March 3, 2022

Winning the Millennial wealth segment

Hitherto largely ignored by financial professionals, Millennials are growing up and (if nothing changes) will present a...

Hitherto largely ignored by financial professionals, Millennials are growing up and (if nothing changes) will present a $3tn missed opportunity for asset managers.

Where the retail industry is being transformed from ‘brick and mortar’ to ‘online’, retail asset managers have been relatively slow to embrace such a change, even taking into account some recent COVID-induced activity. And with good reason; the Millennials who drove the early shift to online shopping have not presented the same rich vein of opportunity to asset managers as they have to online fashion retailers. However, that is set to evolve, and engagement strategies need to respond.

The status quo approach has been defensible for two reasons:

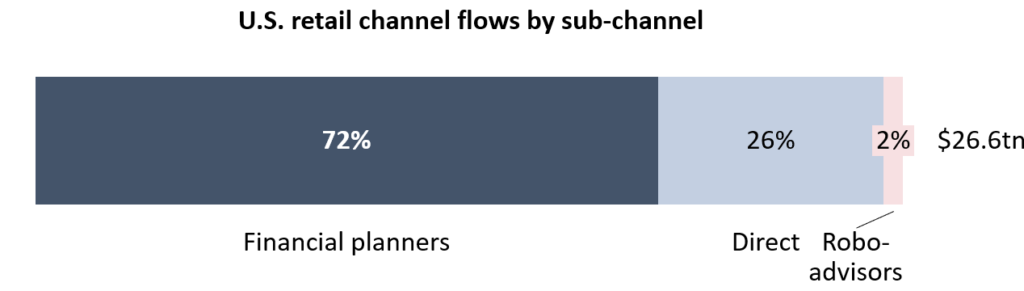

Firstly, asset management is heavily intermediated, primarily relying on financial planners for retail distribution, where they represent >70% of flows (see our first chart, below). So, the strategy of maintaining focus on financial professionals (as compared to targeting consumers directly, online) has been the correct path. It also must be said, flows that have been generated outside of the advice channel (either directly, or through robo-advice) have generally been in ultra low-margin passive strategies.

Exhibit 1:

USD trillions, U.S. retail channel netflows, 2021

Source: NMG Consulting

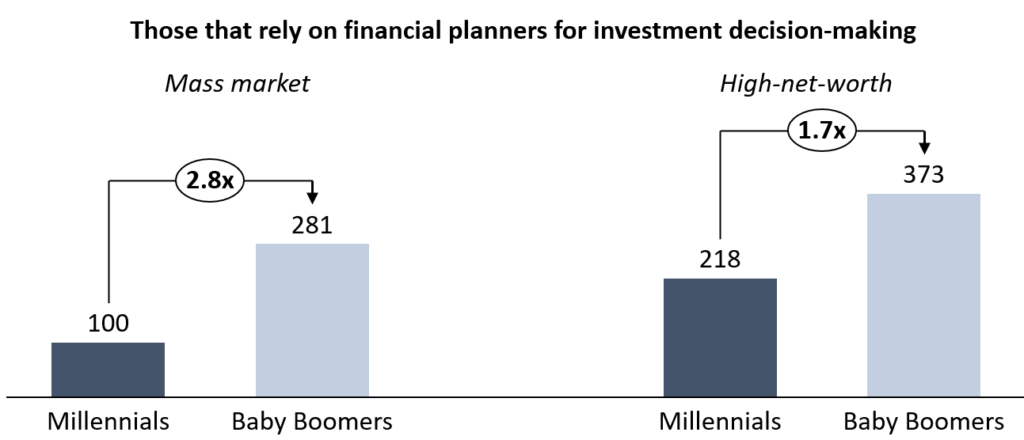

Secondly, Baby Boomers have, rightly, been the ultimate end client. Financial planners are obviously heavily reliant on clients wealthy enough to justify the cost of professional financial advice. When making investment decisions, mass market Baby Boomers are almost three times as likely to rely on financial professionals than Millennials (see our second chart, below); this gap persists (even if at a lower level) when comparing high-net-worth individuals cross the two generations.

Exhibit 2:

% of U.S. investors that rely on financial planner input when making investment decisions, rebased to 100

Source: NMG Consulting

So far so good – financial planners are servicing the most relevant generations for their businesses. But the future will look different, and the ability of financial planners to generate future fund flows to managers is increasingly under threat. While only 5% of Millennials fall into the relatively under-serviced ‘High-Net-Worth Millennials’ segment today, this clearly has the potential to become a huge missed opportunity as that mix shifts.

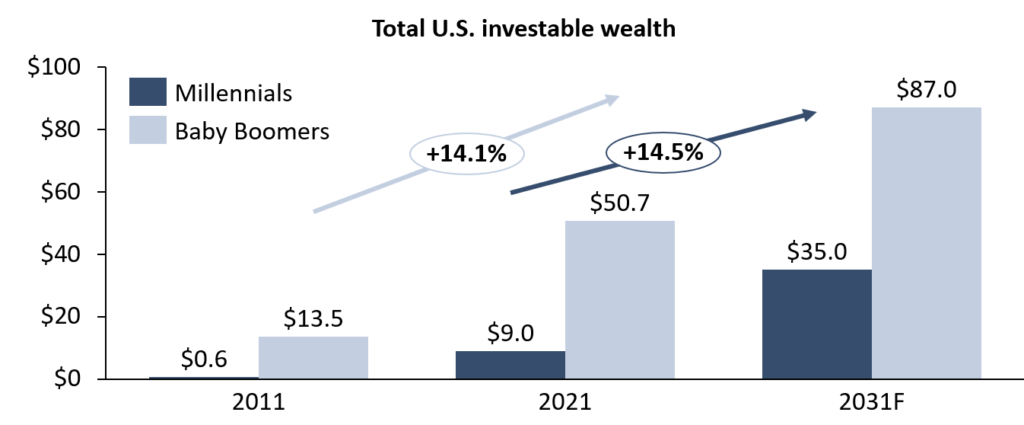

Millennials are expected to amass $35 trillion in investable wealth by 2031, up from $9 trillion today (see our third and final chart, below) through the net sum of contributions, investment returns and the transfer of intergenerational wealth. Because Millennials are evidently less likely to use advice, this growth puts into question whether those financial planners will be able to generate the same level of flows for asset managers that they have in the past.

Exhibit 3:

USD trillions, U.S. investable wealth across generations

Source: NMG Consulting

Of course, the great hope is that once Millennials accumulate sufficient investable wealth, they will transition from digital platforms to taking holistic advice from more traditional financial professionals.

However, unlike their forebears and despite not having seen a financial planner, Millennials have in fact had meaningful engagement with the asset management industry well before reaching minimum wealth bands to qualify for traditional financial advice. Brokerage platforms and robo-advisors are taking advantage of digital investment and engagement models to establish trusted relationships with Millennials, despite their lower balances. We think unshackling them from these relationships is going to be quite a complicated exercise, but a failure to do so will irrevocably change the opportunity set for retail asset managers.

Financial planners and the asset managers that rely on them risk losing out on capturing this burgeoning segment. Digital platforms have the head start and often deliver low margin, internally manufactured and/or passive products to consumers that don’t present a substantial revenue opportunity for asset managers. However, there is a silver lining: Millennials are more likely to switch who manages their money as loyalty to a specific player is weaker than that displayed by Baby Boomers. The key for asset managers is to be the provider with the right distribution channel or engine to ensure they are on the receiving end of those asset switches.

Further complication of distribution channel strategy appears inevitable, but it is clear that the myopic focus on intermediaries is unlikely to yield the same success in the future as it has done to date. We see two potential strategies.