Specialist alternatives managers have taken the lion’s share of alternatives inflows and enjoyed the associated high margins, but the shift to focus on retail demand for alternatives plays right into the hands of traditional asset managers.

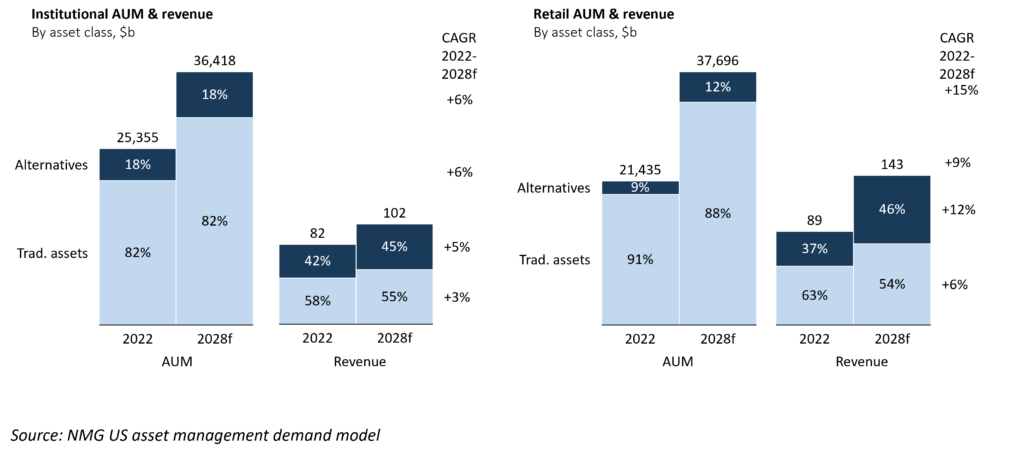

Exhibit 1: US institutional and retail AUM and revenues by product type (alternatives vs traditional assets)

The retail alternatives market is exhibiting much stronger growth than the institutional market

Alternative investments are a relatively mature category for institutional investors, with an asset allocation of just under 20% but representing over 40% of contestable revenues. Those high margins have been relatively stable when compared to public market strategies, largely because the same pressure from low-cost passive or smart beta strategies as a potential substitute doesn’t exist.

NMG sees retail alternatives AUM and revenue growing at more than double the pace of institutional channels over the period to 2028. Historically, retail investors and their advisors had much lower exposure to alternatives than their institutional counterparts due to a lack of product availability, but also significant demand-side barriers (eg difficulty in transacting, lack of liquidity, and fiduciary concerns with recommending complex products for clients). There has been strong progress on both fronts; retail demand for alternatives is increasing as dedicated platforms make transacting simpler and reduce minimum investment thresholds (eg CAIS, iCapital). Furthermore, advisers are increasingly comfortable with investment vehicles facilitating some, but not daily, liquidity (eg interval funds, non-traded REITs, BDCs, evergreen funds, etc).

To date, alternatives specialists have dominated the institutional alternatives opportunity – the sales process is meaningfully different from that of public markets strategies, as is the operating model, compensation schemes and other aspects and specialists have been better set up for success. However, traditional asset managers looking to expand their presence in the lucrative alternatives market have been scooping up acquisition targets at pace (alternatives managers made up more than one-third of asset management M&A transactions, by value last year), in no small part with a view to the retail opportunity. It is NMG’s view that success in retail may come more easily for the traditional asset managers than it does for the specialists simply because they have a competitive advantage in distribution that will be difficult to erode.

That competitive advantage centers around brand and distribution breadth, both of which are critically more important to success in retail than in institutional. Note, we are not downplaying the importance of brand and distribution to institutional success, rather articulating a point of relative importance which is confirmed in our comprehensive Global Asset Management Study.

Consequently, with their expansive distribution forces, existing access to retail gatekeepers and their coveted ‘approved lists’, ability to educate advisors en masse on the portfolio diversification benefits of alternatives, and their strong retail brand franchises, traditional asset managers are positioned to win the alternatives opportunity. Alternatives specialists will take years to build out a similarly competitive proposition.

Of course, product (and performance) trumps everything in the end. The pressure will be on traditional managers to ensure quality investment teams deliver long-term performance outcomes in line with their promise whilst managing the many conflicts introduced into an organization that has both listed and unlisted investment capabilities under the one roof. The managers who execute this effectively have the potential to lead the pack in the race to “retailize” alternatives.