March 13, 2023

Advice: Back to a better future

The recommendations of the Quality of Advice Review would force large institutions back to the table on...

On an outlook of healthy contestable flows, plenty of opportunity exists for well-positioned retail equity managers in Australia, despite industry headwinds and global sentiment.

Compulsory superannuation and a strong economic backdrop have long made Australia one of the world’s most attractive markets for asset managers.

In more recent times, active equity managers have faced relative headwinds. Consolidation within the Superannuation industry and the nature of the evolution within the retail advice market have intensified competition for managers. Combined with the well-publicised shift to passive, it is understandable that many managers hold some concerns for their prospects medium term.

Asset managers have faced significant challenges with respect to institutional demand, however, looking beyond immediate competitive pressures, retail active equity managers should continue to view the segment as attractive.

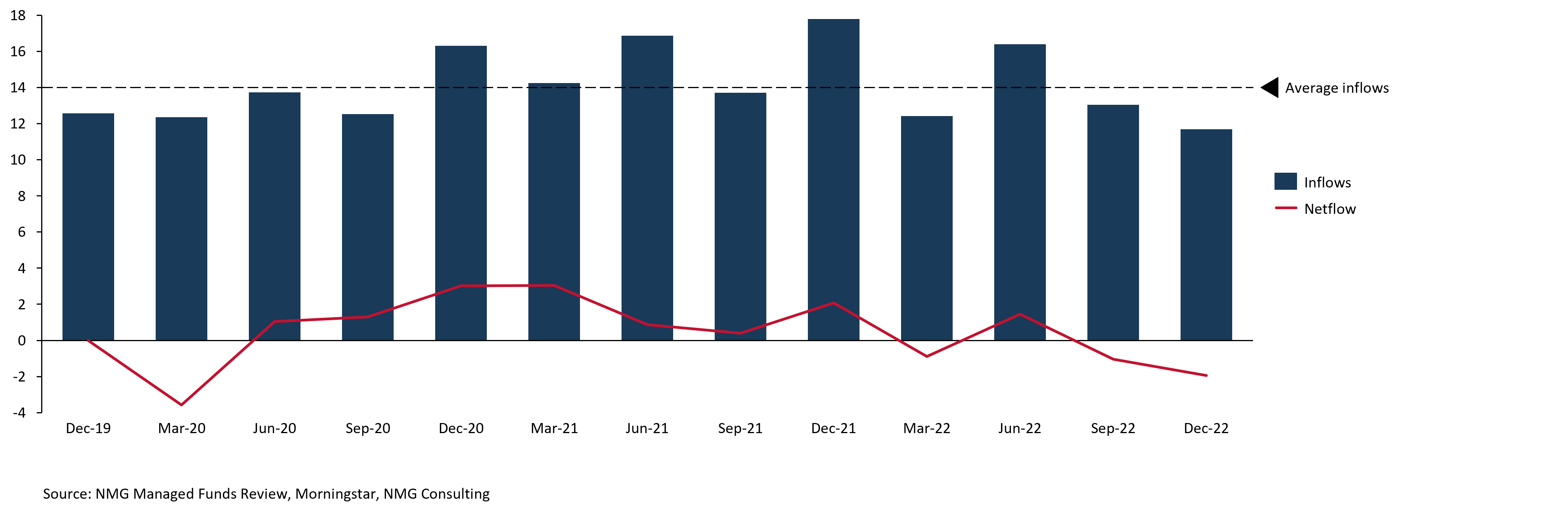

Despite growing flows to passive within the retail advised channel, contestable opportunities for active retail managers have hardly diminished, with well over A$50bn in annual inflows over the past 3 years.

“Annual contestable flows to active equity managers have exceeded A$50bn for the past 3 years”

Exhibit 1: Plenty to play for in retail active equities

Gross inflows, active equities within retail advised channel ($b)

Attractive opportunities thus remain for active managers able to combine compelling propositions with strong distribution capabilities.

Additionally, as this is a mature market, investment returns will drive the lion’s share of revenue growth for active managers. On conservative medium-term market return scenarios, forecasts anticipate mid-single-digit growth in revenue pools for active retail managers over the next five years.

And yet, despite sizeable opportunities for active managers, the success of any individual firm is far from assured.

The retail advice market is finally emerging from the structural chaos that has defined it for the better part of a decade.

The average adviser is no longer a product salesman, instead having repositioned in profile towards an ‘investment strategy professional’, increasingly likely to enlist specialist intermediaries (researchers, investment committees etc) to implement investment philosophies.

This repositioning increases the level of sophistication within the average advised portfolio, as well as reshaping retail buying behaviour more towards that of the institutional market.

Like institutional CIO’s, retail portfolios are scrutinising where and how to use risk and fee budgets, with the ‘passive-core / high-alpha satellite’ approach continuing to grow in popularity.

There is also a (re)emergence of quasi-institutional advice firms. This new breed of firm is typically (U)HNW focused, making use of professional investment committees, and operating with fewer liquidity constraints than traditional advice firms. This provides an additional set of product opportunities for managers in the retail market and adds to the growing demand for niche high-alpha (and high-fee) products.

There is a need for a more honest assessment of growth prospects for legacy product back-books. The pain caused by the rotation to passive is yet to fully run its course and sub-par back-book exposures will wear the brunt of this. There is nothing wrong with running-off back-books provided distribution, product, pricing, and client service strategies are appropriately aligned.

Secondly now is the time to re-set product strategies. The key to success over the next decade will be an ability to anticipate and meet the demands of an increasingly sophisticated buyer. For some managers this will mean repositioning existing strategies to capture demand for sub-asset class exposure. For others, this may require additional capabilities to be built, or acquired.

“Anticipating (and meeting) the demands of increasingly sophisticated buyers will be a key to success over the next decade”

And finally, distribution and client segmentation models need to be assessed in line with changes in the advice market. The focus should be on approaches to portfolio construction (buying behaviour) and the evolving role of intermediaries and will be driven by the product capabilities and scale of each manager.

The experiences of the active multi-asset sector over the past decade should serve as a warning here. Changes in adviser behaviour may be slow to materialise, but they can be devastating to the unprepared. This is an industry where it really does pay to be on the front foot.