May 4, 2020

ESG endures the crisis: Environmental and social factor adoption set to accelerate

Environmental, Social and Governance (ESG) investing has been the leading topic of interest amongst asset owners globally….

Despite playing in an industry where scale matters, too many asset managers play too close to home

One of the enduring mysteries of the global asset management industry is how non-global it actually is. While many asset managers serve clients from across the world, very few are truly global.

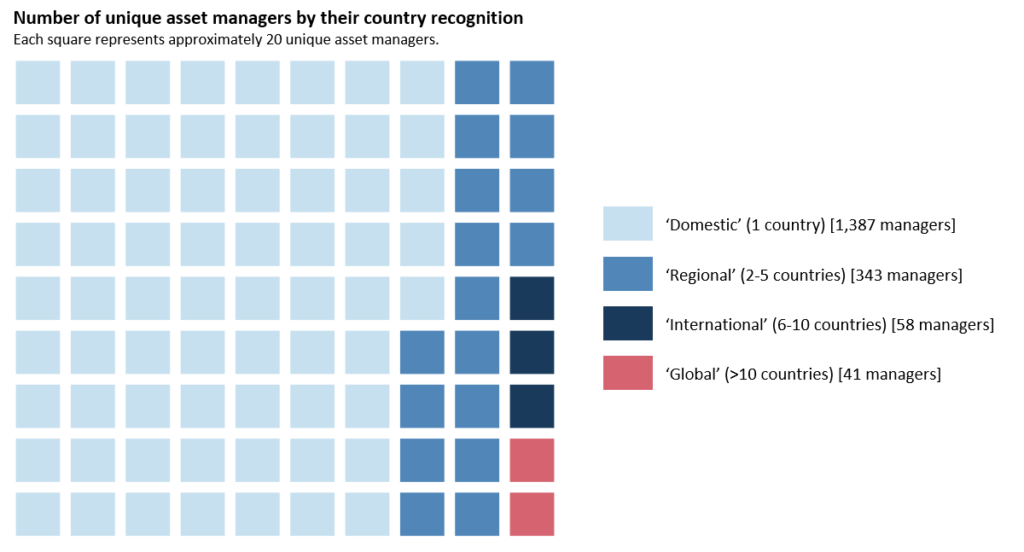

Chart 1 – How global are you really?1

The majority of the world’s asset managers are focused on a single country. Further, of the top 20 global asset management brands, over half are US companies. Managers from all other regions are punching below their weight.

What happened to the benefits of scale? (and don’t get caught in the middle)

Asset management should be one of the most global financial services – investment capabilities are transportable across markets, there is global demand for diversifying investment exposures (across different asset classes, investment styles and currencies) and barriers to entry are low.

For managers based outside the US, failing to play away from home significantly limits scope for growth. Whilst the US represents over 40% of global AUM, no other market represents more than 10%.

Importantly, managers playing at home are running up against constraints in their local market, including capacity problems both in terms of distorting pricing through trading in such large volumes, and being screened out of portfolios by institutional gatekeepers.

These constraints are not material for investment-led boutiques that are comfortable with limiting available capacity to existing investors to maintain investment performance. However, these constraints can work against mid-sized investment managers that have already accepted the complexity which comes from managing multiple investment strategies, but do not enjoy the scale benefits available to the largest, truly global asset managers.

Asset managers ’in the middle’ face difficult strategic choices. Staying in the middle is unlikely to be truly successful long-term as smaller rivals are nimbler and more focused and larger rivals are more efficient. They could follow a boutique strategy of breaking up into autonomous investment teams competing on investment excellence and client focus or they could scale up to compete with larger rivals by adding investment capability and building distribution presence more globally. Any approach requires a strong brand, but the characteristics for success will differ.

The exceptional Americans

Whilst major managers in many jurisdictions are butting up against scale problems in their local markets, US managers have long used the scale advantages achievable in their home market to fund international expansion and are well represented amongst global leaders.

Analysis from our Global Asset Management studies over several years shows one of the reasons for the success of major US players like BlackRock, Fidelity, and J.P. Morgan is their willingness and ability to exploit the power of scale and, crucially, the power of their brands.

Brand is entwined with global success (and failure)

Our analysis demonstrates that brand and assets under management (AUM) importance have a tight relationship. In 70% of situations, a positive movement in brand ranking was accompanied by a positive movement in ranking for AUM. Similarly, falls in brand rank were most often accompanied by falls in AUM rank over the same period. This relationship between brand and AUM performance held true across different types and sizes of asset managers and across different markets.

“There is a 70% co-relation between brand ranking and AUM ranking”

In simple terms, the drivers of success for both institutional and retail asset managers are the same as the drivers of brand. But in the 21st century economy, ‘brand’ is more wide-reaching than it used to be. Far more than a logo or an ad campaign, our study suggests that brand [impression] is driven by multiple factors.

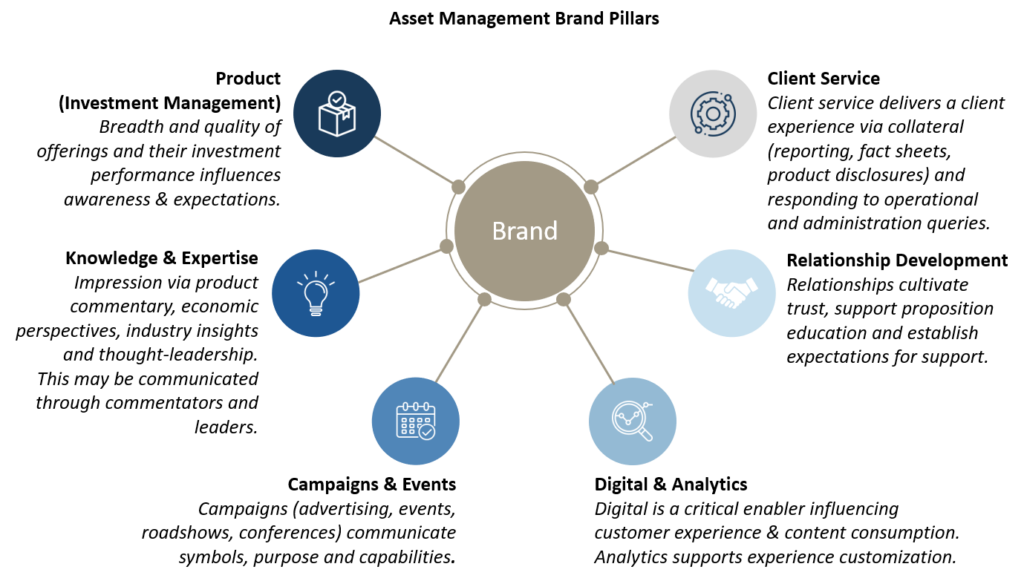

Six brand pillars

In asset management, we have developed 6 distinct pillars which describe the underlying drivers of brand – and how that experience affects the customer.

Chart 2: NMG Consulting’s six brand pillars

Brand pillar influence in global asset management

To maximise the power of your brand – and support sustainable AUM growth – companies need to apply these drivers efficiently and ensure investment management, sales, service and marketing are aligned and working together. This requires brand to be firmly on the agenda of the CEO, because only they can provide the leadership, resources, organisational structure and alignment to optimise the collaboration which is required.

1Source: NMG Global Asset Management Study 2020. Country recognition is the number of countries an asset manager achieves at least one top-of-mind mention for overall importance, an asset class or a competency (e.g. ESG, thought leadership). 1,829 unique asset managers nominated across the 14 countries included in the study.