April 19, 2020

Never waste a crisis – new customers flooding aligned advice firms

It feels like very old news to even mention the Royal Commission now, but if I can...

It’s no secret that passive investments have been on the rise – a global phenomenon that in many parts of the world has shown little sign of plateauing. This shift in mix from more expensive, active strategies to lower cost passive (and smart beta) is the main inhibitor to revenue growth in asset management and is exacerbated by the continued desire from asset owners and retail intermediaries for a gross fee reduction across all strategies. As if any evidence of this trend was required, the ETF industry proudly trumpeted the achievement of a (perhaps temporary) $6 trillion AUM milestone at the end of 2019.

We are regularly asked by clients when the fee pressure will reduce, but in most markets there is no sign of any abatement. On the contrary, we have seen even those clients who philosophically believe in the value of asset management increasing their allocations to passive as a means of reducing overall fee budgets.

The response from the active industry has – with some notable exceptions – been underwhelming, fragmented and in some cases blatantly self-serving. To be fair, the story is arguably more nuanced than the passive one, and there are many, many more large active managers than there are passive ones, so the challenges in developing a consistent, impactful rhetoric are greater. Nevertheless, an important leg to the narrative has commonly been that active managers really shine in a bear market; that down markets are where the value of active management can most clearly be demonstrated. The question is – who was listening to this argument during the extended bull market?

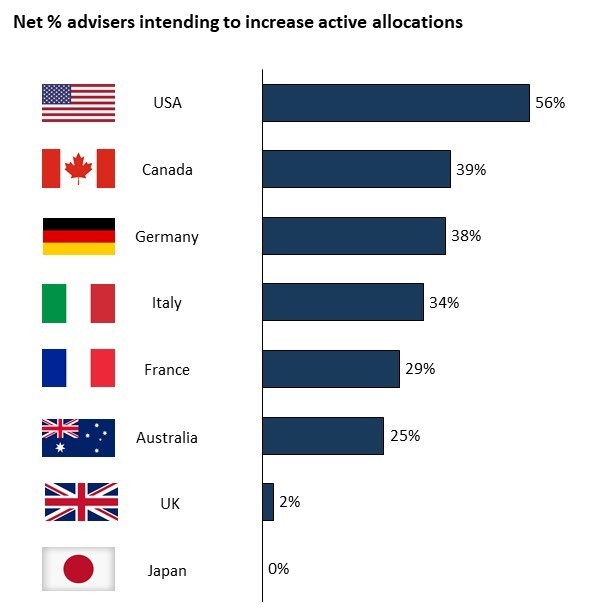

As it turns out, financial advisers the world over got the message loud and clear. As the chart above shows, with the exception of Japan and the UK (where they seem to be happy to stick with passive), advisers are absolutely intending to increase exposures to active managers. Nowhere is that trend more pronounced than in the US which has possibly the highest passive allocations of any of the countries we reviewed (and therefore, for active managers, the most to gain).

Nobody would wish a Coronavirus on the world, but if advisers follow through with their intentions, active managers could see a silver lining.