April 7, 2020

More than staying the course: COVID-19 messaging to US investors and advisors

COVID-19 and its drastic impact on the economy has resulted in unprecedented physical and financial insecurity for…

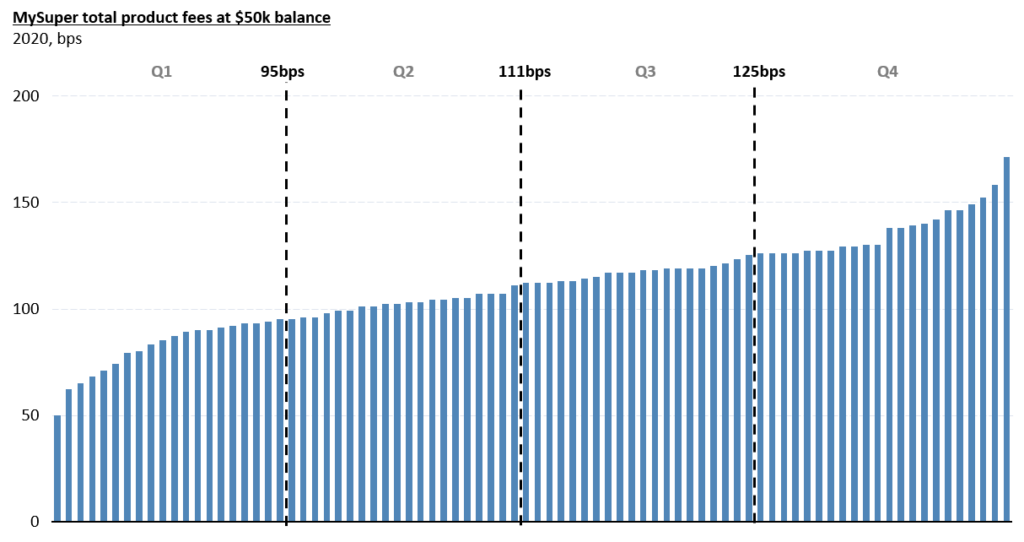

There is enormous disparity in fees and performance of MySuper funds (and there isn’t necessarily a positive correlation between the two). To complicate matters, the recent Budget announcements – particularly the performance testing component of the super reforms – will force trustees to make an important choice as to their ambition: low cost or high performance.

Today’s first chart shows the significant disparity of fees paid by members in MySuper funds. For a $50k member, total fees range from 50bps to more than 150bps at the extremes.

We aren’t alone in expecting these fees to fall across the board. And for a while this has had us thinking, how low can they go? And what’s a future competitive price point?

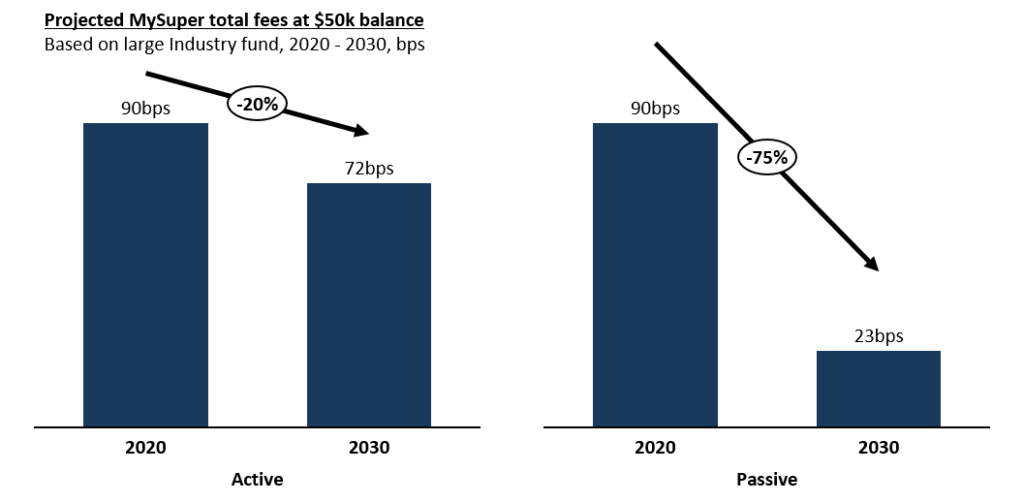

Biggest funds to reduce fees by 20%

The industry’s biggest funds, (the ‘titans’ with more than $80bn under management), are mostly growing much faster than their smaller rivals, and are likely to re-invest some or all of their scale economies into price. Our modelling indicates the biggest not-for-profit funds will have the flexibility to reduce fees by around 20% over the remainder of this decade setting a notable benchmark for their rivals and other large funds.

And it’s important they do reduce fees. Price is an important lever, but one that has rarely been pulled (notable exceptions being ING, which it turns out wasn’t free after all, and HostPlus). In both those examples members responded very positively, suddenly becoming engaged with their super and switching to the low-cost funds. Funds have long been frustrated by low levels of engagement amongst the member base, but it does seem as though ‘low price’ is an effective way to dislodge an otherwise dormant set of your competitors’ members.

Some funds will cut fees by 75%

Is a 20% fee cut from our largest super funds enough? Perhaps, but we think others will go further. The annual performance testing announced in the most recent Federal budget is likely to cause some (but certainly not all) funds to adopt a passive, or mostly passive, approach to investing. The performance testing compares net of fee returns against an implied benchmark return series, and proposes to penalise funds that consistently fall behind over longer time periods (more on that in our next Trialogue).

Given the (mostly) active investment budget makes up around 2/3 of an average fund’s total expenses, passing through cuts to that investment budget in a shift to passive will have a huge impact on fees, as our second chart shows, with possible total fee reductions for a $50k member in the order of 75% by 2030.

Which is to say, we expect to see a bifurcation of approaches emerging:

Whilst many funds have hitherto positioned themselves as being both low cost and high performance, we doubt that will continue to be possible as some funds transition to being truly low cost. Trustees need to make an active choice to be either a low cost, mostly passive, fund at around 30bps – or to take a big swing and back the investment team to produce consistent alpha, probably at a total fee of 70-80bps. It’s a big decision, and with APRA looking over their shoulder, an even bigger one.

Moving to such a binary choice has far reaching implications beyond just naming and shaming underperforming funds. There are big decisions for the regulator as well as trustees involved.

1Per the current APRA MySuper Heatmap