December 21, 2021

Covid-19 Actuarial Modelling of the Pandemic – South Africa

NMG Consulting created a multi-state actuarial model forecasting COVID-19 cases to help understand changes over the long…

A focus on growth is the logical post-pandemic response for South African insurers, strategies for which will require active support across the value chain, particularly from reinsurance partners

The Covid-19 pandemic has inflicted significant injury on the South African economy, more than the damage done in developed economies (and more than in several other emerging markets).

The general (‘short-term’) insurance industry in South Africa has also had more than its fair share of challenges with rising claims, ratcheting reinsurance prices, and high levels of uncertainty in general. Add to this operating costs pressures and unresolved Covid-19 exposures, and it is unsurprising that profitability and future margins are both prominent concerns.

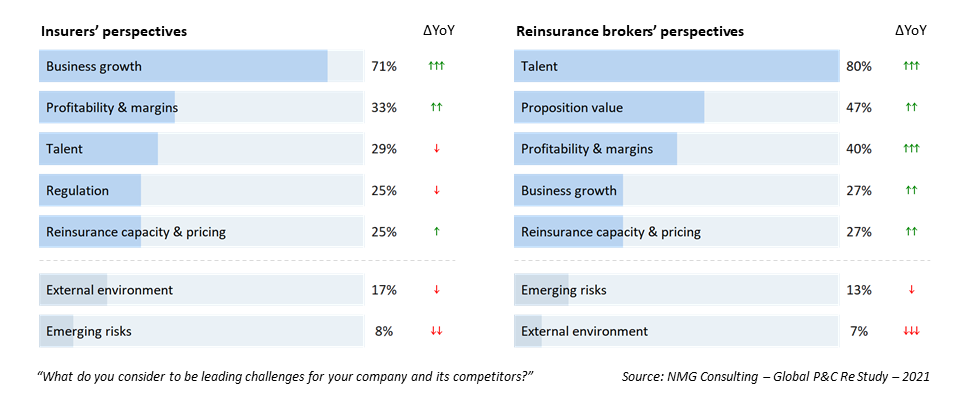

Exhibit 1: Leading challenges

Proportion of executives indicating as a leading challenge. Maximum of 3. Feb-May 2021

Delivering growth is usually a strategic priority for insurers, particularly in emerging markets. For 2022, the year of emergence from the pandemic, even more so.

As Exhibit 1 illustrates, ‘business growth’ is clearly seen as the leading challenge for insurers in South Africa and is set to top strategic priorities for 2022. There is clear advantage to be gained for competitors that pick the ‘path and timing’ of the recovery.

… competitors that pick the ‘path and timing’ of the recovery will be advantaged

‘Skills gaps’ present a significant on-going challenge to the South African insurance industry, being noticeably elevated compared to other markets. The supply-side drivers are well understood: the training, development, and retention of suitably-skilled teams, in a country where education levels remain inadequate. The demand requirements are for both experience and specialisation, particularly in an industry that is digitalising. The overlay of these demand and supply considerations creates a perfect storm.

With talent and proposition closely linked, the competition for talent in the reinsurance broking is consistently high. In 2021, 4-in-5 brokers viewed ‘talent’ as a leading challenge (and 3-in-5 consider it the leading challenge). This uplift is attributable to a more dynamic competitive environment, including the near creation of Aon Willis, and the emergence of several ‘challenger’ franchises intent on offering suitably-scaled alternatives to the three largest reinsurance brokers. Despite being highly attractive businesses to operate, reinsurance brokers feel an unrelenting pressure to evolve their propositions beyond the transactional elements.

…, the competition for talent in reinsurance broking is consistently high

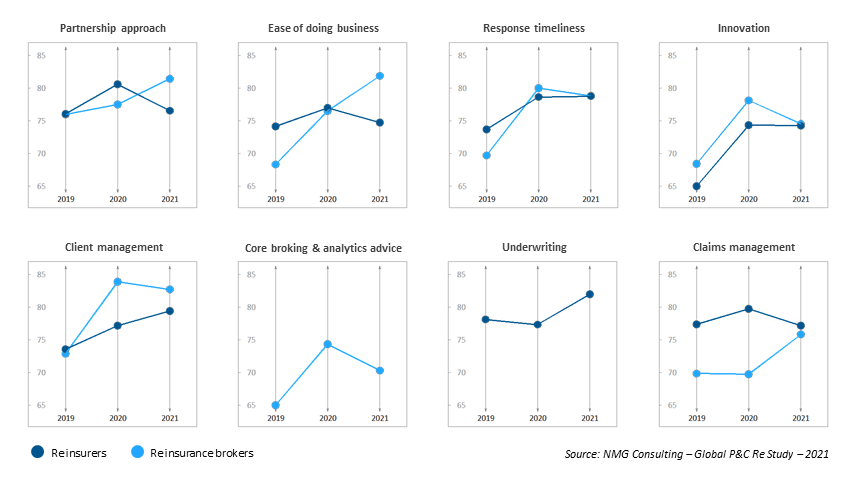

Insurers indicate that their reinsurance partners performed well in 2021, building on the committed support delivered to their insurance clients in 2020.

Reinsurer achievements arose from improved ratings for client management and underwriting, despite firmer prices and terms. Reinsurance brokers lifted servicing levels generally, and client-facing brokers achieved higher ratings.

Exhibit 2: Strong performances

Aggregate average ratings of the most-used reinsurers (15) and reinsurance brokers (10) in South Africa as evaluated by insurers

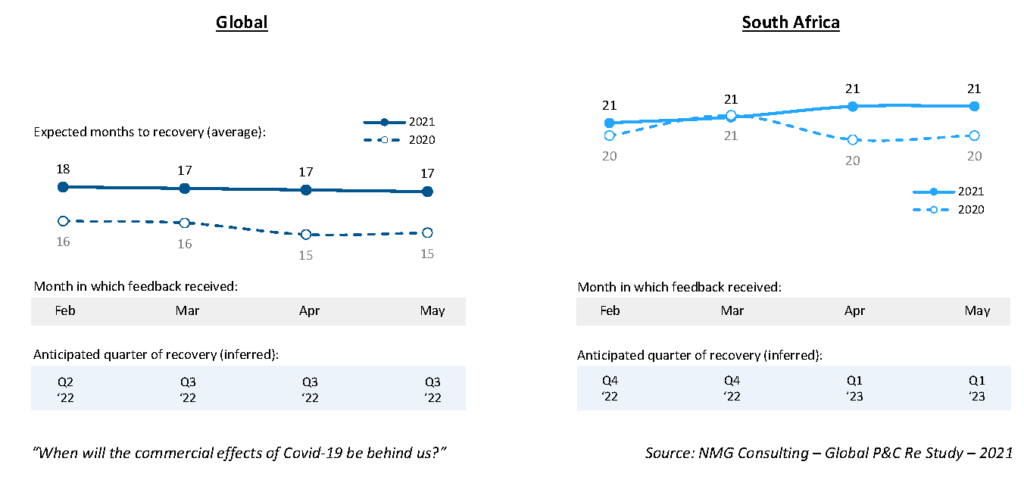

In 2020, industry expectations for the time to return to ‘commercial normality’ widely missed the mark, by way of being too optimistic. In 2021, expectations of the time to recovery are even more extended (meaning the original expectations were out by a factor of two).

Expectations of the time to recovery in South Africa are among the most protracted globally, and likely overly-pessimistic given the significant inherent immunity resulting from high levels of cumulative infection. NMG modelling assumes two-thirds of South Africans have already been infected, and that the current fourth wave should – baring a macro mutation – be mostly manageable; future waves should continue to reduce in impact. Read more about South Africa’s fourth wave.

Expectations of the time to recovery in South Africa are among the most protracted globally, and likely overly-pessimistic

Exhibit 3: Timeframe to commercial recovery from Covid-19

Insurer and reinsurance broker expectations on the time to recovery (months). Feedback: Feb to May 2021. Recovery by Q1 2023 for South Africa seems overly pessimistic

The South African insurance industry has long prided itself on its capacity for innovation and dynamism and has faced challenging periods on many prior occasions. While a pandemic of this scale is a 1-in-100 event, rebooting growth is something the industry has achieved many times before. The return to a growth focus will be a common theme of most if not all insurer strategies.

Reinsurers and reinsurance brokers are logical ‘go to’ partners to drive growth objectives, particularly around new product development, digitalisation, and improved data management and analytics.

A complication is that insurers and brokers widely expect reinsurance prices to harden further for all lines of business into 2022, as reinsurers are firmly committed to rate rationality.

Consequently, reinsurers will need to redouble their efforts and ‘walk the talk’ in their approach to partnership and claims support. Reinsurance brokers will need to demonstrate their core broking expertise to navigate a cautious underwriting environment, all the while pursuing the on-going reinvention of their value proposition.

The pendulum is set to swing towards reinsurance partners bringing more ‘innovation’ in 2022

The pendulum is set to swing towards reinsurance partners bringing more ‘innovation’ in 2022, although hopefully not at the expense of maintaining high levels of support.