July 17, 2024

Understanding DC Advisors’ preferences

Recordkeepers face a complex challenge in addressing both the explicit and implicit preferences of DC Advisors. Advisors...

Specialist managers excel in private markets, while diversified firms leverage strong brands to dominate retail alternatives. With rising competition, the landscape is shifting as firms expand product availability and outreach.

Specialist alternatives managers have long dominated their diversified, public-markets peers in the contest to raise funds from institutional investors for private market asset classes.

All the while, in retail, diversified managers have converted their strong brands and distribution breadth into ‘mindshare’ advantage in alternatives. As a result, US retail advisors and gatekeepers indicate that six of the Top 10 retail alternatives firms are not pure-play alternatives managers.

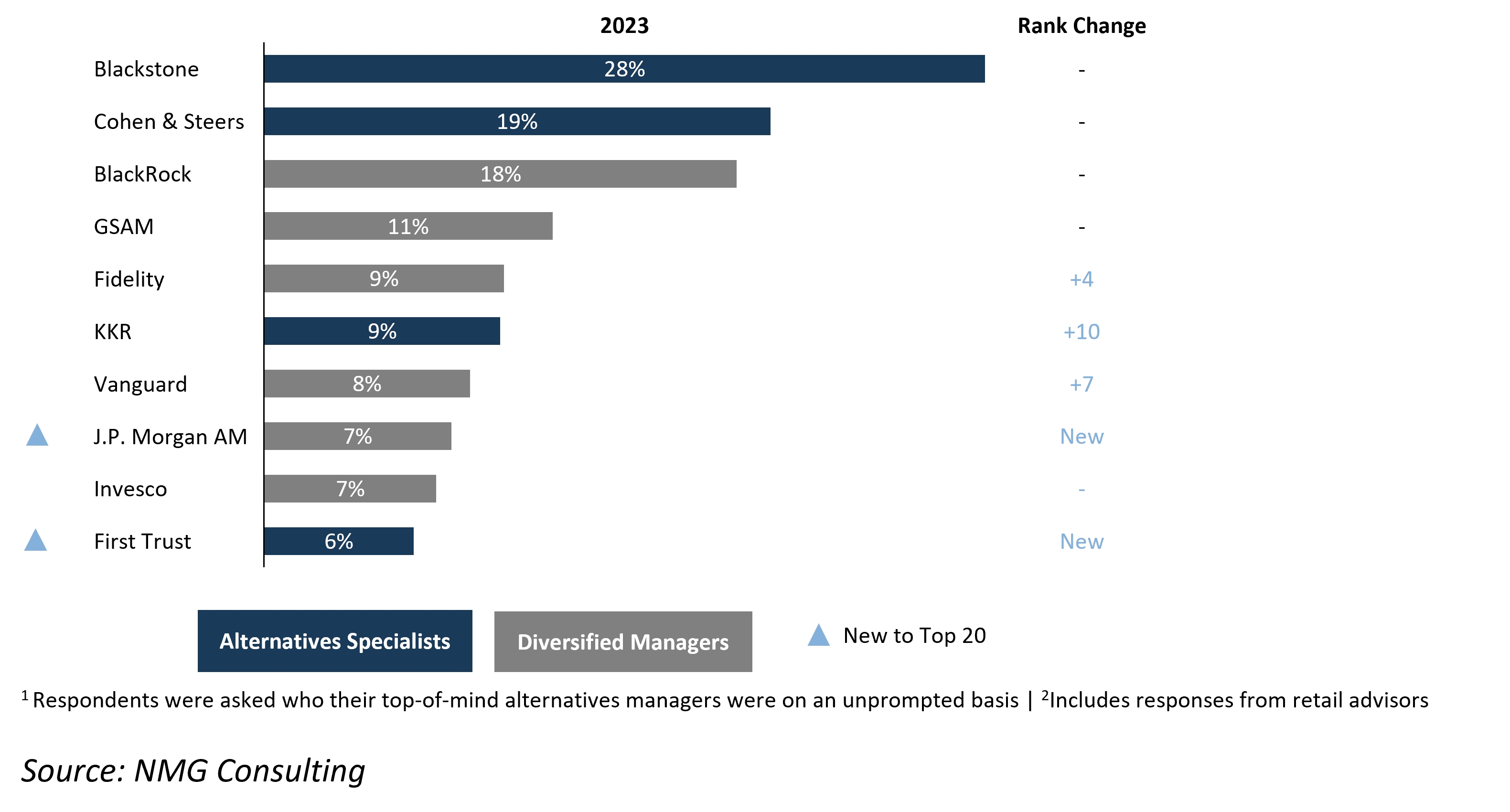

While Blackstone and Cohen & Steers have the top two positions, diversified asset managers comprise six of the remaining Top 10, with public-markets giants BlackRock, GSAM, and Fidelity following, and well-known names Vanguard, JPM AM and Invesco rounding out positions seven to nine.

Exhibit 1: Top 10 leading alternatives managers

% of US retail advisor/gatekeeper respondents, 2018 vs 2023

Interestingly, some of the biggest gains over the past five years have been made by Fidelity and Vanguard, reflecting their expansive investments in brand, marketing and distribution. Presumably, these will prove difficult for specialist firms to match.

But the tide is turning.

Of course, these rankings do not tell the whole story. Specialist alternatives firms are increasingly putting pressure on their diversified peers; their awareness is growing around 50% faster over five years, suggesting that the increased availability of product (particularly in the wirehouses, but increasingly in RIA firms as well) and the accompanying hike in sales force hiring and outreach is having a key impact.