November 17, 2020

Doubling down on successful partnerships

The insurance industry in South Africa is doing its part in responding to a 1-in-100-year global event….

The collective investment being made in transforming the life insurance proposition exceeds anything seen in the last thirty years – a working lifetime. Reinsurers have raised the bar on client experience over the past decade, while also expanding scope, investing and re-organising to support the transformation of the primary insurance industry. And in so doing also their own.

NMG’s annual Study of the Global Life & Health reinsurance industry is by now familiar to many, if not most, including c.1,500 insurance executives and practitioners across more than 50 countries who contributed their expert perspectives in 2020.

The Study serves as a valuable source of insight into market trends and is used by reinsurers to develop strategies to deliver better client outcomes over time, as well as provide support for business cases for new investments and innovations.

The life insurance industry is engaged in a significant transformation. What started as a period of reflection was then followed by what can be fairly described as a level of confusion, subsequently advancing to a state of continuous innovation involving the adoption of new technologies and business models. The momentum of innovation effort within insurers and reinsurers continues to build without any near-term expectations of peaking.

Life Insurtech ventures are important agents in the process of transformation, although are often obscured by the much larger media and industry focus on P&C Insurtech (and RiskTech). Nonetheless, there are more than 50 Life Insurtech ventures of significance around the world, although most of these remain domestically focused and are yet to progress to scale.

2020 was a record year for capital raising into Life Insurtech ventures, accelerated only in part by the Covid-19 pandemic.

Embedded at the core of this transformation is a recognition that the life insurance industry has made products particularly difficult to acquire for retail customers. Furthermore current life insurance products still mostly lack elements that are now considered essential for today’s digital consumers (which includes just about everyone at this point). Finally, there is a growing realisation that the way in which insurers address customer segments and approach the process of underwriting is set for fundamental change.

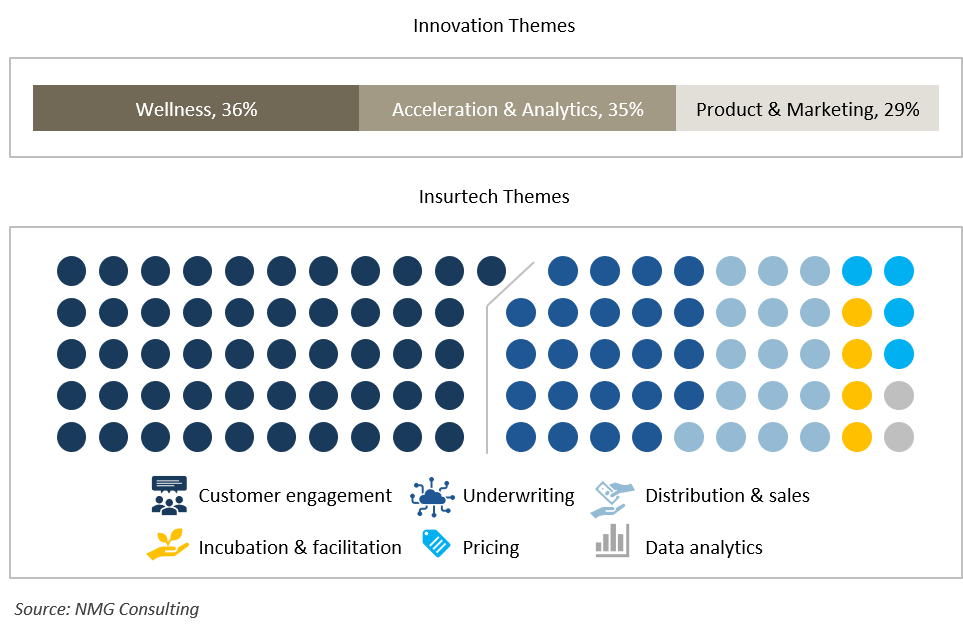

Exhibit 1: Insurer Innovation & Insurtech Themes – Life Insurance

Wellness engagement remains the most prominent innovation theme among the most innovative life insurers, acceleration and analytics lifted significantly year on year. Customer experience is the leading focus of the Top 50 Life Insurtech ventures

As such, Life Insurtech activity is significantly focused on finding new ways to frame the customer experience (‘CX’ in the new parlance) with ‘customer engagement’ at its core. While life insurance products will presumably never hold the same appeal as an iPhone, Life Insurtech CEOs talk about their offerings with a similar fervour. Prevailing levels of enthusiasm notwithstanding, life insurance is set to remain a sold product for a while to come, as none of these improved offerings sell themselves. And thus Life Insurtechs focused on distribution opportunities usually carry the most value upside.

We expect that insurers will be able to point to only modest achievements for these early-generation innovations, and the majority of Insurtech ventures will find the timelines to success protracted (relative to their expectations, with some infinitely deferred!). This is not to suggest that much of the current activity is without merit. In fact, to the contrary, conception remains one of the most difficult elements of innovation, rivalled only by the challenge involved in finding successful operational models as many of the Insurtech trailblazers are now experiencing.

The bigger point here is that the collective desire to take advantage of new technologies and datasets to transform the way life insurance (protection) is sold and managed is without precedent. We know from experience that we are prone to over-estimating short-term progress while underestimating the medium to long-term impact of some of these changes. Seen this way, the industry might be doing better than we think, and there is a real risk of underestimating the scale of transformation longer-term.

In this regard, reinsurers have a major role to play in framing new strategies and have re-organised to participate actively in these transformations. The question about the commencement of reinsurer involvement is not one of ‘If or When?’, but ‘How long ago?’

This claim should not be contentious, even if not immediately obvious.

After two decades of strategies aimed at putting the customer at the forefront, more recently transformed by new technology capabilities, companies across a wide range of industries have successfully created customer experience outcomes never seen at an equivalent scale. Unfortunately, few of these are in the life insurance industry; at least for the time being.

There are still numerous examples of poor customer experience outside the life insurance industry (certain airlines and telcos spring to mind), but when done well the case for ‘best-ever’ (in many domains) is a compelling one. There are also enough ‘best-ever’ cases to have permanently reshaped our rising collective expectations. Telsa motor vehicles automatically turn on when their owner’s approach, and crank up the aircon on a hot day before one gets inside!

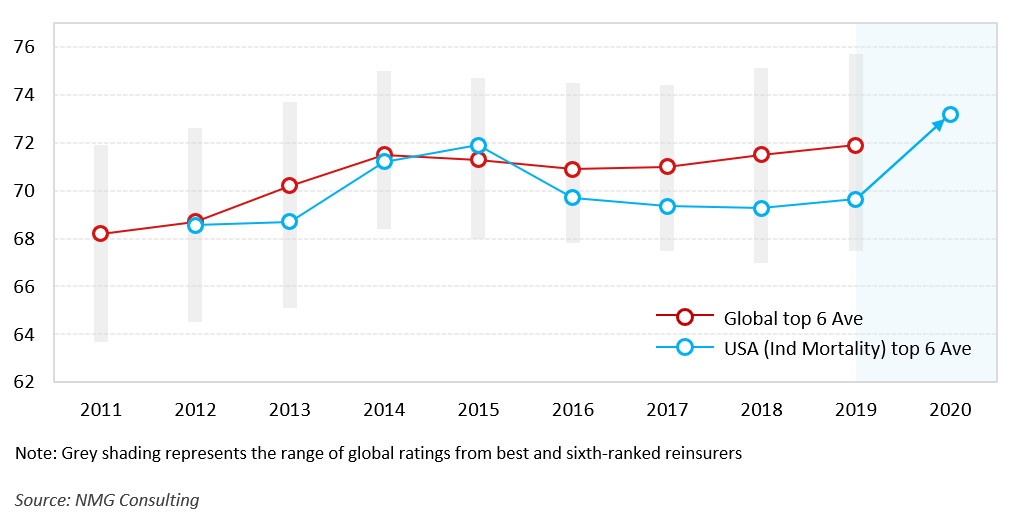

This provides relevant context for the life & health reinsurance industry, where NMG’s Business Capability Index (BCI) has reached 70 or higher for the past five years, a significant uptick from prior years. [The BCI is a measure of insurers’ perceptions of how effectively they have been engaged and supported by their reinsurance partners, as well as their reinsurers’ capabilities, execution and innovation effectiveness.]

Exhibit 2: The Rising Tide

2011-2019 movements in BCI for the L&H Re segments, globally. L&H reinsurers demonstrated their value in a crisis in supporting life insurance clients in the USA

This broad-based performance uplift for reinsurers can be attributed to multiple sources, including the narrowing of the scale differentials between the six largest reinsurers (by total premiums). Additionally, reinsurers have deployed service-led segmentation strategies, better matching propositions to client needs, as well as broadened offerings to include financial solutions, longevity, and technology solutions. At a foundational level, reinsurers consistency place a value on the ‘customer experience’ and have a much greater appreciation of lifetime client value and manage accordingly.

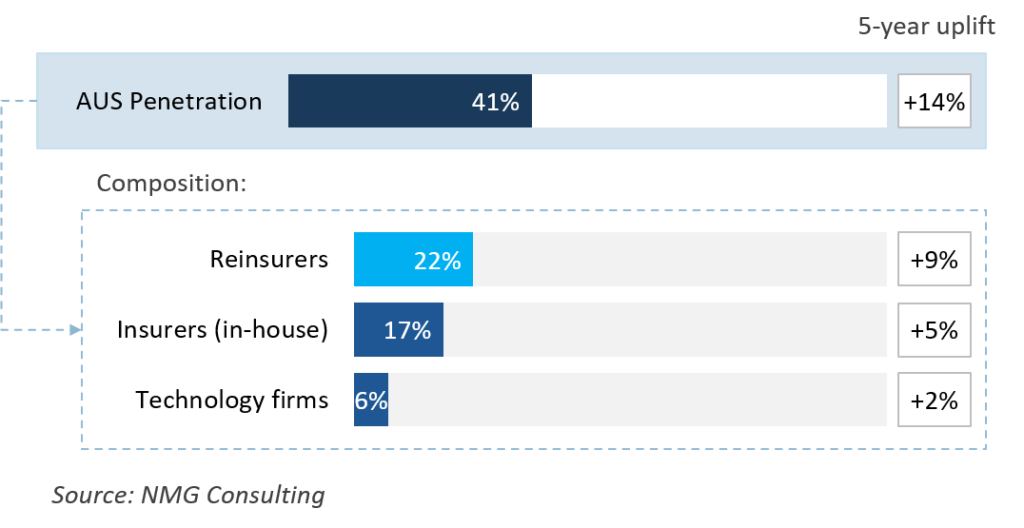

In the 24 months to 2016, reinsurers had successfully installed (or received firm commitments for) 100 new automated underwriting systems (AUS) globally. In 2017, we named them the “Life Insurtech Pioneers”, making the point that these significant investments by reinsurers should be included in an assessment of the life insurance industry’s early progress in Insurtech.

The total number of reinsurer-owned AUS installations exceeded 300 at the end of 2020.

Incumbent relationships have carried some advantage, although insurers’ assessments are increasingly driven by preferences for contemporary technology platforms, intuitive interfaces, and the capacity to incorporate external data sources over time. Furthermore, the term ‘upgrade’ of the leading systems can be misleading; while new systems carry the same name, they are usually sufficiently different from their predecessors that insurers generally opt to make their decisions via a full tender process.

Insurers have in the meanwhile continued to develop and invest in in-house systems (often in conjunction with third-party technology solutions), yet as we expected this trend has slowed, particularly after most reinsurers doubled down on their AUS investments. The anticipation is that the growth of in-house systems is set to taper further.

Exhibit 3: Automated Underwriting Penetration

The proportion of insurers with at least one automated system globally. For large, protection-focused life insurers, AUS usage is now nearly ubiquitous. Reinsurer systems have ~50% market share

Reinsurer balance sheets are capital-intensive, thus ultimately requiring these AUS investments to deliver a return in the form of a margin on reinsurance premiums. Reinsurers have adopted very different strategies so far, both aligned (where the AUS is made available only to a current reinsurance client) and also non-aligned (where the anticipation of a premium-based return is deferred). Most recently, non-aligned strategies have seen a growth in take-up, but it is unclear whether they will prove to be more successful.

Growth in automation brings new efficiencies and a standardised approach in underwriting as well as an essential strategic narrative for a modern re/insurer. Today’s AUS are not yet driven by machine learning, rather encoding the decision frameworks used by human underwriters, and thus represent a digitisation of the intellectual property built over the past century. These AUS are likely the last of the ‘reflexive question’ systems awaiting the eventual launch of the genuinely intelligent systems that are currently in various stages of development (although mostly of limited scope).

There is an explosion of new investment and activity in the areas of data & analytics, which applies to both pricing and underwriting. The US and China are the leading markets in this respect, home markets for the world’s tech giants, and where third-party data is currently relatively accessible at scale thereby facilitating faster adoption.

In the US, 60% of insurers are currently using predictive analytics of some form (particularly around underwriting), and nearly all insurers have plans to do so in the near-term. While still embryonic in most instances, take-up schedules are accelerated compared with those of AUS platforms at the same point stage of development, with new initiatives into electronic health records likely to lift the pace further.

An important caveat is that significant uncertainty exists as to the future responses from regulators (and the courts) about what constitutes acceptable practice in terms of data privacy and the avoidance of discrimination.

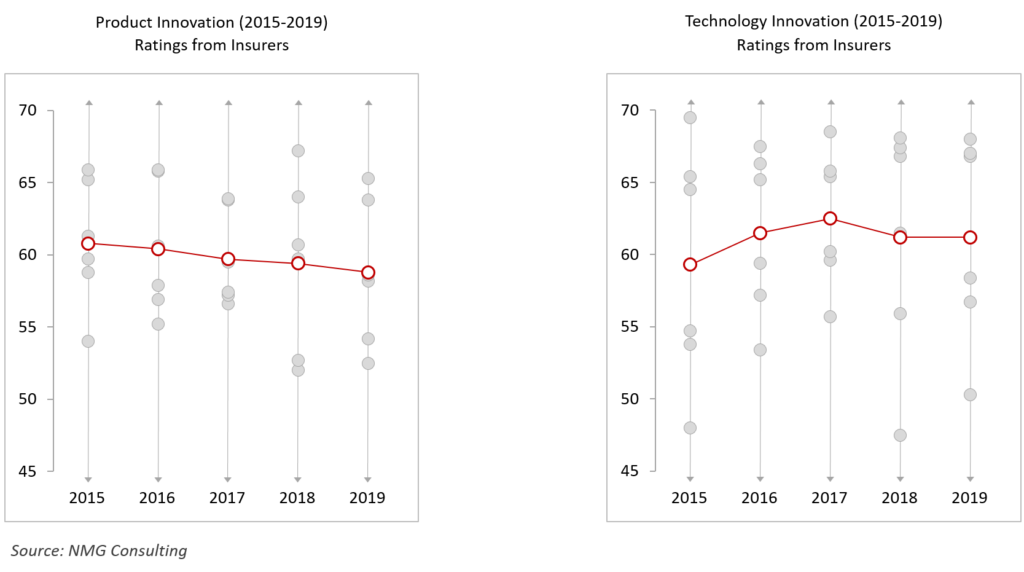

Product innovation remains a cornerstone of the reinsurance proposition. Innovation is hard, and thus when done well it is a key source of differentiation for reinsurers.

Ratings for reinsurers’ product innovation capabilities have declined over the past five years, while those in respect of their technology innovation capabilities have risen. Several reinsurers now attract higher ratings for technology innovation than they do in product innovation.

Exhibit 4: Shifting the goal posts

Insurers’ ratings of the innovation capabilities of reinsurers, trended over time

While it would certainly be a mistake to suggest that reinsurers are becoming technology companies, their successes in building technologies to supplement the efforts of insurers in the broader transformation of the industry are well-recognised.

Conversations of strategy at reinsurers are very different today than they were a decade previously. Partly this has to do with scope, being much more diverse businesses today. Also, it is to do with the pace of change and how quickly new ideas are adopted into operational reality.

This is a genuinely exciting time for the life insurance industry and particularly for reinsurers, being agents of change. By extension, it is also one of the most demanding periods, one in which competitive success will be significantly differentiated between winners and losers.