August 12, 2019

The forgotten advice distribution opportunity

There is no doubt that there are significant shifts occurring in the advice industry: FASEA will see…

There have been many ‘Chicken Little-esque’ predictions that the sky is falling in, that FASEA and the fall-out from the Royal Commission will decimate the number of advisers in the industry, creating a large advice gap and preventing many investors who could benefit from advice from being served. While there is no doubt that the advice industry is undergoing rapid change, we think the implications aren’t as dire as you might otherwise be led to believe.

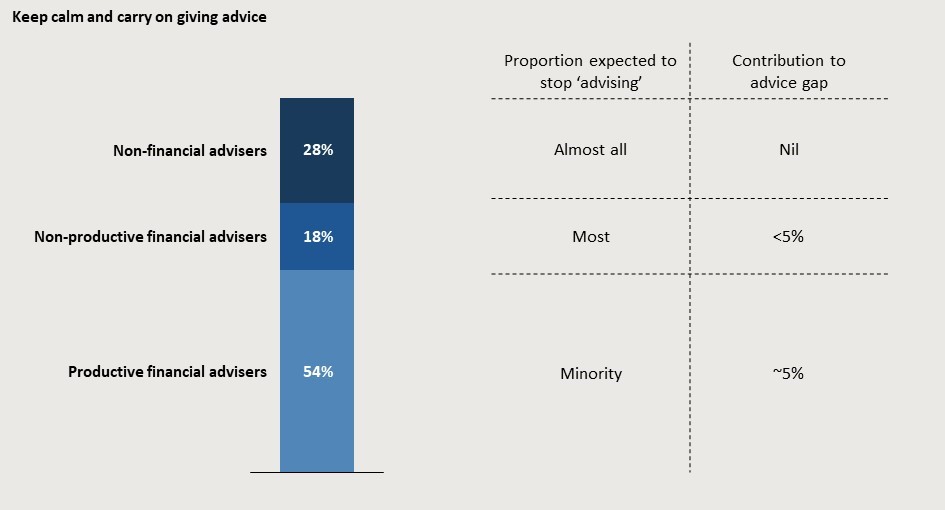

To understand why, it is useful to recognise that not everyone on the ASIC financial adviser register is equal – in fact, there are three significantly different types of individuals listed on the register, and the implications of the groups exiting the advice industry (as a result of FASEA or otherwise) are profoundly different.

In our recent NMG Australian Adviser Insights Programme, we identified that only 8% of advisers in the ‘productive non-salaried’ segment are planning to stop providing advice when the FASEA requirements come in. And of those, many are intending to stay in the business in a management role and use qualified advisers to run the client facing advice activities.

If a non-productive (or a non-financial adviser) leaves the industry, this doesn’t create an advice gap. We see it a little bit like a tree falling in the woods – if nobody is there to see it. Nor does it create an immediate sales problem for asset managers, platforms or insurers either, because the productive advisers are the ones who are responsible for almost all of the new business in the industry.

Of course, over time, some of those clients of non-productive advisers (who leave the industry) will be served by the remaining advisers, and moved to contemporary products (eventually putting them in a better position).

This is similar to what we saw in the UK following the implementation of the Retail Distribution Review (RDR) (where poor sales practices stopped, but the provision of quality advice continued unabated).

Demand is rising

However, against this background of a slight reduction in supply of advice, demand is rising thanks to a growing number of affluent and high net worth households.

Outside of simply increasing price, there are two levers available to meet this growth in demand:

So, while the sky is not falling in, and the advice market will not significantly reduce output in the near future, there are impacts on both adviser business models (where adviser practices and licence providers need to rethink their target markets, advice support framework and recruitment) and also on product providers (asset managers, platforms and insurers) who need to review their product and distribution strategies to ensure they are meeting the needs of this brave new world of financial advice.