October 28, 2021

Readying to Rebound

A focus on growth is the logical post-pandemic response for South African insurers, strategies for which will...

The South African (re)insurance industry has shown its mettle in responding to COVID, and what truly matters.

For over two years, South African insurers have found themselves on the front line responding to the reverberations of COVID. Moments of crisis are when the insurance industry must demonstrate value, and South African insurers, supported by their reinsurance partners, have risen to the challenge. What we have witnessed is a rapid reversion to insurance fundamentals such as operational efficiency and concerns around product-market fit – factors which if mastered will enable insurers to meaningfully stand out given the recent turmoil.

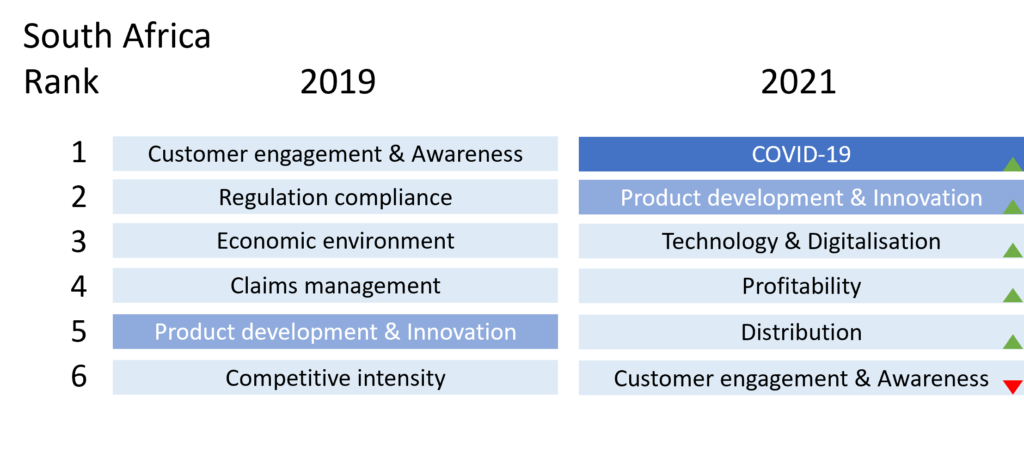

Exhibit 1: Insurer Stated Challenges (Categorised) – 2019 vs 2021

Source: NMG South Africa Life and Health Reinsurance Study, 2019 -2021

Some of the trends already present pre-pandemic were accelerated due to the challenge of deploying and maintaining insurance services during a period marked by widespread illness and lockdowns. Insurers have shown operational agility and a willingness to evolve from established, and in some cases insufficiently agile, business models and processes whilst deploying their own business continuity plans. Notably, these have included: providing flexibility to their own workforce, assisting distribution and sales networks, and most importantly supporting customers (for example through premium relief, ongoing coverage measures, education and enabling access to vaccines) during their greatest time of need.

Reinsurers have been key contributors to this support system across multiple functional areas such as claims and underwriting, and in doing so have clearly demonstrated their commitment and expertise during a challenging time for the industry.

Looking ahead, it is clear the impact of the pandemic will be felt for years to come. Insurance executives expect the ongoing repercussions of COVID to be their main challenge over the coming 24 months (Exhibit 1), forcing them to focus on the key pillars of running a successful insurance operation. These include: product development, digitising (in many cases, just going paperless), as well as the following:

A tall order, all whilst trying to build consumer trust in the industry.

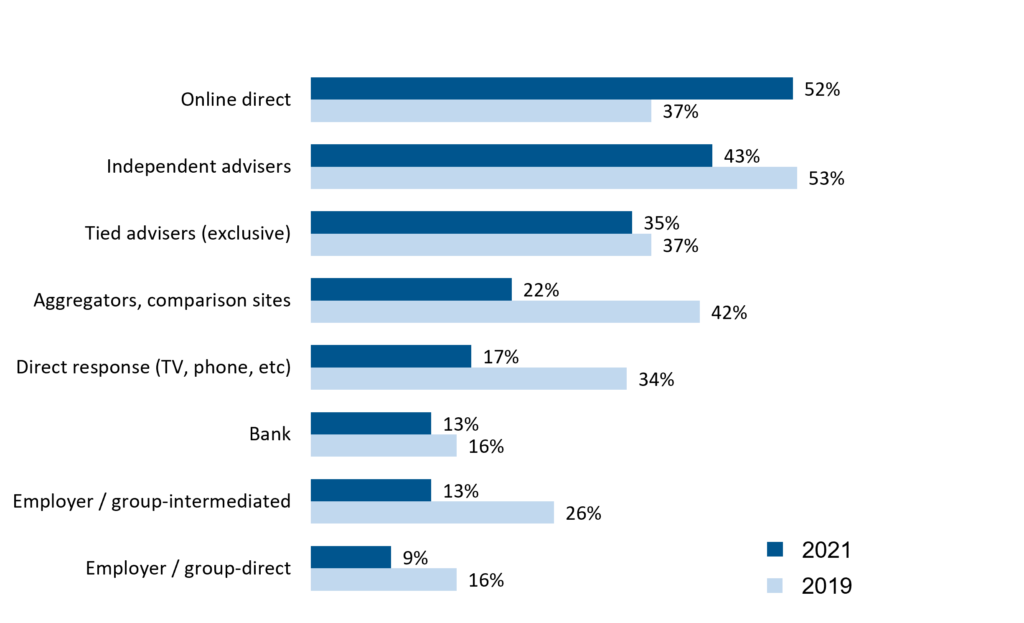

In 2021, as expected, insurers we spoke to re-emphasised the importance of investing in online direct channels (Exhibit 2). This, to be clear, is not expected to replace advice channels. All large and multi-channel insurers continue to invest heavily in intermediated channels including aligned adviser networks. Additionally, specialist direct insurers that have achieved scale are now considering growing into the advised space. It is evident therefore that online direct sales will remain focused on simplified products.

Overall, the digitalisation of distribution should not be mistaken for sales via digital or online channels. Insurance executives expect digital investments (digital tools/enablers) to assist intermediated channels and lift efficiencies around new business processing.

What we can say with some certainty is that digital investments will have a positive impact across intermediated channels, and also benefit customers. For example, operational efficiencies resulting from newly enhanced digital processes have improved insurers’ servicing capability to both intermediaries and customers. We have seen this reflected in interviews with South African IFAs, where “ease of business” has come through as the most important factor in selecting insurers, largely as a result of COVID and new, digitally optimised, ways of working.1

Exhibit 2: Insurer Expected Investments in Distribution Channels

Source: NMG South Africa Life and Health Reinsurance Study 2019-2021

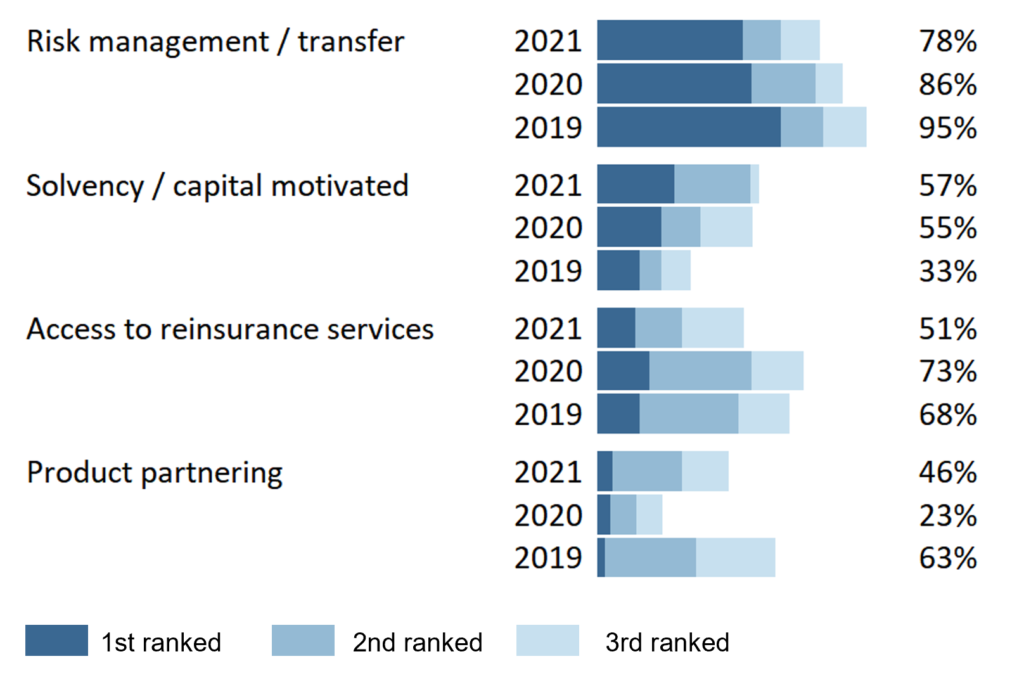

In 2021, product partnering rebounded in importance as insurers took a fresh critical look at how products performed during the pandemic, and whether they are fit for the future (Exhibit 3). We expect the importance of support from reinsurers in this area will continue to grow. We also saw an increasing trend for solvency/capital motivations for reinsurance usage (Exhibit 3). This was reflected by additional COVID related provisions insurers had made during the year, therefore relying on reinsurers for new business financing, mass lapse and general solvency relief. In addition, insurers indicate a willingness to cede more for several risk classes at the “right” rates although the long-term partnering capability of reinsurers will be a key determinant of future collaboration and successful placements.

Exhibit 3: Principal Motivations for Reinsurance Usage

Source: NMG South Africa Life and Health Reinsurance Study 2019-2021

Reinsurers’ unaided brand attributes are often linked with reputation for being innovative and supportive. Reinsurers are thought of as experts in their field, knowledgeable, with strong technical skills, and over the last two years have further exhibited reach and expertise through their provision of insights relating to COVID. Incumbent reinsurers focused on deepening relationships with current insurers whilst those with growth appetite saw an opportunity to provide support more broadly.

Exhibit 4: Reinsurer Brand Attributes

Source: NMG Life and Health Reinsurance Study, 2021

In 2021, we saw an uplift on NMG’s Business Capability Index (BCI), NMG’s proprietary scoring methodology that quantifies reinsurer effectiveness by aggregating insurer feedback across key capability areas.

In identifying the areas of most valued support, insurers have expressed demand for the fundamentals to be done well, such as underwriting, product and claims management. Off the back of this, opportunities abound for further innovative developments, such as underwriting engine deployment as insurance businesses becomes more digitised.

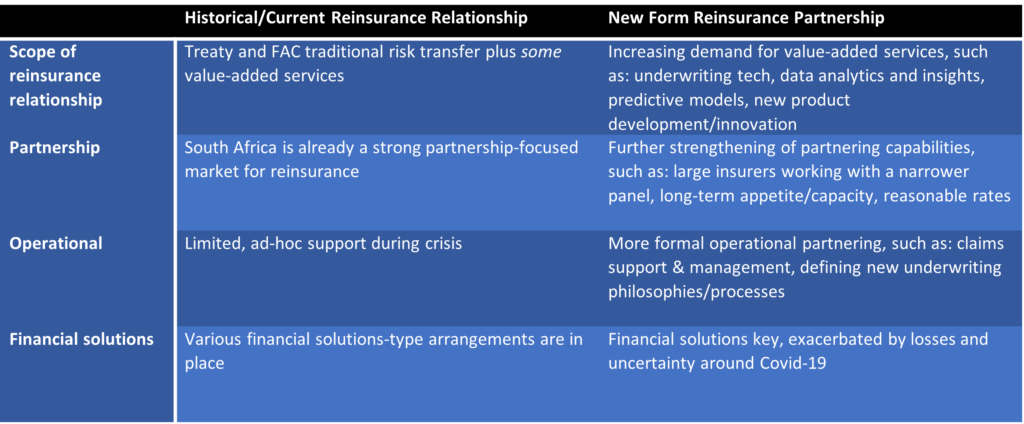

We see ample opportunities for reinsurers to become increasingly embedded as partners, providing innovative solutions and financing arrangements, in addition to their more traditional risk transfer proposition.

Exhibit 5: Case study – A New Type of Reinsurance Partnership

Beyond nearly all other regions globally, South Africa has been at the forefront of experiencing the negative impact of COVID. Its mature insurance industry was well placed to respond and has done so – although it hasn’t been easy, and much is still unknown, such as the long-term consequences of work-from-home mandates on health & wellbeing and resulting claims.

These secondary and tertiary impacts will go some way in shaping the industry for years to come but offer an opportunity for genuine product and proposition innovation. Reinsurers, being key financial and operational partners during the crisis, have also demonstrated their value – not just to insurers, but also to customers. This highlights the potential for an attractive path forward, as innovative partners, embedded in insurers’ organisations and demonstrating value beyond traditional risk transfer solutions.

Having faced down the immediate challenges of the pandemic, the benefits to (re)insurers of having focused on the key aspects of running a successful insurance business, namely paying claims, caring for customers and employees, are increasingly clear to see. We view the South African industry as having evolved many years, in the space of just a few, and an industry prepared for a volatile future.

2021 was the 15th year of NMG’s annual Life & Health Reinsurance Study in South Africa, in which we carried out 87 interviews at 41 life insurance entities, including all of the largest insurers and cedants. Our study seeks to track the major trends in the life (re)insurance industry and is the foremost study concerning the mindset of insurers when considering reinsurance.

Jane Cheng, Partner based in London ([email protected])

Evan Baars, Partner based in London ([email protected])

William Coles, Programme Manager based in London ([email protected])