September 16, 2021

MPS Market Landscape: Part 1 – Asset Managers as MPS Providers

In the first part of our MPS Market Landscape series, we will be covering - why asset...

With growing allocations of private capital into the long-term savings market, small independent Master Trusts offer an opportunity to private equity investors.

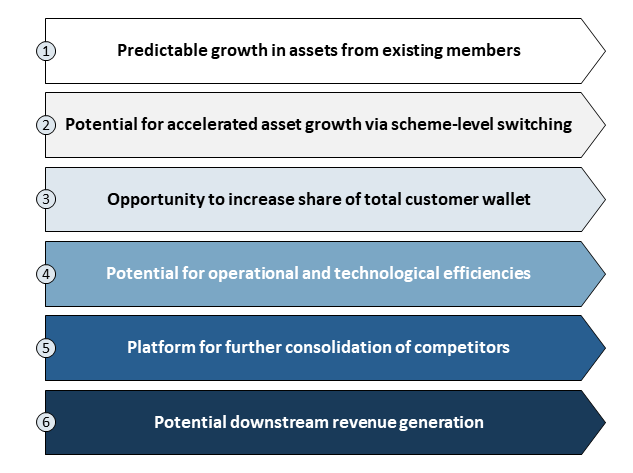

NMG has identified six key factors that underpin the equity story with small independent Master Trust providers:

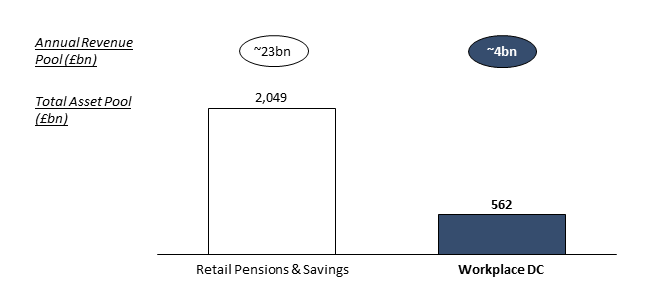

Over the past five years, there has been substantial growth in participation of private equity in the UK long-term savings market. To date, private capital has been largely attracted to the retail channel due to its larger total asset and revenue pools than workplace defined contribution plans (“Workplace DC”), as seen in Exhibit 1.

Exhibit 1: 2020 Long-Term Savings Assets and Revenue Pools (Retail vs Workplace DC)

Source: NMG UK Stock & Flow Model

This extent of private equity fund participation has been enabled by the breadth of acquisition targets in the retail channel, c.9,000 retail advice firms and a broad range of independent service providers to retail advisory businesses (including advisory practice management and CRM software, financial planning software, and platform providers).

However, workplace DC has been steadily increasing in importance since Auto-enrolment (AE) phasing-in began in 2012, compelling UK employers to offer opt-out workplace DC pensions to most of their employees.

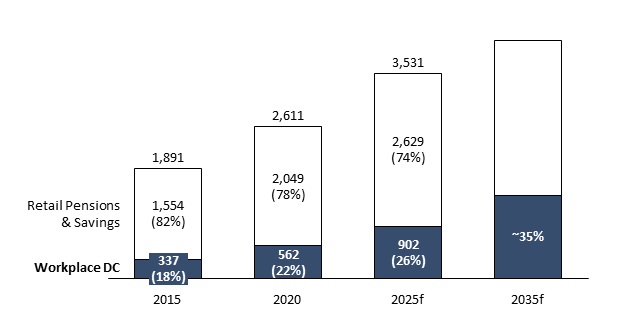

While most large AE-compliant schemes had been set up by 2015, the ongoing contributions associated with AE drove up workplace DC share from 18% of assets in 2015 to 22% in 2020. With forecast net inflows of ~£15bn pa into workplace pensions, this growth in share is expected to account for 26% of the UK long-term savings market AUM by 2025f as shown in Exhibit 2, and up to ~35% by 2035f.

Exhibit 2: Workplace DC Share of UK Long-Term Savings Market Assets (£bn)

Source: NMG UK Stock & Flow Model

There are three key types of workplace DC pensions: contract-based, single trust and Master Trust. While contract-based and single trust pensions are controlled by large insurance groups, Master Trusts (MTs) have a range of ownership structures:

With large client numbers and (currently) small average customer balances, operational and technological efficiency is a key challenge for Master Trust providers. In NMG’s 2020 corporate adviser study, small independent MT providers received lower ratings for operational management and technology than insurer and EBC-owned peers. In the absence of funding for significant admin and tech platform upgrades, the technology and operational performance of small independent MTs is unlikely to improve.

Furthermore, regulatory direction is moving the obligation to provide for scheme members into retirement onto workplace DC providers, with Investment Pathways expected to represent just the beginning of a number of market developments around the at-retirement member proposition.

Despite an overwhelmingly positive growth outlook for the workplace DC segment as a whole, small independent MTs are likely to lose market share in the absence of funding for significant admin, tech platform and retirement income proposition upgrades.

So what makes small independent Master Trusts an attractive target for private equity?

While representing a strong investment story, private equity investment in small independent MTs is not without its challenges, notably through:

We will explore both of these challenges in detail in the second part of this Citylogue series.

For more information, contact:

Charles Lake, Partner (London; [email protected])

Rodolfo Crespo, Senior Consultant (London; [email protected])