March 18, 2021

Increased opportunity meets rising opportunity cost

It has been a long time since prospective margins in US Commercial Lines look as attractive as...

Reinsurance prices have yet to peak

Competitive positioning – reinsurers

Proposition/capability differentiation – reinsurers

Brand matters – reinsurance brokers

Anchor

Public policy responses led to the Covid-19 pandemic being a bigger P&C event (than L&H) for the insurance industry. Global trading conditions have however improved steadily throughout 2021 for P&C re/insurers, despite the anticipation of a return to a ‘new normal’ being significantly protracted relative to expectations at the same time in 2020.

Exhibit 1: A ‘rolling 18 months’ to the post-Covid-19 new normal

Insurer and broker expectations on the time to recovery (months) at 17 months (up from 15 months in 2020). Feedback: Feb to May 2021. Global expectations of recovery average at Q3 2022

Source: NMG Consulting – P&C Reinsurance Study – 2021

The industry has sustained its focus on profitability, and newly-raised capital continues to be deployed with caution. On a risk-adjusted basis, expectations were for reinsurance rate rises to continue into 2022, combined with further tightening terms & conditions.

Growth expectations, a measure of sentiment, lifted globally, to be above those pre-pandemic. Yet, or perhaps partly as a result, insurers increasingly pointed to the challenges faced in legacy system migration, investments in data management, and keeping pace in the digital ‘arms race’.

Reinsurers operating in lead roles faced challenges in terms of living their values around engagement and partnership, with significant variations evident between reinsurers.

The ultimate collapse of the Aon Willis mega-merger, due to competition concerns of regulators in several key markets, is set to provide near-term benefits to insurers (improved choice) and also Gallagher. On the flipside, the prospect of Aon Willis further energised investment in the broking segment, with competitors investing to build additional scale, new technology platforms and differentiated propositions (from those of the largest players).

Anchor

Insurer growth expectations exceeded those of 2020 by nearly 2%, demonstrating a distinct improvement in sentiment.

Rating increases were largely the source for boosted expectations for commercial lines (7.4%), with those in personal lines (6.5%) being more dependent on customer growth and new product offerings. These expectations can be considered ‘real’ as price inflation at the time was at or near zero, with concerns of deflation present in early 2020. Rate increases may prove to be the high watermark for the industry on a ‘risk adjusted’ basis.

Exhibit 2: Insurer growth expectations lift to pre-pandemic levels

12-month growth outlook. ~2000 views of executives and practitioners at insurers (2020)

Source: NMG Consulting – P&C Reinsurance Study – 2021

The wisdom of the crowd: The views of a broad sample of individuals is a better statistical predictor than those of a single expert.

Anchor

Questions of margin sufficiency on newly-written business remain ‘front and centre’ for an industry generally dissatisfied with its long-term performance, quashing any temptations of moderation that might have emerged following recent lifts in underwriting margins.

Concerns about existing portfolio profitability remain prominent for insurers, despite current claims developments appearing favourable relative to Covid-19 provisions. ‘Social inflation’ and climate change coupled with signs of rising economic inflation globally, mean that profitability concerns will likely remain elevated.

The rising pressures of meeting growth expectations is a strong signal from the 2021 feedback, given the combination of higher return expectations and the protracted pandemic recovery.

Exhibit 3: Leading challenges

Proportion of executives indicating as a leading challenge. Maximum of 3. Feb-May 2021

Source: NMG Consulting – P&C Reinsurance Study – 2021

Digitalisation investments (including Insurtech) continue to drive a re-organisation of the insurance value chain, known to be both extended and complex. Insurers are faced with investing in new platforms for data management and automation as a survival imperative, being part of the journey to becoming fully digitally-enabled.

Viable strategies for sustainably higher margins are needed to merit the required investments to modernise. Late adopters will certainly find this more difficult. Partnerships and fast-follower strategies may prove to be the most effective.

In contrast to commercial concerns, risk-related challenges generally slipped in relevance(‘external environment’, ‘emerging risks’ & ‘claims’ concerns all fell) from the high-water marks set in 2021.

Anchor

Rises in reinsurance rates were widely reported at renewals throughout 2021, building further on rate increases achieved since 2017. [See NMG’s Reinsurance Pricing Report 2021 on NMG Connect for a more detailed analysis of price movements]

The levels of capital supporting the reinsurance industry have remained largely stable, despite frustratingly low returns on equity being a persistent feature of the industry. Reinsurers have therefore continued to be more selective in capital deployment.

Historically low fixed-interest yields have also supported a heightened focus on technical underwriting margins. This is doubtless a net positive for an industry that had struggled to be consistently be disciplined in underwriting.

Reinsurers entered the 1/1/2022 renewal with firm expectations for further rate rises, which were consistent with insurer and broker expectations in the first half of 2021.

Exhibit 4: Insurers correctly anticipated further reinsurance rate increases

A large majority of insurer respondents anticipated increases at renewal (vertical axis), although views as to the adequacy of reinsurance rates were more divided (horizontal axis)

Source: NMG Consulting – P&C Reinsurance Study – 2021

One-half of insurers and reinsurance brokers viewed current reinsurance prices as adequate. Views of ‘rate inadequacy’ moderated towards ‘uncertainty’, with only 12% of respondents indicating current reinsurance pricing as inadequate (vs 21% in 2020). Insurers and brokers were united in their views that prices for Aviation and Cyber risks were the most under-priced.

Views of adequacy notwithstanding, insurers and brokers expect further price hardening across all regions and business lines into 2022.

Anchor

Brand confers a meaningful competitive benefit in reinsurance. Those reinsurers rated as having the ‘best-quality’ brands have high awareness as well as desirable brand attributes.

‘Market importance’ (tied to ‘usage’, both domestically and globally) contributes significantly to brand awareness, meaning that brand attributes are most relevant for comparisons between reinsurers of similar scale. By extension, the competitive landscape of reinsurer brands is a tiered one.

Reinsurer brands can be categorised between Global, Regional, and Local. Seven brands emerge from the analysis as being genuinely Global, carrying their value statement across all regions.

Exhibit 5: Top 50 brands – Property, Casualty & Speciality Reinsurance

Rankings derived by way of an index of the unprompted views of insurers and reinsurance brokers as to the “best-quality brands” and their partner preferences including those by line of business (> 30,000 datapoints)

Source: NMG Consulting – P&C Reinsurance Study – 2021

Anchor

Swiss Re again received the highest ratings from insurers on NMG’s Business Capability Index (ahead of Hannover Re and Munich Re). For the first time, Hannover Re received the highest ratings from reinsurance brokers (ahead of Swiss Re).

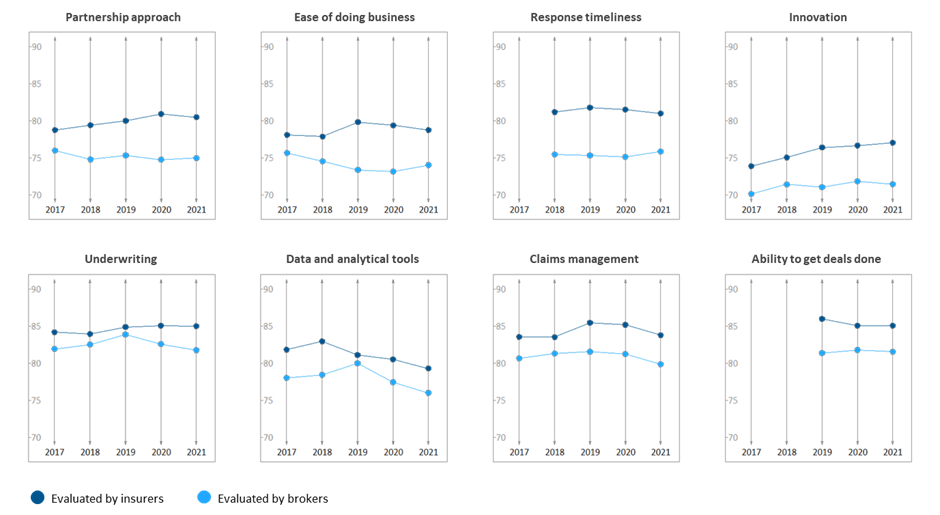

In a challenging year, ratings for the 20 most-used reinsurers held steady from insurers while lifting slightly (+0.8 on average) from reinsurance brokers. In particular, insurers awarded higher ratings to reinsurers for ‘innovation’ while ratings held steady in key areas such as ‘underwriting’ and ‘getting deals done’, despite firmer prices and terms.

Exhibit 6: Business Capability Index – Global

NMG’s BCI aggregates ratings across a range of performance factors for reinsurers, being a predictive indicator of future success. Market penetration defined as the proportion of insurers where reinsurers are active

Source: NMG Consulting – P&C Reinsurance Study – 2021

Exhibit 7: Innovation improvements counterbalance partnership declines

Average ratings of the 15 most-used reinsurers globally as evaluated by insurers and reinsurance brokers

Source: NMG Consulting – P&C Reinsurance Study – 2021

Anchor

In addition to specialisation within lines of business, our analysis of reinsurer competitive performance reveals many opportunities for competitive differentiation.

This is a positive signal for an industry considered by many as transactional and partly commoditised, while also revealing that the majority of differentiation opportunities remain unclaimed (including several of prospectively high value).

Exhibit 8: Lead reinsurers by factor (Treaty business)

Insurers and reinsurance brokers look for different capabilities when engaging reinsurance partners in leading and following roles. Reinsurers operate under different strategies and have made prioritised capability investments at differing levels

Source: NMG Consulting – P&C Reinsurance Study – 2021

Measures of unprompted brand recognition are closely tied to relevance and usage within markets. Brokers operating across the largest number of regions thus have the leading levels of recognition globally. Size within markets clearly matters too.

Seven reinsurance broking firms have meaningful levels of brand recognition globally (ie visible in 6 or 7 regions); however, this is set to become just six after the integration of Willis Re into Gallagher (in 2022). Three broking firms stand apart in terms of their scale and scope.

While Aon Re is the world’s most-recognised reinsurance broking brand, Guy Carpenter’s higher ratings for ‘brand experience’ likely offer competitive benefit. Still, using the asset management industry as a point of reference, it would seem that potential remains for these industry leaders to deliver greater differentiation in brand experience.

Exhibit 9: Brand: Recognition vs Experience

Views from insurers contributed between February and May (2021). Single-market and regional brokers are more differentiated, both positively and negatively

Source: NMG Consulting – P&C Reinsurance Study – 2021

Absent the advantages of scale and scope, it is essential that smaller rivals (operating across fewer regions) find meaningful sources of competitive differentiation to warrant selection and continued usage.

Mark Prichard is the CEO of NMG Consulting based in Sydney ([email protected])

Jane Cheng, Partner based in London ([email protected])

Desiree Lim, Consultant based in Singapore ([email protected])