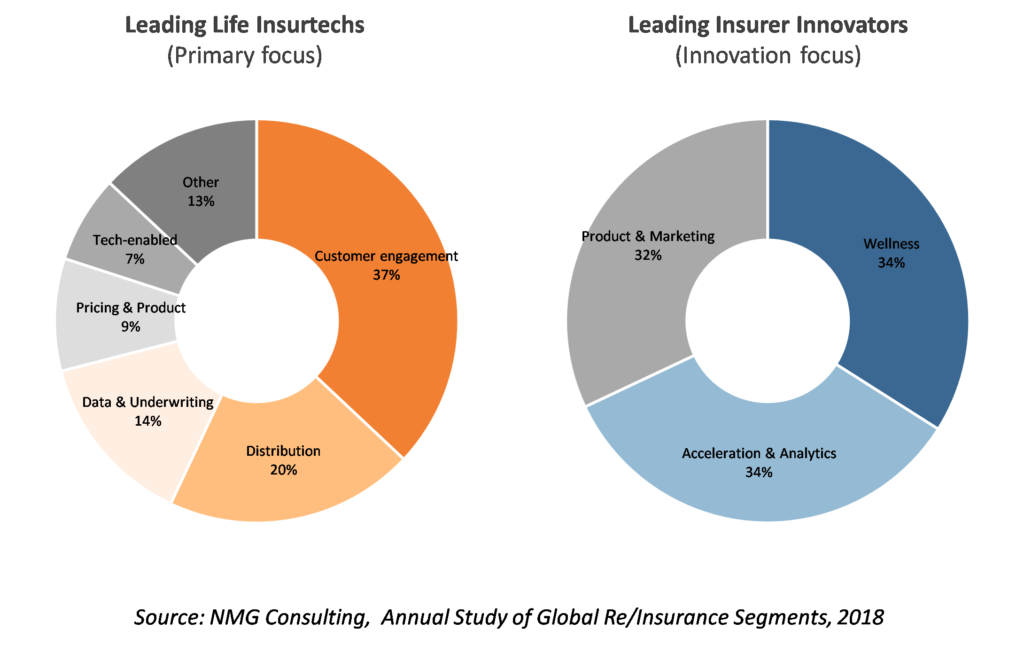

The level of collective investment focused on transforming the life insurance proposition exceeds anything seen in the last thirty years – a working lifetime. Insurers have put significant focus on wellness innovation while the boldest among the insurtech field have focused on holy grail itself – hacking the life insurance distribution model. Customer engagement and new data & analytical models are key to both the strategies of life insurers and life insurtechs.

Unprecedented changes

The life insurance industry is engaged in a dramatic transformation. What started as a period of reflection was followed by what is perhaps best described as a state of confusion, subsequently advancing to a phase of continuous innovation, involving the accelerated adoption of new technologies and business models.

Supplementing our annual Study of the life & health reinsurance segments, NMG continues to track the leading insurance and reinsurance innovators on a global basis, profiling their innovations, strategies and technologies, as well as their market impact. It is particularly clear that the momentum underlying these innovation efforts continues to build without any near-term expectations of peaking.

There are more than 50 life insurtech ventures of significance globally, albeit mostly with a domestic focus and yet to progress to scale

Life insurtech ventures are important partners in the transformation process, yet these contributions tend to be obscured by the huge media and industry focus on P&C insurtech (which swamps Life by a factor of ten in terms of investment and number of ventures). Yet, even allowing for this relative under investment, there are more than 50 life insurtech ventures of significance globally, albeit mostly with a domestic focus and having yet to progress to scale. For the time being.

Customers: self-directed and always connected

Embedded at the core of this transformation is a recognition that life insurers have made products particularly difficult to acquire for retail customers; an area in which the US industry has set the benchmark! Another recognition is that current life insurance products mostly lack elements that are considered essential for digitally-integrated consumers (which nowadays includes just about everyone). Finally, there’s a growing realisation that the way in which insurers address customer segments and approach the process of underwriting is set for fundamental change.

Current life insurance products lack elements that are now considered essential for today’s digitally-integrated consumers (which nowadays includes just about everyone)

Life insurtech activity thus is highly focused on finding new and broader ways to frame the customer experience (‘CX’ in the new parlance) with ‘customer engagement’ at its core. While a life insurance product may never hold the same broad appeal as an iPhone, the energy that insurtech has generated is sufficient to enthuse life re/insurance CEOs to channel their ‘inner Steve Jobs’ when they talk about change. This is really amazing if one thinks about it.

Exhibit 1: Life insurtech and Life insurance Innovation Themes, 2018

Insurtech ventures focused on new distribution carry significant upside, tackling the perennial difficulty of new customer acquisition. Prevailing levels of enthusiasm notwithstanding however, life insurance will surely remain a sold product for a while to come since none of these improved offerings simply sell themselves. As all too many new ventures have already discovered, product modernisation alone is not sufficient.

Unfortunately, people don’t leap out of bed in the morning wanting to buy life insurance; it will remain a sold product for a while to come

Innovation/Insurtech is now a verb

To date, insurers can only point to reasonably modest achievements for their earliest innovations, and the majority of insurtech ventures have found the timelines to success protracted relative to expectations. This is not to suggest that much of the current activity is without merit. To the contrary, ideation remains one of the most difficult elements of innovation, perhaps surpassed only by finding successful forms of operational excellence in these same domains. Ventures and initiatives must now have realistic commercial prospects to capture interest, and in this sense what constitutes ‘worthwhile’ innovation and insurtech has morphed from being a noun to a verb.

Ventures and initiatives must now have realistic commercial prospects to capture interest

The desire to transform the way life insurance is sold and managed is without precedent. We know from experience that we are prone to over-estimating short-term progress, while underestimating the medium to long-term impact of some of these changes. Thus, as we struggle with a wicked problem, the industry might well be doing better than we think.

Insurtech – early signals from successful incubation models

In our recently released 2019 Study of the individual re/insurance in America, insurer executives identified more than 50 life insurtechs as being worthy of mention. Given the importance of industry profile, one way to evaluate these is by level of ‘awareness’.

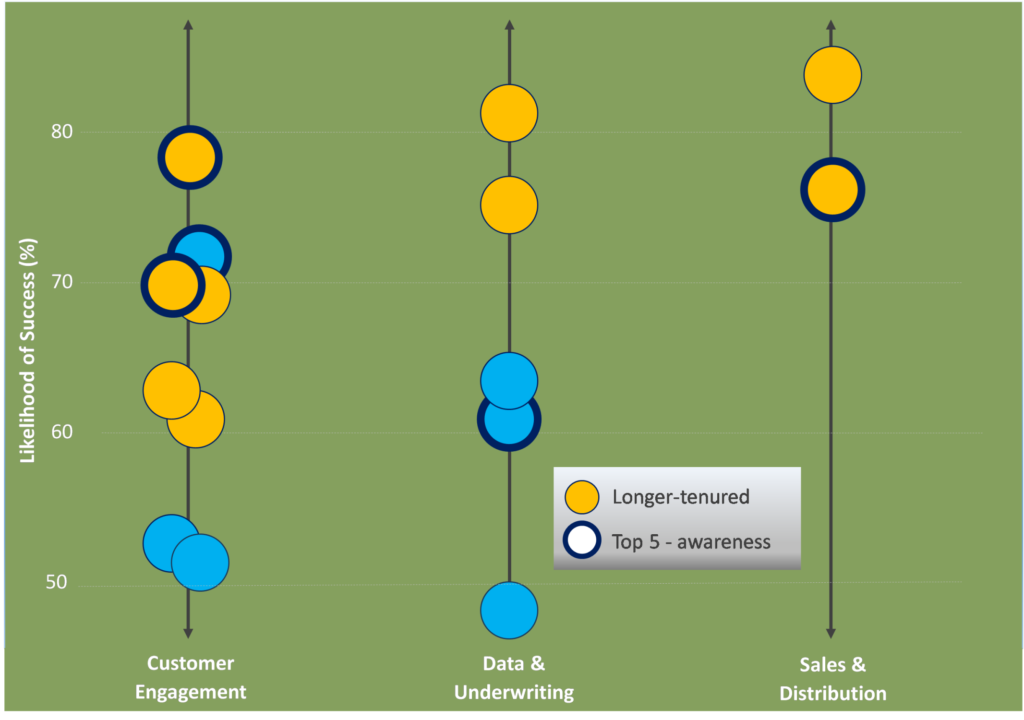

Perhaps optimistically, 16 of the top 20 insurtechs were considered to have a better than even prospects of long-term success, with those earlier movers being seen as being most likely to succeed.

Exhibit 2: Life insurtech outlook, USA 2019

Insurtechs focused on Distribution & Sales seem particularly well-placed, although we note a strong survivorship effect, recognising that several of the early trailblazers of this profile are no longer with us.

Views on the prospects for insurtechs focused on Customer Engagement and Data & Underwriting are more divergent, with those of longer-tenure again seen as more likely to succeed. Several of the recognised insurtechs are newly-established divisions/entities of larger groups, confirming the idea that the volatility of adolescence benefits from the support of a good home.

Several of the recognised insurtechs are newly-established divisions/entities of larger groups, confirming the idea that the volatility of adolescence benefits from the support of a good home

Longer-tenured insurtechs typically have strategic owners and/or are well-capitalised with professional money. Beyond basic survival, these foundations also provide the opportunity to address the issues of greatest need and value, in so doing establishing a platform to achieve competitive advantage over time.