July 7, 2021

Inflection Points for the Australian Advice Market

‘Inflection Points’ was the theme of our annual strategy event in Sydney where the team identified a...

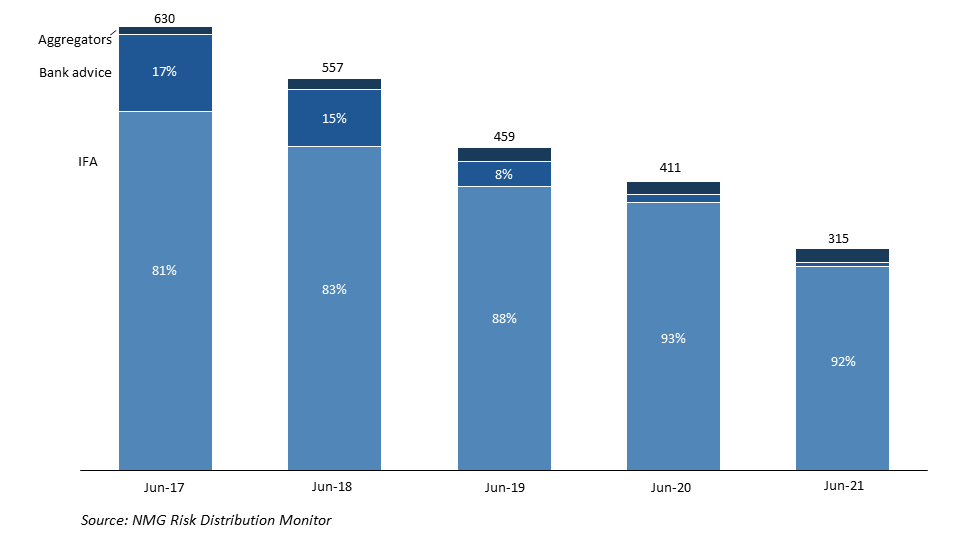

After five years of decline, advised life risk new sales in Australia are at last finding a firmer footing. The fundamentals remain robust and there is building evidence for clearer skies ahead.

Insurers and reinsurers have both experienced large losses from advised life risk portfolios, particularly in the last five years. Shareholders are now rightfully more cautious.

It has been a difficult time for advisers too, with higher regulatory requirements for advice, regulatory intervention on product offerings, and limits on commissions payable.

The result has been, unsurprisingly, a sharply declining market for life risk new sales. In fact, staggeringly so, with new sales for the financial year ending 30 June 2020 falling to 50% of their peak of 2017.

By extension, this means that consumers are also less well insured.

Exhibit 1: In rapid decline

Australian life risk sales (AUDm) by distribution channel (Financial year)

Industry participants resilient enough to have survived this unprecedently challenging period might however feel they have some reasons to feel optimistic.

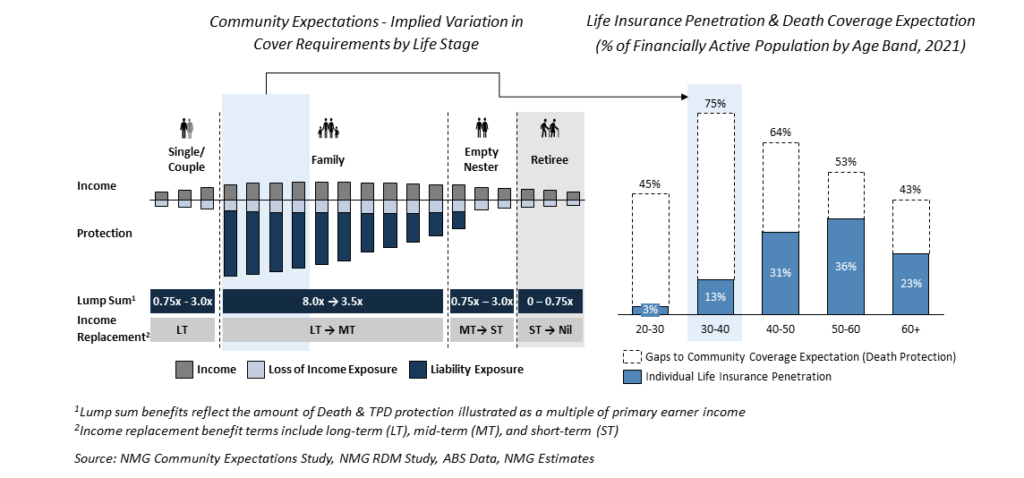

Life insurance is best thought of as a ‘community good’; that is, one purchases it in the hope one never needs to use it, and in the case that hope is dashed, its benefits (in most cases) go to others. So, life insurance benefits go to the community as opposed to the acquirer, being quite different to the typical profile of a consumer good.

The standard for life insurance sought by the community is for it to act as a safety net to help families avoid hardship in the face of adverse events (such as death and disability), focused on the family and the family house, supporting a re-structuring of affairs to allow ongoing engagement with the community.

While this standard is largely consistent across demographics, the implication is that the level of community protection for Australians is based on age and life stage. Currently, expectations are not being equally met at each life stage, and declining new life risk sales means these gaps are set to widen.

The gap between actual coverage levels and reasonable community expectations remains an opportunity for the advisory industry. New, more efficient, advice models are required, but also more efficient processes for new business acquisition. Lightened regulatory settings would be a welcome boost too.

Exhibit 2: Expectations and reality

Those under 40 (typically young families with a mortgage) have the greatest exposure to liabilities and loss of income, and are the least well insured

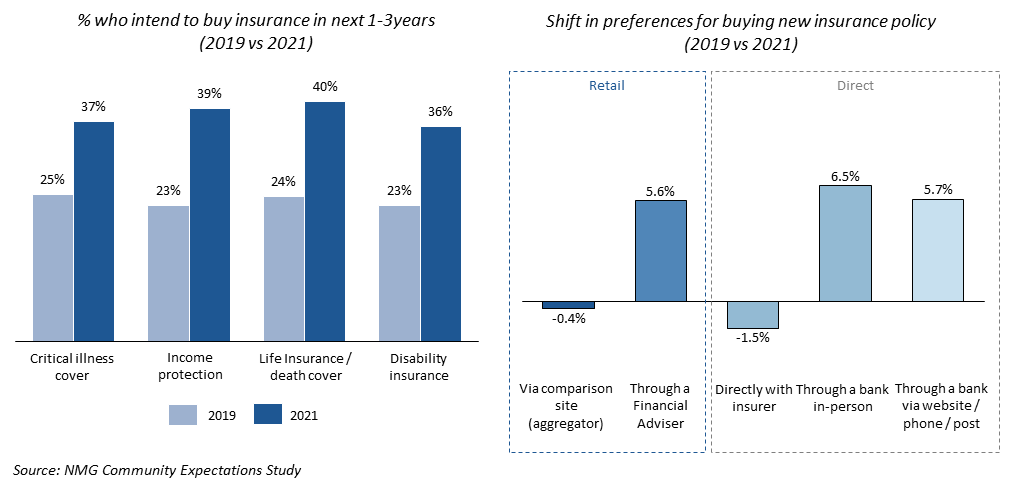

Australians have high levels of risk awareness generally. Over the past 24 months in particular:

Exhibit 3: More life, more human

Consumer stated life risk purchase preferences – October 2021

This should be a welcome relief to the ~7,000 active risk advisers, particularly those who are able to mobilise a new approaches to address these needs which are currently unmet.

Part of the success of direct insurers has been their accelerated adoption of data-driven, digitally-enabled acquisition and business models.

Advice channels have yet to receive the full benefits of a digitally-enabled value chain, and the productivity gains that will follow (such as lead generation and more streamlined risk acceptance).

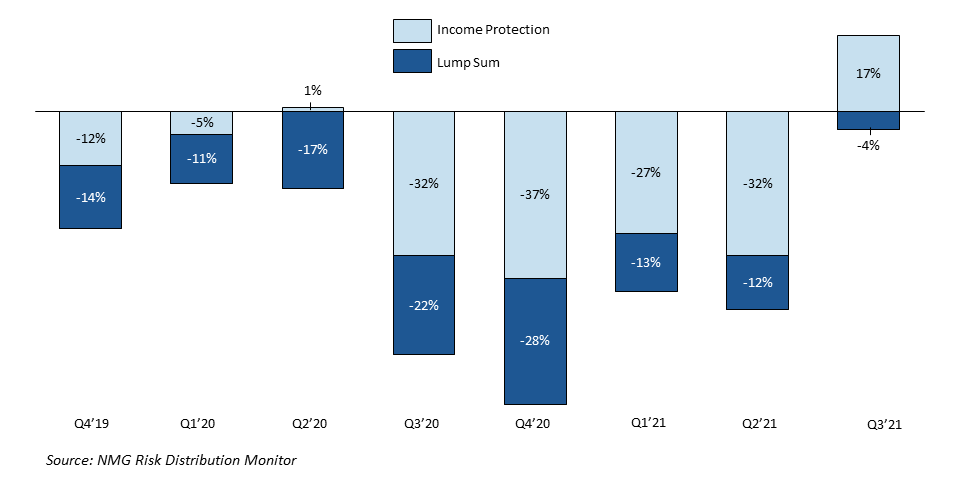

While in part driven by accelerated purchasing of disability income covers ahead of the regulatory deadline (before which only new more conservative designs can be sold), for the first time in the last eight quarters there has been growth in sales for the quarter (Q3 2021, 13%) on a year-on-year basis (ie compared to Q3 2020).

Exhibit 4: Ultimately uplifting

Changes in annualised new sales for the quarter, on a year-on-year basis. 17% uplift in Income Protection sales. Lump sum sales almost fully tapered

The decline in Lump Sum new sales (which make up nearly 70% of total new sales) seems to be almost fully tapered, suggesting that sales are finally at an inflection point. Income Protection new sales will continue to be more volatile and thus harder to anticipate, and will likely fall immediately after the period of accelerated processing comes to an end.

Is it too soon to make the call that advised new life risk sales are about to embark on a meaningful recovery? Probably.

That said, one could confidently claim that firm ground has now been found, and that there are upside scenarios boosted by higher risk awareness and favourable tailwinds in terms of customer preferences. In other words, evidence for long-awaited ‘green shoots’.