October 28, 2021

Readying to Rebound

A focus on growth is the logical post-pandemic response for South African insurers, strategies for which will...

Medical schemes in South Africa face the challenge of correctly anticipating rebounding claims costs, but also deteriorating trends in membership and mix. Successful competitors will need to be astute in pricing and separately find ways to address issues of access and affordability

The medical schemes industry started 2021 in its strongest solvency position for more than a decade, on the back of reduced levels of health servicing since the onset of the pandemic in 2020.

Many if not most Open schemes intend to redistribute these excess reserves over 2022 and 2023, mostly in the form of lower contribution increases. Rapidly rising claims costs and worsening membership profiles will present significant challenges for all schemes. For some, these may prove to be existential in nature.

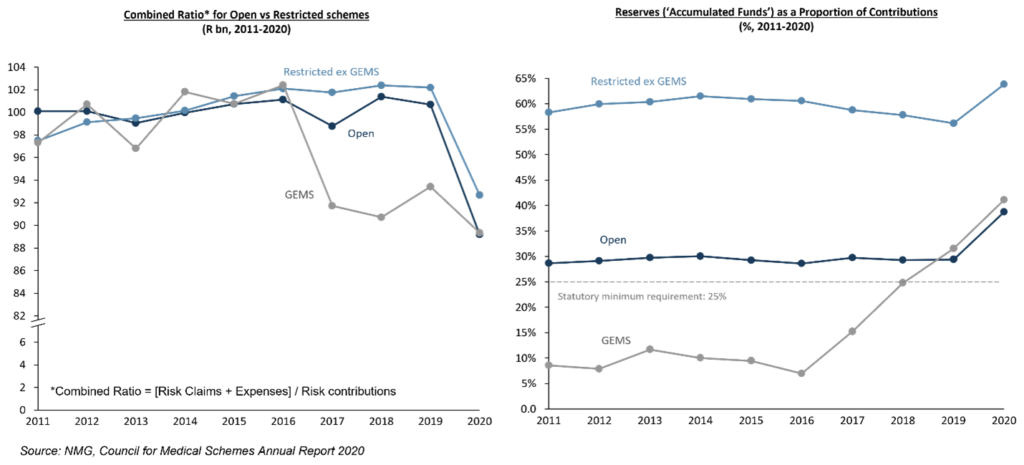

In 2020, combined ratios fell below 90% for Open schemes (on average) as well as the Government Employees Medical Scheme (GEMS), while ratios for Restricted schemes averaged 92%. Going into 2020, risk pricing increases for the industry were reasonably standard at 7.2%, only for insured claims costs to then fall 3.7% when non-emergency treatment was either deferred or did not take place at all as a result of the pandemic.

Administration and distribution costs were well-managed and tracked inflation at 4.1%.

Exhibit 1: Declining claims costs lift year-ending 2020 reserves

These lower claims costs have in turn significantly boosted scheme reserves. Accumulated funds (against which solvency is assessed) have risen by nearly 10% of contributions across all schemes on average. Restricted schemes have the highest level of reserves at ~65% (fully 40% above the statutory requirement). Open schemes and GEMS have reserve levels of circa 10% above the statutory requirement.

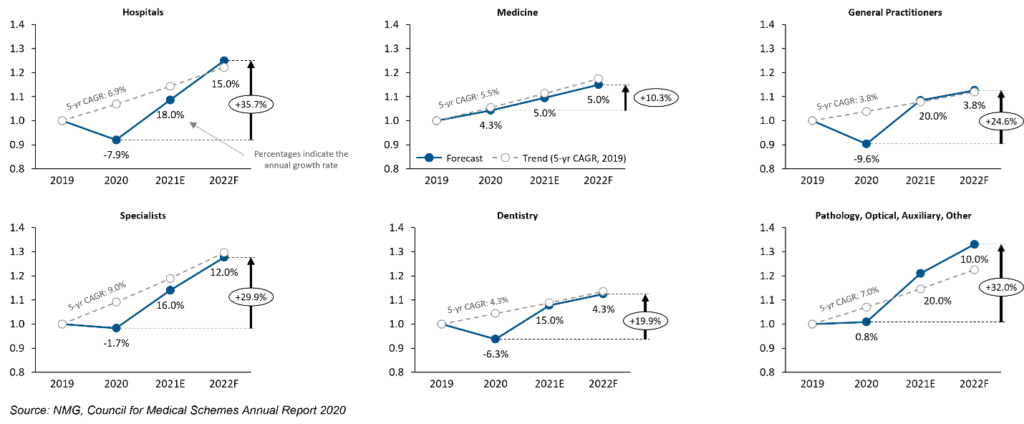

Anticipating the extent to which claims costs will rebound is challenging. Claims outcomes in 2021 and 2022 depend on levels of ‘pent up’ treatment demand, capacity in health care systems, future Covid-19 developments, and the emergence of alternative servicing patterns and models. Forecast 2022 claims costs may be more than 30% higher than in 2020 for some medical cost categories.

How older-aged members (aged 50 and above) re-engage with health care delivery systems is a large source of uncertainty, having shown a significantly lower propensity to engage since the pandemic commenced. Confidence will need to return before they do, and while there have been signs of recovery this remains fragile.

Exhibit 2: On the rebound

Total Claims Costs per Category (2019-2022F)

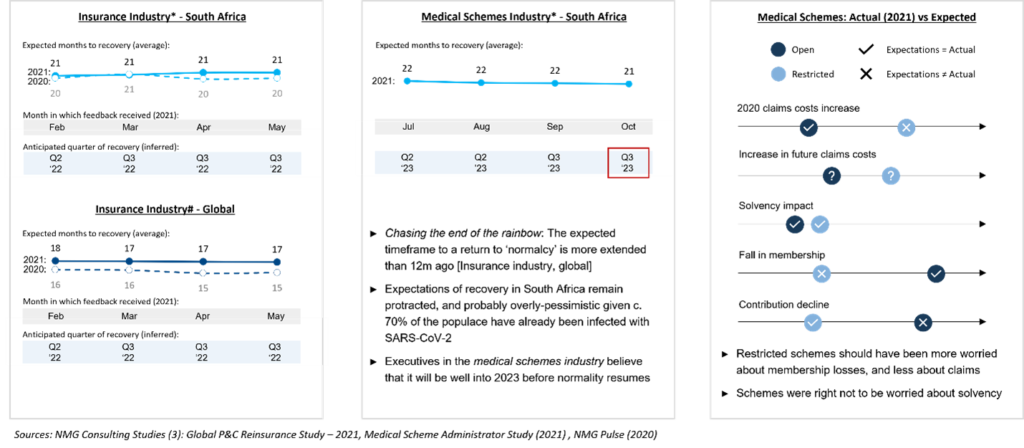

For the insurance industry globally, the expected time to reach the ‘new normal’ would appear to be to be a rolling 18 months. While events turned out less favourable than expected in 2020, one could assert now that South Africans are overly pessimistic, particularly medical schemes executives, who anticipate the return of ‘normalcy’ only in the second half of 2023.

Exhibit 3: Covid-19 Uncertainties Linger

By when will the commercial effects of Covid-19 be behind us (months)? Specific concerns of medical scheme executives (2021 actuals vs 2020 expectations)

As to the impact on future claims costs, uncertainty remains. Pathology costs have risen sharply due to high levels of Covid-19 and seem set to remain elevated. Potential upsides of improved vaccine penetration and increased hesitancy towards hospitalisation may be more than offset by the effects of “Long Covid’ and increased incidence of mental health illnesses. And the risk of new variants able to evade accumulated immunity will be ever-present. Medical schemes will retain a keen focus.

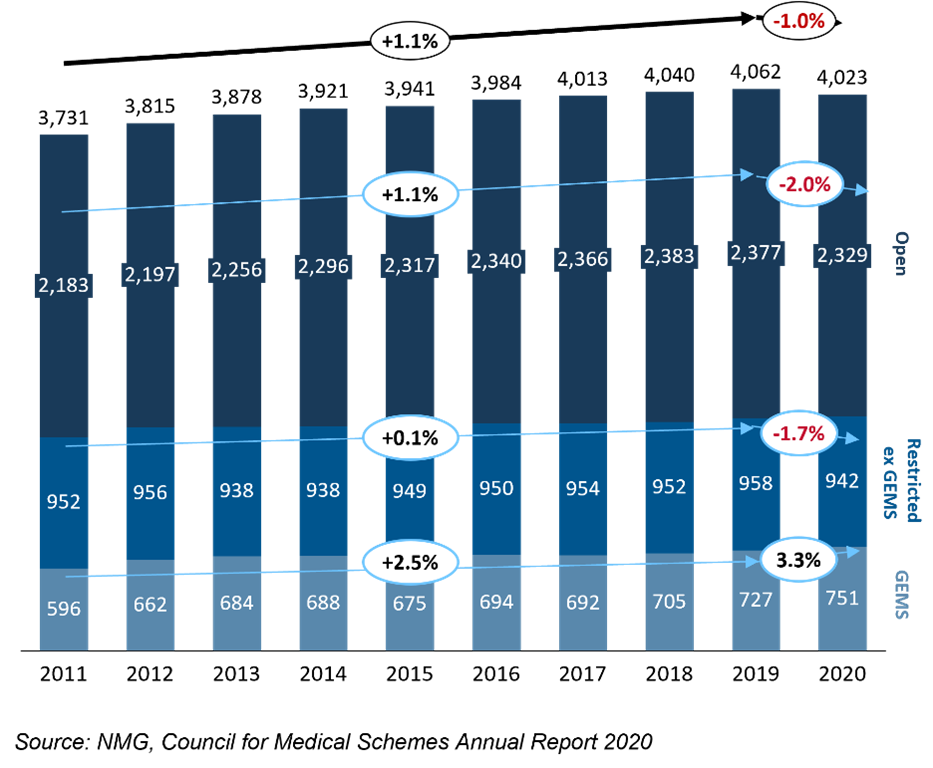

Open scheme membership was hardest hit by the pandemic. Restricted schemes membership remains below that of 2011, while in contrast GEMS continued to grow strongly. 2021 could be the year when one-in-five medical scheme members are part of GEMS (up from 16% in 2011).

Exhibit 4: Growth interrupted

Industry growth in principal members (‘000s, %) led by GEMS. Open and Restricted schemes see peaks in membership in 2019 and 2020, respectively

Modest membership growth should reflect the economic recovery in 2022, although affordability (limited by prescribed minimum benefits) will remain a constraint. Solutions provided by insurers and health providers will continue to play an important role addressing the coverage gaps that exist for uninsured employees (and their families).

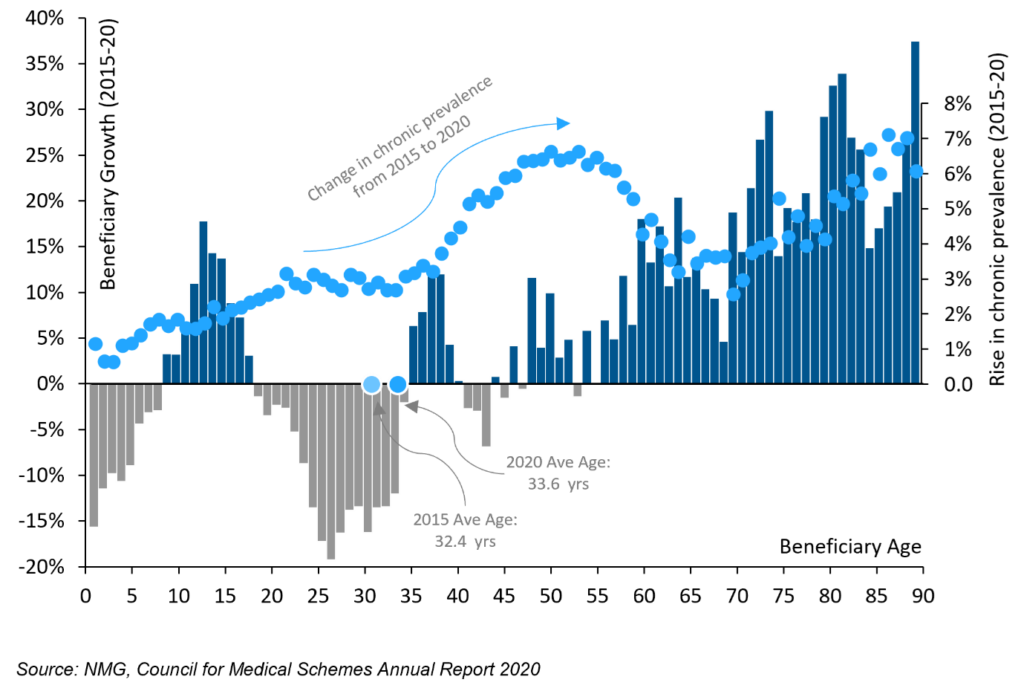

Beneficiaries of Open schemes are ageing, continuing to ‘leak’ younger beneficiaries, particularly those aged 20-35. Schemes with ageing membership profiles usually see this manifest as increasing average contributions over time, further exacerbating affordability challenges.

Schemes require not only growth to remain vital, but also that growth be of a specified profile, which includes continuing to draw in (healthy) young members in a community-rated environment.

Exhibit 5: Older and less healthy

Worsening age mix. Rise in Chronic Prevalence (2015-2020)

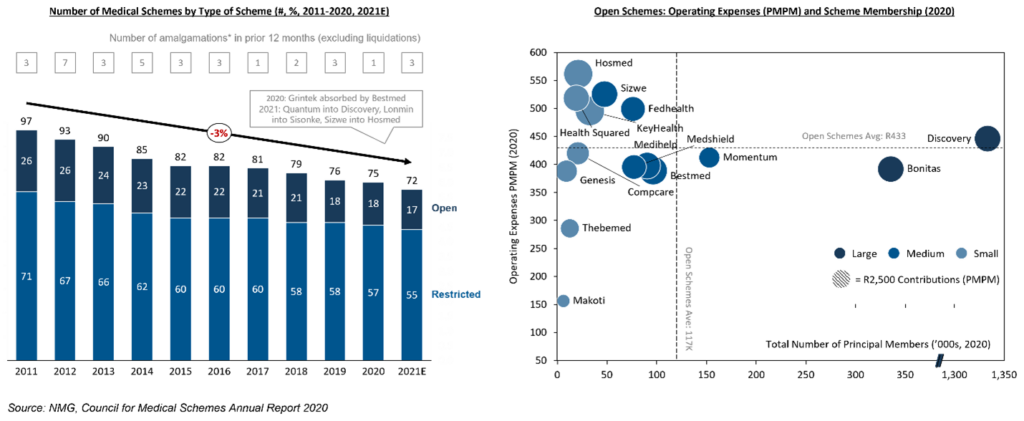

The number of medical schemes has fallen by 25 over the past decade (26%), and continues at a rate of just over two annually since 2018. Operating efficiencies arising from scale are mostly not in evidence in the South African medical schemes segment, with disadvantages from (lack of) scale tapering once 50,000 principal members have been reached.

Consolidation activity can be expected to continue at a similar pace as in the last few years. High reserve levels will make amalgamation mechanics easier, although ‘being well-capitalised’ could also defer merger plans between schemes by alleviating pressure to take short-term action.

Exhibit 6: Consolidation momentum not halted by an absence of scale efficiencies

Four schemes have been absorbed the past 24 months. Scale economies from 50,000 principal members

Special thanks to those who contributed to this cross-disciplinary effort, particularly: Sena Adachi, Adam Lowe, Casper de Vries and Priya Makanjee