April 8, 2024

Peaked or a pause?

Having lifted by >50% since 2017, the increases in reinsurance rates at Property CAT during 2024 renewals...

Hard markets typically mean higher revenues and can sometimes forge leading careers in reinsurance broking. Higher bars for performance, can also raise the stakes.

Hard markets are generally a boon for reinsurance brokers and an opportunity to operate at the peak of their powers.

Hard cycles are however not without their challenges. Partnerships and placement capabilities are put to the test, and brokers can find themselves drawing fire for matters beyond their reasonable control.

So how have reinsurance brokers in Asia performed a year on from the hard-market reset?

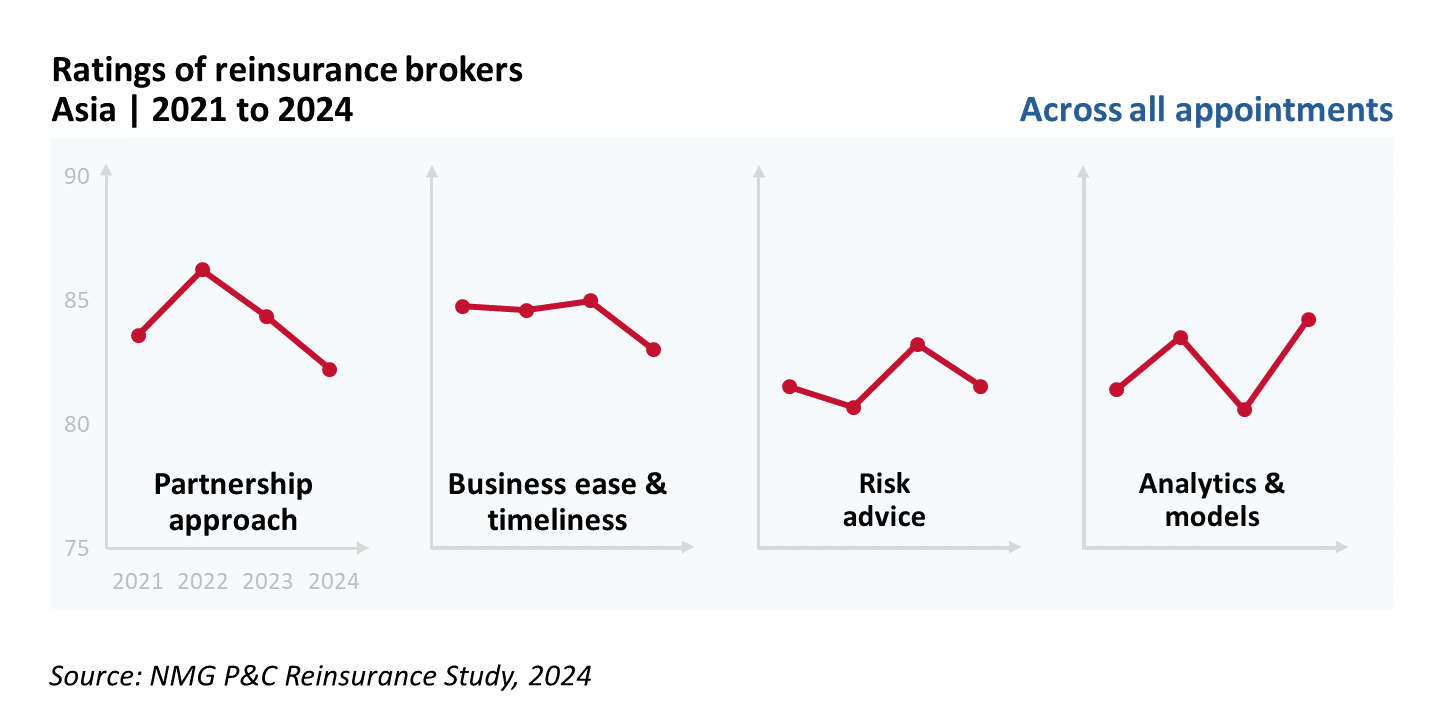

Exhibit 1: Pressures on servicing & placement

Broking appointments are typically under heightened scrutiny in the years following cycle peaks and risk being seen as profiting excessively during a time when reinsurance costs are already elevated. As client experience is a key source of competitive differentiation, reinsurance brokers need to reinforce/lift heading into 2025.

Lower ratings across all appointments for ‘Partnership’ and ‘Business Ease & Timeliness’ has to be a concern for reinsurance brokers, even if the ratings baseline could be considered somewhat elevated (Covid19).

Insurers mostly make use of multiple reinsurance broking partners (3 on average in Asia), selected for different roles based on their capabilities (some brought from scale). Almost without exception, there is a clear ‘primary’ or lead broker with which the insurer works most closely.

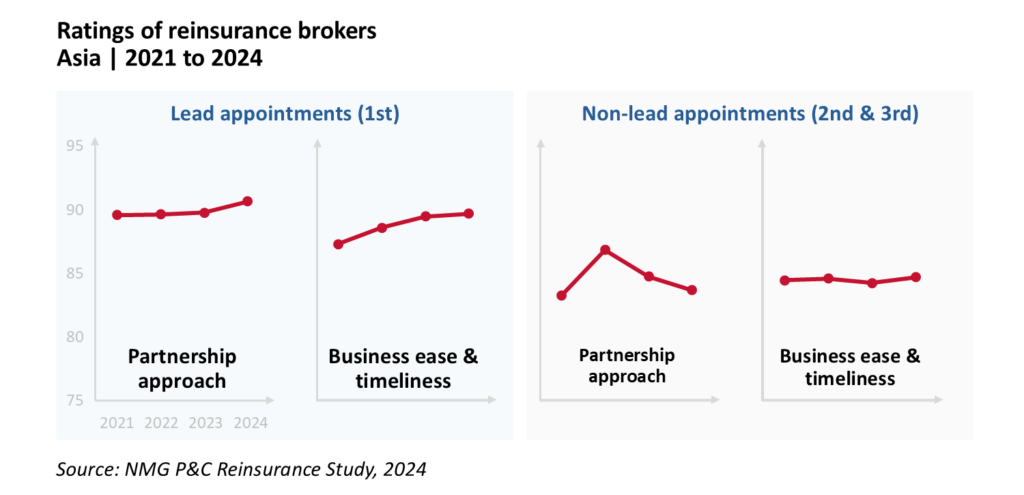

Exploring the ratings of reinsurance brokers appointed as leads offers additional insights.

Exhibit 1: Lead brokers have lifted client experience

In Asia, brokers in lead roles have steadily improved partnership ratings, particularly in 2024, in contrast to those in non-lead roles.

This is strong evidence for a strategic approach to lead relationships and that reinsurance brokers have invested to raise the bar more generally.

Improved ratings for the largest three franchises in part explains this, between them accounting for ~80% of all lead appointments in Asia.

The inference is that current leads are mostly well-defended. Assuming the status quo remains, broker fortunes are thus tied to those of their existing clients as converting new leads could prove difficult.

This also raises the question of when ratings for brokers in non-lead roles will recover, particularly as ‘partnership’ is a value driver not limited by size of franchise.

Broker effectiveness in the origination of new (especially lead) accounts could be the difference-maker, currently an area where brokers are widely-separated in both activity and the focus of their offerings.