February 7, 2022

Brand matters

Updated global brand rankings Property & Casualty Reinsurers, 2021 (including Specialty Lines)

The lens of ‘brand’ offers an interesting cross-section of the large and growing reinsurance broking industry

Brand recognition of the world’s largest reinsurance brokers is near ubiquitous. ‘Brand experience’ differs significantly between brokers, depending on organisational cultures and capabilities.

Sustained levels of differentiation inevitably become visible in ‘brand experience’

Unaided brand awareness is closely tied to broker usage levels and relevance within markets. Those firms operating across the most number of regions will correspondingly have higher levels of global recognition. Size within markets matters too.

Brokers operating across a global scope are recognised for their ‘globality’, as well as the scale of their ‘platforms’, capability breadth and their ability to press reinsurance markets.

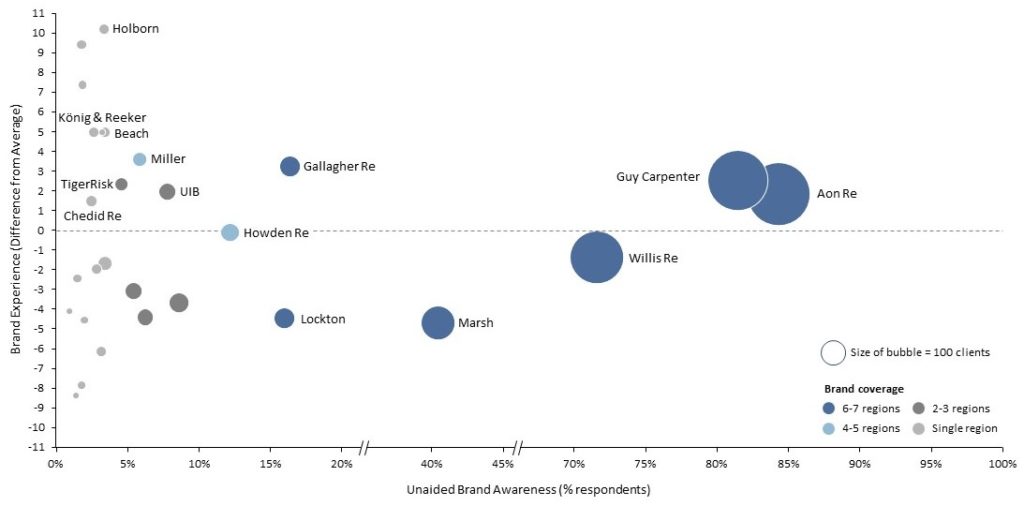

Exhibit 1: Unaided Brand Awareness vs Brand Experience

Views from insurers contributed Feb-May 2021 – Note the breaks in scale on the x axis

Source: NMG Consulting – P&C Reinsurance Study – 2021

Brand differentiation manifests competitively between rivals with similar market penetration and relevance. As such, the brands of Aon Re and Guy Carpenter compete ‘head-to-head’. While Aon is the most-recognised reinsurance broking brand, Guy Carpenter’s higher ratings for ‘brand experience’ offer compensating competitive benefits.

The largest reinsurance brokers still have untapped potential for brand differentiation

Insights from the asset management industry nevertheless suggest that the largest reinsurance brokers have untapped potential for further brand differentiation.

Unable to draw upon any advantages of scale and scope it is essential that smaller rivals find ways to differentiate. And, fortunately, there are many cases providing evidence that brokers of all sizes can carry positive levels of differentiation.

Insurers on average utilise between two and three reinsurance brokers, and while lead positions may often go to the largest firms, specialist capabilities and engagement attributes (including customer servicing, broker teams and partnership approach) remain key sources of competitive differentiation.

Brokers of all sizes can carry positive levels of differentiation

Even complex analytics capabilities are now within the reach of smaller firms, consequent of partnership-driven ecosystems and the reducing barriers to proprietary platform development.

Several brokers have delivered sustained differentiation to the extent that this is now clearly visible in perceptions of ‘brand experience’. Holborn, focused exclusively on reinsurance broking in the US market, is a leading example of this globally, having translated its long-standing focus on customer relationships and servicing capacity into brand experience.

Other firms have brands that communicate an out-sized capacity for business acquisition and innovation, thus offering signals for above-average growth prospects. The stand-out examples here include TigerRisk and Gallagher Re.

While those high performers have exciting prospects within their current markets, the unavoidable conclusion must also be that firms operating without the benefits of scale or positive brand experience have few other levers to pull, in turn impacting upon their commercial prospects. This is particularly true in an industry where remuneration is accepted to be a fixed percentage of reinsurance premiums paid.

Intense competition (particularly around talent and modernisation) makes it that much more difficult for brokers trading at lower margins to make the investments necessary for differentiation and growth. And yet there is an urgency to do so. This will become especially evident when the pricing cycle eventually turns.