February 7, 2022

Brand matters

Updated global brand rankings Property & Casualty Reinsurers, 2021 (including Specialty Lines)

Global overview

The rising relevance of climate

What insurers want

Growth returns, for insurers

Continued tailwinds, for reinsurance brokers

Reinsurance rates to rise further

As if modernising technology platforms and going digital were not themselves sufficient challenges, the insurance industry currently faces a particularly uncertain environment, involving:

Exhibit 1: Growing uncertainties, higher risk premia

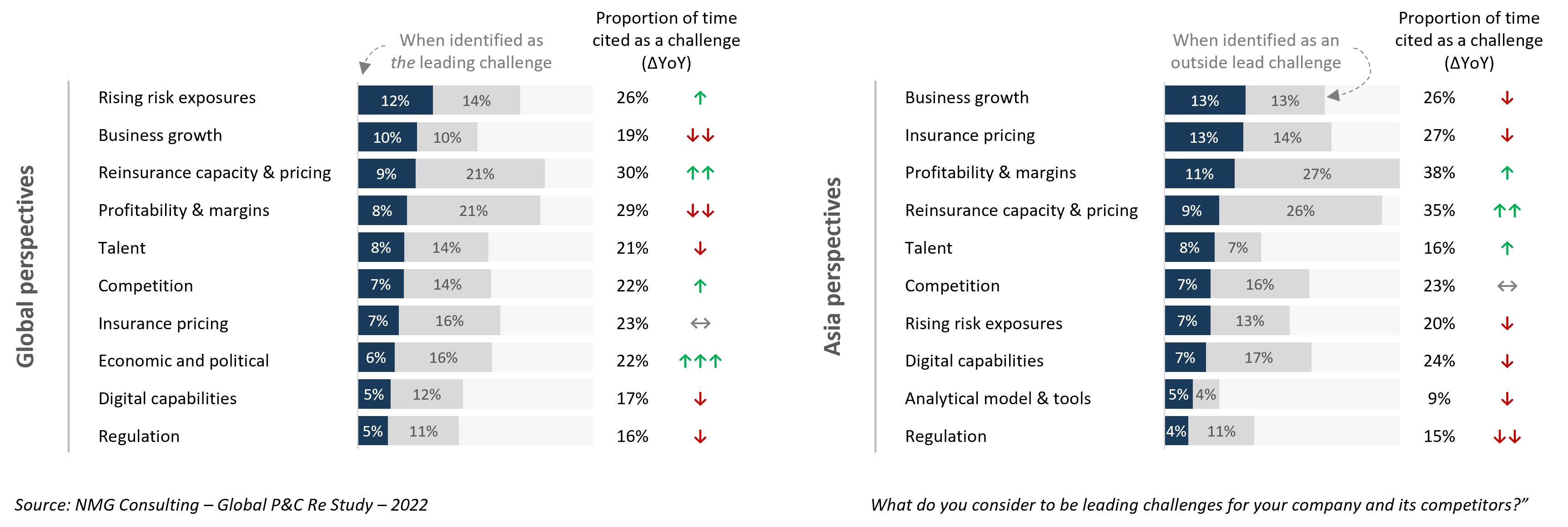

Proportion of insurer respondents indicating as a leading challenge. Maximum of 3. Feb-June 2022

Globally, insurers now most often consider ‘rising risk exposures’ to be the leading challenge faced by their companies. Adjacent concerns about the stability of reinsurance programmes are also elevated, as an extended run of low returns for reinsurers has driven the pricing dynamic to what now only can be regarded as a true ‘hard market’.

The combined effects of rising geopolitical tensions and rather late switch in monetary policy from stimulus to restraint in the world’s mature economies, have contributed substantially to the return of inflation and rising risks of recession in mature economies. Developing markets have – so far – done a better job of keeping inflation under control, including those in Asia.

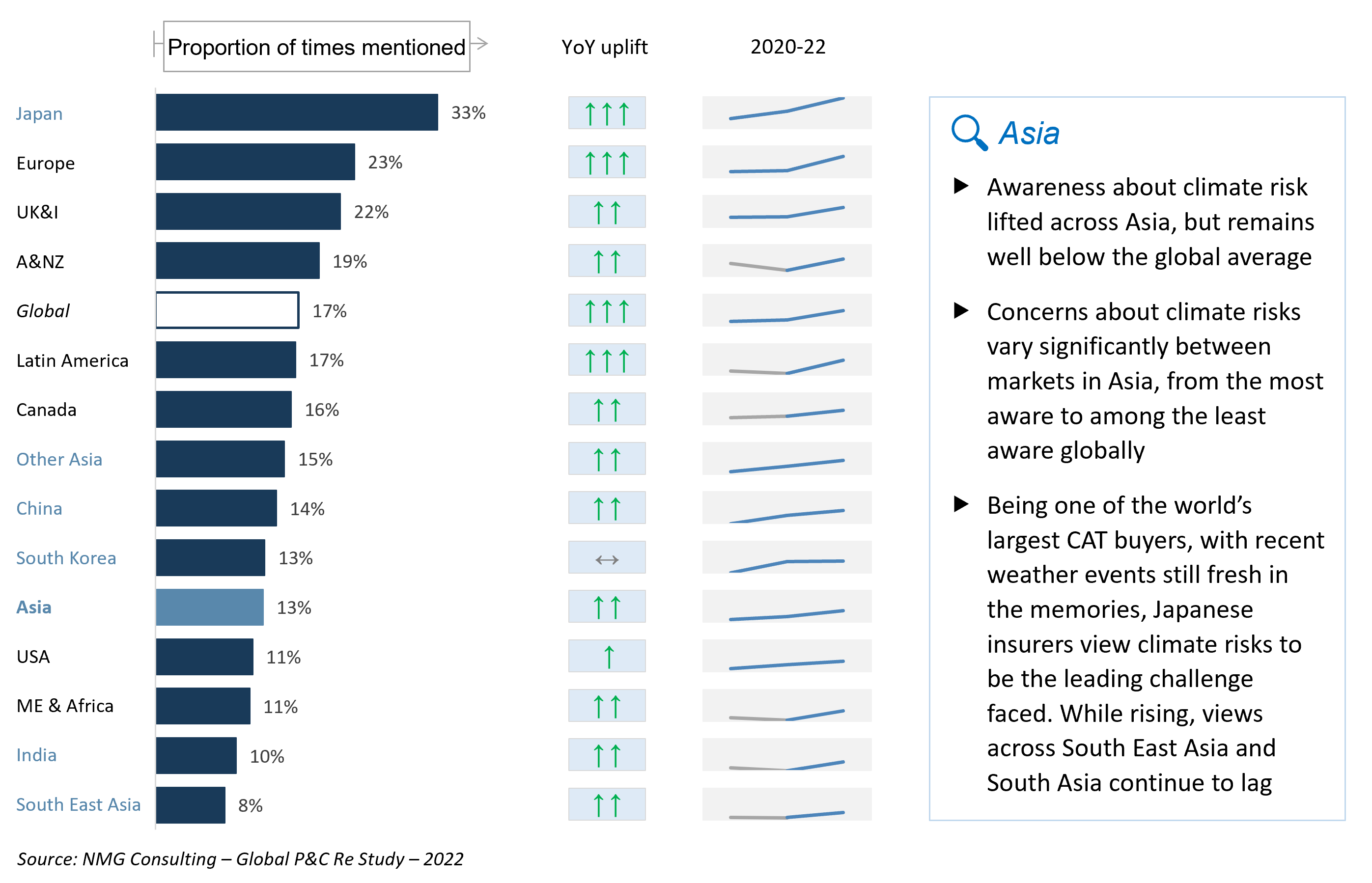

The anthropomorphic impact on climate is viewed as the most important element of ESG for the insurance industry. This would seem to be intuitive given the direct effects of climate change on claims, affordability, and reinsurance costs. And insurability.

European nations continue to lead the way in terms of climate sensibilities, with nearly 1-in-4 practitioners citing it as one of the leading challenges for their company and industry.

‘Down under’, record rainfalls on the East Coast of Australia have sharply lifted awareness, having followed record bushfires the year before. ESG has grown substantially in importance in reinsurance partner selection as a result.

Perhaps long-standing exposure to volatile weather events has respondents in America somewhat hardened to the phenomenon of climate risk. Rising awareness across Latin America in 2022 is positive, but risk awareness must translate into action.

Exhibit 2: Climate risks grow in relevance

Proportion of respondents citing climate change as a leading challenge. Recorded under ‘rising risk exposures’ in Exhibit1

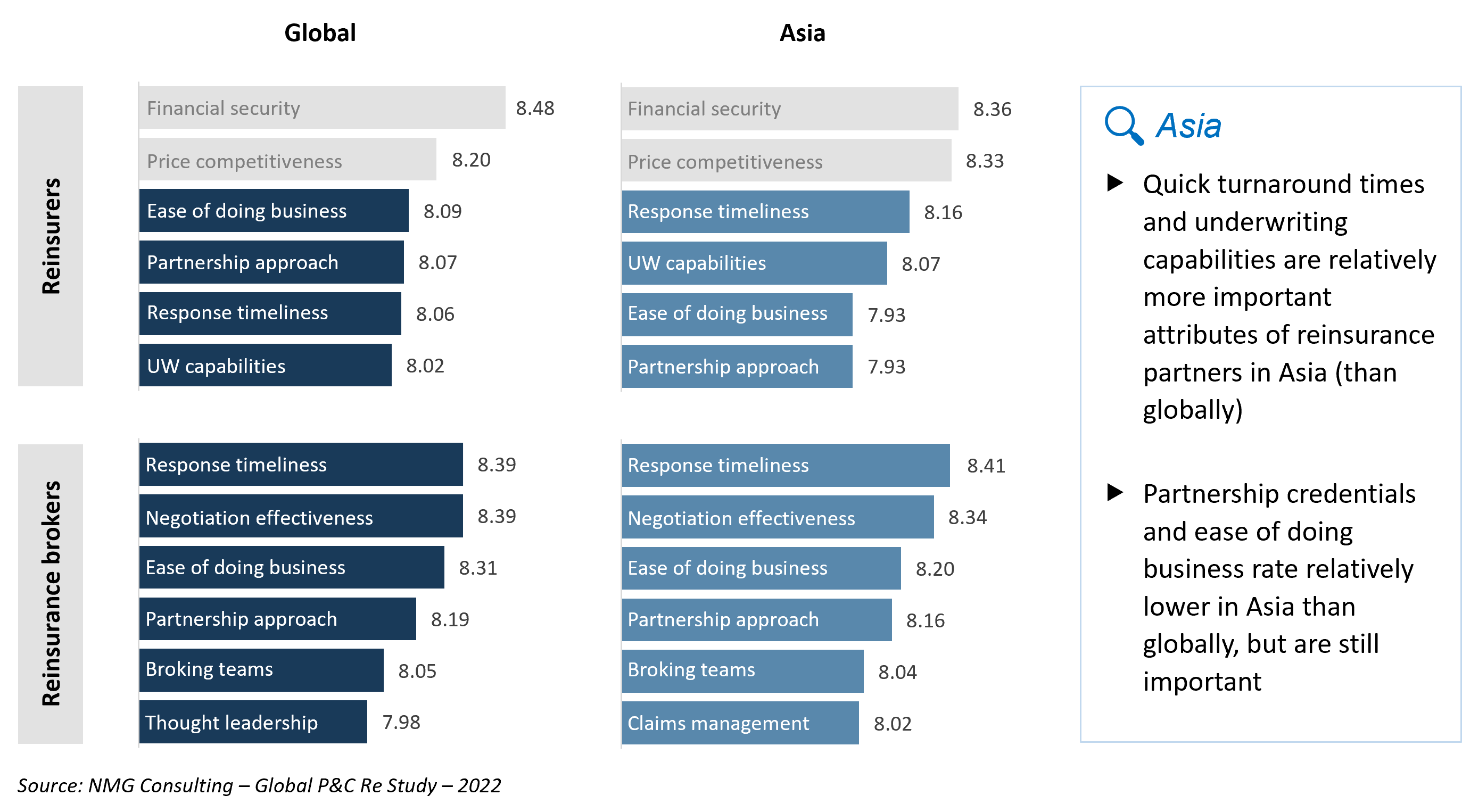

Insurer requirements understandably extend well beyond competitive pricing, capacity and financial security, although these are minimum requirements (or ‘table stakes’) for participation.

A strong customer orientation drives reinsurer selection, particularly around ease of doing business and good partnerships. This is true globally. Underwriting expertise has risen in importance as a selection factor over the past two years, in response to rising uncertainty.

Somewhat equivalently, the negotiation effectiveness of reinsurance brokers rose in relevance, with brokers facing new challenges of navigating the hardening market to source for appropriately-priced capacity. Customer orientation also a key feature in drivers for reinsurance broker selection globally.

Exhibit 3: Leading drivers for reinsurer partner selection

‘Top 6′ factors for selecting reinsurer and reinsurance broker partners. Ratings by insurers

Insurer growth expectations remain positive for both personal and commercial lines on a global basis, with the anticipated impact of claims inflation mostly assumed to be passed on to customers. For the time being, at least.

Growth expectations for commercial lines portfolios (+8.2%) are again higher than those for personal lines (+7.2%), where lower rate increases mean more dependence on customer growth.

Rises in core inflation during the course of 2022 will mean that real increases will look less impressive, and that insurers would be wise to allocate resources for accelerated settlements.

Insurers cannot continue to pass on increases to customers indefinitely however, and likely are nearing an affordability threshold beyond which the insurance gap will begin to widen. Higher underlying inflation will make this even more challenging.

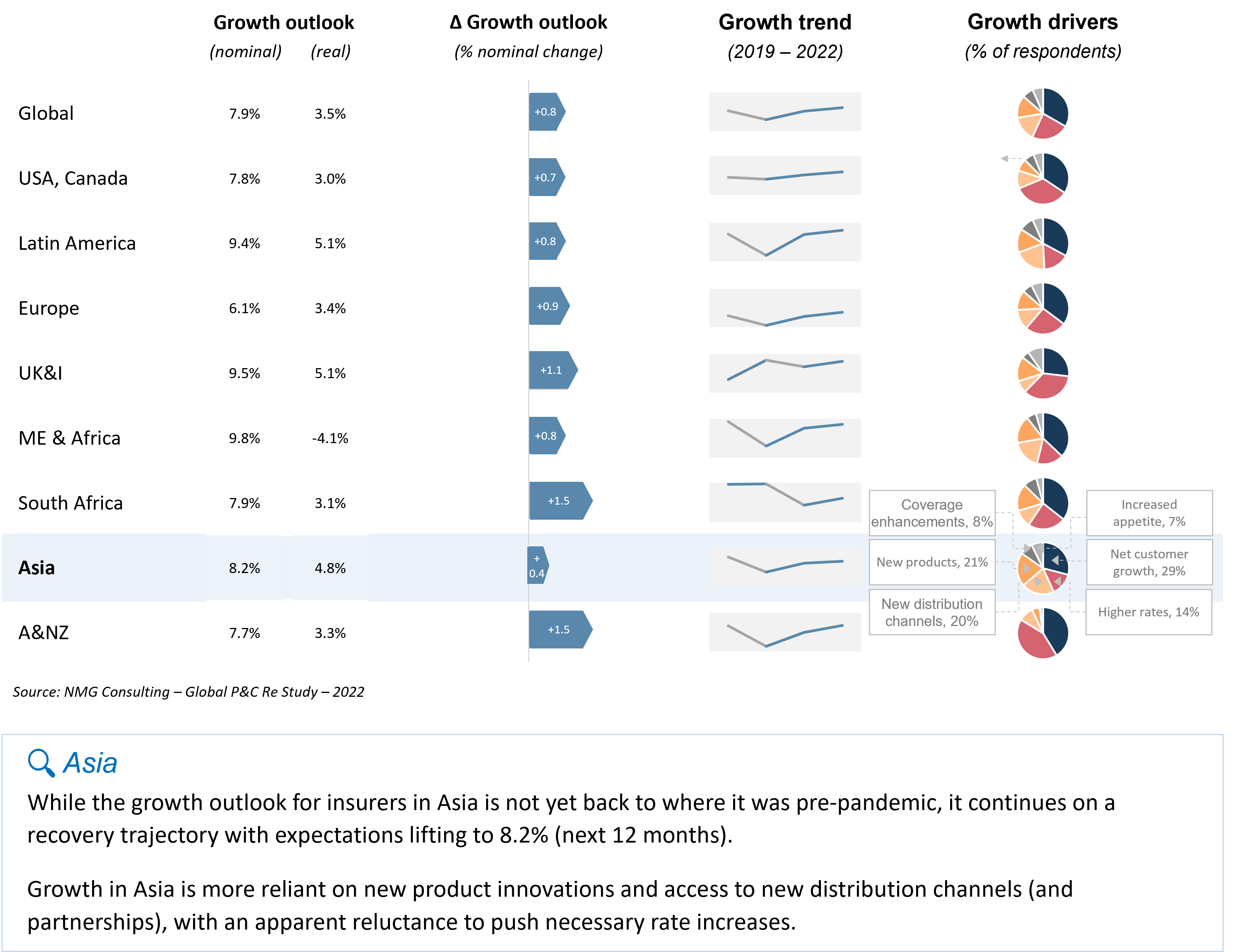

Exhibit 4: Growth outlook – insurers

12-month growth outlook. ~1,500 views of executives and practitioners at insurers

Higher reinsurance premiums translate to higher commissions in most markets, with growth in reinsurance premiums outstripping that of insurance premiums, particularly for CAT risks.

Some restructuring of the competitive landscape is also driving growth expectations for reinsurance brokers, with investment levels rising with Willis re-joining the Gallagher family, as well as the coming together of the segments most aggressive participants in Howden Re (by acquisition) and TigerRisk Partners (organic).

Brokers recognise that they need to make the most of the hardening tailwinds, although the resulting competition for talent, combined with more challenging placement means that they won’t necessarily have everything their own way across 2023 renewals.

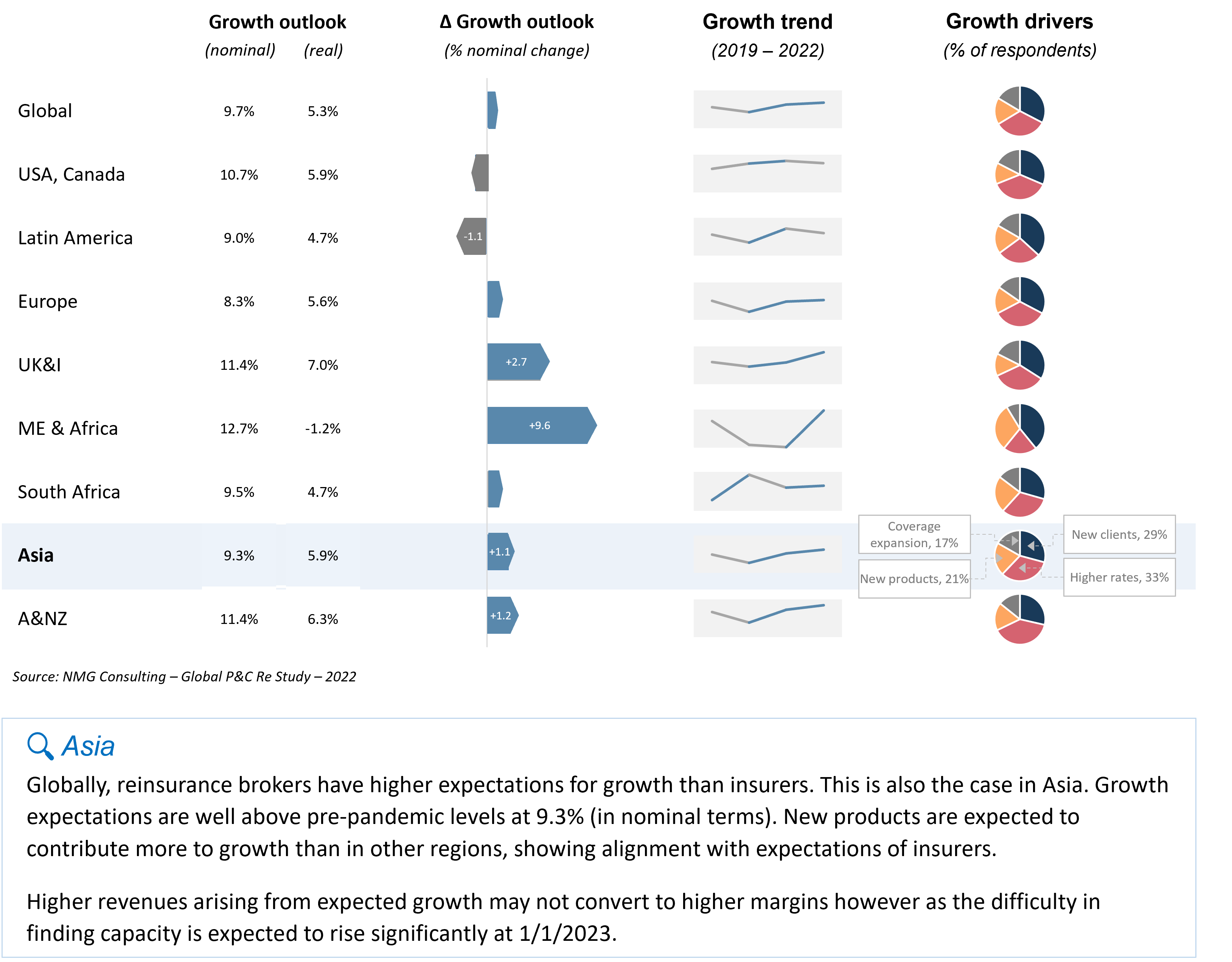

Exhibit 5: Growth outlook – reinsurance brokers

12-month growth outlook. >500 views reinsurance brokers

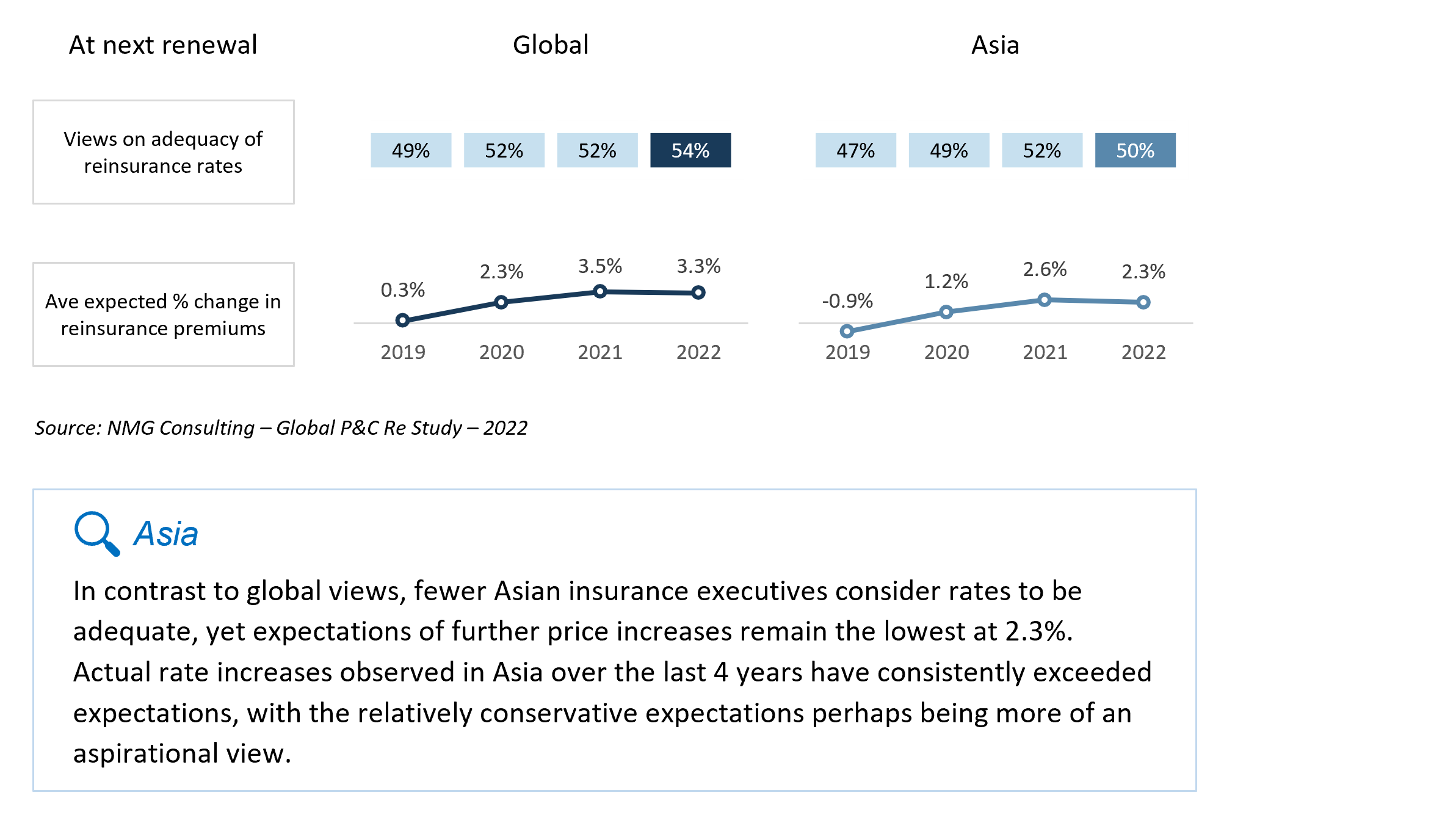

Notwithstanding five consecutive years of upward re-ratings, nearly one-half of respondents are still either unsure about rate adequacy or consider rates to be inadequate, indicative that the ‘right rate level’ remains a moving target (upwards).

Expectations remain for further increases at similar levels at forthcoming renewals, although at lower levels for Liability and Speciality Lines. Expectations for Property Lines remain elevated.

Exhibit 6: Rising costs of reinsurance coverage

Not yet peaked. 54% of insurer and broker respondents view rates to be adequate, but nevertheless expect overall rate increases of 3.3% on average at their next renewal (3.5% for Property lines, 2.9% for Liability lines and 2.6% for Specialty lines)