October 28, 2021

Readying to Rebound

A focus on growth is the logical post-pandemic response for South African insurers, strategies for which will...

This article is founded on evidence and observations in the global asset management industry; however, the learnings may equally apply to other industries where business-to-business relationships have traditionally been supported through face-to-face engagement.

The journey of converting a target customer to a client generally relies on the development of trust, specifically trust in the supplier to deliver products and services of an expected value. In the competitive asset management industry, this trust building has traditionally been assisted by face-to-face (‘F2F’) interactions that provide a personable connection to the asset manager, important in explaining investment philosophy and capabilities, coordinating services, and providing accountability. However, the pandemic has changed norms for F2F interaction and thus impacted the process of trust building.

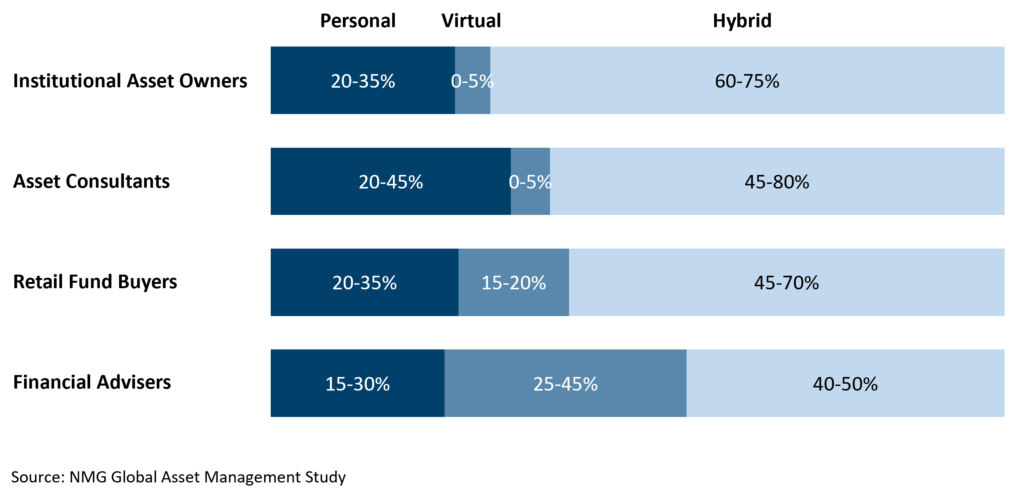

Through forward looking questioning of over 3,000 investment professionals (institutional investors, asset consultants, retail fund buyers and financial advisers) across 14 countries, we recognised three customer profiles[1] (‘Personal’, ‘Virtual’, and ‘Hybrid’) based on future engagement preferences and established the relative size of each profile by customer audience (as shown in Exhibit 1).

Exhibit 1: Split of client types by engagement profile

Range of %’s represent regional differences across North America, EMEA, APAC

Each profile is meaningful, but its size varies by audience and country. The proportion of professionals with a ‘Personal’ profile (who prefer F2F and personal video call interactions) varied the most by country and culture but was more consistent across professional audiences, except for ‘asset consultants’ who had the highest ‘personal’ proportion (which aligns with the consultant value proposition of performing in-depth due diligence with asset managers).

“Even though online meetings became the main communication, we like face-to-face meetings, especially for initial communication.“

(Japanese institutional decision maker)

The ‘Virtual’ profile (who prefer to self-serve online and engage remotely) was most prominent with Financial Advisers, with one third of advisers globally preferring a highly virtual and self-service approach. This is efficient but poses challenges to asset managers seeking to strengthen trust and conversion with (non-client) target advisers.

“I prefer easy and quick access to a relevant website with all resources available at a click.”

(Canadian Financial Adviser)

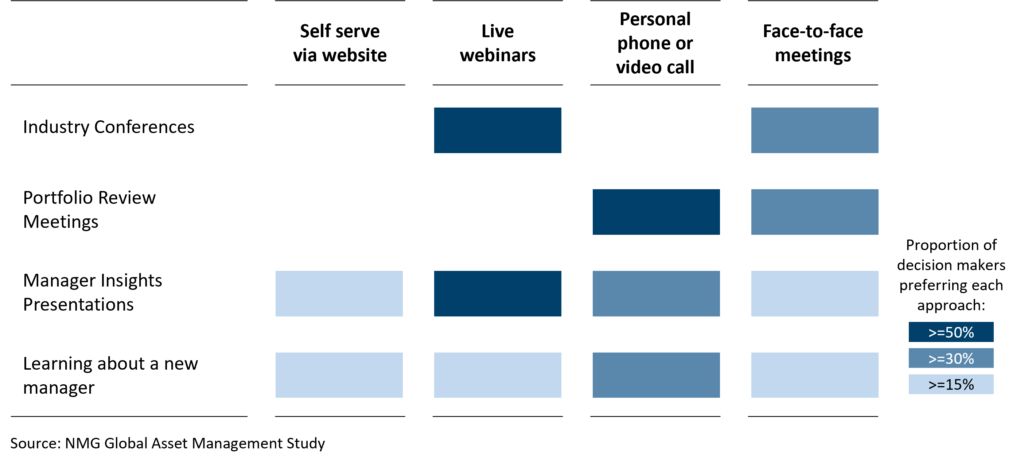

The ‘Hybrid’ profile is dominant across audiences and geographies. Hybrid decision makers will be selective between virtual and personal options on a case-by-case basis, depending on the associated value attached to the option and their underlying engagement preferences (as illustrated in Exhibit 2).

“There has been a positive experience with video calls. I expect this to increase in use. Fewer face-to-face meetings to reduce travel, though there will need to be one face-to-face manager meeting each year.“

(US institutional decision maker)

Exhibit 2: Engagement preferences by type of interaction for ‘hybrid’ institutional decision makers

Feedback from asset managers indicates that current engagement outcomes are varied and nuanced by a post-pandemic wave of demand for F2F interaction, that is tempered by the remote engagement preferences of clients and prospects aligning with the ‘virtual’ or ‘hybrid’ profiles above.

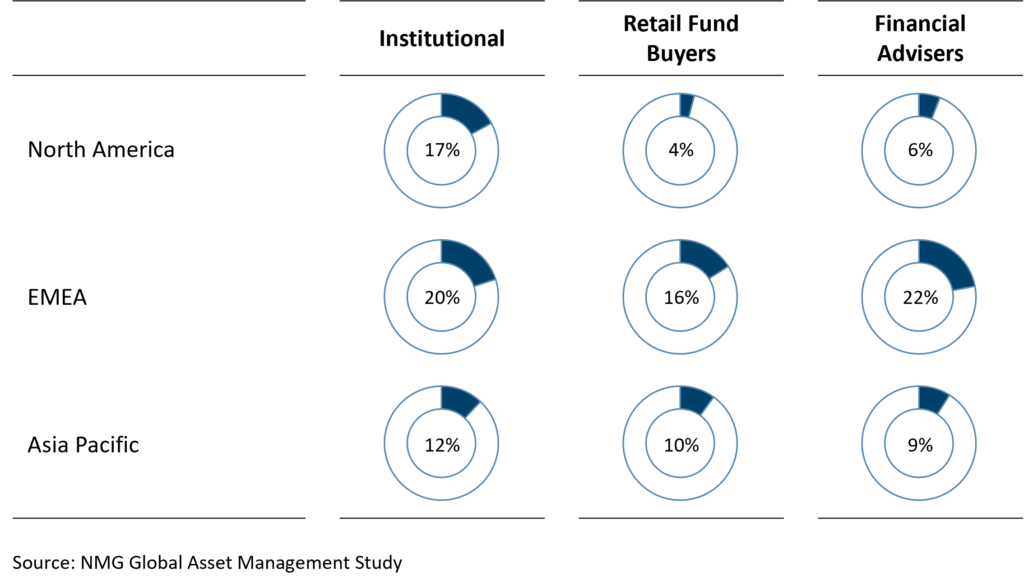

In addition to obvious drivers of change (home-office working[2], virtual efficiency[3]), the adoption of ESG, especially in Europe, is also having a permanent impact on how clients wish to engage. As shown in Exhibit 3, a proportion of asset management decision makers and their firms are committed to reduce their travel to industry and asset manager events due to environmental principles. We anticipate the proportion of decision makers influenced by environmental principles will grow globally in tune with the momentum of ESG adoption.

Exhibit 3: Environmental principles’ impact on intention to travel to industry and manager events

Proportion of decision makers where environmental principles highly impact their intention to travel less to industry and manager events

While asset managers adapted exceptionally well to service business-to-business clients remotely in the pandemic, as countries emerge from covid-19 restrictions, managers are confronted with a new set of challenges when competing for fresh client relationships.

We maintain that personal engagement is critical in initially building trust and winning new clients but the dilemma (for asset managers) is that a large proportion of target clients will push back on inefficient face-to-face contact. Asset managers must therefore be creative to flip preferences and pursue high-value face-to-face interactions with prospects and new customers and, in parallel, deliver the benefits of virtual self-service and remote personal engagement, which will be valued once relationships are formed.

On-the-whole, we think the following strategies will assist asset managers seeking to progress their engagement model:

The ultimate advantage would be to fully understand the preferences of each target customer and then to customise interactions accordingly. This advantage is far from being realised, but asset managers that are alert in their approach, continually testing, learning, and adapting, will be better positioned going forward to build trust with new customers and strengthen relationships with existing customers, in the new era of engagement.

[1]A summary of the characteristics of each profile is contained in the appendix to this article.

[2]Many professionals have locked-in to a balance of career time spent between company-office and home-office. Aided by technology, meetings that were previously conducted F2F can be effectively attended at home. This balance is more in favour of home-office where the commute to the office is expensive in time or cost, or where the office environment is not appealing or productive.

[3]The acceptance of remote working processes, improved technology integration and online access to information and tools, has resulted in efficiency and productivity gains, that strengthen bottom-line outcomes.

Appendix: Customer Profiles based on engagement preferences