April 7, 2020

More than staying the course: COVID-19 messaging to US investors and advisors

COVID-19 and its drastic impact on the economy has resulted in unprecedented physical and financial insecurity for…

The pandemic has significantly and broadly impacted the US life insurance industry. Traditional advisor networking has been disrupted, insurers have had to demonstrate greater responsiveness and flexibility in underwriting and embrace a more digital approach. Reinsurers have had to be proactive and flexible while maintaining standards for risk acceptance and claims support. In short, the advisors, insurers and reinsurers that have performed well in the crisis, now have an opportunity to capitalise.

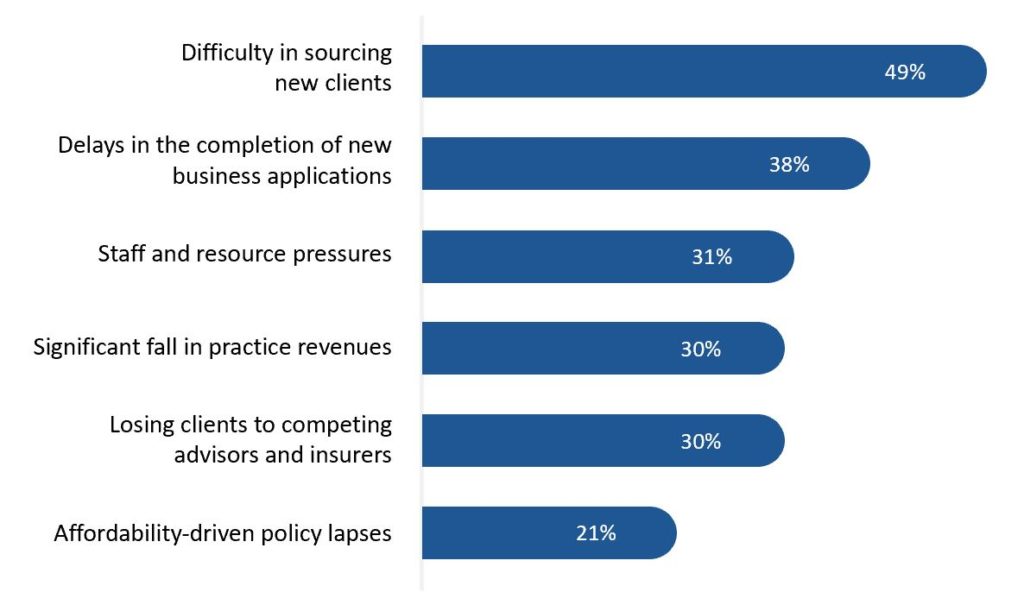

While advisors have been successful in supporting their current clients on a virtual basis, our recent Pulse study of 200 independent US life advisors shed light on advisor thinking about the primary challenge now faced: nearly 50% of advisors are ‘concerned’ or ‘extremely concerned’ about the difficulty in sourcing new clients.

Exhibit 1: Leading Advisor Concerns in the times of Covid-19

Source: NMG’s Advisor Protection Pulse, US – August 2020

The underlying concerns of advisors centre around the constraints arising from social distancing obligations and the new norms that could take hold before the pandemic is fully contained. Advisors, like their clients, are skewed towards the older working ages, meaning both are likely to take a more conservative approach to distancing. This is a major headache for a distribution system heavily dependent on networking. Advisors report that traditional networking activities, which are essential to sourcing new clients, are down by almost 80%.

Advisors report that traditional networking activities are down by almost 80%

Absent new approaches to client acquisition, new life insurance sales can reasonably be expected to decline, at least in the short-term and potentially longer. The impact of Covid-19 has brought into stark focus the need for alternative methods of lead generation and client development. It seems that there will be no special exemptions for the life insurance advice industry when it comes to Covid-19.

Rather than wait for a face-to-face opportunity and driven by heightened risk awareness generally, customers have become more proactive. More than 60% of advisors report an uplift in calls received and, crucially, one-third of these calls are from potential new clients (mostly triggered by ‘word of mouth’ referrals), who are evaluating their needs for life insurance and coverage.

One-third of inbound calls are from new clients, triggered by word-of-mouth referrals

Highly-trusted advisors with strong client engagement models are set to be the clear winners in this environment, whereas those solely dependent on traditional prospecting capabilities seem set to lose ground. In a sense, the pandemic is winnowing out those advisors with poor engagement models and capabilities.

These trends have implications for insurers as well as advisors and their clients. Insurers will want to work with those advisors they perceive to be crisis-resilient, being those with proven ability to earn client engagement and resultant referrals and thus much less likely to turn to insurers for referral support. Insurers will need to be prepared for the risk that a greater proportion of applications will come from groups more vulnerable to the effects of Covid-19.

According to advisors, optimal insurer support in the crisis boiled down to just two key themes:

(1) Timely, high-quality communication

The top-rated insurers so far have been those who have understood the value of proactive communications: in particular, regular updates on their changes to product coverage. Also, the top-ranked insurers have responded quickly (by phone/email/chat/text) to advisor queries.

Poorer performing insurers were either slow to communicate or, paradoxically, rushed their communications and created a disconnect between announcement and implementation. In a rapidly changing environment, insurers’ automated call centre support at times frustrated advisors (because they lacked the intuitive sense to direct queries to the appropriate specialists).

(2) An effective operational response

This virtual engagement model enforced by the pandemic has rewarded insurers already well-advanced in using advisor/customer engagement platforms, and those which have refined a reliable and easy-to-navigate electronic application process.

Independently of the pandemic, life insurers have been investing in accelerated underwriting processes and technologies for many years. Insurers have adopted different strategies during the crisis and several have tightened standards for accelerated underwriting on the grounds of greater uncertainty and the potential for increased anti-selective behaviour from customers.

Others chose to differentiate their capabilities by relaxing underwriting guidelines to recognise the challenge in obtaining medical evidence in a world with social distancing and where the health industry is stretched dealing with Covid-19.

Insurers that lifted their thresholds for non-medical applications were also viewed positively. In addition, several insurers were recognised for being reliable on policy acceptance and on-time with their advisor payments, a lifeline for advisors during a period of income uncertainty.

“The more we can use digital tools to submit business as well as reform medical information requirements, the easier it will be to do business with carriers.” Advisor

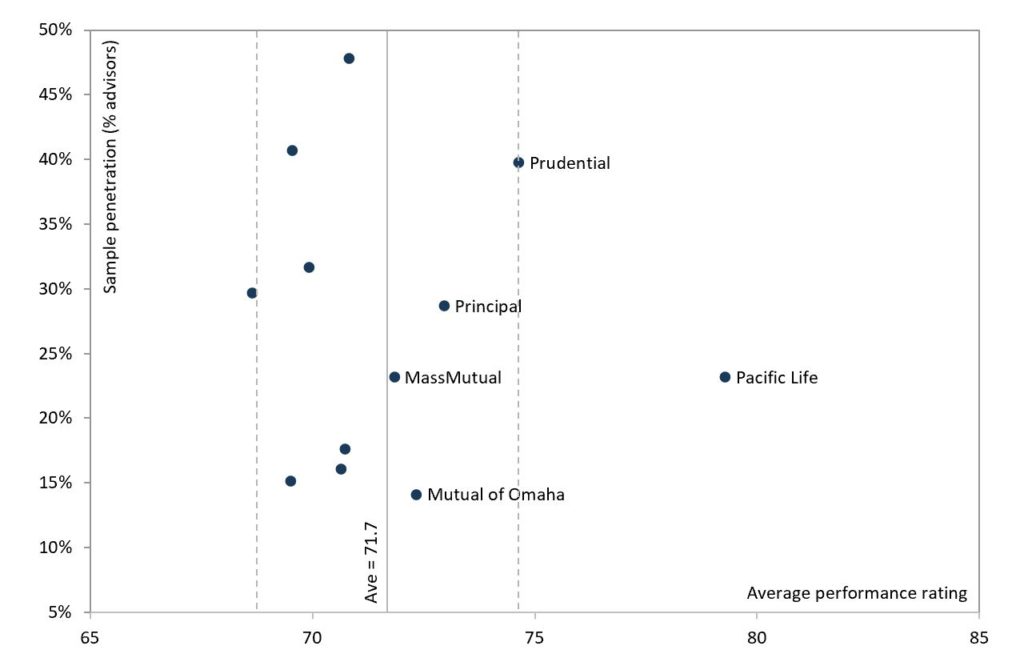

Advisors rated insurers’ responses to the crisis positively overall, although the ratings of insurer performance are quite diverse.

Exhibit 2: Insurer performance during Covid-19 (Q3 2020)

Source: NMG’s Advisor Protection Pulse, US – August 2020

Pacific Life is strongly differentiated from all competitors, more than enough to look beyond its smaller sample coverage and narrower product set. Of those insurers ranked ‘top 3’ for sample coverage, Prudential received the highest aggregate ratings from advisors.

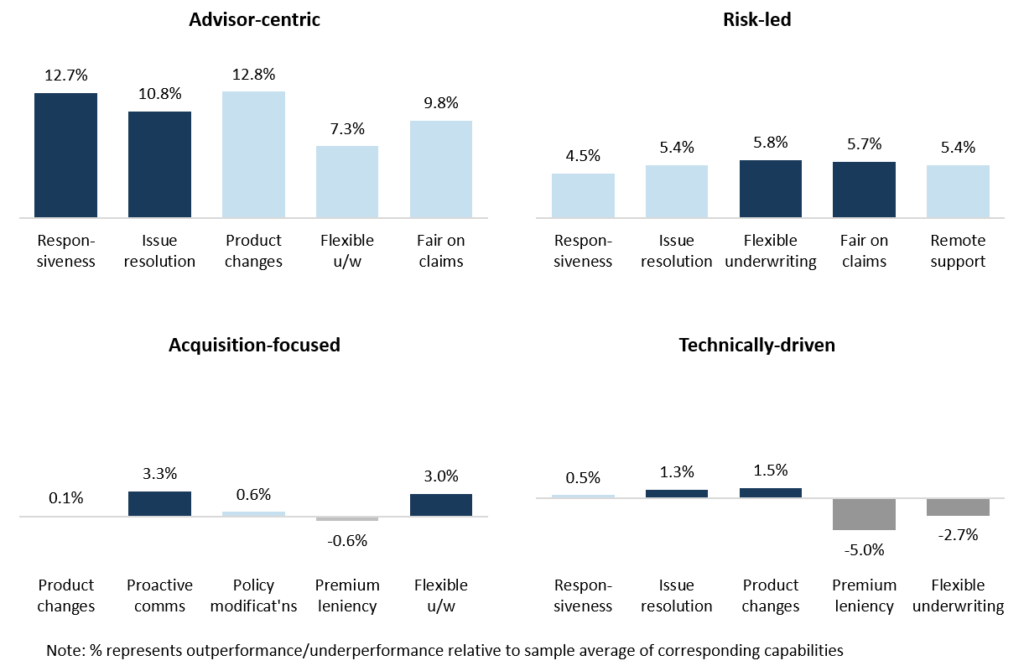

Closer inspection of insurer-specific ratings revealed distinct insurer responses to Covid-191:

Exhibit 3: Insurer over/under performance by capability (relative to industry mean)

Source: NMG’s Advisor Protection Pulse, US – August 2020

It should be noted that insurers rated as being more flexible in underwriting or better in claims does not imply technical inferiority or lower margins. Nonetheless, insurers generally seek to achieve high ratings from their supporting advisors on these factors.

1Note that all life insurers focus on the attributes outlined, yet are different in where emphasis is placed (measured by performance against the mean rating for each factor)

Life insurers hold a more favorable view of near-term growth2 than do advisors, incorporating views across all distribution channels, although should take heed of current signalling from advisors.

Insurers face additional challenges, being disproportionately exposed to older lives where the impact of Covid-19 is most intensely felt. Insurer expectations are for significantly worsening claims experience in mortality and disability portfolios (with perhaps more favorable experience emerging in other classes such as longevity and LTC). Insurers also face additional margin pressures with yields at all-time lows on fixed income portfolios.

Insurer expectations are for significantly worsening claims experience on mortality and disability portfolios

A lasting effect of the pandemic will be to accelerate the pace of ‘digitalisation’ of life insurers, although the need to double down on these efforts currently is a significant additional stress point.

2 Insurer expectations for new premiums indicate an average decline of 10% to June 2021 (Life Insurer Covid-19 Pulse)

Reinsurers are similarly exposed to reductions in new reinsurance premiums and worsening claims experience and carry the most-skewed exposure towards older and sub-standard lives. Reinsurers also experience additional volatility arising from larger policy risks assumed.

Nevertheless, reinsurers have underlined their partnership credentials throughout the crisis, providing highly-valued support to insurers in areas including flexible underwriting, claims fairness and proactive knowledge sharing. Insurer evaluations of reinsurer performance have risen sharply, most noticeably for responsiveness and claims support.

US insurers and advisors face several similar challenges in the new normal. Both need to respond to more risk-aware consumers experiencing hip-pocket pressures and facing an uncertain environment. Both need to optimise their digital and remote channels to deliver information, access and underwriting at levels they have never achieved previously. Advisors and customers will have expectations that these higher levels of servicing and support will become permanent.

Advisors have an expectation that the higher levels of servicing and support will become permanent

At the same time, insurers will need to balance flexibility in underwriting and new business acceptance with adequate risk management. The search for substitute risk factors for medical information will be important. Underwriting standards are thus a key risk point and one insurers and reinsurers will focus on.

Those advisors and insurers who have shown resilience in the crisis have developed a hard-earned competitive edge. As the industry settles into a new normal, we’ll learn how effectively they capitalise on this.

NMG Consulting focuses exclusively on the insurance, reinsurance, wealth management and asset management industries. Our advisory model integrates strategy consulting, insights, and analytics. Within our Insights division we run annual studies, to examine market and competitor trends, as well as pulses to assess changing dynamics. This article draws on evidence from three of our 2020 studies in the US, namely: Advisor Life Insurance Covid-19 Pulse, Life Insurer Covid-19 Pulse, and our annual Individual Mortality Reinsurance Study 2020.