November 24, 2021

Find your fixed income goldilocks

Fixed income funds are better designed and marketed to appeal to a sub-set of advisers with a...

The growing gap between consumers’ protection needs and the risk advice industry’s capacity to meet them is the widest for advisers who service middle-class Australians.

The Australian risk market has seen more than its fair share of hurdles in the last few years:

This has naturally created a significant gap between the risk advice that was previously being provided/demanded by consumers and the capacity of the advice industry to meet this demand.

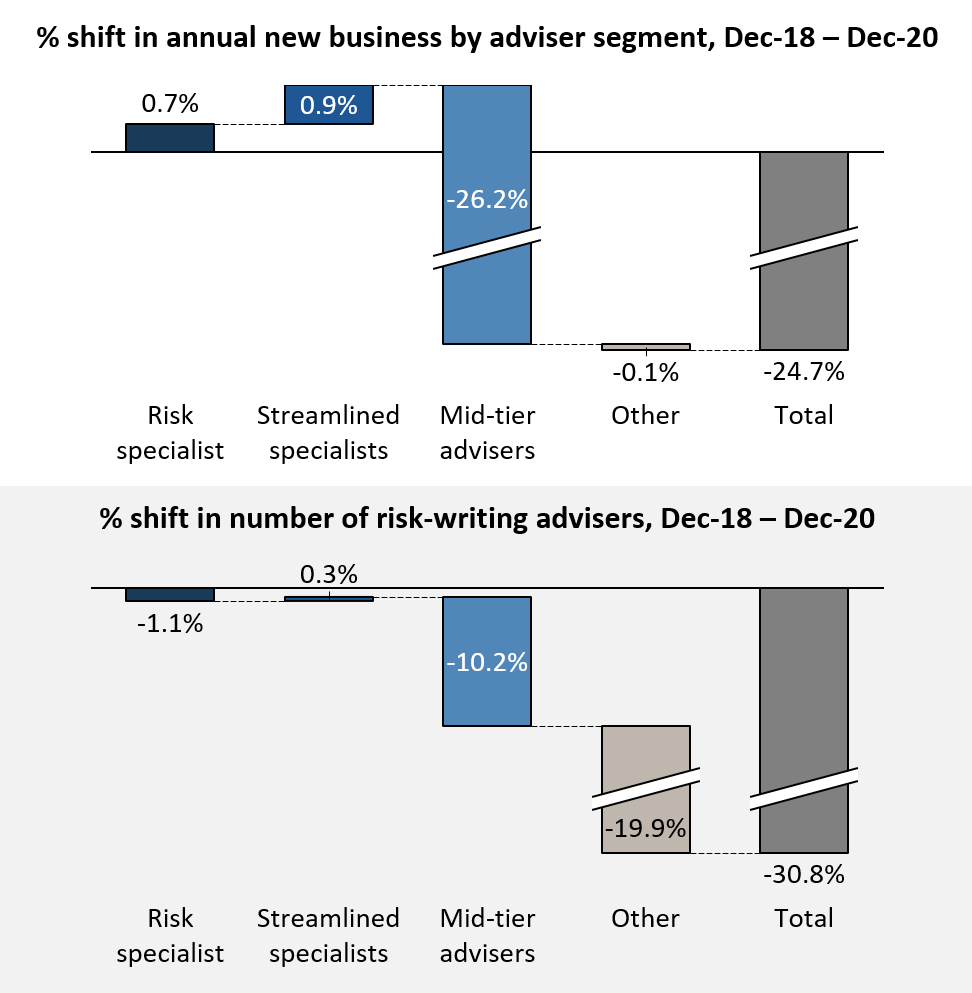

By December 2020, more than 30% of the 13,000 advisers that advised on risk just 2 years prior had ceased providing insurance advice. In this same time span, the total new risk business written by advisers in the last 12 months has dropped from $438m to $345m. However, like other components of Australia’s advice gap, the advised risk gap is growing quite differently for some adviser segments than others.

Exhibit 1: Mid-tier advisers account for the majority drop in numbers and new business

Percentage shift in annual new business and number of risk advisers by segment, Dec 2018 to Dec 2020

Despite dwindling in supply, risk specialists (advisers with more than 80% of revenue from risk advice) have written more business as a group – their share of annual new risk business has risen from 15% in 2018 to 20% in 2020.

The mid-tier segment – holistic, general practitioner and investment-focused advisers who provide a mix of wealth and risk advice – has significantly shrunk in numbers and total new business.

A large portion of “other” advisers (who generally write 1-2 policies a year) have ceased providing risk advice entirely, but with minimal impact on total sales.

While there has been an exodus of risk writers, risk specialists are somewhat offsetting…

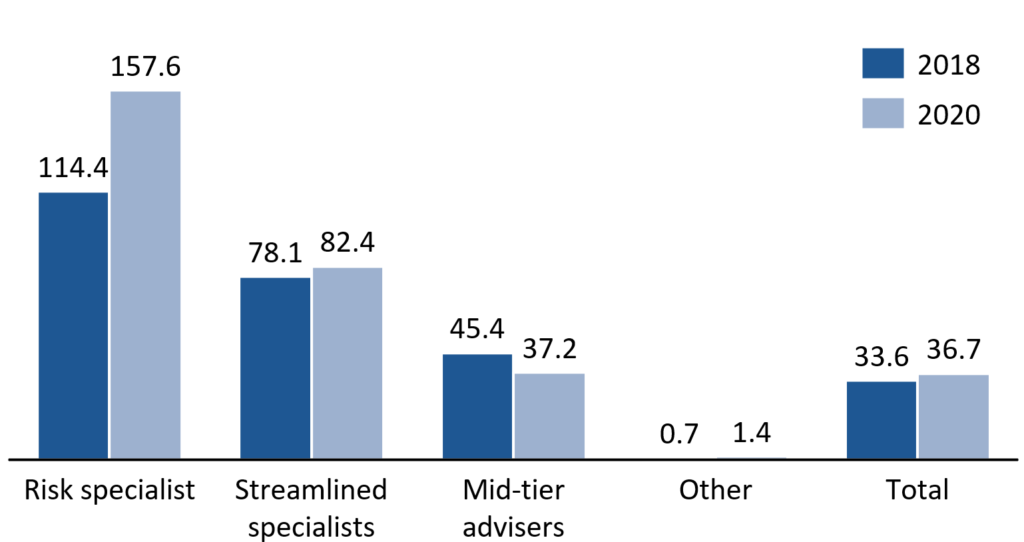

As a result, while there has been an exodus of risk writers and a corresponding plunge in new business written, the most risk-focused advisers are making up the difference at the upper end of the market – risk specialist productivity (annual new business written per adviser) rose by $43.2K from 2018 to 2020.

Exhibit 2: The gap is growing fastest at the mid-tier adviser segment

Annual new business per risk adviser (‘productivity’), 2018 to 2020 ($’000)

Instead, the advised risk gap is growing fastest at the mid-tier segment, where the shrinking pool of generalist advisers is unable to service their client base (who are primarily middle-class Australians – mass affluent with moderate-to-complex advice needs) at the level they once could. We estimate this gap to consist of ~140K policies that would have otherwise been written between 2018 and 2020, if mid-tier advisers’ risk-writing capacity remained constant.

This presents two immediate opportunities: firstly, current risk specialists can grow via referrals from more wealth focused advisers; and secondly, there is room for a new model of insurance advisers to efficiently tackle this gap.