July 16, 2021

Inflection Points for the Australian Asset Management Market

‘Inflection Points’ was the theme of our annual strategy event in Sydney where the team discussed some...

Designing a fixed income fund to appeal to a sub-set of advisers with a particular fixed income objective is preferable to trying to appeal to the whole market

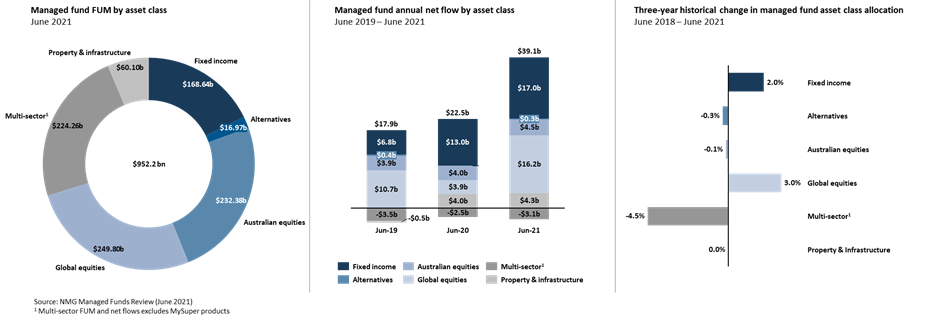

Fixed income is typically the quiet achiever in the Australian retail asset management industry: more recently it has benefited from strong net flows with the mass exits from term deposits (due to ultra-low rates) and a steadily declining risk profile across the retail asset management industry as the market continues to mature and shift towards a retirement focus.

Exhibit 1: The role of fixed income in Australian retail asset management

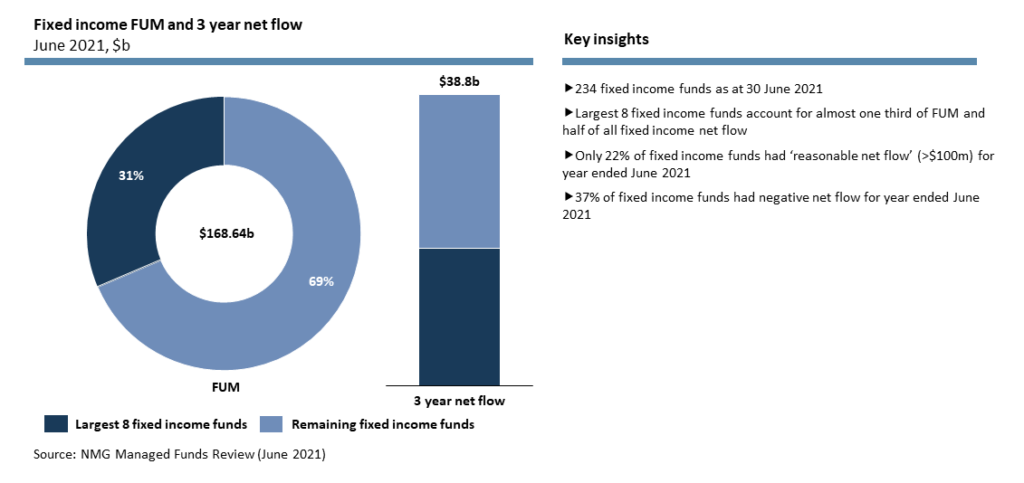

However, that tailwind is not treating all fixed income funds equally, and there is only a handful of winners.

Exhibit 2: Concentration of fixed income funds

As part of our engagement with advisers on how they build portfolios for clients, advisers state they use at least one of three primary core objectives in their fixed income allocations

While these objectives are not mutually exclusive (in fact, most advisers have a primary and secondary objective), the primary objective for an adviser has a significant impact on the types of products they use (and their resulting allocations).

Those eight products currently receiving half of fixed income net flow are particular relevant to one of these objectives, and are therefore heavily supported by advisers who use that as their primary approach to fixed income.

That is, instead of trying to appeal to all advisers, these funds recognise they may be too hot or too cold for some objectives. Instead, they understand where they are ‘just right’ for a particular objective that advisers want from their fixed income allocations, and then target their product, sales and marketing activity directly towards those advisers.

Winning products are targeting just one of three primary objectives within advisers’ fixed income strategies

Just as we have seen with equity funds moving away from benchmark relative product towards a barbell approach with a blend of passive and high conviction product, we are seeing fixed income allocations shift away from traditional products towards ones targeted to one of these core objectives.

For fixed income managers, this means finding your Goldilocks, and making sure your products are ‘just right’ and designed to meet one of these primary fixed income objectives.