November 17, 2020

Doubling down on successful partnerships

The insurance industry in South Africa is doing its part in responding to a 1-in-100-year global event….

It has been a long time since prospective margins in US Commercial Lines look as attractive as they do currently, although this does not mean that they will be easily secured or evenly distributed. Competitive stratification in the commercial lines segments served by independent producers is significantly more evident in 2021 than a year ago. Which carriers are ‘best placed’ to capture the biggest share of the upside? Which carriers are prepared to invest? And if carriers are not prepared to invest now, then when would they?

Given its scale, the repricing of the US commercial lines segment, particularly Liability lines, carries global significance. Marsh’s Global Insurance Market Index points to 13 back-to-back quarters of rate increases since Q4 2017, while a similar tracking study from Willis indicates Q4 2020 increases as being the highest in this sequence. Expectations generally are that prices will continue to rise into 2022 with further tightening in coverage definitions and terms.

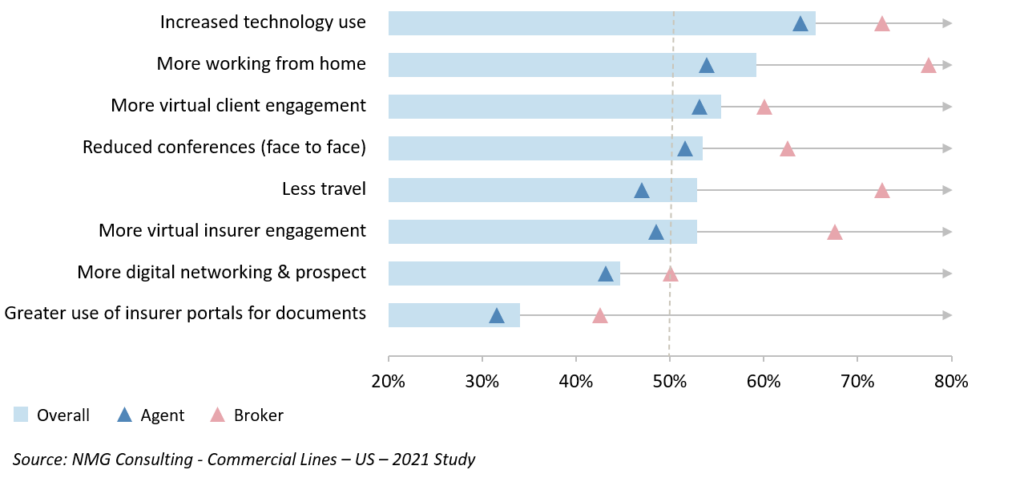

The Covid-19 pandemic has had its impact not only on claims but also on operations, requiring insurers to adopt new servicing models, and independent producers to find new ways to engage clients and carry out prospecting. Many of these changes are set to become permanent.

In combination, these forces mean insurers and producers currently face a unique mix of opportunities and challenges. It is at least a decade since the rewards for the right strategic decisions have been so appealing – and the opportunity costs of making the wrong investments so stark.

Carriers’ competitive positioning with independent producers is driven by strategic choices and capability differentials; it is a contest in the sense that performance improvements need to be achieved in relative terms (ie to competitors).

This analysis is drawn from NMG’s annual Study of the US Commercial Lines segments (2021), incorporating the views of more than 1,500 independent producers responsible for circa US$1bn in commercial lines placements on an annual basis. Since inception in 2010, the Study has provided insights into the forces shaping the segment and the competitive performance of insurance carriers within it, focused upon which companies are doing well and why. NMG works with insurers supporting decision-making, addressing where they should focus on operational improvement and investment as well as tracking performance outcomes over time.

Independent producers indicate lifted performance from lead carriers in several areas of obvious importance, including partnership, servicing, products & coverages, underwriting, and claims.

These producers also indicate the growing importance of ‘servicing capability’ relative to other performance areas. The pandemic has raised the bar for servicing requirements and support in general.

Independent producers are also ‘walking the talk’ when it comes to their choices for their lead carriers, aligning most closely with those delivering higher servicing quality.

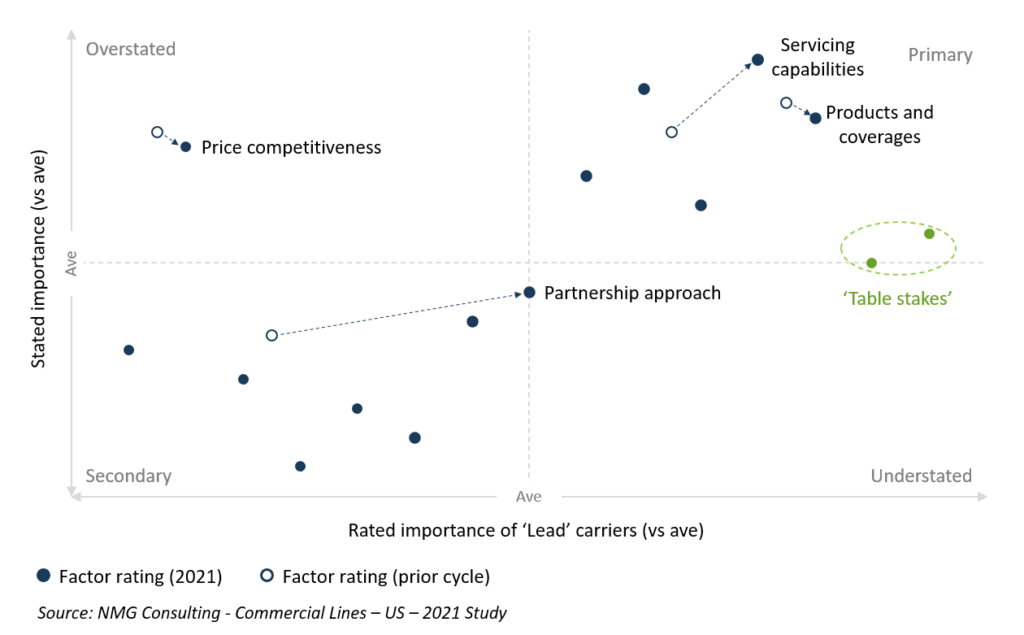

Exhibit 1: Insurance partner selection in commercial lines

Servicing capabilities have lifted in importance as a stated selection criterion for independent producers (‘stated importance’), as well as in the ratings profiles of their lead carriers (‘rated importance’)

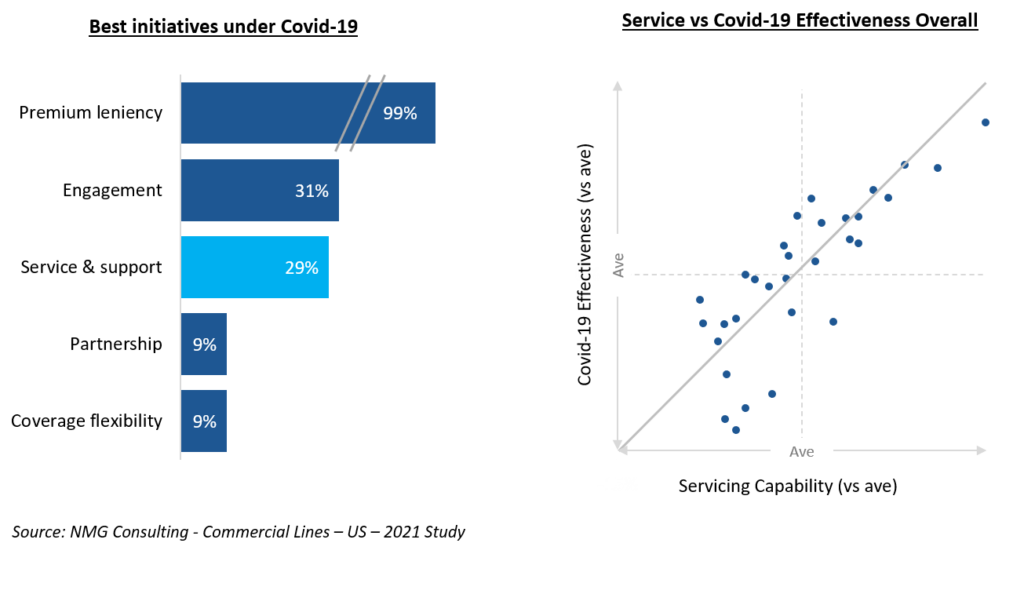

Leniency in premium collection was common to all support strategies under Covid-19, such accommodations being tactical and more easily orchestrated. As such, these essential efforts will not have driven competitive differentiation.

Insurers that drew above-average ratings for their ‘overall effectiveness under Covid-19’ were generally those that were well-rated for servicing capacity, suggesting this outperformance was more reliant on prior servicing investments than capability newly developed in 2020.

Premium accommodations aside, independent producers’ citations of ‘best insurers under Covid-19’ related to engagement and servicing.

Exhibit 2: Servicing capabilities drive ability to respond under Covid-19

Premium leniencies were essential but also ubiquitous. Ratings for overall Covid-19 effectiveness correlate strongly (>0.8) with ratings for servicing capability

Ratings differentials for servicing capability are particularly significant given their importance to independent producers.

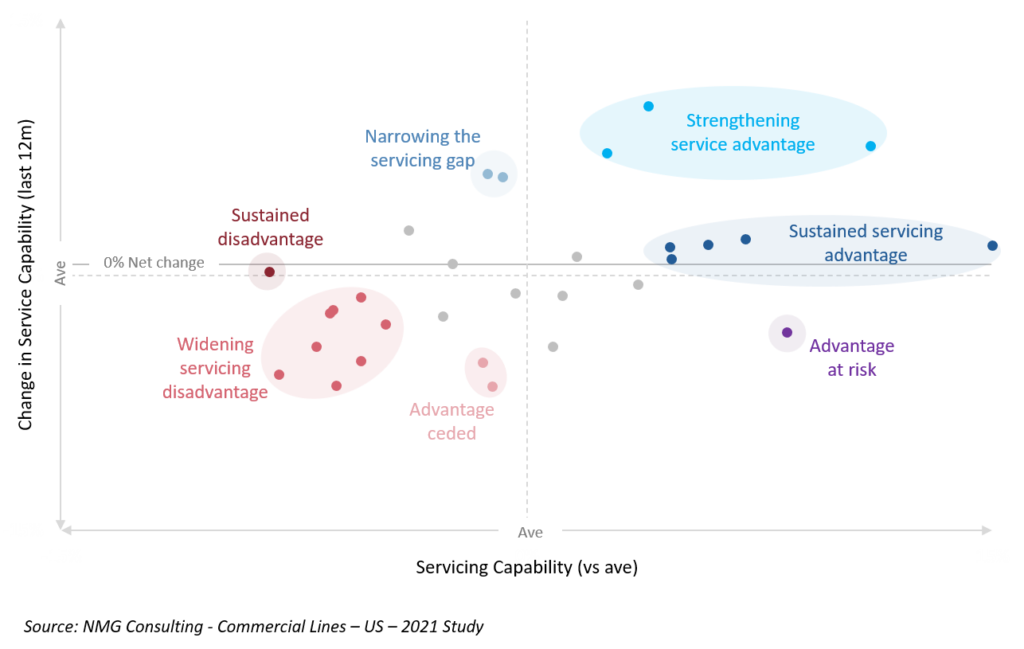

Exhibit 3: Servicing capability – polarizing performances

A group of insurers operate with a clear ‘servicing advantage’. Performance differentials have widened

Ratings for service capability of insurers have diverged and are clearly more polarized.

Nine insurers currently compete with the benefit of significant ‘service advantage’, five of which have enjoyed these advantages for at least 24 months (some considerably longer).

In contrast, eight insurers operate with sustained and/or widening gaps (disadvantage) to the servicing capability average, consequently depending on other proposition elements for compensating lifts, which could put pressure on underwriting quality and may steer these companies towards being price-led – with implication for margins and long-term profitability.

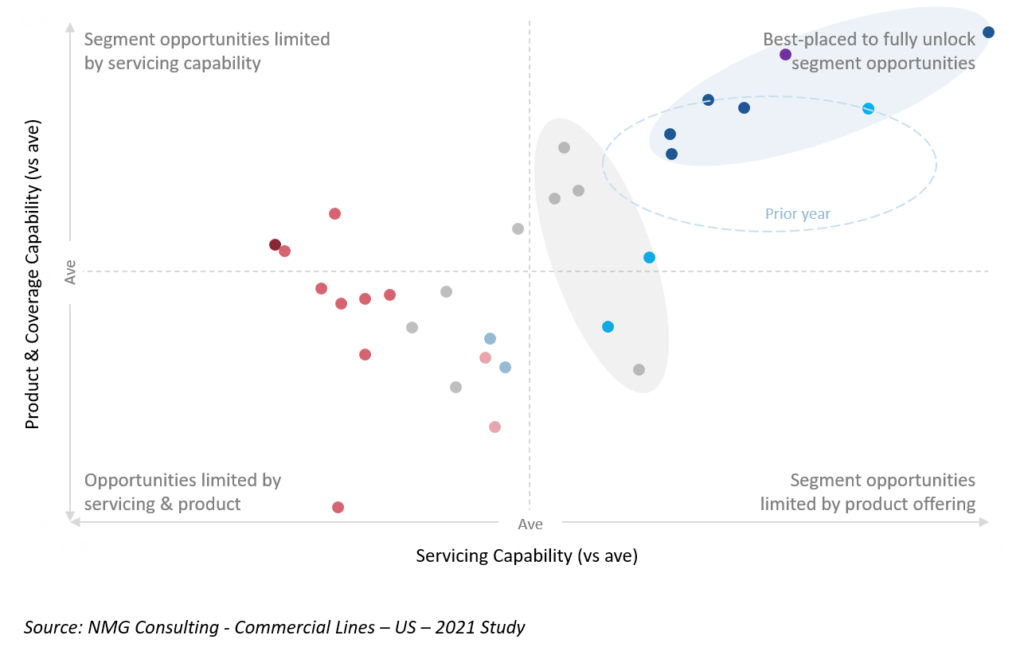

A combined view of servicing capability and product & coverage performance reveals a distinct group of best-placed competitors, once again more polarized than a year before.

All five insurers with ‘sustained service advantage’ (Exhibit 3) are among the seven best-placed across product and servicing combined.

All seven best-placed competitors for product and servicing lifted their product ratings relative to the average in 2021. Remarkably, in a year when carrier ratings for ‘product & coverage’ fell, five of these companies achieved higher ratings than a year prior.

Exhibit 4: Service vs Product & Coverage – Stratified competition

Group of leading competitors lifted by higher ratings for ‘product & coverage’. Stratification into three distinct tiers

Product and service ratings are positively correlated, but examples disproving causation are readily available: a large fall in servicing ratings for one of the ‘best placed’ carriers occurred while its product ratings improved. Similarly, lifts in service ratings were achieved by several carriers without any corresponding lift in product ratings. This points to the added significance of the successes of those best-placed carriers that have performed well across both areas.

Lifting product advantage may in part result in a ‘halo effect’ for servicing effectiveness and vice versa, but only at the margin; larger movements are only achievable through focused capability-specific investments.

One potential ‘game changer’ is technology, where two-thirds of independent producers indicate an expectation of increased technology adoption generally.

More significant are intentions to move to a more virtual approach to client and insurer engagement as well as prospecting, with consequent reductions in time on the road and in the office, as well as at in-person conventions.

Independent brokers are more open to change than their agent counterparts and likely more ready too.

Exhibit 5: A more virtual reality

Independent producers indicate a more virtual approach, driving increased technology usage

A sustained hardening market makes for both increased opportunity and the increased opportunity cost of inaction (given the rising value at stake). Widening competitive gaps in critical performance areas further raises the stakes and increases the investment required to remain competitive. And a failure to invest limits carriers’ available options to respond, increasing dependence on pricing competitiveness and underwriting leniencies (with obvious implications for margins).

‘Best-placed’ carriers should determine how to balance future capability investments and risk appetite, so as to optimize growth and margin potential while not lapsing into complacency; the profiles of demand and competitor capabilities evolve quickly and continually. Competitors that are one capability lift away from being ‘best-placed’ will be motivated to invest accordingly. For those remaining twenty competitors the challenge is more daunting, requiring step-change in performance across multiple capability areas; but is sitting it out a realistic option, and if not now, then when?

At an industry level, given producer adoption intentions and a permanent commitment to a more virtual engagement approach, technology platforms are set to be a long-term differentiator. Nevertheless, for the balance of 2021 at least, continuing to have regular check-ins with producers, effective digital information-sharing, and responsive support will remain pivotal.

Virtual networking and prospecting will present producers with new challenges requiring demonstrably different skill sets and approaches to engagement. Outcomes for independent producers will stratify around effectiveness under a virtual model; brokers appear more ready for change.

Insurers will need to carefully balance their short-term needs for risk management and their longer-term objectives around addressing insurance gaps and product and industry relevance.