May 4, 2020

ESG endures the crisis: Environmental and social factor adoption set to accelerate

Environmental, Social and Governance (ESG) investing has been the leading topic of interest amongst asset owners globally….

Long an institutional focus, ESG is rapidly gaining ground amongst retail advisers helped by regulatory change but also rising consumer demand and product availability. Managers are responding, but as ever it’s a nuanced market.

Three years ago, it was difficult to find any adviser who proactively asked clients about ESG. Up until the last year or so, our conversations with advisers about their ESG processes made it clear advisers weren’t comfortable with ESG nor proactively recommending ESG products.

Anecdotally, conversations with advisers showed how clients would be offered an ESG product on request. And often, after the adviser spent time and effort researching ESG product options to recommend, the client would end up going with the original recommended portfolio, because ESG “wasn’t that important”.

Today, things are different. The interpretation of FASEA Standard 6 has already seen 40% of advisers now proactively talk to clients about ESG issues (with many still intending to incorporate ESG into client conversations).

As a result, it is clear that ESG is here to stay.

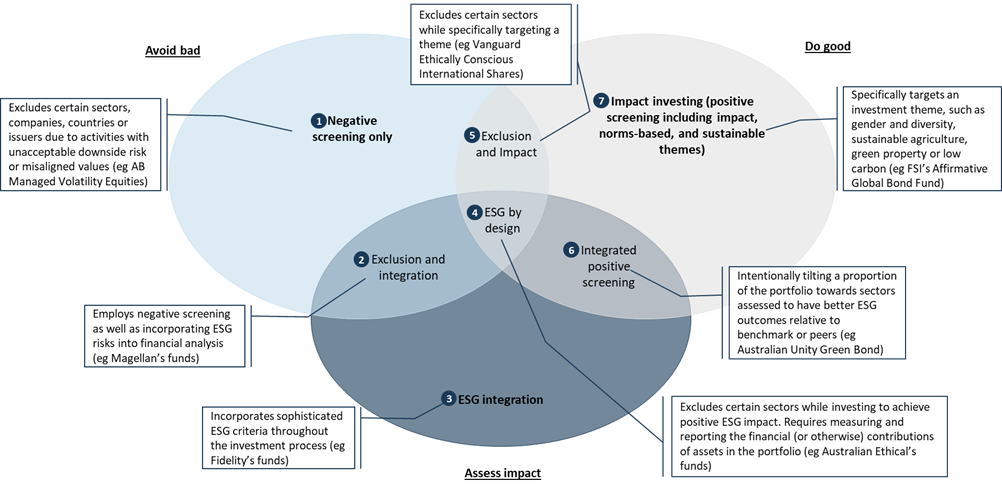

However, not all ESG is the same. As part of our recent quarterly NMG Managed Funds Review, we investigated the use of ESG across asset management products. We found there are 3 broad approaches1 to using ESG:

1Note, there is also shareholder activism and company engagement – which are additional activities managers may undertake to improve ESG outcomes as part of being an active owner of companies.

However, those 3 approaches are not mutually exclusive – which gives rise to seven different categories of ESG product.

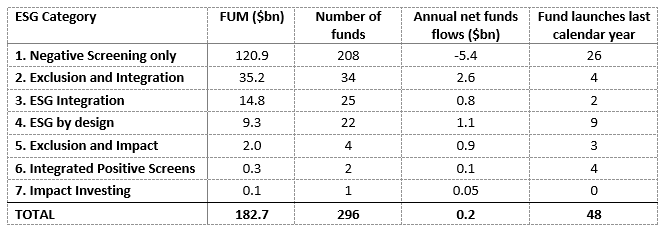

Not surprisingly, there are some significant variations in how managers participate, FUM and flow levels, and new product launch activity.

So, whilst negative screening was initially favoured by managers as a way to commence their ESG journey, it is falling out of favour as investors seek more sophisticated ESG solutions.

The data also shows there is:

As with performance, not everyone can be first quartile in ESG – but given the breadth of participation options available, it’s highly likely there’s one right for you! Either way it is becoming difficult to defend the lack of a clearly articulated ESG strategy – it’s an area that is quickly becoming a core focus for CEOs, product, investors, researchers, marketing and distribution teams in addition to investment folks.