August 11, 2020

The Financial Adviser Opportunities for DFMs

With growing competition between model portfolio providers, what can discretionary fund managers do to position themselves more…

COVID-19 has highlighted the risk of involuntary unemployment and is driving consumer interest to retail Income Protection (IP); but does retail IP actually meet their needs?

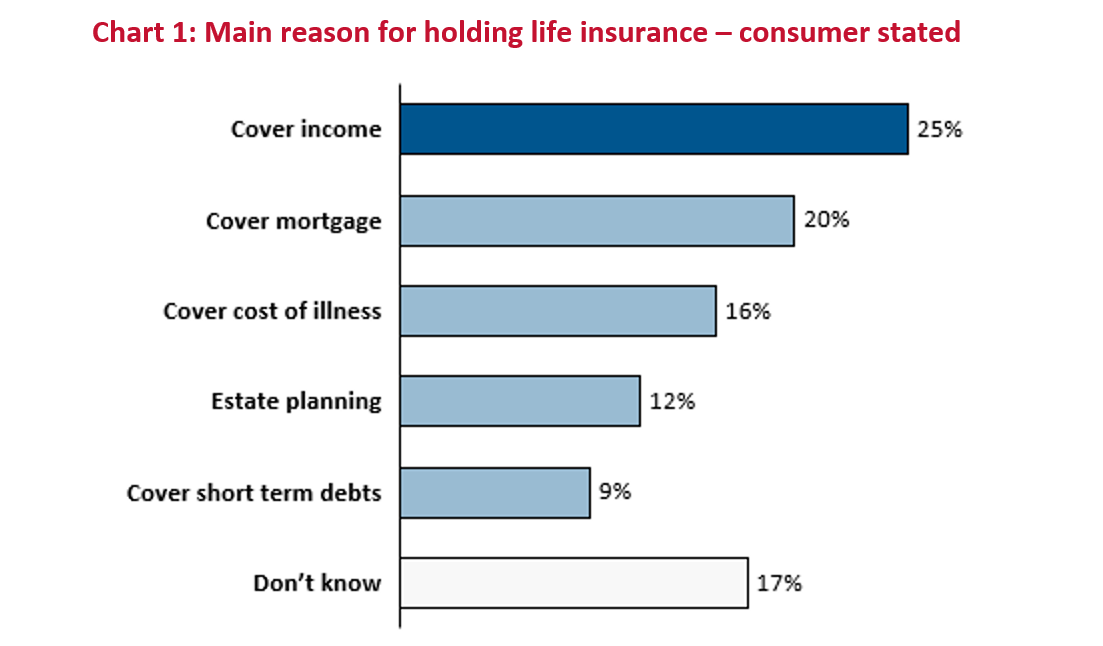

NMG’s latest research into UK consumer attitudes towards life insurance shows that consumers believe covering income is the main reason for holding life insurance, above paying off debts mortgage or to cover the flow on costs from any potential critical illness.

Source: NMG UK Consumer Life Risk Study 2020

Intuitively, Income Protection is the best positioned life insurance product to deliver this coverage.

Advisers acknowledge the value of IP. Particularly for younger aged (<40 year old) consumers with dependents, mortgages and limited savings, who are more likely and most vulnerable to suffer a morbidity (mental illness in particular) rather than mortality event.

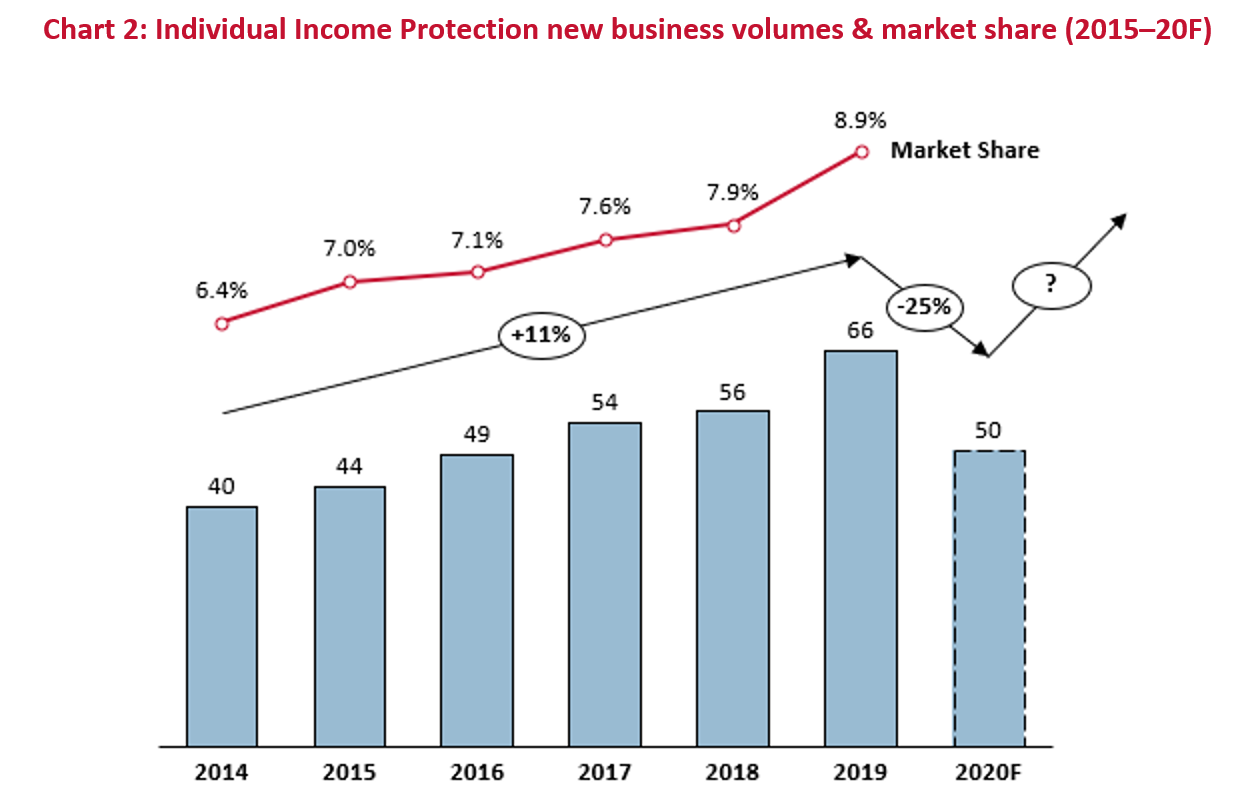

Combined with the aforementioned consumer perceptions on life insurance, IP has been one the fastest growing individual life protection products over the 5 years to 2019. IP has grown at 11% CAGR and increased its share of the individual life protection market from 6% to 9%. However, IP holds ~40% market share of individual new business volumes in Australia, suggesting significant further potential for IP in the UK market.

Source: NMG UK Stock & Flow Model (as at September 2020)

NMG forecasts IP sales to be down ~25% in 2020, though this is due to insurers/re-insurers restricting new business given underwriting challenges and to limit risk, rather than a lack of demand. NMG expect these restrictions to be lifted within the next 12 months (if not earlier), and volumes to return to pre-COVID levels soon afterwards. Will growth then revert to the historical trend of ~10% per annum, or has COVID-19 provided a catalyst for accelerated adoption?

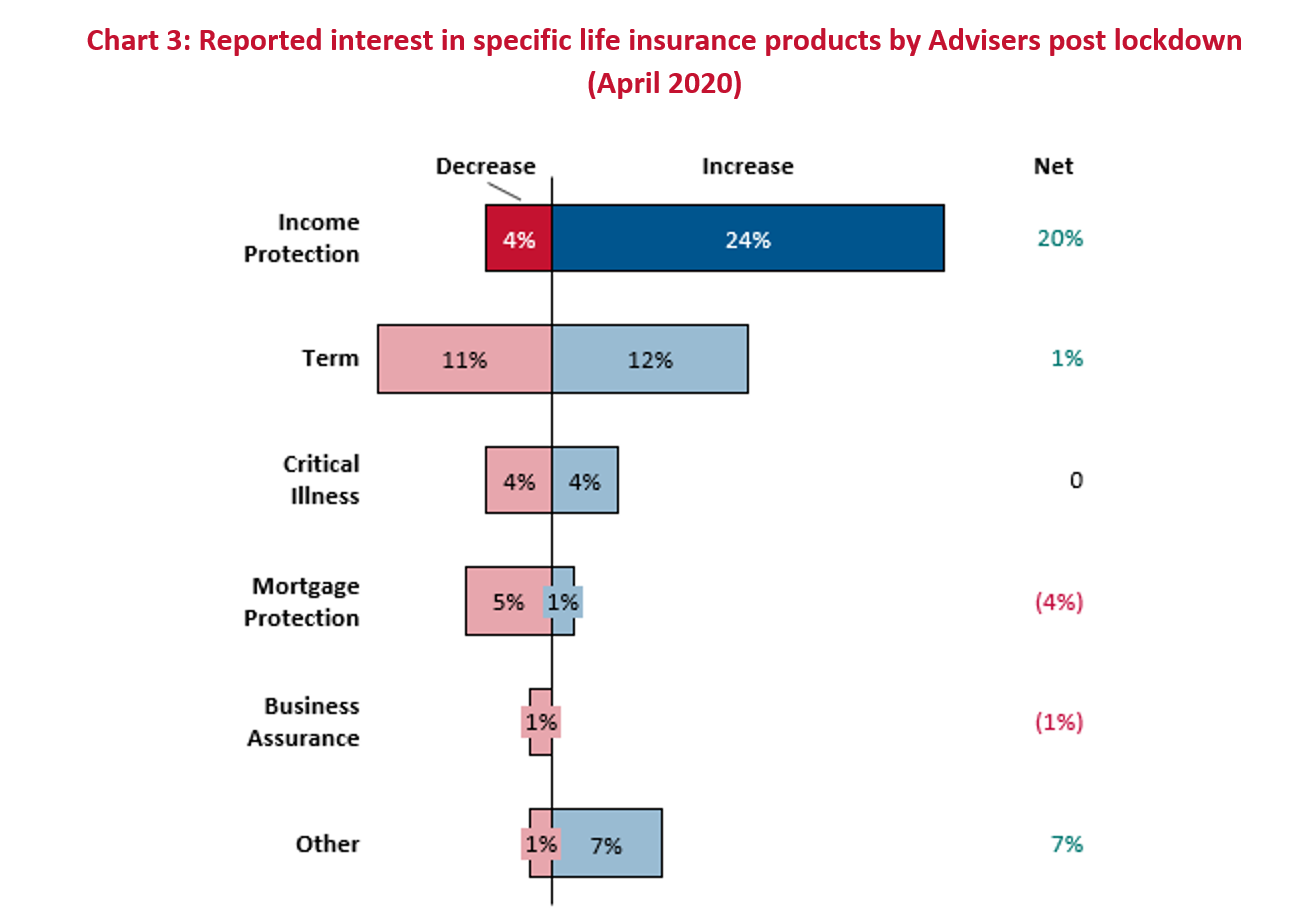

While COVID negatively impacted short-term supply, it has also drawn consumers attention to the risk of losing their jobs and income. Consequently, advisers saw a material spike in interest for income protection post-lockdown as shown below.

Source: NMG UK Adviser Market Volatility Pulse: COVID-19 Impact on UK Life Insurance (April 2020)

NMG expect this spike in awareness and appreciation to endure as the economic impact of COVID-19 becomes clearer and the furlough scheme is wound up. 300k redundancies were planned across June and July 2020, an almost sevenfold increase to the same period in 2019.

However, while COVID is a potential catalyst, there are a number of issues that insurers need to address before broader market adoption can arise.

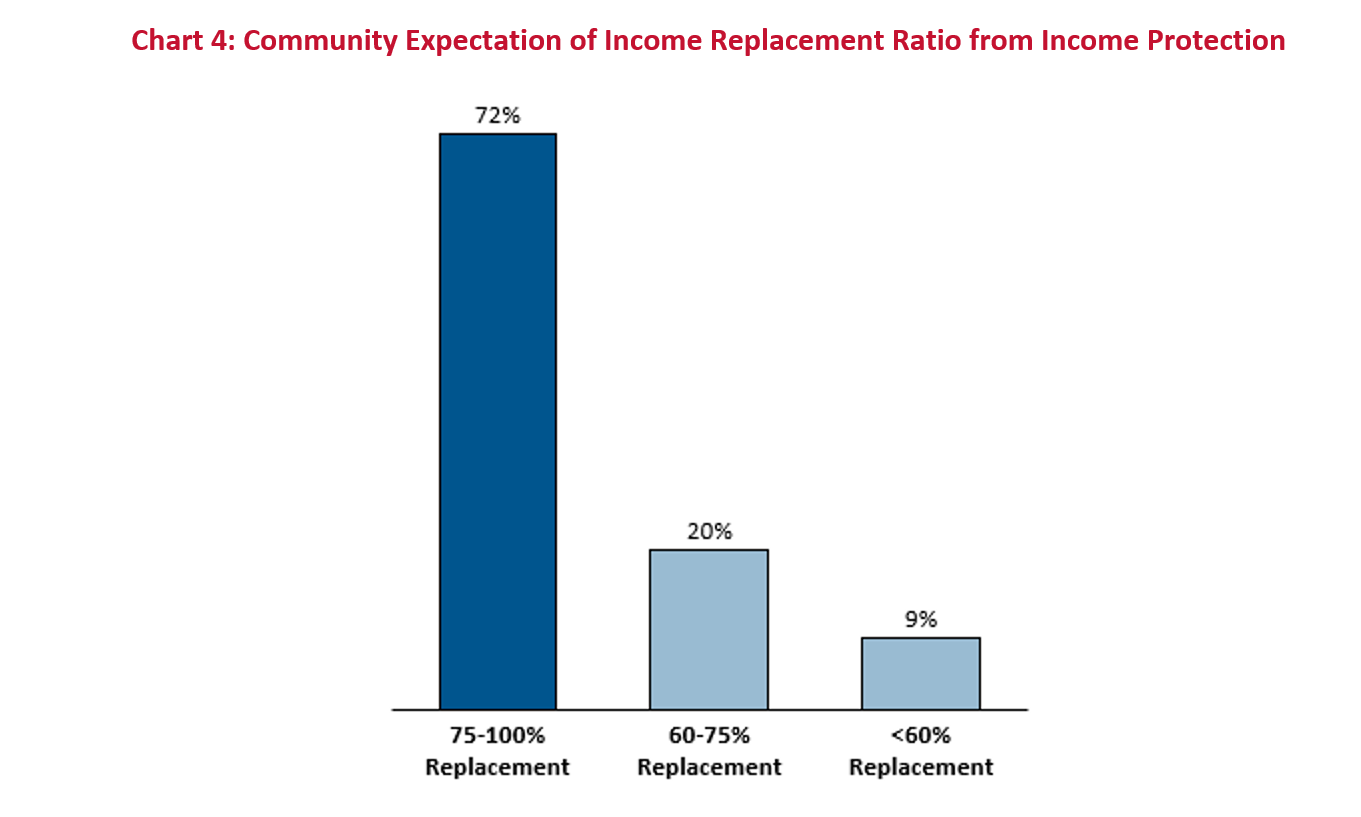

A. Cover

B. Benefit Limits

C. Complexity

Source: NMG Community Expectations Study 2019

There are a number of challenges with bridging these gaps, including but not limited to:

NMG is working with clients to navigate these issues and more, to help increase the number of consumers protected from loss of income.