April 7, 2020

Crisis offers recordkeepers opportunity to stand out from the crowd

The rapid spread of corona virus has resulted in the U.S. economy coming to a screeching halt….

Asset managers and recordkeepers have done a good job of helping DC advisors manage the impact COVID-19 is having on their practices. Both groups have been responsive to advisors, which is absolutely critical. Market volatility communications are, by and large, seen as effective. If there is anything to take a look at, it is on the recordkeepers to evaluate their proactive communications.

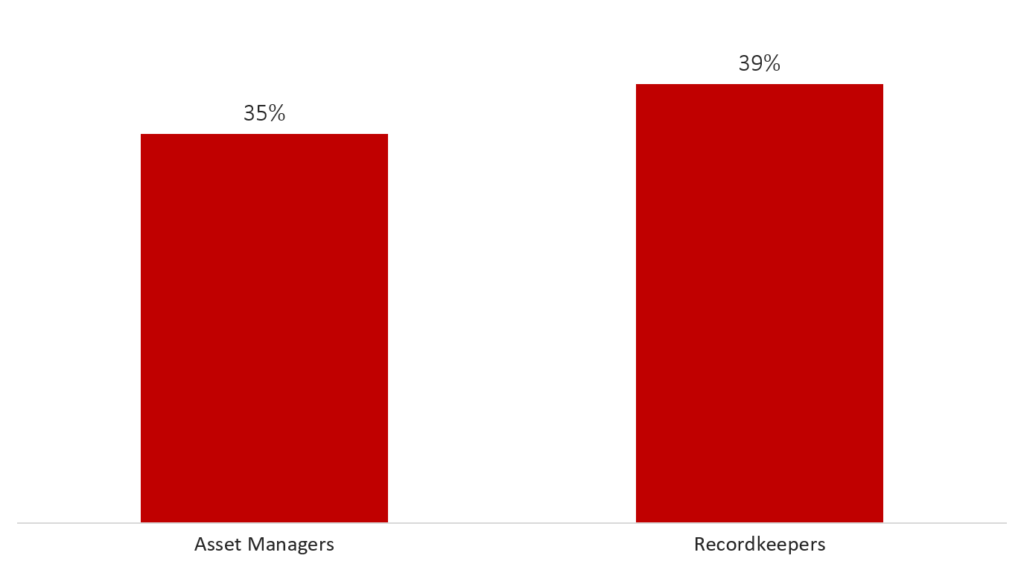

Despite the solid effort so far, there is an opportunity for asset managers and recordkeepers to partner with advisors to build stronger, deeper relationships. We asked advisors, without any prompts, to tell us which asset managers and recordkeepers have provided an “exceptional” level of support. Their response? Nearly 4 in 10 said no provider has hit the “exceptional” mark. And the majority of asset managers and recordkeepers received just a handful of mentions.

Advisors Saying No Asset Manager or Recordkeeper Providing “Exceptional” Support

Average % of advisors

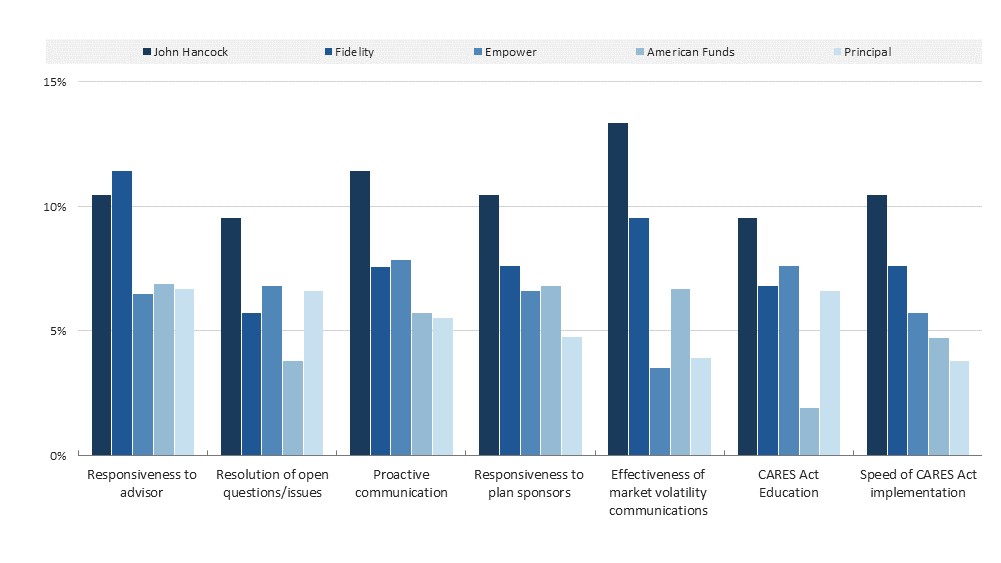

There are a couple of providers worth watching, though. Among recordkeepers, John Hancock received the most “exceptional” support mentions in 6 out of 7 criteria. Fidelity also performed well, often receiving the second highest number of mentions and leading recordkeepers in the always important Responsiveness to advisors criteria. The remaining recordkeepers are not out of the game, but also are not standing out.

Top-5 Recordkeepers Providing “Exceptional” Support

% of advisors naming recordkeeper

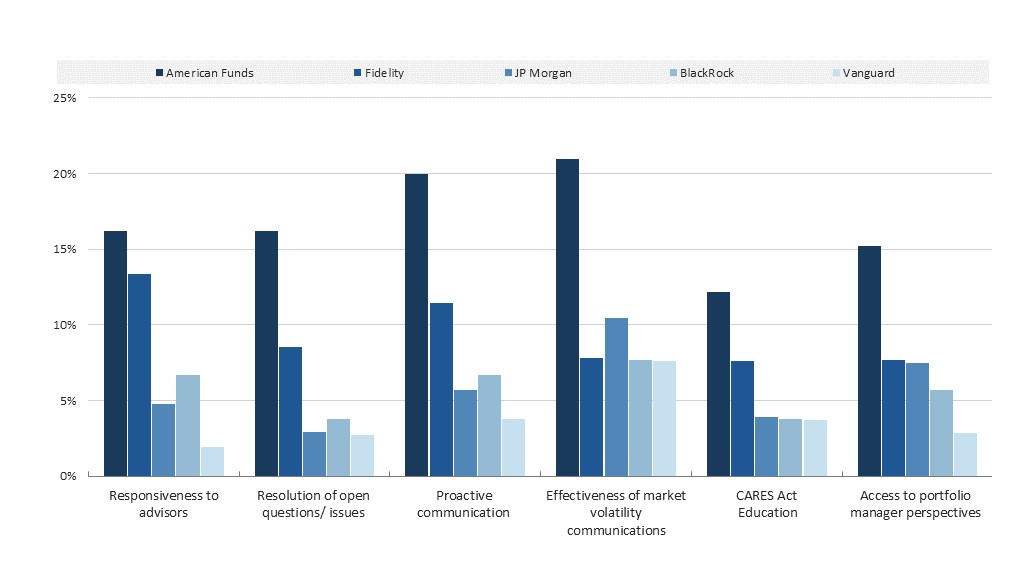

American Funds tops the list of asset managers in every rating criteria – often by a healthy margin. Fidelity, again, received consistent praise from advisors, separating itself from the competition in several areas. Similar to recordkeepers, the remaining firms are competitive, but have not distinguished themselves.

Top-5 Asset Managers Providing “Exceptional” Support

% of advisors naming asset manager

To date, the majority of DC advisors report the impact of COVID-19 on their practice is about what they expected. That does not mean these advisors would not welcome some assistance from recordkeepers and asset managers. They are facing two challenges:

Adjusting to remote engagement – Advisors have expressed a willingness to adjust their engagement models and maintain those changes in a post-COVID world, but there are indications they might need some help getting there. In March, when we asked advisors what capabilities they had in place, less than half said they could conduct a video conference and about one-third could host a webinar or launch a marketing campaign. Advisors with video conferencing capabilities jumped 16 points to 65% in May, indicating a willingness to adapt. Meanwhile, adoption of webinars and marketing did not increase.

Business development – Prospecting, sales, and recordkeeper searches are slowing down. 71% of DC advisors have stopped at least some, if not the majority, of prospecting for new clients. Nearly three-quarters have not initiated a recordkeeper review since late-February. Many are also delaying final decisions about recordkeeper changes and considering putting a hold on some plan implementations. This slowdown will have an impact on recordkeeper sales and, potentially, changes to fund lineups.

The past several months have been tumultuous, to say the least. It remains unclear when things might return to normal and what that might look like. According to advisors, that normal will not arrive until early-2021 — approximately 8 months away. In the meantime, they continue to adjust their engagement models to accommodate physical distancing, closed offices, and participants who are working remotely.

With advisors expecting things to take a lot longer to get back to normal, the time period by which advisors will judge record keepers and asset managers on their support during a crisis will be much longer. Poor, or even average, service in a short crisis might be easily forgiven. In a long, uncertain situation, sub-standard service may be held against providers, impacting relationships and sales once things reach a new normal.

Partner on business development plans – The majority of advisors have not initiated a recordkeeper review or search since February. Many are concerned about missing sales goals, just like asset managers and recordkeepers. Now is the time to help them put together a plan for prospecting and developing relationships with potential clients. This will set everyone up for success once plan sponsors have the mindshare to consider recordkeeper and investment reviews.

Help non-specialist advisors educate plan sponsors – Advisors who do not specialize in DC plans may not be educating plan sponsors about the CARES Act or options for adjusting a plan’s match. As a result, sponsors may not be aware of available options and/or critical decisions they need to make. It is important to know who these advisors are and work with them to ensure your mutual client, the plan sponsor, is doing everything they can to help their plan and its participants.

Help advisors reach plan sponsors and participants – Video conferencing is catching on with DC advisors, but 35% still have not implemented it. Few, if any, have added webinar or marketing capabilities since March. Meanwhile, recordkeepers and asset managers use these technologies on a regular basis. Consider providing information on how to choose video conferencing service, providing content to be used in webinars, and sharing best practices on proactive communication with clients.

In response to recent market volatility caused by COVID-19, NMG conducted an online survey of 105 financial advisors who are currently advising defined contribution plans. The survey was fielded May 7, 2020 through May 15, 2020. Advisors were asked to share the concerns, the impact the crisis has had on their practice, what their plan sponsor clients are concerned about, and to rate partner support.