December 8, 2021

Growing advice risk gap for middle-class Australians

The growing gap between consumers’ protection needs and the risk advice industry’s capacity to meet them is...

Many pension systems globally started with insurers dominating the competitive landscape, though insurers often struggled to retain their share as the markets matured.

Canada is at an early stage in the development of defined contribution (‘DC’) pensions, but average growth of DC assets under management (‘AUM’) is high at ~8% p.a. over the last 10 years1. We expect this trend to persist with the Canadian DC market growing from just 6% of the total AUM in the pension market today to 15% over the next decade2.

In Canada, insurers dominate the group retirement market, with the big three providers (Sun Life, Manulife, and Canada Life) holding more than 90% of the market’s assets3.

In most growing international DC markets, we have seen the entry and success of non-insurer providers such as specialist pensions recordkeepers and asset managers, with insurers often eventually losing out.

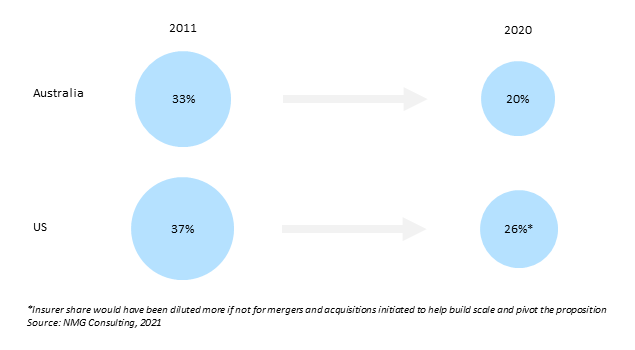

Two examples stand out: Australia and the US. In both markets, insurers have lost dominant market positions and perhaps even relevance in the respective pensions industries. This trend commenced several decades ago but is evidenced over the last decade, when insurers among the top 10 players in the DC market in Australia and the US collectively lost approximately one-third of their market shares by AUM, as non-insurer competitors continued to gain prominence in the market (Exhibit 1).

1Global Pension Assets Study, Willis Towers Watson, 2020

2NMG Consulting, 2021

3Pension Universe Report, Fraser Group, 2021

Exhibit 1: Market share of insurers out of total AUM of top 10 players in the DC market

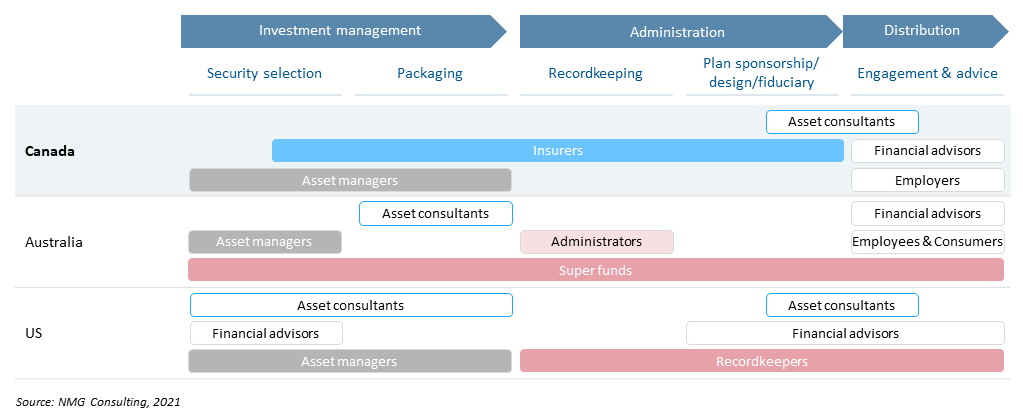

As seen in Exhibit 2, insurers are highly embedded across the investment management and administration of DC pension plans in Canada. In contrast, specialist superannuation administrators dominate the Australian market and have a comprehensive offering, including sourcing group life insurance for members. In the US, asset managers, insurers and pure play recordkeepers are the primary players in the market, providing recordkeeping to administer the plan as well as the investment platform, a channel through which to distribute their own investment solutions. In both markets, this change in structure and increased competition has led to lower fees and solutions that are better tailored to the needs of employers and members.

Exhibit 2: Global DC Pension Structure

There is a lot to be learned from the Australian and US experience. In our view, three lessons are most relevant:

1. Fees were set to maintain short-term profits over long-term scale

In both Australia and the US, insurers kept participant fees (including plan administration and investments) at above 200bps for longer than was ultimately beneficial and even in the face of newer, lower-cost propositions entering the market. Fees have now settled at much lower levels, below 100bps, even for fully active portfolios. Where fees continue to be relatively high in Canada, it is important that insurers prepare to adapt as competition intensifies in the market, including adjusting their cost base and continuing to invest in technology, automation and service. Fees will come down, the question is whether you lead or follow that trend.

2. Failures to adapt to changes in advisors’ buyer values

The US and Australia have both seen notable changes in regulation and a change from commission-paid to fee-paid distribution. This changes the way buying decisions are made. The advisor is no longer potentially conflicted by the opportunity to earn commissions (driving, for example, the churn of participants or employers), rather they focus on getting it right for the long-term interests of the client, the very best combination of value for price. This led to a shift away from insurer’s proprietary products and towards open architecture (broader selection of non-proprietary funds), cutting margins that would have allowed insurers to invest in other capabilities to compete effectively. As a result, insurers in the US and Australia failed to differentiate their products and stuck with aging technology and legacy operating models that no longer stacked up in terms of value and cost. When advisors could take the opportunity to switch to something more contemporary that offered superior service and investment solutions without hurting their own income streams, they did so in droves.

3. Under-investment in understanding client needs

In Australia, insurers failed to cater their proposition to the needs of different employer and member segments. As the market switched to DC, trade unions and industry collectives supported the development of standalone administrators and propositions tailored to evolving superannuation rules and their requirements, which consequently gathered momentum on the back of industry-wide employer acceptance. As they reached viability, scale and confidence, these new players competed in the insurers’ traditional target markets. While this evolution is yet to occur in Canada, public pension plans make up a large proportion of the pension market and as they make the shift to DC over time, they could threaten insurers that are underperforming in DC products, services and net returns.

The Australian and US DC markets highlight that complacency will lead to an eroding market share as the DC market matures. Canadian insurers who can address these learnings and adapt their propositions, will be better placed to benefit from the growth of the DC segment over the long-run.

If you would like to learn about NMGs Canadian Group Retirement Study or our international studies, please contact Karan Sabharwal, Partner ([email protected]) or Karen Lau, Consultant ([email protected]).

NMG’s 2021 Canadian Group Retirement Study is an independent study based on executive interviews with key decision makers across consultants and brokers focused on Group Retirement across Canadian landscape. The study identifies some of the challenges and opportunities for providers in the Canadian market. The study highlights the importance of competitive pricing, service, technology, and relationships as key drivers for success in the Canadian Group Retirement market. It also evaluates capabilities for the various providers across product, proposition, people, technology, operational capabilities and pricing across various regions.