December 8, 2021

Growing advice risk gap for middle-class Australians

The growing gap between consumers’ protection needs and the risk advice industry’s capacity to meet them is...

Intermediaries in Canada have been vocal about their concerns with soaring group disability insurance prices and a lack of high-quality disability management, since the start of the Covid-19 pandemic. However, insurers have faced several challenges, including finding the balance between price sustainability and competitiveness as claims rates have grown, and in an environment of low investment returns. Many new health and wellness market developments have also emerged in recent years and communicating carrier offerings, and how they differentiate, has proven difficult.

Against this context, insurers are reviewing their group disability insurance propositions and, in this article, NMG Consulting has marked out three key areas that require focus.

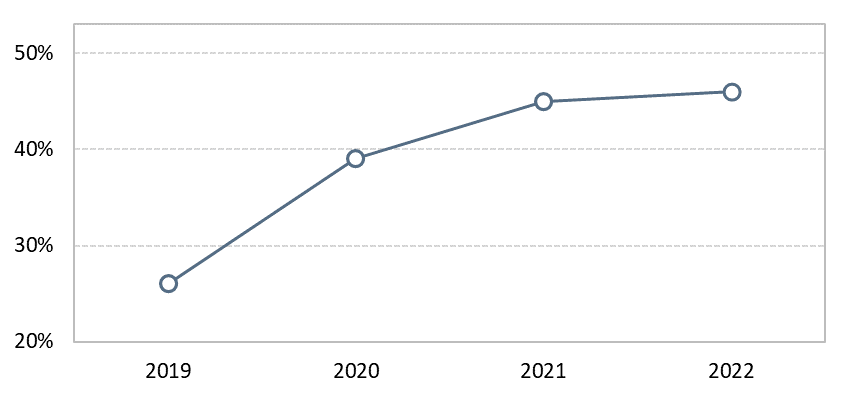

Since the onset of Covid-19, group long-term disability (LTD) insurance rate hikes have been a pain point for the intermediary community (Figure 1). Advisors and consultants have found it challenging to rationalize rate actions with employers, partly because of poor communication. There is no suggestion that the pricing strategy needs to change, however the lack of transparency from insurers in communicating changes has created uncertainty and mistrust between intermediaries and insurance carriers.

Figure 1: Proportion of intermediaries considering Group LTD pricing to be high1

(2019 – 2022)

Insurers in the UK have experienced similar challenges in recent years, a period when group disability insurance pricing has been fluctuating. Carriers encountered trust issues when they failed to effectively communicate the reason for rate increases. Those who crafted a clear story around their pricing rationale, supported by data sharing and service, have been more successful (Canada Life, Unum, and Aviva). For instance, some insurers have been more open in sharing claims data to facilitate dialogues between intermediaries and plan sponsors.

Based on our learnings in Canada and internationally, NMG Consulting believes Canadian insurers should consider these three elements in pricing communication:

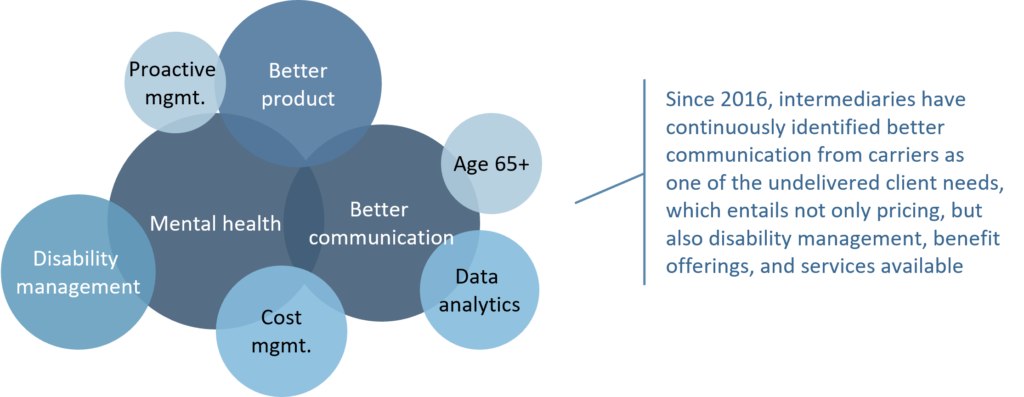

Over the past two years, new market developments related to health and wellness have increasingly attracted the attention of intermediaries (particularly around virtual care, EAP programs, and mental health services). However, employers and members do not always understand which benefit offerings and ancillary services they are entitled to, and how insurers can help employees manage disability and return to work. There is a clear need for insurers to communicate these propositions more effectively (Figure 2).

Figure 2: Canadian group disability insurer opportunities/undelivered client needs1

(2016 – 2022)

This issue is not unique to Canadian insurers. Carriers in Australia are criticized for a lack of clarity as to who has the principal responsibility for identifying at-risk employees and retraining/re-skilling plan members. Some insurers in Australia successfully differentiate by taking a more empathetic approach to claims and rehabilitation management (such as OnePath and AIA), while others have stepped up communication of their mental health philosophy and preventative care support services (such as MLC Life Insurance).

In view of this feedback, Canadian carriers should consider:

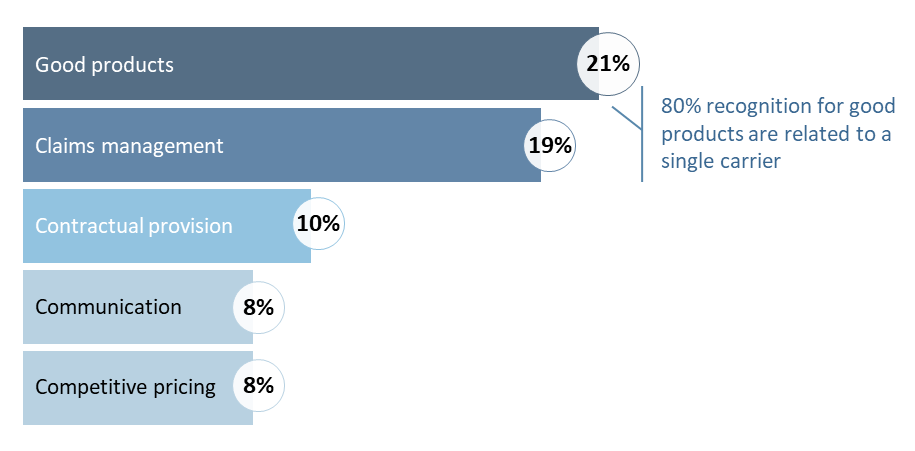

When it comes to LTD products, most carriers in Canada have yet to show adequate differentiation (Figure 3). The current product design, typically covering members until the age of 65, can be expensive. It also lacks the flexibility needed by younger employees and gig economy workers. These findings indicate an opportunity for product evolution and cost management.

Figure 3: Top reasons for being best-in-class LTD carrier in Canada1

(2022, % of respondents)

In the UK, carriers have successfully introduced limited benefit payment terms. This cost saving option allows the employer to choose a 2 to 5 years disability payment period instead of coverage until retirement. Although the traditional LTD product is still more prevalent in the UK, the introduction of this design has made the product more affordable and encouraged members to get back to work sooner with the help of support services.

Considering evolving client needs, insurers should:

The challenge of group insurance affordability and evolving member needs will continue to create pain points as well as opportunities for participants in the Canadian group benefit industry. Insurance companies play a critical role in providing employees with a financial safety net, supporting individual health & wellness, and creating a bridge to strengthen the bond between employers and their talents.

Our evidence suggests that Canadian insurers have an opportunity to better meet plan sponsor and employee needs, through more price transparency, proactive communication and differentiated products. It is pivotal for insurers to continuously adapt their products and services to new market dynamics and client interests, and effectively leverage their data and human capital to communicate clearly and convincingly.

1Source: NMG Canadian Group Benefits Study