Necessarily different and somewhat Darwinian. The intensity of competition within the P&C reinsurance market has compelled reinsurers to develop genuine sources of competitive differentiation to survive. The markets of the US and Canada provide many clear examples, illustrated by the results of NMG’s Flaspöhler Study (2019).

Active versus Passive

It’s fair to say that the reinsurance industry is successfully adapting to the disruptions caused by the influx of alternative capital, now considered a permanent feature of the industry. This ‘passive’ capital, seeking non-correlated investment returns, has contributed meaningfully to lower prices, low single-digit returns, and several loss-making quarters for reinsurers.

Seen through an asset management lens, reinsurers play the role of the ‘active managers’ of the reinsurance industry and like active asset managers, have to justify to all stakeholders their added value relative to the higher costs of being ‘active’. Alternative capital solutions also provide a useful benchmark cost for a ‘passive’ solution.

Profile of Premium Partner

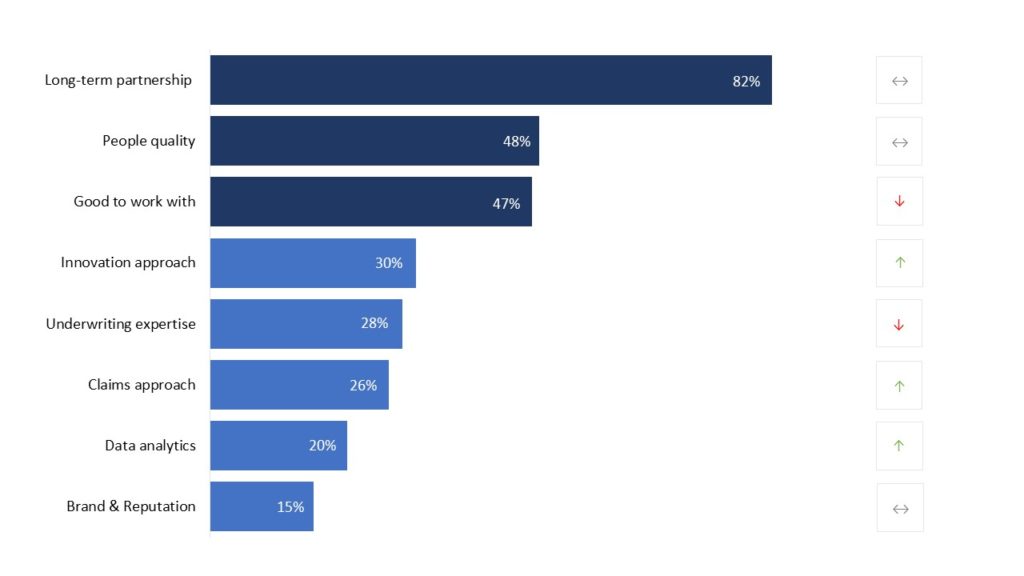

Successful P&C reinsurers are those that bring the right balance of pricing, financial strength, underwriting guile, servicing and quality of client teams.

Long term partnerships are also extremely important to margin creation, and insurer feedback makes it patently clear that softer, intangible factors more often define the profile of a premium partner than core functional expertise. This makes for an interesting dynamic in an industry in which underwriting capability and discipline is essential to returns (and survival).

Exhibit 1

Profile of a premium partner – Insurers, US & Canada

Source: P&C Reinsurance Study 2019, NMG Consulting

Competitive differentiation

Individual competitors have proved very successful in carving out distinct competitive attributes and offerings for the US and Canada (as well as globally).

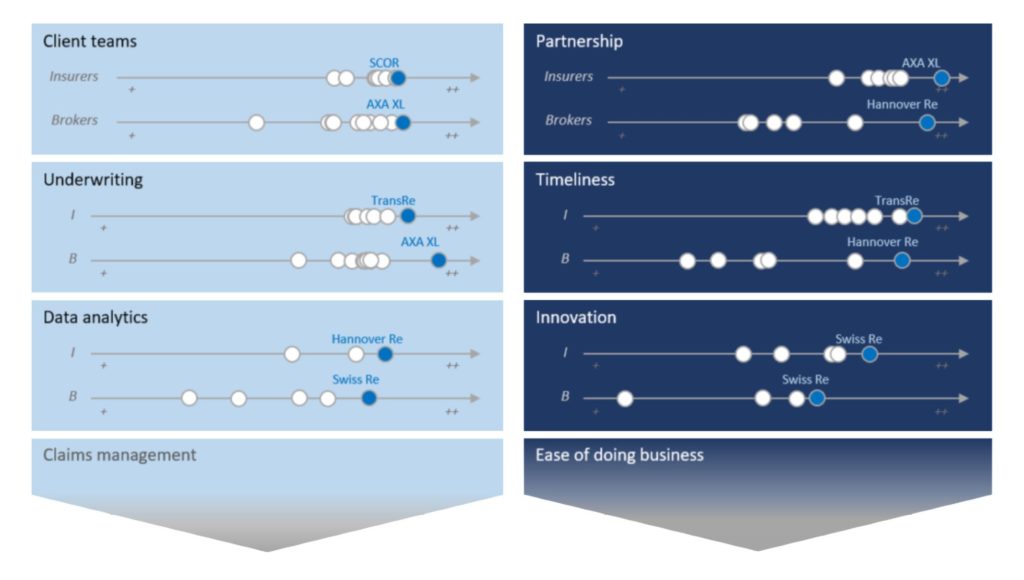

Our analysis distinguishes ratings provided to reinsurers when operating in a lead role as opposed to a following capacity. This is fundamental, as required engagement parameters differ significantly according to the profile of the engagement.

Exhibits 2 and 3 provide an extract of six performance factors, three from functional areas and three relating to the customer engagement. Ratings are also shown separately from insurers and broker as, once again, insurers and brokers have different requirements (although there is clearly also overlap).

Leading Leads

Reinsurers operating in a leading capacity need strong client teams and specialist underwriting expertise.

For reinsurers operating in the capacity of a lead market, top ratings from insurers across six factors were shared between five different ratings leaders:

- Swiss Re was top-rated for their innovation solutions, and second rated behind SCOR for their client teams in a tightly contested field

- Insurers that used TransRe in a lead capacity awarded them the highest ratings for underwriting expertise and also service timeliness

- AXA XL was top-rated by insurers for their partnership approach, while Hannover Re drew the highest ratings for data analytics

Exhibit 2

The leading leads – US & Canada

Source: NMG’s P&C Re study, US & Canada, Insurers, 2019

At the reinsurance broker interface, top ratings for those operating in a lead capacity were also widely shared:

- Swiss Re was again top-rated for innovation, as well as data analytics

- Hannover Re received high, differentiated ratings for their partnership focus and was top-rated for timeliness

- AXA XL was top-rated for underwriting by brokers, while Munich Re’s renewed focus on the broker interface helped contribute to leading ratings of its client teams with brokers

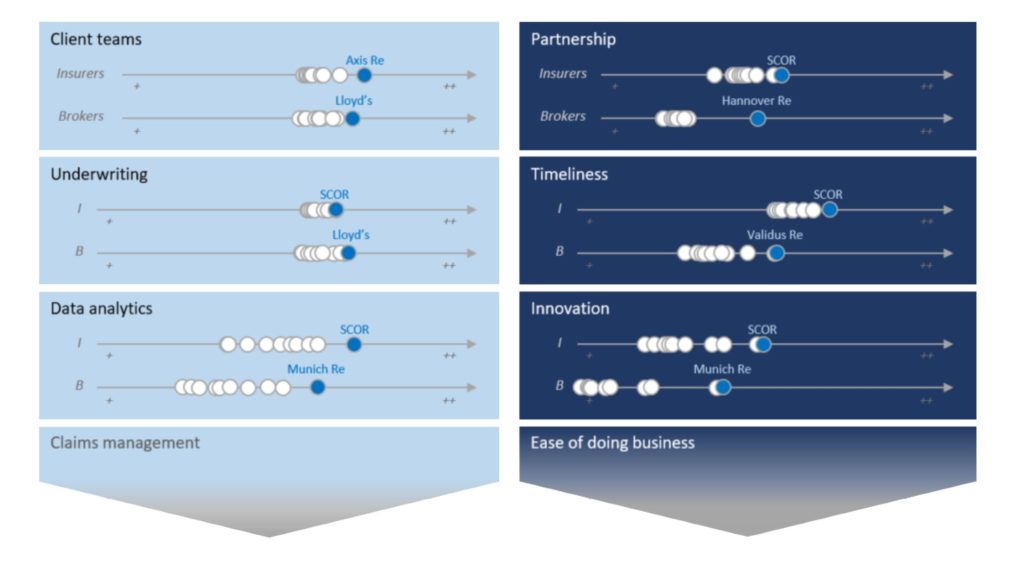

First-rate Followers

Being a successful follower requires a different engagement model as well as heightened capabilities in certain areas, such as portfolio analytics.

For reinsurers operating in the capacity of a following market, top ratings from insurers were shared between just two reinsurers:

- The client teams of Axis Re drew the highest ratings when operating in the capacity of a following market

- SCOR was top rated as a follower across the five remaining factors shown, especially for innovation and data analytics

Exhibit 3

The leading followers – US & Canada

Source: NMG’s P&C Re study, US& Canada, Insurers, 2019

For reinsurers operating in the capacity of a following market, top ratings from reinsurance brokers across the same six factors were shared between four reinsurers:

- Lloyd’s drew the highest ratings for both their client teams and their underwriters

- Munich Re received the leading ratings for data analytics and innovation

- Hannover Re was top-rated for its partnership approach (thus rated as such in the capacity of both a lead and a following market)

- Validus Re drew the highest ratings for timeliness when operating in a following capacity

Competitive strategy and identity

Outperformance needs to be sustained over a period of years for this to be a meaningful source of differentiation, and for many competitors this has been the case.

Sources of differentiation also need to align with strategy and identity. Competitors need to evaluate whether these assets are being appropriately leveraged or whether a different focus might be required. As we see in nature, not all sources of differentiation carry equal value, and some potentially carry little or none at all.