October 7, 2020

Sizing the growing Financial Advice Gap

Doom and gloom predictions about the future of the financial advice industry are widespread, and while there’s…

Superannuation in Australia has had a tough year; with memories of a bruising Royal Commission still fresh, the industry has been asked to facilitate early access to super on a scale never before seen, all while helping members through a global pandemic and the associated market volatility. There is no room for sympathy, though, with Budget 2020 handing down a number of ultimately sensible but challenging reforms.

There were four main initiatives set out in the Budget, targeting what the government see as ‘structural flaws’ in the industry:

This week we look in detail at the proposal to ‘staple’ employees to their default superannuation account.

Stapled Super

Whilst the default element of Australia’s system of superannuation is often coveted internationally for its near-universal coverage, the implication of this default approach to retirement savings is that levels of engagement are low. And, arguably, that produces great outcomes for many members. However, it also creates a situation where members open additional super accounts each time they change employers, either unwittingly or perhaps out of indifference. As a result, and according to the 2020 Budget papers, 4.4 million Australians pay ~$450m every year in unnecessary superannuation fees relating to duplicate super accounts.

Stapling accounts to employees – such that they are not separated when the employee changes jobs – is designed to prevent this wastage. Under the proposed changes, when an employee joins a new employer and does not nominate a super fund, their new employer will be required to direct super contributions to their existing account.

Reduction in employer channel opportunity

The biggest consequence of this reform is perhaps the importance of your first super account, which is clearly a boon for those funds that have strong employer relationships in the retail and hospitality sectors.

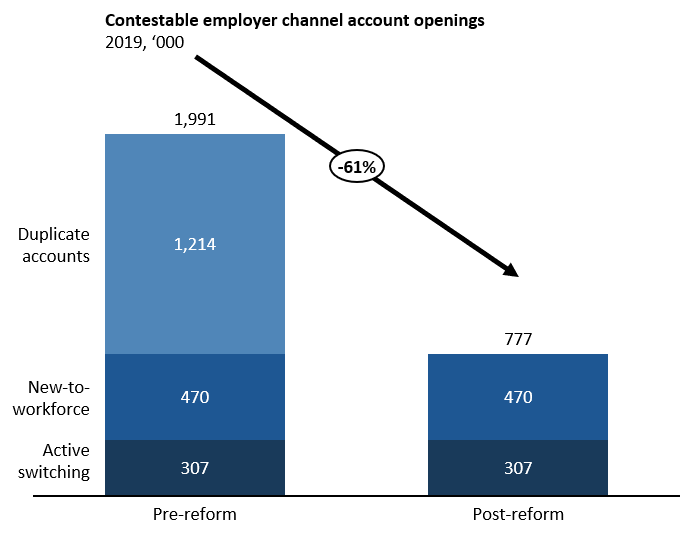

As for the impact of these reforms on new account creation, the chart below shows the contestable pool of new employer default super accounts each year potentially falling by as much as 61%*; now entirely reliant on new-to-workforce members and active switching.

This presents an interesting distribution challenge for super funds, who will have to shift their focus from member retention to member acquisition – no simple task given the extremely low levels of engagement with superannuation among younger Australians.

Absent any change to the relationship between employment agreements and super, success will require convincing Australians young and old to be actively engaged with their super and cultivating an employer client base that hires teenagers.

The funds most adversely exposed to these reforms are those with a high portion of their members in MySuper, but who are unlikely to be their members’ first fund (think any fund targeting university graduates, for example). On the face of it, the winners will be those funds like REST, CBUS and HostPlus that capture a significant proportion of the new-to-workforce opportunity amongst their target member base.

Two other implications

There are two other interesting consequence of this reform:

Future of the employer channel

The link between employment arrangements and superannuation has been under attack for several years now, with many funds having made contingency plans for their growth should one of the Productivity Commission or Royal Commission recommendations for the allocation of default funds be adopted, for example. Even if such a change doesn’t occur, stapling superannuation accounts to members decreases the size and value of the employer channel, and may be the first of several cuts to come.

*NMG analysis – we see this reform potentially preventing the creation of ~1.2m default employer super accounts based on total new MySuper accounts in 2019, after accounting for rollovers, SFT, switches in from Choice products and new-to-workforce account openings