March 18, 2021

Increased opportunity meets rising opportunity cost

It has been a long time since prospective margins in US Commercial Lines look as attractive as...

Rises in reinsurance rates were consistently reported at renewals throughout 2020, building further on rate increases achieved since 2017. [See NMG’s Reinsurance Pricing Report 2020 on NMG Connect for a more detailed analysis of price movements.]

The levels of capital supporting the reinsurance industry have remained largely stable, but low return on equity is both a typical and persistent feature of the industry. Reinsurers have thus continued to be more selective in terms of the deployment of capital, particularly given the uncertainties arising from the Covid-19 pandemic.

Historically low fixed-interest yields have also supported a focus on technical underwriting margins, which is a positive for the industry overall.

Reinsurers have become more optimistic about the outlook for returns going forward, based on an expectation of further risk-adjusted rate rises in 2020.

Exhibit 1 – Insurers correctly anticipated further reinsurance rate increases

A large majority of insurer respondents anticipated increases at renewal (vertical axis), although views as to the adequacy of reinsurance rates were more divided (horizontal axis)

Source: NMG Consulting – P&C Reinsurance Study – 2020

The views of insurers and reinsurance brokers typically differ more around rate adequacy, with insurers less easily swayed by rationales advanced for rate increases based on adequacy.

Interestingly, insurer views of rate adequacy seem to have limited correlation with their outlook for pricing.

Beset by the Covid-19 pandemic, growth expectations fell by 1.7% from 2019, but remained in positive territory underlining the counter-cyclical nature of insurance demand as well as the effects of an upwards repricing in commercial lines.

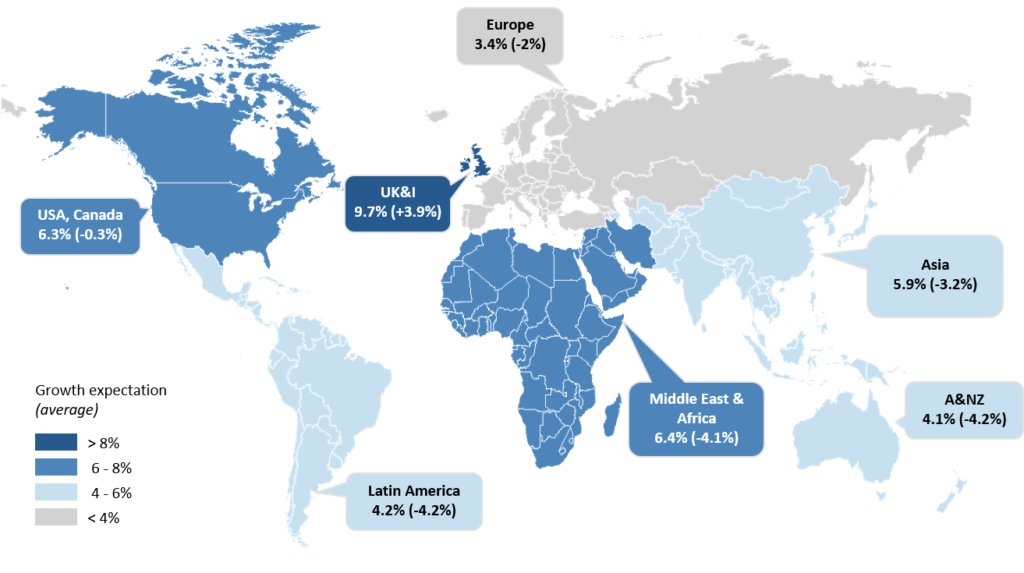

Exhibit 2 – Growth expectations most affected in developing markets

~1800 views of executives and practitioners at insurers in 2020, providing a 12-month view of growth their company in their country(ies)

Source: NMG Consulting – P&C Reinsurance Study – 2020

The wisdom of the crowd: The views of a broad sample of individuals is a better statistical predictor than those of a single expert, although statistically it would seem in our analyses that people find it harder anticipate business shrinkage at the company level.

Brand confers competitive benefit in reinsurance.

‘Best-quality’ reinsurer brands clearly correlate (positively) with scale and competitive position, but vary significantly between reinsurers with similar levels of market importance.

Reinsurer brands can be categorised between Global, Regional, and Local. Eight brands emerge from the analysis as being genuinely Global, carrying their value statement across all regions.

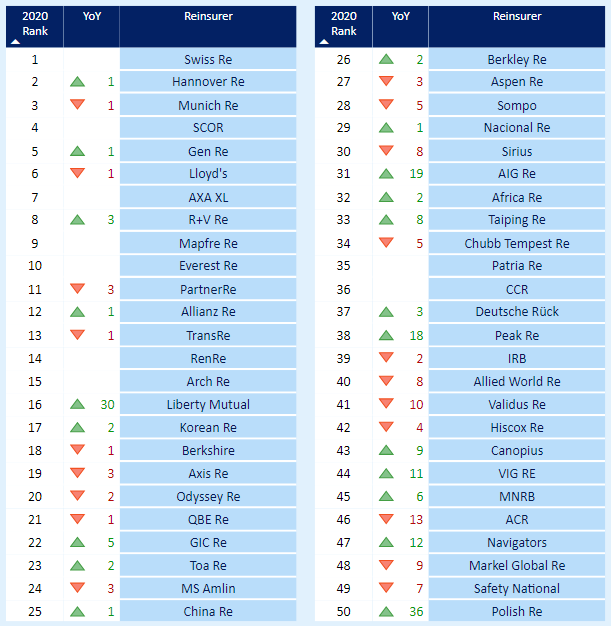

Exhibit 3 – Top 50 brands – Property, Casualty & Speciality Reinsurance

Rankings derived by way of a synthetic index from the unprompted views of insurers and reinsurance brokers as to the “best-quality brands”, partner preferences including those by line of business (> 30,000 datapoints)

Source: NMG Consulting – P&C Reinsurance Study – 2020

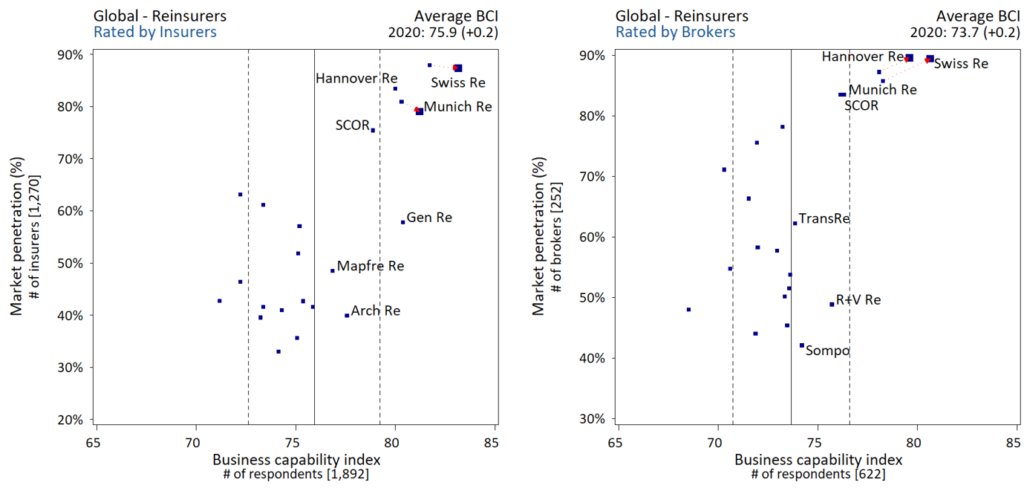

Swiss Re again received the highest ratings from insurers on NMG’s Business Capability Index (ahead of Munich Re and Gen Re), and also from reinsurance brokers (ahead of Hannover Re).

Ratings for the 20 most-used reinsurers lifted slightly (+0.2) on average with both insurers and reinsurance brokers, with the largest reinsurers achieving above average uplifts: +1.3 from insurers and +1.6 from brokers. To describe this as a flight to quality would be overstated, but it is fair to say that the largest reinsurers have been proactive in supporting their clients and brokers in a particularly challenging year.

Exhibit 4 – Business Capability Index – Global

Market penetration indicates the percentage of insurers where reinsurers are active, while NMG’s BCI aggregates ratings awarded across a range of performance factors for reinsurers and is thus a predictive indicator of future trading success

Source: NMG Consulting – P&C Reinsurance Study – 2020

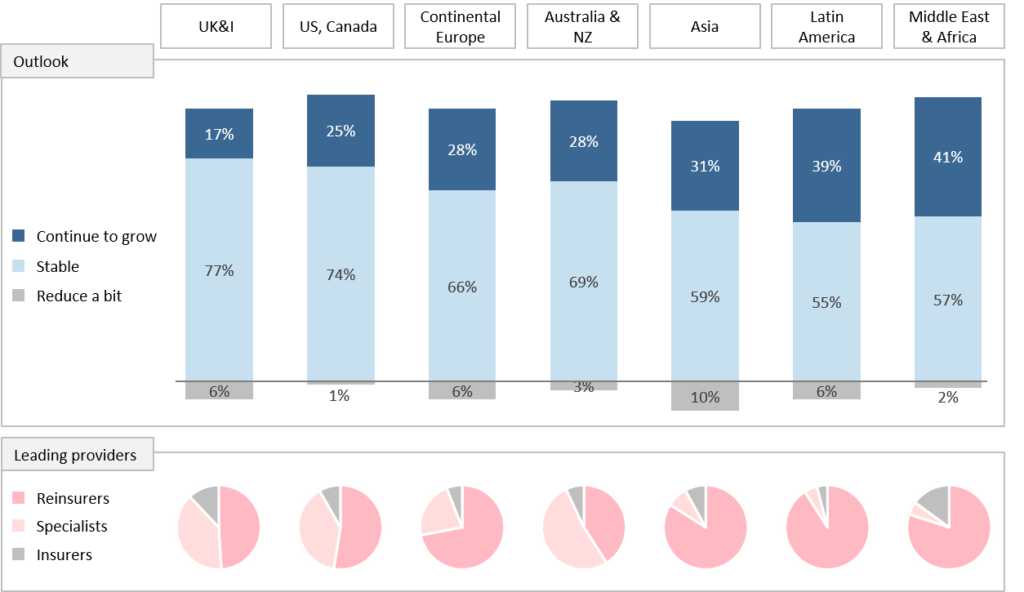

Alternative capital solutions continue to be seen as a permanent feature of the industry, although the outlook for growth in usage has trimmed significantly from a year ago.

Despite some significant losses, investors continue to view insurance risks as being an attractive non-correlated asset class and as such capital levels have remained at similar levels, although fortunately are now being deployed with higher return expectations (in better-structured products).

In the world’s advanced markets, specialist providers of alternative capital are dominant, especially in the USA and UK. Continental Europe, home to the bulk of the world’s global reinsurers, stands apart with reinsurers overwhelmingly considered the leading facilitators of alternative capital solutions. Global reinsurers also hold dominant positions as providers of alternative capital solutions in the regions of Asia, Latin America and the Middle East & Africa.

Exhibit 5 – Moderated growth outlook for alternative capital usage

Globally, 64% of insurers indicated a stable outlook for the alternative capital usage in 2020 (up from 37% in 2019). Those expecting growth in usage fell to 31% (down from 46%) globally, particularly across Asia and Latin America

Source: NMG Consulting – P&C Reinsurance Study – 2020

In addition to specialisation within lines of business, our analysis of competitive performance reveals a rich topography of points of competitive differentiation at the customer interface with insurers, reinsurance brokers and across regions.

This is a positive signal for an industry often considered transactional and commoditised, but also suggests that one-half of the potential universe of differentiation opportunities current lies unclaimed.

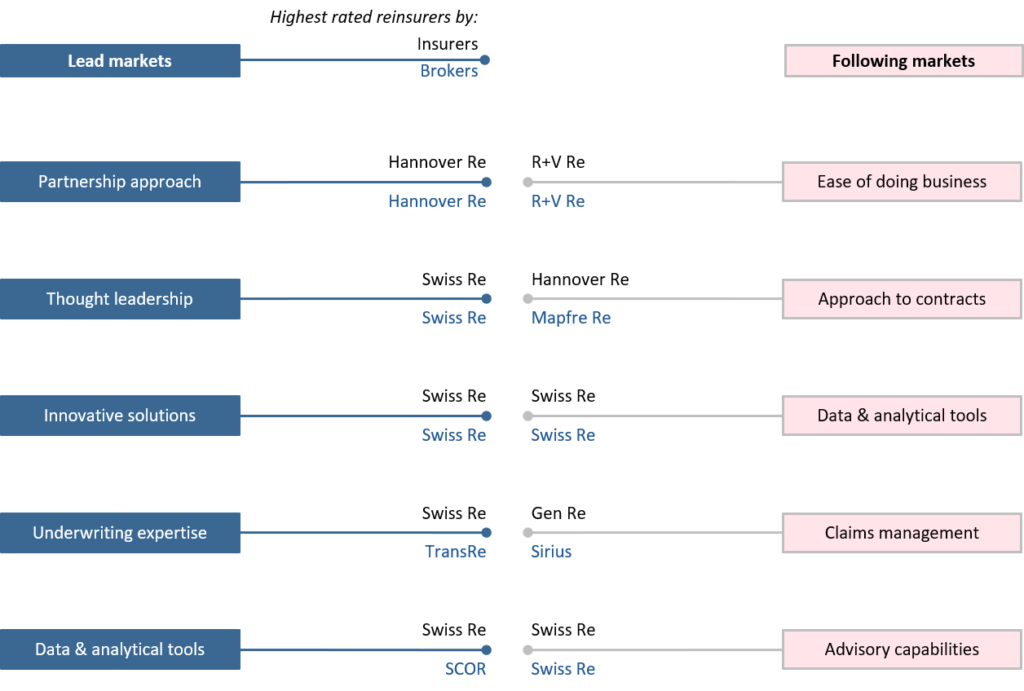

Exhibit 6 – Lead reinsurers by factor (Treaty business)

Insurers and reinsurance brokers look for different capabilities when engaging reinsurance partners in leading and following roles, while reinsurers perform differentially across factors and roles

Source: NMG Consulting – P&C Reinsurance Study – 2020

Mark Prichard is the CEO of NMG Consulting based in Sydney ([email protected])

Jane Cheng, Partner based in London ([email protected])

Rick Flaspohler, Partner based in Kansas City ([email protected])

See Siang Cha, Data Scientist based in Sydney ([email protected])