February 26, 2020

About Leading and Following

Necessarily different and somewhat Darwinian. The intensity of competition within the P&C reinsurance market has compelled reinsurers…

The insurance industry in South Africa is doing its part in responding to a 1-in-100-year global event. While the path out of the Covid crisis is long and uncertain, the successful functioning of key partnerships within the industry is making a real difference.

While pandemics typically occur every decade or so (think H1N1 in 2009, that infected 25% of the global population), it is not since the ‘Spanish Flu’ of 1918 that one has had such a dramatic impact as Covid-19.

The P&C insurance industry (locally more usually referred to as ‘short-term’ or ‘non-life’ insurance) is doing its job of ensuring the South African economy demonstrates much-needed resilience, despite the industry itself facing many challenges, both global and local.

Most industry practitioners have never experienced such high levels of uncertainty, and many consider the impact of Covid-19 to be even more dramatic than that of September 11, 2001.

This ‘coming together’ as an industry is particularly crucial in South Africa, where the insurance sector is especially important given the absence of a meaningful public sector ‘safety net’.

While the comments here are made specifically about the P&C insurance industry, evidence from NMG Studies drawn from similar (and additional) vantage points in the South African life insurance industry strongly support the same view.

Exhibit 1: Insurance industry thematics – South Africa – P&C – 2020

Synthesis of insurer and broker perspectives describing the leading challenges for their industry

Source: NMG Consulting – Global P&C Re Study – 2020

Reinsurers (and reinsurance brokers) – friends in need

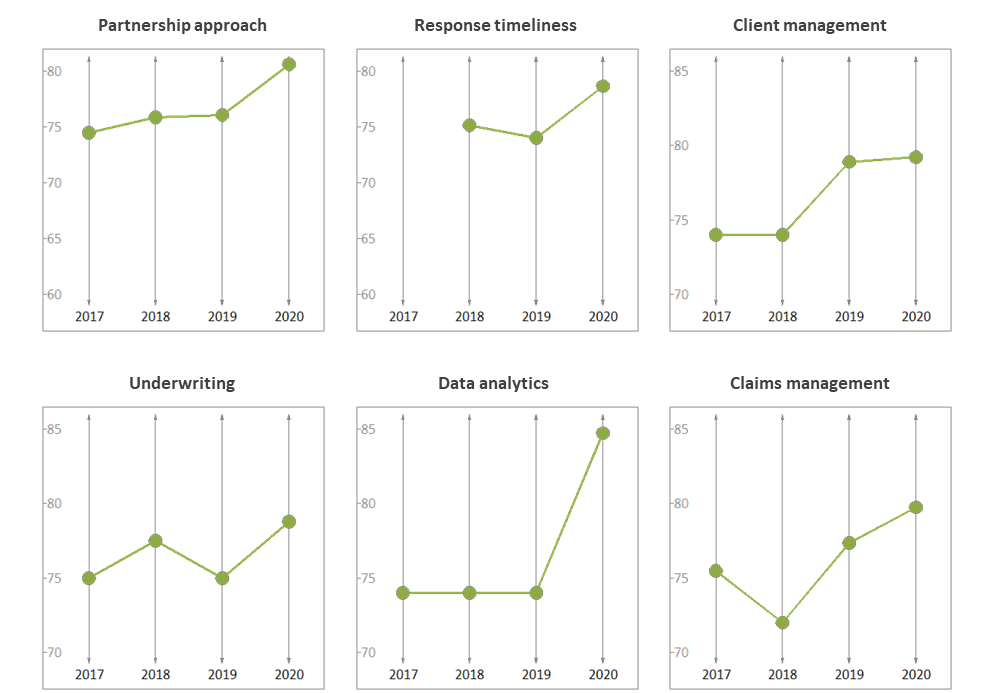

The results of NMG’s P&C reinsurance Study 2020 clearly illustrate that both reinsurers and reinsurance brokers have lifted performance levels above those seen in recent years.

With hardening reinsurance prices and more cautious risk appetites, not to mention the enormous impact of Covid-19 on South Africa and its people, one could have reasonably expected the opposite. And yet both reinsurers and reinsurance brokers received significantly higher ratings from insurers in 2020.

A decomposition of these ratings indicates that reinsurers have done well by maintaining a focus on partnerships in these difficult circumstances, while being proactive in their support for claims settlement and fairness. Ratings for client-facing people and teams rose despite the challenges of virtual-only engagement, running counter to the global trend seen in P&C reinsurance markets in 2020.

Exhibit 2: Rising to the occasion in 2020

Average ratings awarded by insurers for the top 15 reinsurers (in aggregate)

Source: NMG Consulting – Global P&C Re Study – 2020

Rates to rise still further

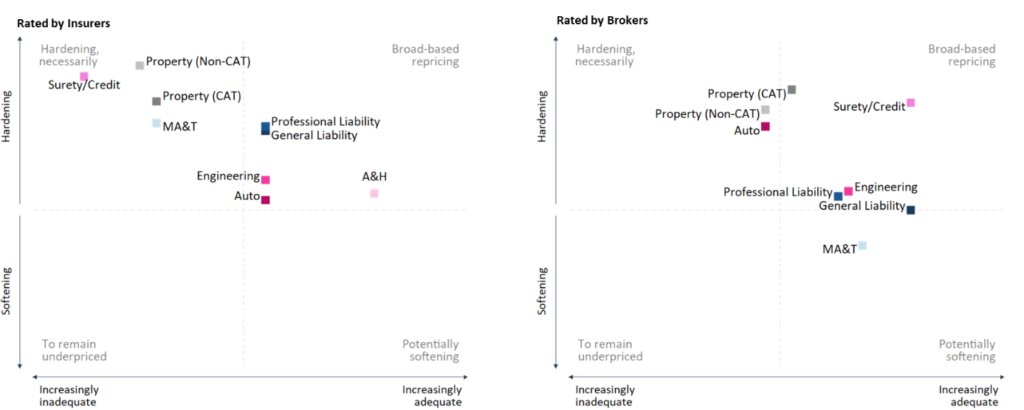

If insurers, reinsurers and brokers in South Africa can be found to agree about one thing, it is that reinsurance prices will rise further, particularly for property lines. Insurers also seem to accept that these prices are driven by inadequate rate levels (although, surprisingly, brokers seem less convinced).

Exhibit 3: Reinsurance Pricing Outlook – 2020 – South Africa

Comparison of the insurer (LHS) and broker (RHS) views on the outlook for pricing against the adequacy of current rates

Source: NMG Consulting – Global P&C Re Study – 2020

Expected rate rises for Property CAT risks is a global theme, linked to a sharp uplift in concerns about climate change across the industry in 2020. Exposed to the financial consequences of climate events, the insurance industry can be viewed almost as a betting market for the consequences of climate change, and hence these opinions are a valuable reference point.

Not quite out of the woods yet

Pressures on reinsurer engagements will rise further at forthcoming renewals. Only time will tell whether reinsurers and brokers will be able to maintain these levels (and profile) of engagement support. Challenging indeed, but by no means impossible.

Looking ahead, the key pressure points are likely to include:

Fortunately, there should be enough positive news to offset these tensions:

Given the upcoming challenges – and the success achieved so far – it would seem to make good sense for the insurance industry to double down on its partnerships for the foreseeable future.