The anticipation is for a moderation in the number of IFA firms selling to Consolidators in 2023. Strategic buyers, aligning their offerings with the more comprehensive requirements of selling adviser-owners, are likely to experience a renewed influx in their prospect pipelines.

Changing motivations

Over the past 5 years, Consolidators have had significant success in acquiring IFA practices, accounting for 12% of total new flows of the financial adviser channel in 2022 (up from 8% in 2017).

The bedrock of M&A activity has been adviser-owners of smaller practices, seeking to cash-in their shares on retirement, capitalising on an influx of private capital (invested via larger advice firms, being the chosen vehicles for consolidation).

More recently however, with the backlog mostly cleared, the pipeline of adviser-owners looking for value realisation upon retirement has declined meaningfully.

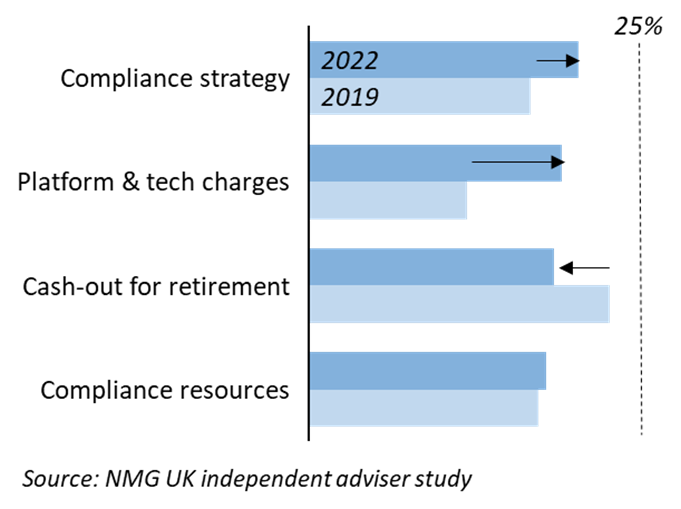

Exhibit 1: Retirement and beyond

A rise in the percentage of adviser-owners citing compliance strategies and cost reduction as the reason for seeking a sale. Cash-out on retirement remains prominent, but less so

It follows that a deal pipeline reliance on retiring advisers alone is unlikely to be sufficient to sustain growth levels. This has become a leading concern for Consolidators (and their private equity backers).

Consumer Duty and Value for Money

The current propositions of Consolidators fail to fully recognise the changing motivations of advisers.

One gap is the priority given to – and the profile of support sought by – adviser-owners in respect of compliance, which in a Consumer-Duty world has become the leading motivation for the owners of IFA firms to enter a sales process.

Additionally, what advisers mean by compliance support has shifted towards the design and enablement of compliance strategies (such as dashboards to monitor customer outcomes and support in regulator engagement for advice process compliance) and away from simply the provision of compliance resources (such as access to compliance templates and dedicated administrators).

Advisers are also aware that Consolidators are better placed to negotiate lower platform and technology provider charges due to their relative scale, which can in turn be passed onto customers to improve ‘value for money’ outcomes.

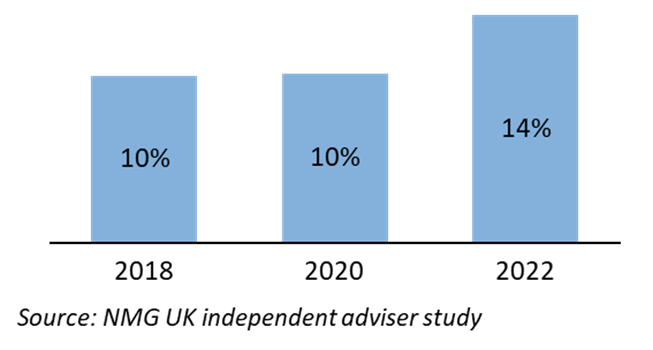

With all motivations considered, adviser-owners’ interests in selling their business have actually increased.

Exhibit 2: Growing interest in a sale

A rise in the percentage of adviser-owner making enquiries into the potential sale/valuation of their advice firm

Improved optionality

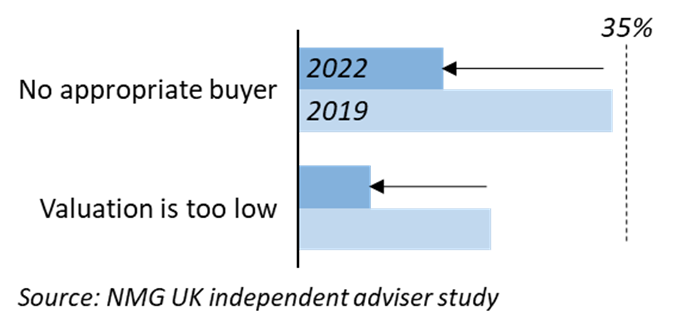

In 2019, adviser-owners reported that a lack of suitable buyers and perceived low valuations were the leading impediments to successful transactions.

In contrast, the number of active buyers today exceeds 50 (having more than doubled), substantially improving the prospects of sellers to find a suitable match (across dimensions that include location, customer segmentation, advice proposition, culture and independence).

Furthermore, today’s Consolidator strategies are adapting to incorporate long-term employment of advice firm management post-completion, thereby creating a broader opportunity set, which can include younger adviser-owners.

The number of advisers citing low valuations as a barrier to accepting an offer has reduced, despite actual valuations remaining largely flat (for now at least). As one adviser-owner told NMG: “What I would get now is the same as a few years ago, but that looks more attractive to me in these uncertain times”.

Exhibit 3: More pragmatism

A growing percentage of adviser-owners are open to accepting an offer for their firm

Proposition evolution

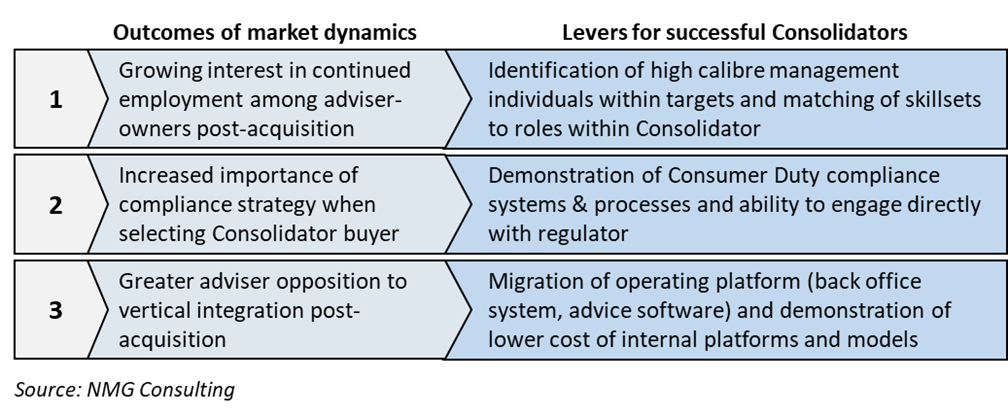

It seems reasonable that the successful next generation of Consolidators will engage adviser-owners around approaches to management team transition, Consumer Duty strategy and enablement, as well as the available scale economies of their in-house platforms and operational models. While competitive valuations will remain essential, for many transactions they will not be sufficient.

Exhibit 4: Success levers

Three levers for Consolidators to pull in order to attract adviser-owners in the future

Size of the prize

NMG modelling suggests that – with the right regulatory and market tailwinds – the Consolidator segment could account for upwards of 20% of new flows by 2027, with growth emerging from both the rebound in M&A activity and the steady shift of Consolidators towards younger advisers (and by association, accumulating customers).

As the competitive landscape shifts towards Consolidators with superior scale and access to capital, independent financial adviser firms must respond by enhancing their compliance processes, ensuring the competitiveness of their fee structures, as well as regularly evolving their propositions (across lead generation and advice capability). This will be no mean feat.

NMG Consulting – Consolidator Study (UK)

We are currently in discussion with decision makers at consolidators and adviser-owners at both independent and recently-acquired practices to build a deeper perspective on growth outlook, target IFA firm profiles, platform selection factors (including white-label solutions), and the impact of Consumer Duty.

If you are interested in participating or finding out more, please contact:

Charles Lake, Partner – Head of UK, [email protected]

Cameron Staveley, Senior Consultant, [email protected]