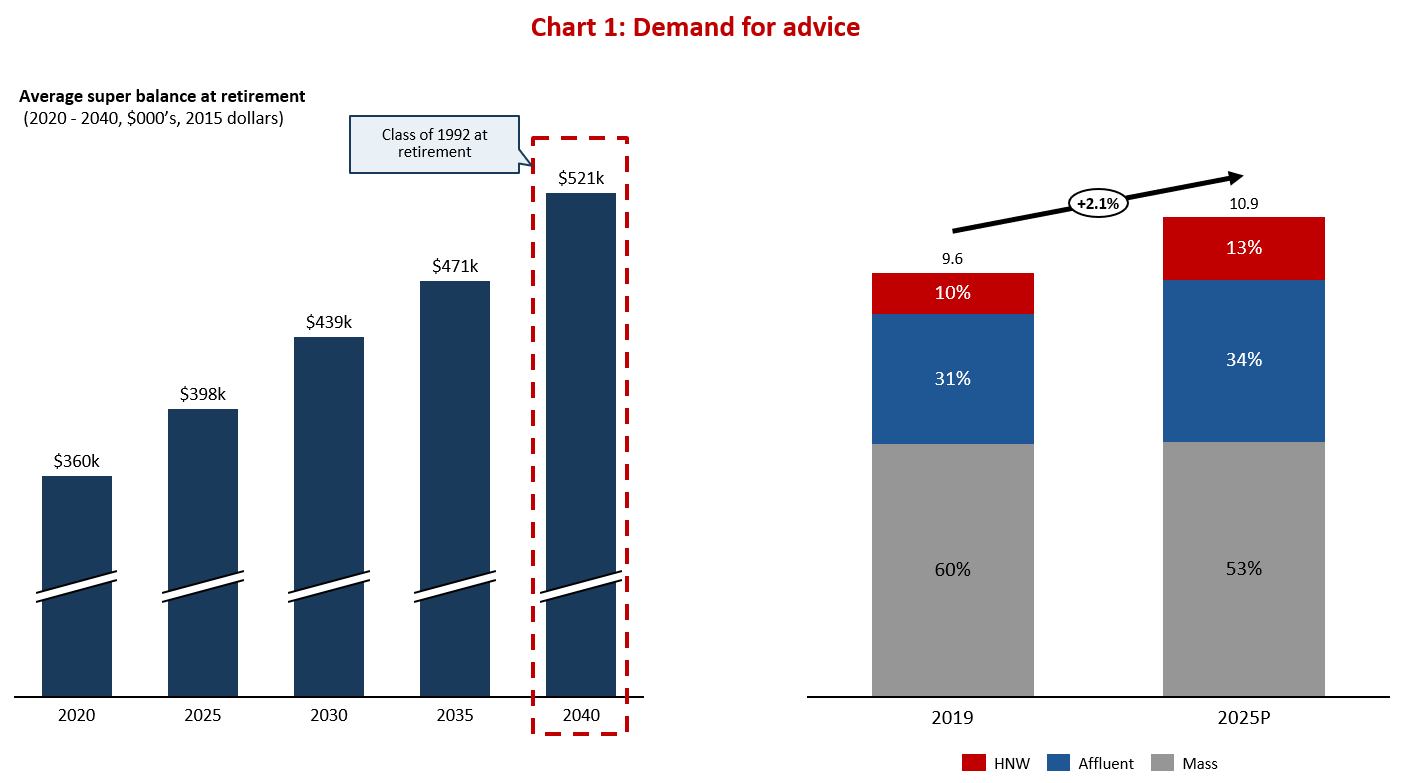

At a high level, demand for financial advice is relatively straight forward – a growing population and rising wealth (largely due to higher super balances) with more complex financial needs sees the future demand for advice continue to rise.

Of course, in addition to shifts in the demand for financial advice, the type of advice being demanded is also changing. While ongoing, annual advice remains important to many households, there is a growing demand for a more transactional, once-off advice that to date has been largely unsatisfied (outside of intrafund advice) and may be better suited to alternative models of delivering advice in the future.

Supply

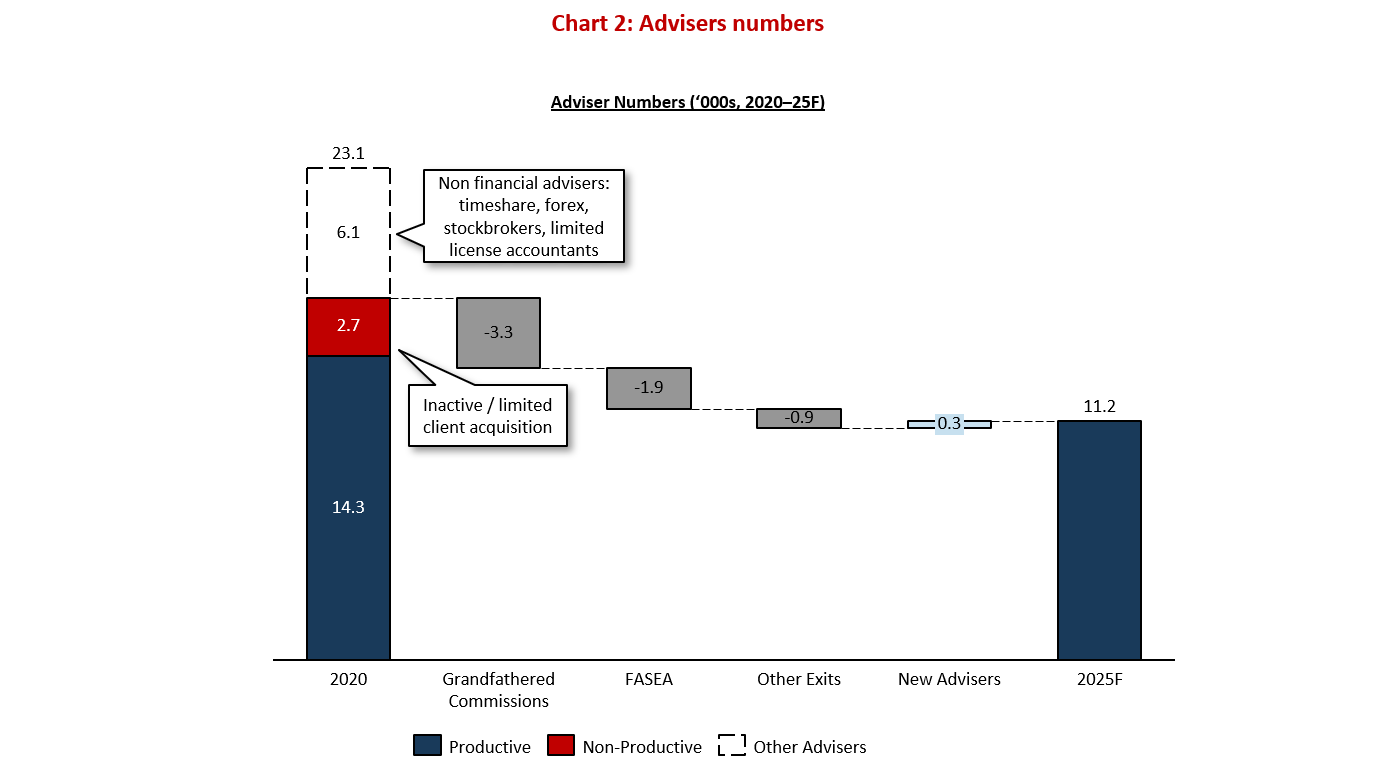

The number of financial advisers will dramatically decline over the near term, but that fall is not as significant as the numbers would imply, for four reasons.

Overall, that still sees productive adviser numbers decline – but the NMG Adviser Model illustrates the decline will be from some 14,000 productive advisers today, to 11,000 thousand.

Bringing the analysis of supply and demand together, the below chart shows that by 2025 the advice gap will dramatically increase.

Our next Trialogue will look at the impact of adviser productivity on the impending advice gap.