May 17, 2022

Consumer Duty – How prepared is the advice sector?

As part of the FCA’s continuing drive to place the consumer front and centre, the forthcoming Consumer...

In this Citylogue, we discuss the opportunity for asset managers to turn net zero commitments into ESG leadership.

ESG became an important consideration for asset managers over the past five or so years; several have sought to take a leading position.

One way in which managers have attempted to lead is with public commitments such as carbon reduction and even net zero.

The Net Zero Asset Managers Initiative, which supports a net zero commitment by 2050 or sooner, has so far been signed by more than 233 international asset managers managing more than US$57trillion in assets.

Committing to firm, measurable targets for many is a positive development, but it is too early to tell which asset managers will ultimately deliver on these ambitious promises.

The magnitude of a net zero commitment, and the difficult and uncertain nature of the execution, cannot be overstated. Events and market conditions following a positive wave of such commitments at COP26 have only increased the complexity of the task.

Asset managers making or considering making commitments face some important questions, among them:

Through in-depth conversations with asset owners1 for our annual ESG study, we have a clear view of the current and emerging leaders of ESG, including impressions of their ESG commitment and execution.

NMG observes two prominent types of ESG leadership among asset managers:

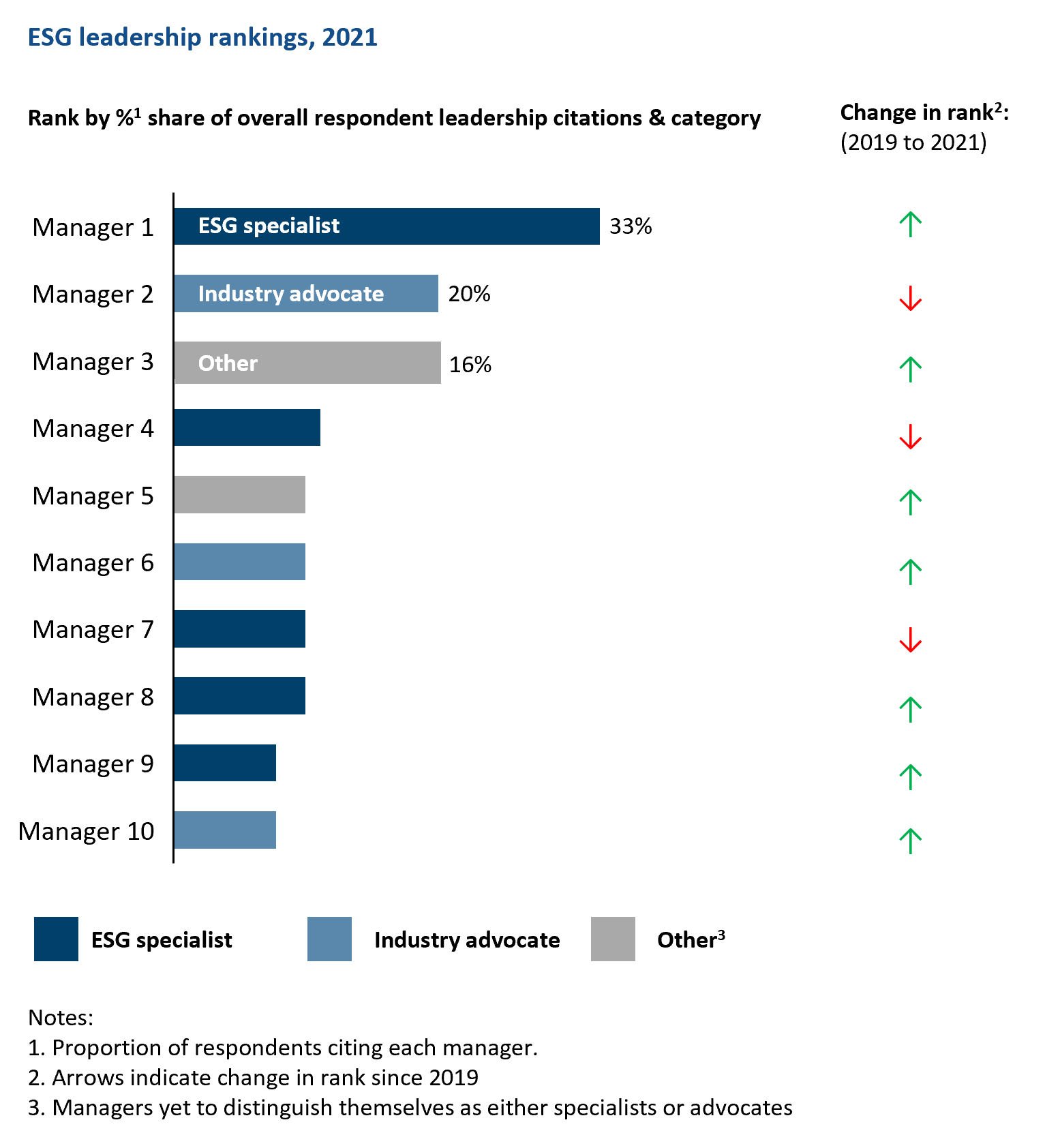

The chart below shows the top rated ESG leaders among asset managers as identified in the 2021 NMG ESG Study – the top two managers receive consistently strong scores, one primarily for being an ‘ESG specialist’ and the other for ‘industry advocate’. Each approach can deliver positive results and while we see an increasing number of ‘voices’, it is the specialists who enjoy increasing legitimacy. A third category (‘other’) covers several large, established global and/or regional managers, many with emerging ESG credentials, yet to distinguish themselves as specialists or advocates.

Exhibit 1: Top ten asset managers by share of ESG leadership citations amongst asset owners

Source: NMG Global ESG Study, 2021

The specialist and advocate ‘approaches’ are not mutually exclusive, and in fact should be mutually reinforcing, particularly in the context of net zero commitments.

While advocating for broader consideration of ESG factors (including social and governance) is important, expert execution of a pledge to net zero is currently the key opportunity for asset managers. Especially as many asset owners look for material outcomes and impact in ESG implementation.

Asset managers are coming under increasing scrutiny from asset owners, advisers, and the media for ‘greenwashing’ and even ‘timewashing’. So concerns about not delivering on net zero commitments, and the potential consequences, are understandable.

In the institutional channel, we believe there is cause to be optimistic, as asset managers are not making these commitments alone.

71 asset owners signed up to the UN-convened Net-Zero Asset Owner Alliance initiative at the start of 2019, and those we speak with, most of them large-scale in terms of AUM and all implementing ESG themselves, frequently tell us they have made, or are exploring making, similar commitments.

Most acknowledge they too don’t have a clear, implementable plan to deliver the entirety of their commitment today and are depending on future developments (often unknown) to do so. They are likely to forgive asset managers who face the same difficulties.

There is alignment then for asset managers making firm commitments and positioning as the voice of the industry. However, those managers would do well to be honest about the magnitude of net zero challenges and be open and transparent with their clients and the market when they are falling short.

Equally, these investors are more likely to acknowledge success. So, managers should be sure to communicate those as well. We are less concerned about that, of course.

Note on methodology:

NMG began conversations for this year’s ESG study in April 2022 and will be delivering insights to help asset managers answer their net zero questions and more in July.

[1] Asset owners’ and ‘institutions’ includes pension funds (DB, DC, state and private sector), life insurance balance sheets, sovereign wealth funds as well as ‘retail gatekeepers’ defined as professionals influencing manager selection within retail banks, private banks, life insurers, research houses, multi-managers, and fund platforms.