March 9, 2022

The UK Master Trust Equity Story

With growing allocations of private capital into the long-term savings market, small independent Master Trusts offer an opportunity...

While banks play a pivotal role addressing the protection needs of the Mid-Market globally, UK banks remain reluctant to participate. Based on our most recent industry research, UK banks should re-enter life protection.

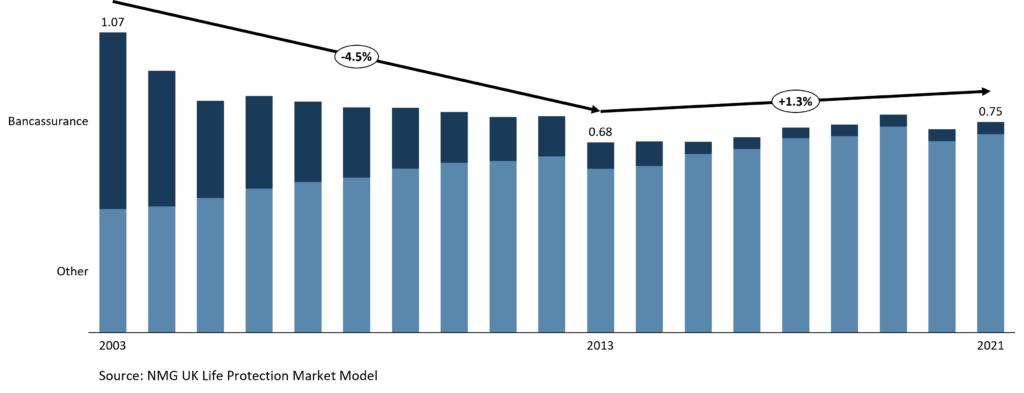

There has been a significant life protection gap in the UK since the banks pulled back from the segment in the early 2000s. Nominal volumes remain 70% of industry peak and are estimated to be <50% when adjusted for premium inflation.

Exhibit 1: UK Individual Life Protection New Business Volumes (APE, £m)

UK banks pulled back from life protection largely as a result of their own actions. Their mismanagement of distribution allowed the mis-selling of Payment Protection Insurance (PPI), heavily impacting their reputation, eroding consumer trust, and resulting in significant fines (>£50bn).

The introduction of RDR in 2012 was the final nail in the coffin, leading to banks effectively exiting from advice and as a result, exiting from any material participation in life protection.

While the banks still technically participate in life protection (typically through ongoing partnerships with insurers), there is very limited focus on this segment translating into ongoing low bank volumes.

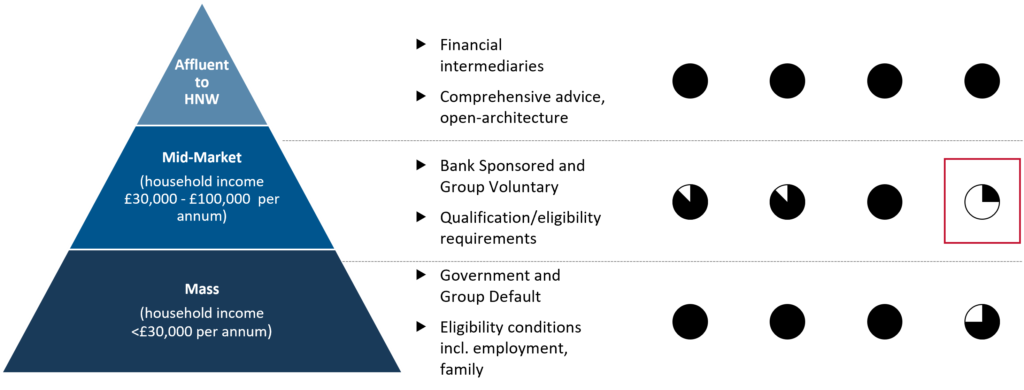

The life protection gap left by the exit of UK banks is concentrated towards the Mid-Market segment (disposable household income of £30,000 to £100,000 per annum). These consumers have the need and means to purchase individual protection, and critically, are more vulnerable to life events relative to the Affluent/HNW consumer segment.

Across leading protection markets globally, each of the key consumer segments is generally well served through distinct placement models matched to their differing life protection needs and affordability constraints.

Exhibit 2: Life Protection Coverage by Layer

Note: Household disposable income (after tax), Harvey balls represent level of individual protection coverage given needs and affordability constraints

In the UK, the service of the top and bottom layers is comparable to leading markets through IFAs and Group Default respectively. However, there is a clear gap in the Mid-Market.

NMG spoke to industry executives at 6 of the top-10 UK life insurers and all agreed that the gap left by banks is heavily concentrated towards the vulnerable Mid-Market.

There have been developments in other channels that skew towards the Mid-Market, namely the emergence of ‘Streamlined Specialist’ IFAs (call-centre based firms partnering successfully with aggregators as well as purchasing/generating their own digital leads) and mortgage brokers increasingly focusing on the life protection cross-sell.

However, not only have these failed to fill the gap, there is a risk that the gap will widen again. New business growth through Streamlined Specialists and Mortgage Brokers is expected to slow, in part due to these advice models maturing as well as current Cost of Living challenges driving these advisers to shift upmarket towards more affluent consumers.

Voluntary Group has the potential to bridge the gap however there has been limited success to date and it faces inherent challenges (requires the introduction of employer-endorsed worksite distribution) relative to banks.

Consumer behaviours and preferences towards life protection are shifting, with the customer journey increasingly beginning in a digital channel. Banks’ (both high street banks and Neobanks) unique and significant inherent advantages are even more pronounced with this shift:

Which should translate into lower cost to serve and increased customer value.

While the optimal participation model (partnership, vertical integration, JV, etc.) remains a question, it is clear that the Mid-Market needs banks to re-enter. The banks however, must ensure that they do not make the same mistakes as before, by focusing on:

NMG has extensive experience supporting banks in peer markets (including Australia) develop their bancassurance strategies, across participation model, distribution, product, and underlying digital/data capability requirements.