July 26, 2022

The complexity of performance fees

Performance Based Fees: a lot more complex than you’re likely giving them credit for, and that may...

Retail channels drive growth and innovation in asset management, but developing a clearly aligned product and distribution strategy is critical.

The investment management industry grows faster and more reliably than most others thanks to investment returns; contestable assets under management (AUM) in the US is up 5% per annum over the last five years (lower than average as 2022 was a difficult year for markets), and NMG’s forecast has it continuing to grow at 8%, assuming normalized investment returns.

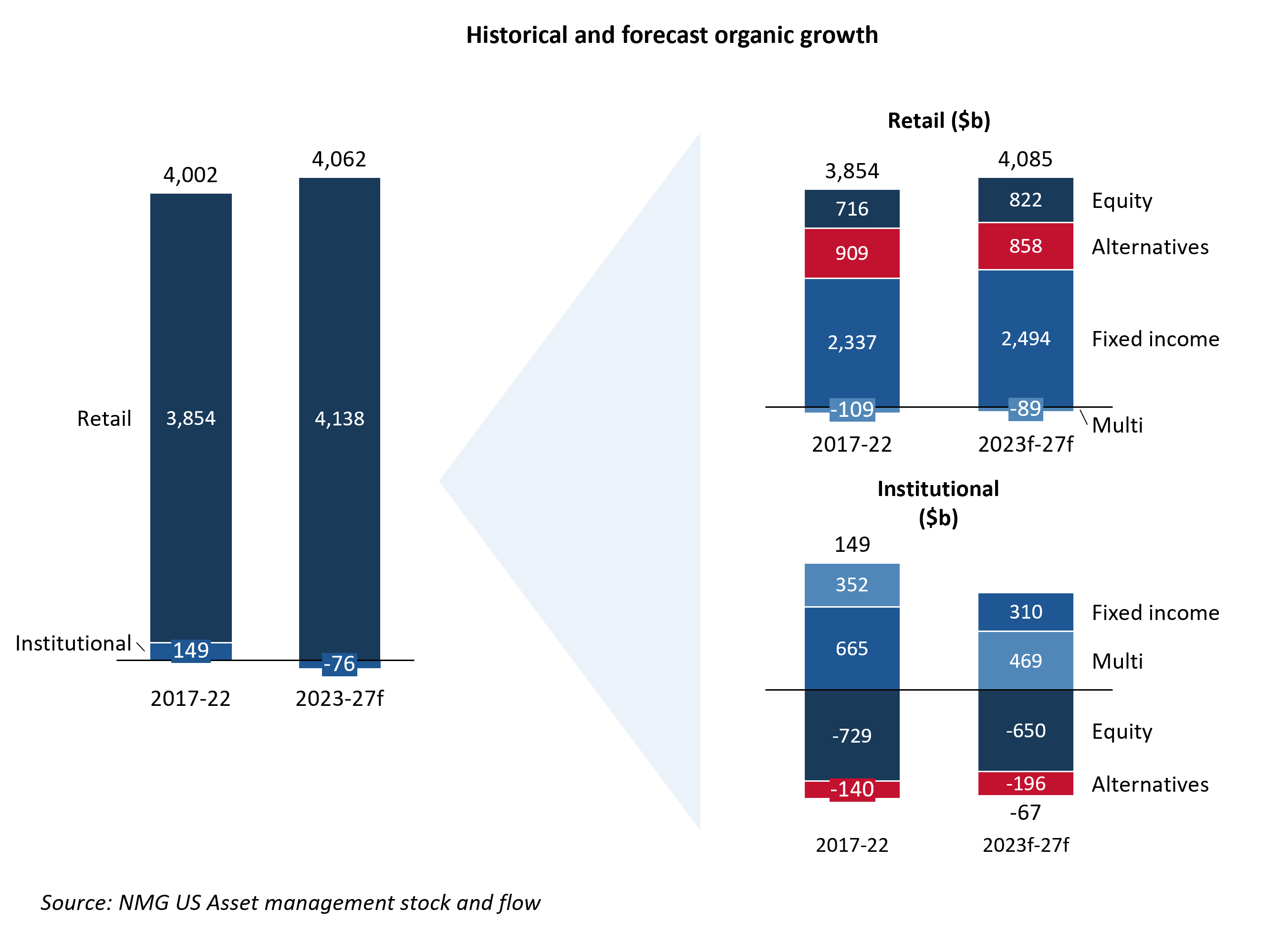

But, the spoils are not evenly distributed. When looking at organic growth over the last five years, Exhibit 1 shows that the vast majority of organic growth occurred in the retail channel despite it accounting for less than half of total industry AUM. Institutional organic growth is essentially non-existent, hampered by large outflows from public/private DB pensions and private DC plans.

Exhibit 1: Cumulative net new flows by channel and asset class ($b)

Retail channels are expected to continue to dominate share of industry organic growth

Not only is industry organic growth predominantly experienced in the retail channel, but it is in the more profitable asset classes as well, as shown on the right-hand side of Exhibit 1. Where a large portion of the institutional organic growth that does exist is in low-margin fixed income products, NMG predicts strong future growth in retail equity and alternatives asset classes. This growth shift towards alternatives in retail, moving away from the more traditional institutional asset owners, is evidenced by various alternatives specialists expanding their retail reach—often with notable success.

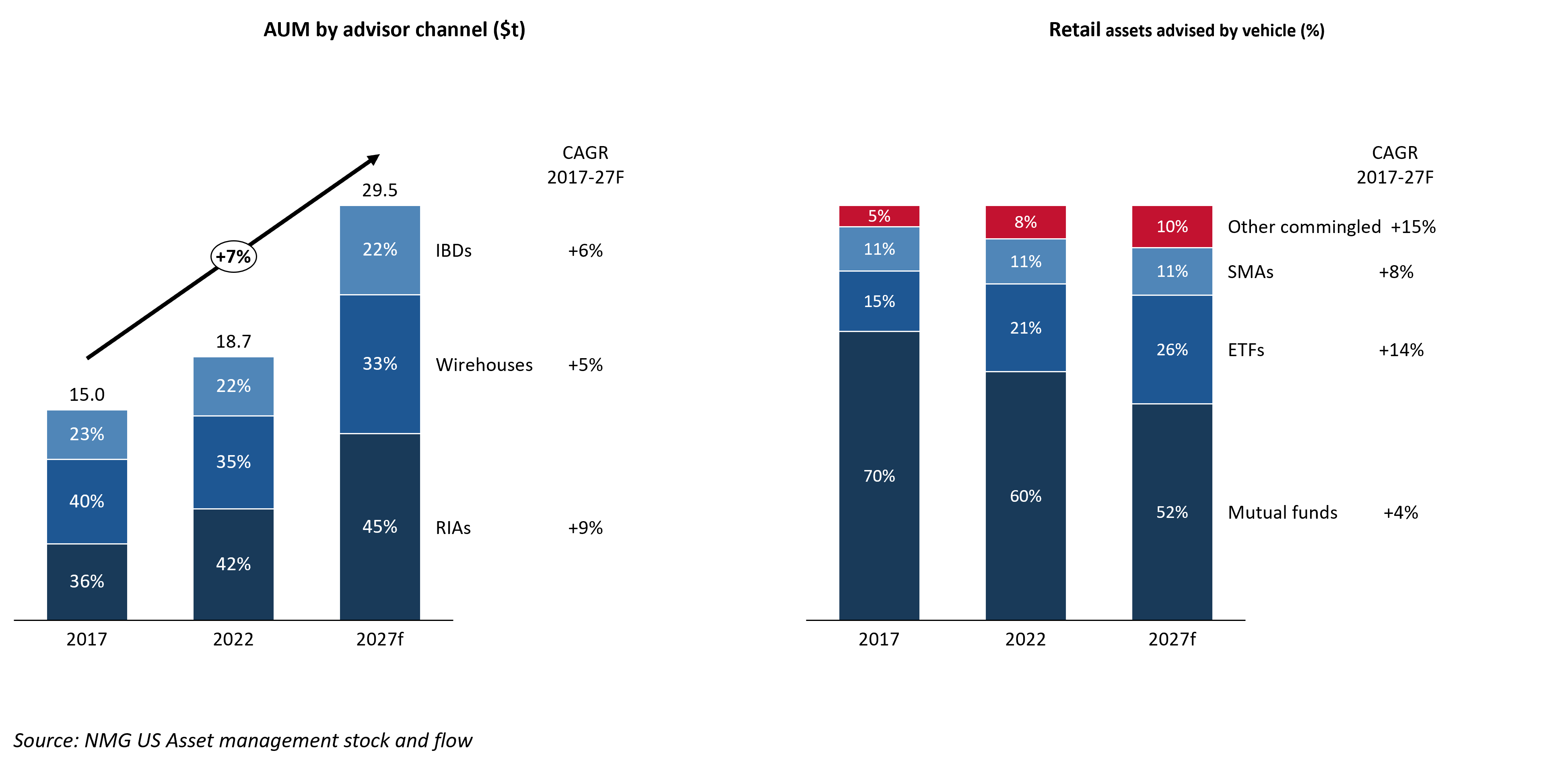

Despite a promising growth profile, the retail system is becoming ever more complex. Not too long ago, a retail product strategy required the manufacturing of mutual funds, period. Nowadays, that one-size-fits-all approach hardly scratches the surface with managers needing to package investment strategies into a litany of three-letter-acronyms (ETFs, CITs, SMAs) and other product structures in order to meet the demands of specific channel sub–segments. Then, it gets more daunting: as Exhibit 2 shows, the RIA channel is the fastest growing advisor channel by some margin, yet it is the most challenging to access given its fragmentation (in terms of numbers, preferences, and behaviors), even taking into account the impact of RIA aggregators (more on that another time).

Navigating this complexity necessitates crafting and implementing product and distribution strategies with more precision and depth than before, and often with vast and extremely well-targeted distribution teams. A firm understanding is needed, not just of the in-demand investment strategies, but also of which advisors are seeking them and in what product structures. Failures in product development often boil down to a mismatch among these vital factors.

Exhibit 2: Retail advised AUM by channel ($t) and vehicle (%) (2017 – 2027f)

RIAs lead retail advisor growth in a new world of investment vehicles

Looking forward, an asset manager looking to drive organic growth in retail should focus on crafting a tailored, comprehensive, and seamless product and distribution strategy that effectively targets the complex – but rewarding – retail channel.