October 22, 2020

Superannuation: Employer channel to shrink in relevance (Australian Budget 2020)

Superannuation in Australia has had a tough year; with memories of a bruising Royal Commission still fresh,…

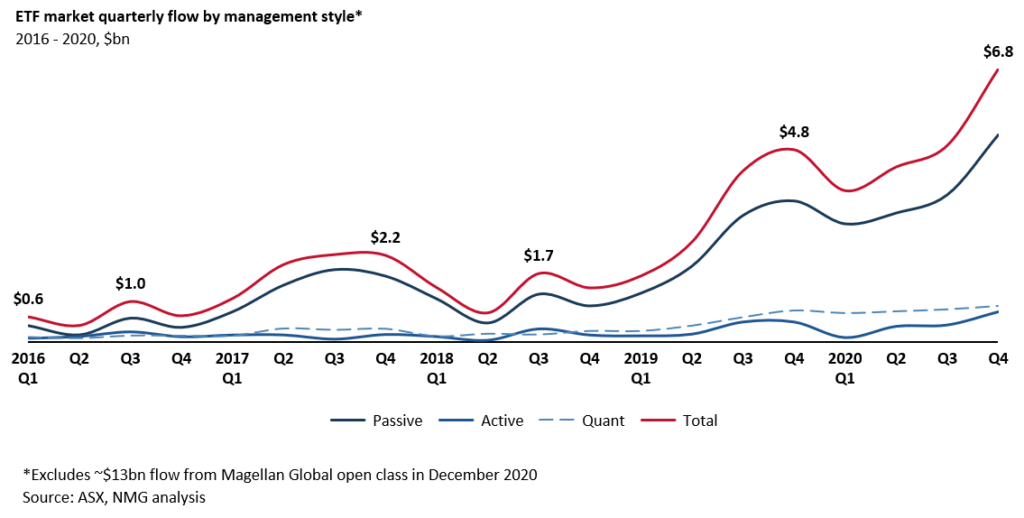

The ETF market recently passed a significant milestone, reaching $100b of assets in January, and we thought it appropriate to mark the occasion with a quick refresher on who’s who in the zoo.

The recent growth of ETFs has been staggering, total assets are up nearly five-fold since 2015 (~35% p.a.), and with monthly netflows hovering around $2b, continuing demand from both the direct and retail advised channels and ETF track records globally, we see total assets exceeding $400b by the end of 2025.

It’s easy to get caught up in the excitement of mid-double digit growth projections, and the fever is clearly spreading; nine new issuers and over 40 new funds have popped up in the past two years. However, a booming sector does not guarantee success, nor does it imply favourable economics, as UBS and AMP Capital seemingly learnt the hard way, both withdrawing from the ETF market last year – so let’s take a closer look…

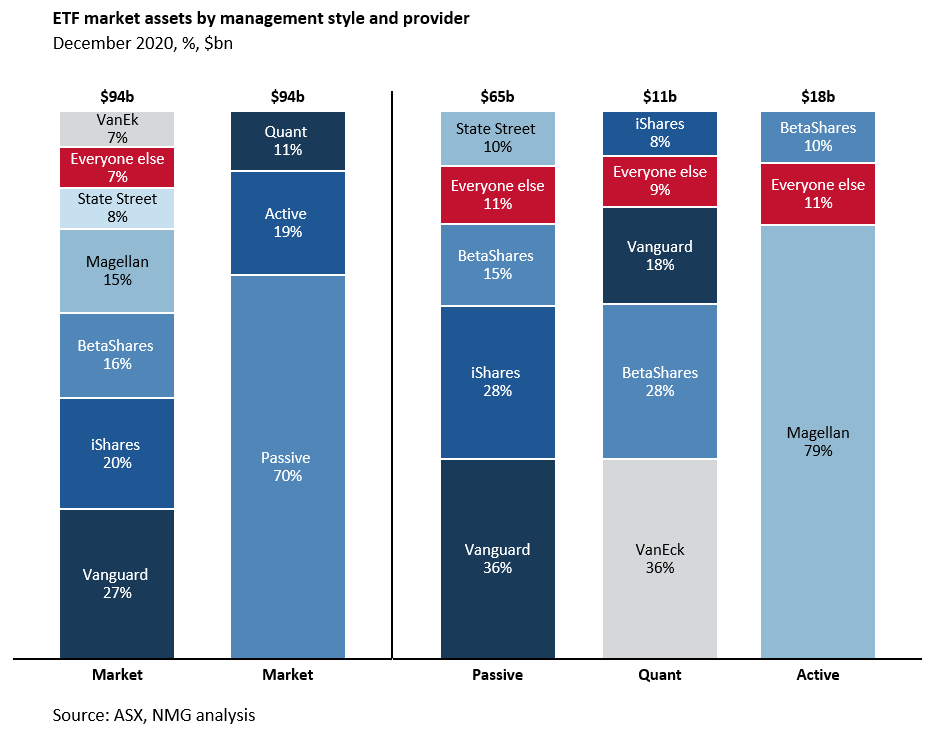

The defining characteristic of the competitive landscape for ETFs, both globally and domestically, is concentration. The top 2 providers control about half the Australian market, and the top six control 93%. This type of scale advantage makes for dangerous waters for newcomers.

The market is best thought of as three distinct offering types with different value propositions and economics:

Passive

Passive funds are often used to provide the key building blocks for investors’ portfolios. However, the scale needed to run a profitable passive fund means that there are very few winners, and they’re currently racing each other to zero on fees – a pureplay ETF provider with products at average ICRs requires $4.5bn of FUM just to break even. So, this is not a friendly market for new entrants, with high economic barriers to entry and heavily entrenched competition with varying appetites for long-term losses.

Quant (Smart beta)

Quant funds are essentially passive funds with thematic screens. They’re commonly used to express views on things like ESG, quality or value. Funds in this space compete on the novelty of the exposure (index creation), and to a lesser extent on price, which is why many new product launches are focussed here. While value-add through the index development process makes for more favourable economics, significant market concentration, entrenched incumbents, and the inherently limited availability of novel ideas make this a difficult part of the market for multiple providers to be successful in.

Active

The active market is best considered in two parts: Magellan, and everyone else.

Magellan has recently made their ~$13b Global Fund available on the ASX via a dual listed/unlisted structure, which skews numbers here. However, it made up about half the active market prior to this move so active has long been a largely Magellan story.

The remainder of the active market – some 4% of the total ETF market – is where most of the new competition is taking place; with seven new providers entering in the last few years.

Whilst the economics of active funds are significantly more favourable, the demand drivers are somewhat ambiguous. Given their price, complexity of investment strategy and low retail brand recognition, active funds are unlikely to benefit from the new pool of direct investor flow that has poured into passive and quant funds recently and are therefore likely to remain an adviser-led proposition. This leaves active ETF providers fighting over the same contestable market as their traditional unlisted counterparts, and reliant on advisers’ preference for ‘listed’ to generate flow. As a result, active ETF flow will come at the expense of unlisted managed funds in what is likely to be a zero-sum game for the next few years at least.

All this paints quite a bleak outlook for all but a few ETF participants, which is consistent with offshore markets where three providers generally dominate – but it is an important long-term play.

The changes we’ve been tracking in adviser preferences toward listed structures, particularly in the growing managed account channel, continue drive switching from unlisted funds. Listed offerings are going to be key to the viability of active managers in the future, it’s just that – as ever – change takes time.

The key is to focus on the right marketing and distribution mix (read: both are required in large volumes) and – as ever – to avoid running headfirst into a market that is much more complex than it first appears.