February 17, 2021

ETF growth up, but new entrants fight over 4% of FUM

The ETF market recently passed a significant milestone, reaching $100b of assets in January, and we thought...

The listed fund market in Australia has taken off over the past few years. We’ve written previously about the staggering growth in listed FUM and cautioned that competition is fierce. It’s an important long-term growth opportunity for asset managers to consider carefully, but what does this shift mean for advisers and the platforms that serve them?

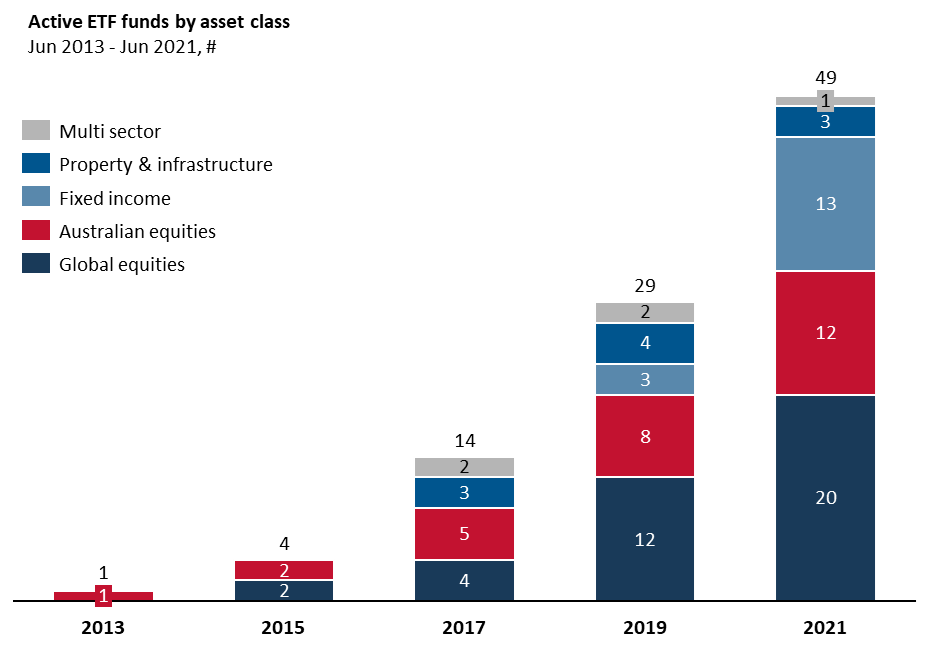

The range of active ETFs available is growing and there are now product offerings in all major asset classes. Asset managers are taking notice and it’s safe to assume the range will continue to grow strongly.

Source: ASX, CHI-X, NMG Analysis

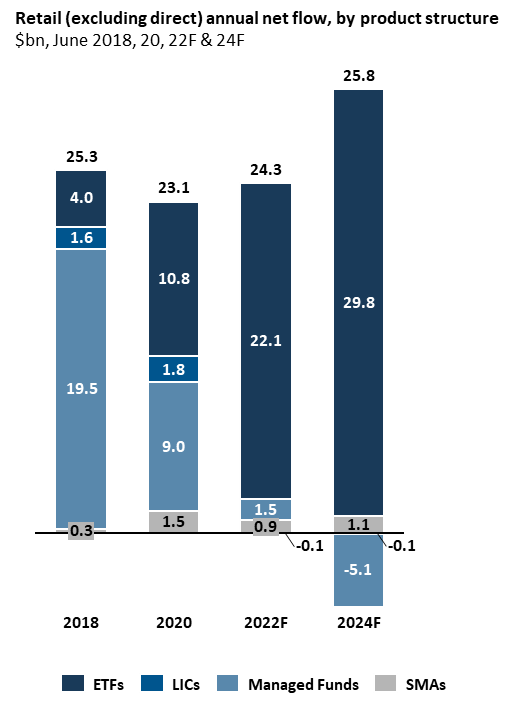

Advisers are now in a position to substitute traditional unlisted active funds for listed equivalents. They’ve been doing this with passive funds already and the availability of active funds will increase the take up of listed products.

Source: NMG Asset Management Model

The rapidly growing range of active and passive funds available on the exchange is more than sufficient to build diversified portfolios for most clients. Therefore, it’s entirely feasible that a segment of advisers that invests entirely in listed products could emerge in the near future.

The implications for asset managers are obvious, but what does this mean for advisers and platforms?

Platforms can expand their contestable market

Neither brokers nor platforms have really cracked the ideal solution for super investment portfolios dominated by or entirely made up of listed products. The maturity levels of platform solutions that advisers predominantly use vary considerably.

The emergence of a more fulsome suite of investment products, including active listed funds, expands the range of investment solutions available on the exchange and increases the opportunity and the demand for better solutions to administer listed investments.

A critical part of platforms’ competitive advantage is a tax structure, trustee and administration service that enables advisers to manage their clients’ portfolios. Whereas off-platform portfolios generally require significant manual intervention – especially at tax time, and the need to open an SMSF to access super tax savings is a significant barrier to an otherwise simple offer.

However, we see an opportunity for platforms to develop a simple listed-only administration proposition bringing their comprehensive tax administration capabilities together with the broker’s trading functionality and access to the exchange. Think of it as ‘broker plus’ more than ‘platform minus’ both in terms of proposition depth and fees. For platforms, this would present the opportunity to tap into the new ‘listed-only’ adviser segment as it emerges, but also to attract unadvised investors in listed products who need a super wrapper.

Simple advice could become more affordable

We’ve written about the advice gap in Australia and particularly that the gap is largest among masses and the lower end of the affluent wealth segments. We know that a large proportion of this group have reasonably simple advice needs beyond their long-term retirement savings requirements (which are largely met with our relatively strong default super mechanism).

An increasing number of younger people have been unable to spend their discretionary earnings during the last 18 months and have turned to investing. It’s a trend we don’t expect to unwind. Their ex-super advice needs could be efficiently served with automated advice solutions, such as robo-advice offers, investing solely into a range of low-cost passive products and differentiated active products (which can be easily implemented into already efficient digital world of listed products).

There is a range of options already available to serve this need and we think now could be their time to shine, particularly if they leverage a more comprehensive suite of listed investment solutions, which would arguably allow them to better serve the needs of a large proportion of the (otherwise under-served) mass segment.

The rate of growth in listed products has been extraordinary, and while the active fund part of the market is only in its early stages of development, it’s clear that the rapid growth will continue. All eyes will be on asset managers’ responses, but it will pay for platforms and providers of advice to keep thinking about what new opportunities this shift might present.